Managing your finances and adhering to the law require an understanding of your income and taxes. A crucial document that aids in this process is the P60 form. It displays the total amount of money you made and the amount of taxes deducted from your salary during the tax year. In the UK, the Pay As You Earn (PAYE) system provides you with a P60 annually if you are employed.

Employees use it as crucial evidence of their salary, which is frequently needed when applying for a loan or mortgage. It is a crucial component of the statutory reporting obligations that employers are required to fulfill. We’ll look at the P60 form’s definition, contents, and significance for both employers and employees in this blog post.

What Is P60 Form?

Employees receive an official document called a P60 at the end of the tax year that summarizes their total income and the amount of taxes withheld. It provides a clear record of financial data for accurate tax filing and personal finance management.

The employer prepares a P60 following the end of the tax year, usually by May 31st. Employees may better understand their tax situation and make sure they’re paying the right amount by using the detailed summary of their income, taxes paid, and National Insurance payments that it gives. Businesses can confirm compliance with HMRC laws by using a P60.

What the P60 Form Includes — and Why It’s Worth Checking

The form displays your whole income and all taxes paid throughout the tax year, including income tax, NIS contributions, and any statutory or student loan payments.

It’s essential to verify all information carefully, as errors may impact future financial applications, benefit claims, or tax refunds.

Employee & Employer Details:

Along with the employer’s name and address, the form contains important identifying information, including the employee’s name, National Insurance number, and PAYE reference number. These specifics guarantee that the tax records match and are submitted to HMRC accurately.

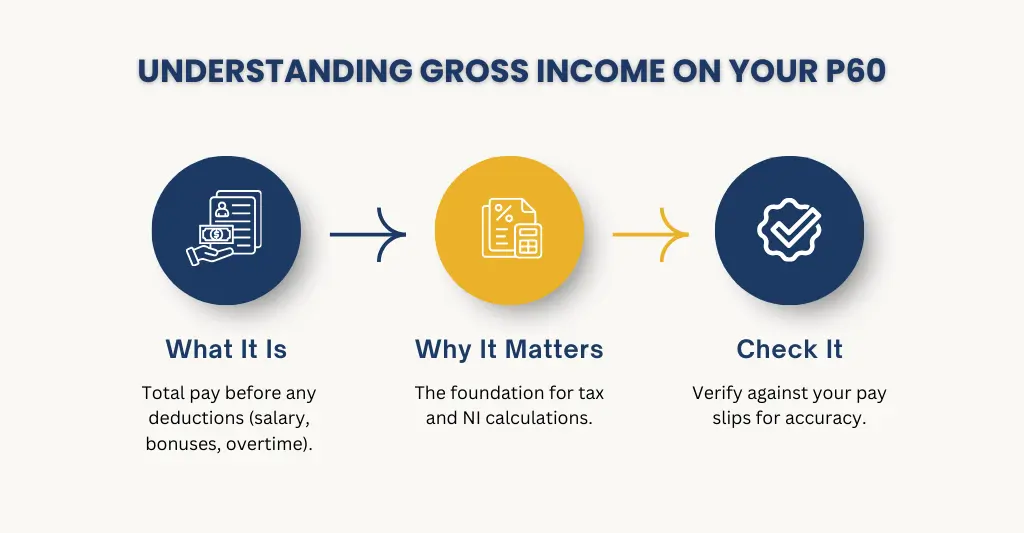

What Is Gross Income on P60?

Before any deductions are made, the total amount of money earned by an employee is shown as gross income on a P60. Basic pay, overtime, bonuses, and other taxable earnings received throughout the tax year are included in this.

Since it serves as the foundation for determining your income tax and National Insurance contributions, it is critical to comprehend your gross income. You can use it as a reference for things like loan applications, benefit entitlements, and confirming that you have received accurate payments all year long.

For example:

Suppose your form indicates that you earned £30,000 in gross income and that you paid £4,000 in income tax during the tax year.

