SIGNUP OUR NEWSLETTER TO GET UPDATE INFORMATION, NEWS, INSIGHT OR PROMOTIONS.

Choosing the Right Construction Accounting Software: A Guide for Contractors and Builders

Author: E2E Accounting Team

Date: February 18, 2025

Category:

CIS

Views: 239 views

Table of Contents

Imagine, your construction company has got a new large project. But you cannot concentrate on it because of lots of pending paperwork, piles of receipts, invoices, and loads of files waiting for your attention.

On the other hand, you have to track multiple expenses on each job site and manage multiple contractors. The list of pending tasks is never-ending. Then you realise that something has to be changed. Therefore, you decide to invest in construction accounting software. But with so many options on the market, how to choose the right one?

Choosing the construction accounting software that has the most functionality isn’t always the best option. Selecting a solution that can manage project-specific financials, compliance, and scalability as the firm expands necessitates knowing the particular requirements of the enterprise. This guide will help you choose the best construction accounting software, by understanding important factors will help you optimise your workflow and stay clear of future costly errors.

What is Construction Accounting Software?

A specific kind of accounting software created to accomplish the particular requirements of the construction sector is called construction accounting software. It assists construction companies in managing their projects, keeping tabs on their finances, and adhering to industry rules. To find the best solutions available, explore our guide on top accounting software for construction.

Reasons to Choose Construction Accounting Software:

- Project Cost and Budgeting: This enables construction companies to monitor project budgets and expenses and spot possible issues before they become serious.

- Job Costing and Tracking: To guarantee that projects are finished on schedule and within budget, construction companies can use this to monitor the expenses and advancement of each project.

- Equipment and Inventory Tracking: This makes it easier for construction companies to keep control of their inventory and equipment levels and make sure they have the tools necessary to finish their tasks.

- Subcontractor and Vendor management: Helps construction companies to ensure that vendors and subcontractors are paid on schedule and in full amount.

- Payroll and tax management: In addition to helping construction companies stay in compliance with all relevant rules and regulations, this also helps them manage their payroll and taxes.

Accounting Software for Construction Contractors

Construction businesses have unique financial and operational challenges that can be tackled by accounting software. However, the use of accounting software may differ for each person according to the nature of the work and its requirements.

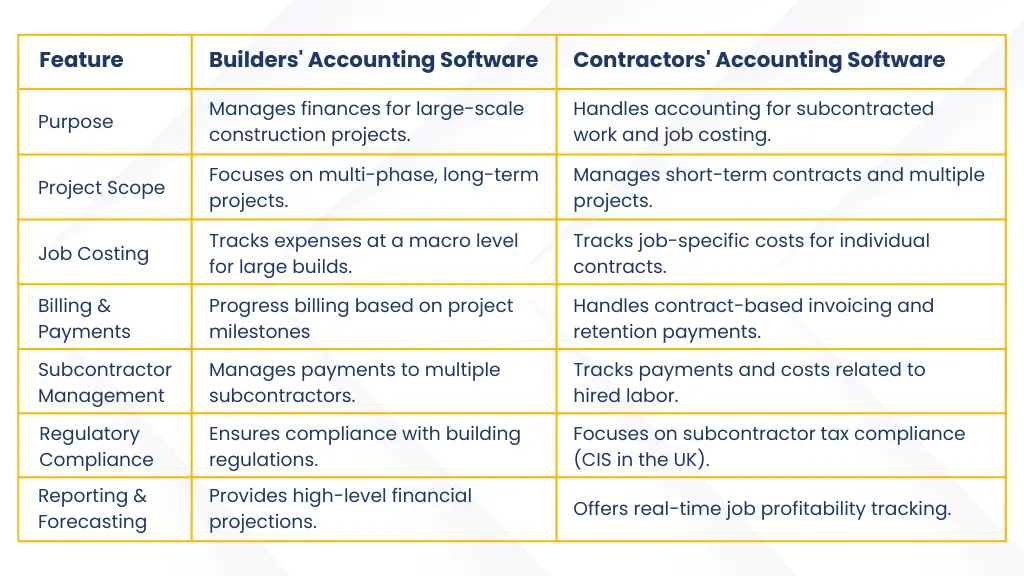

What Makes Construction Contractor’s Accounting Software Different?

- Project-based accounting: Construction accounting is focused on specific projects, as opposed to retail or service companies that monitor transactions across the entire organisation.

- Job Costing: To guarantee precise cost distribution and profitability evaluation, every job needs to be tracked independently.

- Contract and Progress Billing: Long-term contracts with milestone-based payments are common in construction projects, necessitating the use of billing techniques like progress billing or percentage of completion.

- Subcontractor and vendor management: Compared to regular payroll, construction companies have to handle material suppliers, make sure tax laws are followed, and keep track of payments to subcontractors.

