Are you thinking of starting your business in the UK? But you are confused about choosing a business structure that’s best for your startup. It’s alright—generally, people get confused before starting a startup. To find a solution to this, we will be discussing various aspects of the business structure. Selecting the right legal structure for a business is the most important decision for an aspiring entrepreneur.

Everything from daily operations to long-term strategic choices is impacted by a company’s setup. It establishes your tax liability, the documentation you must fill out, your liability in the event of an emergency, and even your capacity to raise funds for expansion. However, a lot of business owners make this decision hastily without completely comprehending its consequences.

This blog will explain the varieties and significance of business structures in the UK, as well as the tax implications of each form. Let’s first review the important facts before getting into the vital topic.

What is a Business Structure?

A business’s structure describes how it is set up and operated. It establishes the structure, management, ownership, operation, and taxation of a firm. The legal framework in which your business will operate in the jurisdictions where you hope to realise your entrepreneurial aspirations is known as the business structure.

The various business structure options will differ depending on the nation or jurisdiction in which the company is based. When the setup is complete, the structure will dictate how you want your business to be represented, how many people you want working for it, how taxes will be applied, and how investments and liabilities will be calculated.

Types of Business Structure

Sole Trader:

The most popular informal business structure in the UK is a sole trader, in which just one individual owns and runs the company. There is no legal difference between a sole trader and a business entity; both are the same in the eyes of the law. Sole traders have unlimited liability for business debts. The sole proprietor’s personal assets, including their house and vehicle, may be at risk if the business is sued.

Generally speaking, a sole trader is an individual who operates a business independently and is self-employed. This implies that to register through self-assessment, self-employed individuals must notify HMRC. Up to a specific amount of profit, you are required to pay national insurance and income tax. All of the remaining business profits are yours to retain after taxes and insurance are paid. On the other hand, you will accept personal responsibility if your firm fails.

Partnership:

A partnership is a type of business arrangement in which two or more individuals jointly own and run the company. Profits and losses are divided among all partners. They share responsibility for the company’s debts and liabilities. Partners in a partnership business don’t need to be actual people. Any legal entity functioning as a person or a partner may do this.

Formal and informal partnerships are both possible. An agreement between two or more individuals to launch a business together is known as an informal partnership. However, in order to have a formal partnership, you will need to draft a comprehensive partnership agreement that outlines the partnership’s obligations and liabilities, dividends of ownership and profits, and the procedures for resolving disagreements and dissolving the partnership.

Limited Liability Partnership(LLP):

An organisation is referred to as a limited liability partnership, or LLP, when two or more individuals jointly own and operate the business as members with limited liability. Directors and stockholders are absent from an LLP. Its members are in charge of running the company instead. Members of an LLP are its owners.

A limited liability partnership (LLP) is a different legal entity from its members(partners). The components of a limited corporation and a partnership are combined in this hybrid business form. This gives its members (partners) limited liability while enabling them to take an active role in running the company. The member’s assets are not at risk if the LLP is sued. Members might still be held accountable for their deeds or any personal promises they made, though.

Private Limited Company (LTD):

One of the most popular business forms in the UK is a limited company. If a limited company is operating under its registered name, you may have heard of or seen one with the letters “LTD” following the firm’s name. An “LTD” or “Ltd” is a limited company.

The legal status of this kind of business is distinct from that of its owners. Owners are known as shareholders, and those responsible for its management are known as directors.

The majority of enterprises are limited liability companies, which means that members’ responsibility is restricted by guarantees or share ownership.

Public Limited Company(PLC):

A Public Limited Company (PLC) is a business in which the managers and owners are not personally tied to the business. The business itself is capable of making agreements, owning property, and pursuing legal action.

These firms are typically larger and better-known. They need two directors, a trained company secretary, and at least one shareholder. The public can purchase its shares. This implies that everybody, not just a chosen few, can purchase stock in the organisation.

Compared to other entities, PLCs are more regulated. Compared to private limited corporations, this limited company is subject to more regulations.

Community Interest Company (CIC) & Charitable Organisations:

Limited companies called Community Interest Companies (CICs) are created to serve the community rather than just private stockholders. They are governed by the CIC Regulator and reinvest their earnings back into their social goal. CICs are perfect for social entrepreneurs who wish to show their commitment to society while maintaining flexibility.

Conversely, charity organisations must be registered with the Charity Commission and only work for charitable causes, such as health, education, or poverty alleviation. Although they are subject to more stringent governance and reporting requirements, they frequently enjoy tax savings.

5 Key Factors to Consider When Choosing the Right Business Structure

- Tax Implications: There are substantial differences in the tax treatment across various legal arrangements. In addition to paying income tax and national insurance on their profits, sole proprietors use Self Assessment to disclose their business revenue. Although shareholders pay taxes on dividends, limited corporations pay corporation tax on their profits.

Because general partnerships and limited liability partnerships (LLPs) provide tax transparency, partners are taxed on their profits rather than the corporation as a whole. This can have major benefits for tax planning and earnings distribution.

- Legal Liability: The amount of personal liability protection varies greatly depending on the type of business. Limited businesses provide limited liability protection to stockholders, whereas single proprietors are subject to unlimited personal liability. If the company experiences financial difficulties or is sued, personal assets are safe in case of limited businesses.