However, you should have only been taxed on £17,430 (£30,000 – £12,570) based on your tax limit, which is typically £12,570. HMRC may calculate that you only owe £3,200 in taxes, and that a tax refund of £800 is due by the HMRC.

You would be entitled to an £800 tax refund in this instance (£4,000 paid minus £3,200 owed). Your P60 is necessary to claim any refund and helps in the verification of these figures.

Income Tax Paid:

Basically, your form displays the income tax you paid throughout the tax year in addition to your gross income. This is the sum that was taken out of your paycheck by your employer and paid to HMRC via the Pay As You Earn (PAYE) system. Your tax code, which establishes how much of your income is tax-free (your personal allowance) and how much is subject to regular rates of taxation, and your overall earnings decide how much tax you pay.

National Insurance Contributions (NICs):

The amount you have paid toward your eligibility for specific state benefits, such as the State Pension, Maternity Allowance, and Jobseeker’s Allowance, is displayed in the National Insurance Contributions (NICs) part of your P60.

If your income exceeds the NI threshold, these contributions are automatically subtracted from your paycheck. You can keep track of your contribution history and make sure your benefit rights are maintained by using the clear record of these payments that your P60 offers.

Student Loan Deductions:

Your form will reflect the total amount deducted from your earnings for the tax year if you are repaying a student loan. Depending on your loan plan type (e.g., Plan 1, Plan 2, Plan 4, or Postgraduate Loan), these repayments are automatically recorded through the PAYE system once your income is above a specific threshold.

When you’re looking for overpayments or checking your total loan balance with the Student Loans Company, this section can help keep track of how much you’ve paid back.

Example: Understanding Your P60

For the 2024–2025 tax year, suppose you were employed full-time and your company provided you with a P60. Each section’s meaning and potential appearance are explained as follows:

Income Tax Paid:

- Your P60 shows:

- Income Tax paid: £3,600

This means £3,600 was automatically taken from your wages during the year under the PAYE system. If you think you paid too much tax—maybe because you changed jobs or didn’t work the full year—you can use this figure to check if you’re due a refund.

National Insurance Contributions (NICs)

- Your P60 shows:

- NICs paid: £2,900

This is the amount you contributed to state benefits such as the Maternity Allowance or State Pension. This sum was deducted straight from your salary if your pay exceeded the National Insurance threshold. A clear record of your contributions toward your benefit rights can be seen on your P60.

Student Loan Deductions

- Your P60 shows:

- Student Loan deductions: £1,200

For instance, if you were on Plan 2 and your salary exceeded £27,295, you would have had automatic repayments deducted from each paycheck. This amount helps you check if you’ve overpaid or how much you still owe the Student Loans Company.

How Can I Get My P60?

In the UK, a P60 is a formal document that provides an overview of your entire income and the taxes you have paid over a tax year, which runs from April 6 to April 5. How to obtain your P60 is as follows:

If You’re Employed:

- Ask your employer: According to the law, your employer must provide you with a P60 by May 31 of the year after the tax year ends.

- Check Online Payslips: If your company has a digital HR system (such as Workday, Xero, or Sage), you might be able to obtain your P60 there.

