SIGNUP OUR NEWSLETTER TO GET UPDATE INFORMATION, NEWS, INSIGHT OR PROMOTIONS.

Accountants for Dentists: Why Your Practice Needs Expert Financial Management

Author: E2E Accounting Team

Date: February 20, 2025

Category:

Dental

Views: 442 views

Table of Contents

Dentistry presents a unique set of financial difficulties and complexities, with a complex web of financial factors that must be considered. This differentiates dentistry from other industries.

Therefore, the unique accounting requirements of dental practices like yours necessitate specialised care to guarantee that your clinic is not only compliant but also financially stable and able to expand sustainably. Accountants for dentists play a crucial role in managing cash flow, tax planning, and compliance, ensuring that your practice operates smoothly while maximising profitability.

Dental accountants can be very helpful in allowing you to focus on what you do best, which is taking care of your patients’ smiles. The unique accounting challenges that dental practices like yours probably face will be examined, along with how a specialised dental tax accountant may help.

The Need for Specialist Accounting for Dentists

Providing exceptional patient care is only one aspect of operating a dental office; another is handling a challenging financial system. Dental practices offer distinct financial issues compared to other types of businesses. These challenges include managing expensive equipment investments and juggling a combination of private and NHS revenue.

For the following reasons, dentists must have specialist accounting:

Unique Tax Structures: NHS and Private Income Considerations –

Dental professionals frequently earn a mix of private and NHS income, each of which has unique tax consequences. NHS income follows contract rules, but private earnings need smart tax planning to reduce liabilities. Dentists run the danger of overpaying taxes or losing out on allowable deductions if they lack specialised knowledge. Accountants for dentists ensure that all revenue streams are appropriately classified, streamlined for tax purposes, and adhere to legal requirements.

Managing Expenses, Staff Salaries, and Equipment Investments –

The overhead expenditures of a dental office are expensive, ranging from rent and employee pay to the purchase of advanced dental tools and supplies. Dental equipment can require careful financial planning and be a significant long-term investment. Accountants for dentists help to reduce spending and manage cash flow, ensuring that investments in new technology align with profitability targets. They also assist in arranging employee pension contributions, bonuses, and salaries in a tax-efficient manner.

Accurate Financial Records and Efficient Tax Planning –

Cash flow challenges, unnecessary tax liabilities, and even compliance problems can result from financial mismanagement. Dentists who receive the proper accounting assistance may assess profitability, keep correct records, and use tax-saving techniques like capital allowances and pension contributions. The practice’s financial stability, accurate recording of expenses, and compliance with tax deadlines are all guaranteed by a professional accountant.

Practice owners may ensure their finances are in capable hands while concentrating on patient care by collaborating with an accountant who is knowledgeable about the dental sector.

Financial Challenges Faced by Dental Practices

Managing a dental practice involves more than clinical duties; it also calls for sound financial management. Several financial obstacles that dentists must overcome can affect their long-term success and profitability if they are not managed effectively. Here’s a closer look at some of the major financial obstacles and the importance of professional accounting.

Complex VAT Rules for Dental Services –

VAT in dentistry is complicated. Certain private and cosmetic operations may be subject to VAT at varying rates, while NHS treatments are typically exempt. Misinterpreting these rules can lead to overpayment or HMRC violations. Accountants for dentists ensure VAT is correctly managed, avoiding fines and optimising savings.

Ensuring Compliance with HMRC Regulations –

Dental practices are subject to complex tax laws, which range from corporation tax for limited firms to self-assessment tax returns for solitary practitioners. Strict HMRC regulations about capital allowances, pension plans, and permitted expenses must also be followed by dentists. Audits, penalties, and needless stress can result from falling behind on compliance. Dental offices can maintain complete compliance and steer clear of financial and legal issues with professional accounting.