- Project Timeline and Budget Tracking: Connect financial information to project management software. Avoid expense overruns and guarantee on-time completion.

Key Features to Look for in Construction Accounting Software

- Job Costing & Estimating: Keep track of the expenditures of labor, supplies, and overhead for each project. Find excess in your budget by comparing projected and actual expenses.

- Progress billing and Contract Management: Instead of using fixed amounts, create invoices based on the task accomplished.Manage retainage, which is the amount of money withheld until the project is finished.

- Project Timeline and Budget Tracking: Connect project management tools to financial data. This avoids expense surpluses and makes sure everything is finished on schedule.

- Payroll and Certified Payroll Processing: Handles multi-state payroll, overtime, and union wages. Produces approved payroll records for government initiatives.

- Change Order Management: To prevent disagreements, record and authorise mid-project changes. Timelines and budgets should be modified appropriately.

- Mobile Access and Cloud Integration: Allow data entry from job sites remotely. Connect accounting programs to construction management platforms such as Buildertrend or Procore.

Essential Tasks Contractors Need to Track

- Job Costing: Assign and track labor, equipment, and material expenditures according to each project.

- Change Orders: To guarantee correct invoicing and budget updates, keep track of all project changes.

- Subcontractor Payments: Manage and handle subcontractor payments while making sure all paperwork is in order (tax papers, lien releases, etc).

- Payroll Compliance: Handle multi-state payroll taxes and certified payroll reports for public projects.

- Retainage Management: To guarantee appropriate cash flow, keep an eye on customer-withheld payments until the project is over.

- Equipment Usage and Depreciation: Keep track of tools and machinery to make sure depreciation is accurately documented.

Accounting Software for Builders

Accounting software requirements are different for builders than for construction contractors. Let’s understand what are the needs of accounting software for builders.

The following are the needs of accounting software for builders

- Material cost tracking: Builders handle large volumes of materials that need precise cost tracking. Therefore, accounting software is used for real-time monitoring of inventory and purchase orders. Software features like supplier integration and automated cost updates help maintain accuracy. It assists builders to track fluctuations in material prices and adjust project budgets accordingly.

- Site Management and Job Costing: Centralised financial tracking is required at multiple job sites. To determine the true project costs, expenses are allocated to each site. Other than this, site workers’ payroll processing, labor law compliance, and overtime computation -everything is managed through construction accounting software.

- Estimating and Bidding: Detailed cost estimates are essential for builders to create precise proposals. Template customisation, historical data analysis, and markup modifications should all be supported by the software. Current material costs are obtained through integration with supplier pricing databases. Proficiency in producing profit margin analyses and expense breakdowns.

Features to look for in construction accounting software for builders

- Automated Material Cost Updates: Reduce manual data entry.

- Site-Based Expense Tracking: Allocate costs accurately.

- Integrated Payroll & Compliance: Manage workers’ wages and legal obligations.

- Estimation & Bidding Tools: Improve accuracy and competitiveness.

- Cloud-Based Access: Enable remote site management and real-time updates.

Why Trust E2E Accounting’s Expert Construction Accountants?

Contractors and builders need to choose the appropriate construction accounting software. Businesses can select a scalable, user-friendly solution that smoothly connects with other products with the assistance of E2E Accounting. We guarantee that your software can develop along with your business, whether it is handling highly complicated tasks or growing.

Having correct accounting, consistent cash flow, and fulfilled tax responsibilities gives builders and contractors peace of mind. Our expert construction accountants improve financial decision-making and save time, enabling construction companies to concentrate on project execution rather than money troubles.

Usability is still another important consideration. We suggest platforms with minimal training requirements, mobile compatibility, and user-friendly dashboards. To ensure that all financial data flows effectively, we also concentrate on seamless interfaces with supplier databases, payroll systems, and project management tools.

Software support is equally important. E2E Accounting provides regular software updates, compliance audits, and troubleshooting to maintain the functionality of your accounting system. Our knowledgeable advice assists companies in streamlining their financial procedures and avoiding expensive mistakes.

E2E Accounting Team

The E2E Accounting team combines expert accountants, legal specialists, and industry advisors to provide valuable insights into finance and compliance. With hands-on experience, we create content that informs, educates, and empowers business owners. From financial strategies to legal updates, our content serves as a reliable guide, ensuring accuracy, clarity, and a deep understanding of business challenges.

Recent Blogs

Why London Restaurants Choose E2E Accounting Services?

Choosing the Right Medical Accounting Software and Billing Support for Your Practice

Restaurant Accounting – A Simple Guide for 2025

Why You Need Expert Accountants for Hospitality?

Hospitality Accounting: Understanding the Basics and Why It Matters