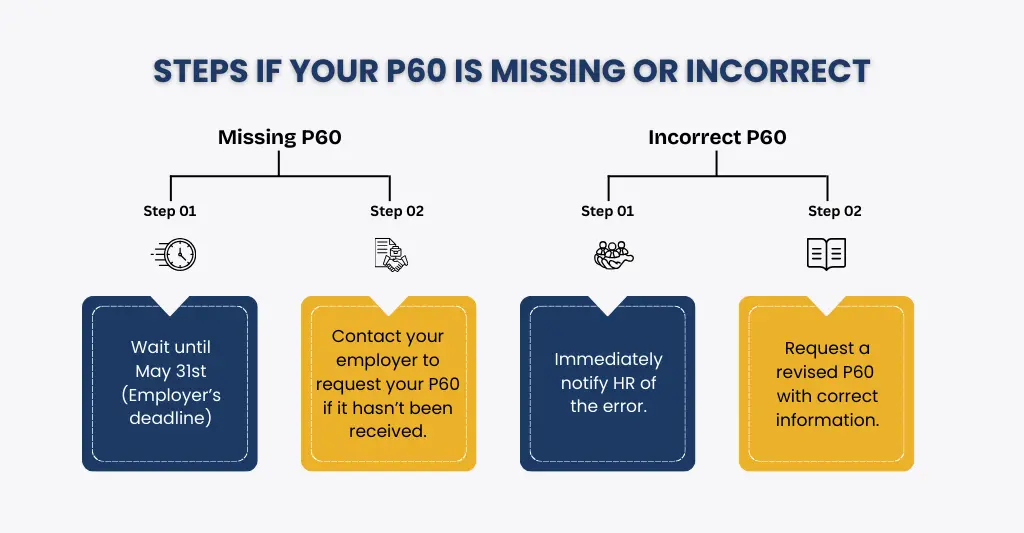

What to Do If Your P60 Is Wrong or Missing?

You must respond quickly to address any missing or inaccurate information on your P60. This is what you should do:

If Your P60 Is Missing:

- Wait Until 31 May: Employers have until this date to provide your P60, following the end of the tax year on 5 April.

- Contact Your Employer: If you still haven’t received it after 31 May, ask your HR or payroll department directly.

- Check Online Systems: Many firms use employee portals to issue P60s digitally; sign in and see whether it can be downloaded.

If Your P60 Is Incorrect:

- Notify Your Employer Immediately:Correcting errors on your form is their responsibility.

- Request a revised P60 that appropriately shows your entire income and taxes.

- Keep Documentation: If HMRC wants to look into your claim, keep the pay slips or correspondence to back it up.

How Do I Correct My P60?

To guarantee that your tax records are accurate, it’s critical to update your P60 as quickly as possible if it contains inaccurate information. Here’s how to accomplish it:

- Identify the Error: Pay close attention to the numbers on your P60, including your total income, taxes paid, and National Insurance contributions. You can compare them to your year-to-date totals or your final payslip.

- Contact Your Employer: Inform your payroll or human resources department of the error as soon as possible. Employers are in charge of issuing and updating P60s; if necessary, they can produce an amended P60.

- Get a Corrected P60: Your company should give you a fresh P60 with the label “Replacement” after the problem has been fixed. It is your official year-end record for student loan, tax, and national insurance payments, so keep it safe.

- Keep a Record: Keep accurate records of the P60s that were wrong and those that were right, along with all relevant correspondence. They can be required for loan applications, tax filings, or future use.

- Contact HMRC (if needed): You can speak with HMRC directly if your employer is unwilling or unable to correct the error. In order to amend your tax record, HMRC could ask for supporting documentation, such as pay slips or P45s.

Difference Between P45 and P60

Although they have different functions and are given at separate times, the P45 and P60 are both legitimate UK tax records. Here’s where they differ:

| Feature | P45 | P60 |

| When Issued | When you leave a job | At the end of the tax year (by 31 May) |

| Who Issues It | Your employer at the time you leave | Your current employer |

| What It Shows | Earnings and tax paid up to the leaving date | Total earnings and tax paid for the full tax year |

| Purpose | Given to your new employer or Jobcentre. | Used for tax returns, loan applications, and claiming benefits. |

| Number of Copies | 3 parts: for you, the new employer, and HMRC | 1 copy for you |

| Covers Multiple Jobs? | No — only one job | No — each employer issues their P60 |

How Long Should You Keep P60 UK?

In the UK, it is advised to hold onto your P60 for a minimum of 22 months following the conclusion of the relevant tax year. Nevertheless, it’s usually a good idea to maintain it longer.