Managing Practice Expenses While Maintaining Profitability –

It’s always difficult to strike a balance between costs and profits. High fixed expenses for dental offices include rent, supplies, equipment, and employee pay. Even a busy practice may experience cash flow problems in the absence of strategic financial planning. To make the practice viable while providing patients with high-quality care, a dental accountant helps to optimise spending, find cost-saving opportunities, and put financial strategies into action.

Payroll Processing and Pension Contributions for Staff –

Paying employees on time is only one aspect of managing payroll. Government laws must be followed by dental practices when handling employee salaries, National Insurance contributions, tax deductions, and pension contributions. Payroll errors may result in penalties, disgruntled workers, or even legal issues. A professional accountant makes sure that pensions are properly set up, payroll goes smoothly, and employee payments continue to adhere to employment regulations.

The Risk of Financial Strain Without Expert Accounting –

These difficulties may build up without appropriate financial advice, resulting in cash flow problems, unstable finances, and even the possibility of company bankruptcy. Many dentists are professionals in their industry, but they don’t have the time or knowledge to handle complicated financial issues. A committed accountant for dentists helps practices grow sustainably, make long-term plans, and increase profitability in addition to preventing financial distress.

Dental professionals can maintain their practice’s financial stability and regulatory compliance while concentrating on patient care by working with a specialised accountant.

How Dental Accountants UK Support Your Practice?

Beyond patient care, running a dental office requires financial planning for long-term success. In the UK, professional accountants for dentists relieve tax burdens, streamline financial processes, and ensure your practice operates efficiently.

Tax Efficiency and Compliance –

Dental practices may be subject to complicated tax requirements, including VAT on certain services, permitted expenses, and distinct regulations for NHS and private income. A dental accountant makes sure your business stays tax-efficient by spotting allowable deductions, carefully allocating your revenue, and maintaining compliance with HMRC rules. This reduces tax obligations while averting fines or audits.

Bookkeeping and Payroll –

Tracking earnings, costs, and profits requires accurate bookkeeping. Dental accountants make sure your financial records are recent and well-organised, which facilitates and improves the accuracy of tax reporting. Along with handling tax deductions, National Insurance, and pension contributions by UK legislation, they also handle payroll processing, guaranteeing that your employees are paid accurately and on time.

Cash Flow & Budgeting –

To pay employees, invest in new equipment, and cover expenses, a successful practice requires a consistent flow of revenue. Accountants for dentists assist you in developing a budget that shows a balance between ongoing expenses and long-term financial objectives. They keep an eye on your cash flow to avoid shortages and make sure you always have enough money to maintain the smooth operation of your practice.

NHS & Private Practice Financial Management –

Dental offices frequently make money from both private services and NHS contracts, each of which has its own set of financial guidelines. To ensure proper tax treatment and financial reporting, a dental accountant assists in managing various revenue streams independently. They also help with contract negotiations, NHS pension plans, and private practice price optimisation for profitability.

Growth & Expansion Strategy –

Considering opening a new site, investing in new technology, or growing your practice? To assist you get funding, evaluating risks, and developing a long-term growth strategy, a dental accountant offers financial insights to inform your choices. Every financial decision you make is supported by sound facts and strategy thanks to their experience.

Working with a dental accountant in the UK can help you understand your finances, manage stress, and position your practice for long-term success.

Why Choose E2E Accounting for Your Dental Practice?

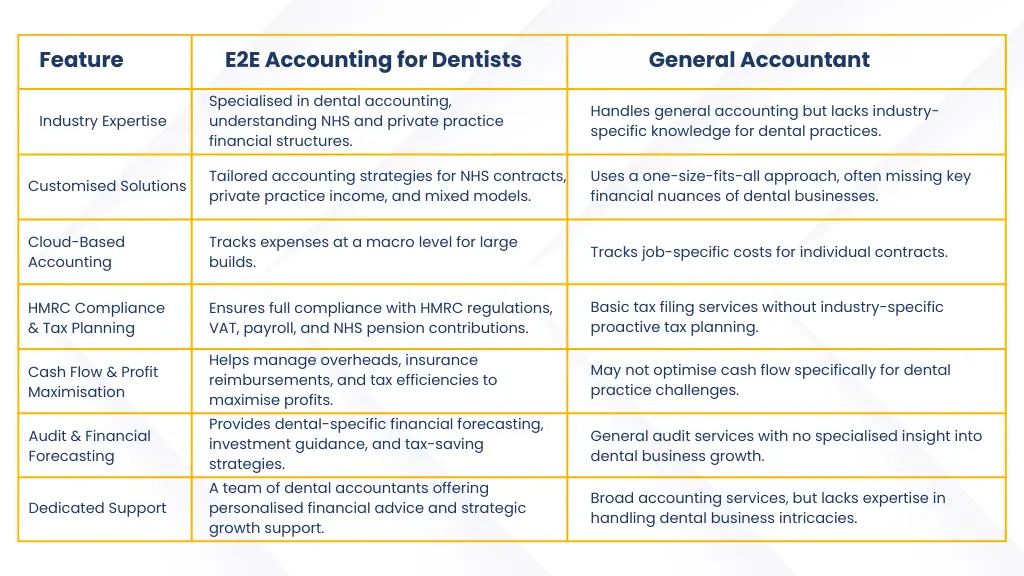

A general accountant might not be sufficient to handle the financial management of your dental office. You require experts who are aware of the particular financial environment in dentistry. This is where E2E Accounting shines, providing professional financial management designed especially for dentists. The following explains why UK dentists have faith in E2E Accounting:

Industry-specific expertise from Dedicated Accountants for Dentists –

Dental accounting is our area of expertise and we do more than just work with numbers. Our staff is aware of the particular difficulties faced by dentists, such as handling private practice revenue and NHS contract payments. Having worked in the field for many years, we offer financial methods that maximise your revenue, minimise your tax obligations, and guarantee compliance.

Tailored Accounting Solutions for NHS and Private Clinics –

No two dental practices are alike. Accountants for dentists at E2E Accounting customise solutions to fit your practice model—whether NHS, private, or a mix of both. We assist with tax-efficient income structures, NHS pension contributions, and long-term financial planning.

Advanced Cloud Accounting for Real-Time Financial Insights –

We utilise modern cloud accounting software, giving you instant access to financial data anytime, anywhere. With real-time insights into revenue, expenses, and cash flow, accountants for dentists help you make informed decisions, automate invoicing, and manage payments efficiently.

Full HMRC Compliance Support –

Dental clinics are particularly concerned about tax compliance because of the stringent HMRC rules about income reporting, VAT, payroll, and pensions. Our staff takes care of everything from tax returns to audit assistance, making sure your practice is completely compliant. We keep an eye on tax law changes in advance, so you never have to be concerned about unforeseen fines or compliance issues.

Conclusion: Take Control of Your Dental Practice’s Finances

A dental practice’s financial management presents special difficulties, such as tracking overhead expenses, managing insurance reimbursements, and making sure taxes are paid. You can optimise your financial operations, increase profitability, and concentrate on what matters; delivering good patient care by collaborating with experienced accountants who specialise in dentistry practices.

Contact E2E Accounting to receive specialist financial support for your dentistry practice. Don’t let financial issues slow you down; leave it to the professionals.

E2E Accounting Team

The E2E Accounting team combines expert accountants, legal specialists, and industry advisors to provide valuable insights into finance and compliance. With hands-on experience, we create content that informs, educates, and empowers business owners. From financial strategies to legal updates, our content serves as a reliable guide, ensuring accuracy, clarity, and a deep understanding of business challenges.

Recent Blogs

Cloud Accounting for Dentists – Making Finance and Receivables Simple

How to Relieve Pressure on Your Accounting Team Through an Accounting Outsourcing Partner

How to Start an eCommerce Business in the UK [Step-by-Step Guide]

Hospitality VAT: A UK Guide for Pubs, Restaurants, and Hotels