Why You Might Keep It Longer:

- Resolving Disputes or Errors: A complete history of P60s can help you prove your wages and deductions in case of a dispute with HMRC, your employer, or a benefits provider.

- Loan or Mortgage Applications: Proof of income from prior years is frequently requested by lenders when processing loan or mortgage applications.

- Benefit Claims: Previous income records may be needed for some benefits.

- Future Employment: Employers may request prior tax records as part of background checks or onboarding for future employment.

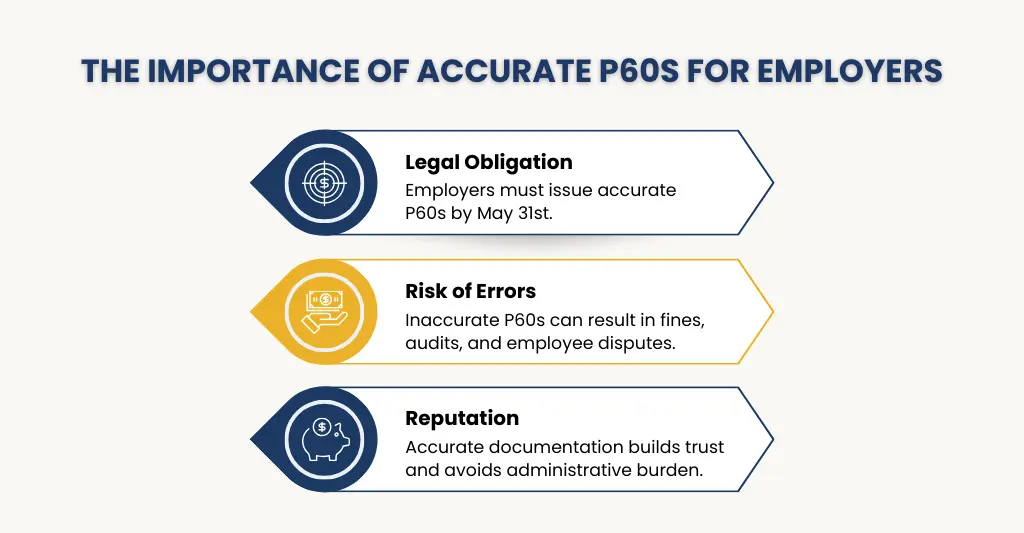

Why Employers Should Care About P60 Accuracy

Ensuring the accuracy of P60 forms that are supplied to employees is a legal and ethical obligation for employers. Serious repercussions could result from errors on this end-of-year tax report, not only for the company but also for its employees. Here’s why accuracy counts:

- Legal Compliance with HMRC: Legally, employers must issue P60s to all employees who are still on the payroll after the tax year ends on April 5. These documents must accurately reflect the employee’s earnings, tax paid, and other relevant financial details.

- Total pay for the year

- Income Tax deducted

- National Insurance contributions

HMRC may impose fines, conduct audits, or launch investigations if the wrong P60 is issued. Errors in reporting might also result from inaccurate information in Real Time Information (RTI) submissions.

- Employee Financial Wellbeing: P60s are used by employees for a variety of financial and personal purposes, such as:

- Applying for mortgages or loans

- Claiming tax refunds or Universal Credit

- Verifying income for visa or residency applications

Employees may experience financial hardship or delays in these procedures due to incorrect P60s. This leads to needless stress and decreased faith in the employer.

- Avoiding Rework and Administrative Burden: Fixing errors after an event occurs often leads to the following things:

- Reissuing corrected P60s

- Responding to HMRC inquiries

- Handling complaints and repeated employee requests

Payroll and HR departments have to do more work as a result, which decreases productivity and raises the possibility of more errors.

- Protecting the Company’s Reputation: An employer’s reputation can be damaged by a pattern of payroll or documentation errors, both internally among employees and outside to stakeholders or authorities. A great employer brand depends on trust and openness in the way employee compensation is handled.

- Reducing the Risk of Disputes: When an employee quits or changes jobs, inaccurate P60s may result in disagreements about tax obligations or income. Accurate documentation helps avert future financial or legal issues.

Why Choose E2E Payroll Services for Your SME?

A reliable partner who is aware of the unique difficulties faced by small and medium-sized enterprises is what you get when you choose E2E Payroll Services. We handle all aspects of payroll management, from sending Real Time Information (RTI) to HMRC, to computing wages and deductions. This guarantees your company’s continued complete compliance with UK tax laws, including the timely and accurate processing of P60s and P45s.

E2E is a cost-effective, scalable, and adaptable service provider that offers tailored solutions to SMEs and can expand with your company. Our payroll professionals take care of the time-consuming and stressful task of managing payroll internally, freeing you up to concentrate on managing and growing your company. With integrated employee support, your team receives clear payslips and year-end summaries, and E2E handles any payroll-related inquiries directly, relieving your administrative staff of some of the workload.

Conclusion

Accurate and effective payroll management is essential for both employers and employees. Transparent tax records, supporting loan and assistance applications, and guaranteeing adherence to HMRC requirements are all made possible by documents such as the P60. Having the proper procedures in place is crucial, whether you’re attempting to access your P60, fix a problem, or comprehend the distinction between a P45 and P60. Additionally, you might need to fill out form P800 if you think you overpaid taxes.

Outsourcing payroll to a reputable company like E2E Payroll Services can help SMEs avoid expensive errors, guarantee legal compliance, and drastically decrease administrative stress. We help small businesses handle payroll with confidence by providing specialised support, safe methods, and knowledgeable advice. This way, you can concentrate on expanding your company rather than managing paperwork.

People Also Ask:

Do self-employed people get a P60?

No, P60S are not given to independent contractors. Employers provide workers with the P60 after the tax year, which summarises all earnings and taxes paid through PAYE (Pay As You Earn). On the other hand, the Self Assessment tax return is used to declare your income and taxes if you work for yourself.

Do I get a P60 if I changed jobs mid-year?

Only the employer you worked for on April 5, the end of the tax year, will give you a P60. You won’t receive a P60 from the company if you changed employment throughout the year and weren’t working there on April 5; instead, you should have received a P45. Each employer should issue a separate form for your earnings with them if you worked for more than one company on April 5th and held various jobs during the tax year.

For example: Sarah worked for

– Company A from April to October

– Company B from November to the following April

She will:

– Receive a P45 from Company A when she left in October

– Receive a P60 from Company B, since she was still employed there on April 5

If she had two part-time jobs and were still working both on April 5, she would get a form from each employer.

How do I request or correct a lost or wrong P60?

A duplicate or amended P60 may be issued by contacting your employer’s payroll or human resources department. If they are unable to assist, request a tax summary from HMRC. Save your P45 or pay slips for documentation.

What does “Pay for the year” mean on a P60?

The phrase “pay for the year” on the form refers to your total taxable pay from that employer for the full tax year. This includes salary, bonuses, and other taxable benefits, before income tax and National Insurance are deducted. It excludes any tax-free income or non-taxable benefits.

Can I use my P60 to apply for a mortgage or loan?

Yes, when you apply for a mortgage or loan, your P60 is frequently accepted as proof of income. It provides lenders with a comprehensive picture of your financial state and job status by displaying your total earnings and tax paid for the tax year.

Can I get a copy of my p60 from HMRC

No, HMRC does not issue copies of P60s. Your employer is responsible for giving you a P60 at the end of each tax year (by 31 May). If you lose it, you should ask your employer for a replacement. They may provide you with a copy or a statement of earnings.

If your employer cannot help (for example, if the business has closed), you can ask HMRC for an employment history letter, which shows your pay and tax details, but it is not the same as a P60.