The partnership rules depend on the kind of partnership you select. Limited partners, like shareholders in a limited business, are shielded from personal liability in a Limited Liability Partnership (LLP). However, the responsibilities of the company can be directly owed by the general partners. In high-risk businesses or when handling significant contracts, this distinction is particularly crucial.

- Compliance & Administrative Burden: Administrative responsibilities are specific to each legal system. Limited businesses and limited liability partnerships are subject to certain corporate governance regulations, maintain statutory registers, and submit yearly accounts and returns to the Companies House.

Although the administrative requirements for sole merchants are less complicated, they nevertheless need to keep proper records and file tax reports. No matter how a business is structured, its size and breadth tend to increase its administrative complexity.

- Scalability & Access to Funding: The business structure you choose influences your ability to expand or secure capital. The ability to issue shares is one advantage of limited corporations, which also tend to look more respectable to banks and investors. Though they have restrictions on how they can allocate income, CICs can draw in grant money and social investment. In addition to being eligible for Gift Aid and being in a good position to receive gifts and grants, charities are unable to raise money through share capital. Conversely, sole proprietors could have a harder time getting outside capital because of their perceived risk. Your decision should be highly influenced by scaling if that is part of your ambitions.

- Control, Ownership & Decision-Making: Lastly, consider who will run the company and how choices will be made. Independent decision-making and total control are maintained by sole proprietors. Depending on the ownership structure, directors and shareholders share control in limited corporations.

Charities and CICs frequently function under boards or trustees, which adds governance and monitoring while limiting individual influence. Sharing decision-making among partners in a partnership can be effective, but it can also result in disagreements if there isn’t a clear understanding. Your desire for cooperation and control will aid in choosing the best fit.

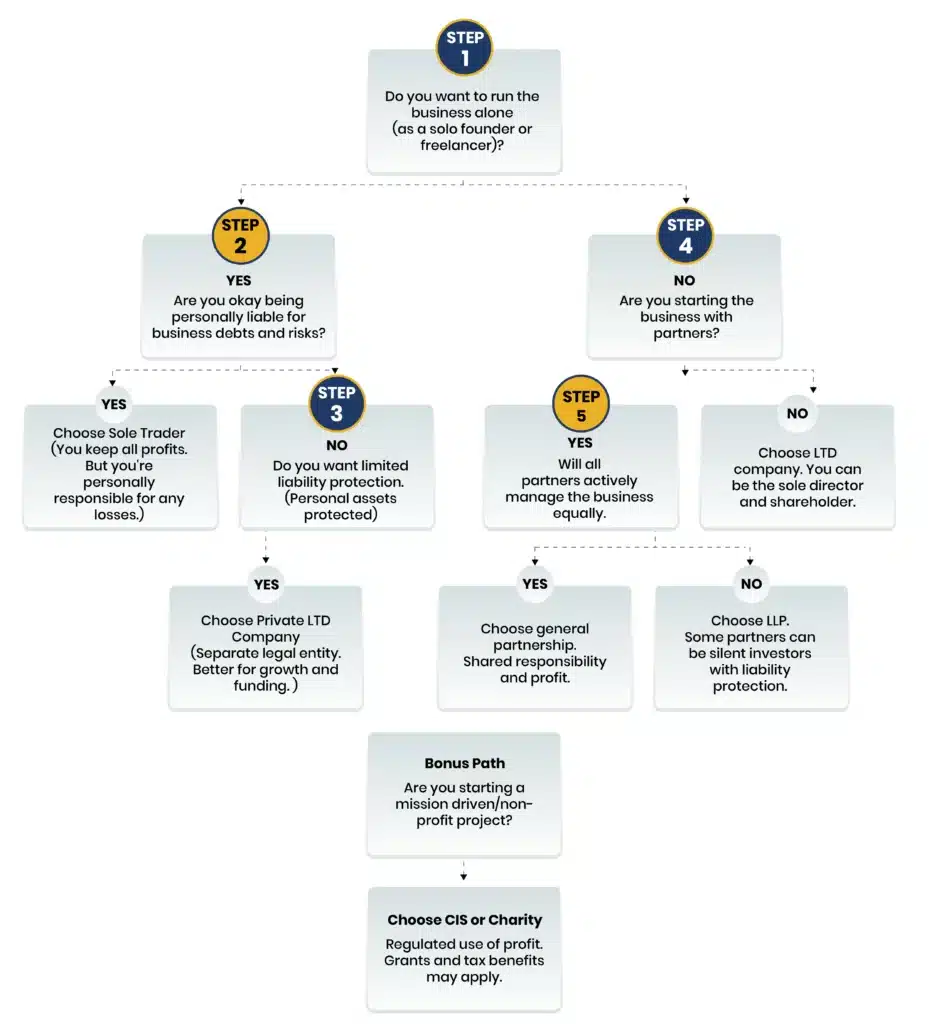

How to Match the Right Business Structure to Your Goals?

The table below compares popular business structures with the following columns: Structure, Liability, Tax Treatment, Scalability, and Admin Burden:

| Business entity | Structure | Liability | Tax Treatment | Scalability | Admin Burden |

| Sole Trader | Owned by one individual | Unlimited personal liability | Income is taxed on the owner’s return | Limited – tied to an individual | Low – minimal formalities |

| Partnership | Two or more owners | Shared unlimited liability (unless LLP/LP) | Pass-through taxation on personal returns | Moderate – depends on partners | Moderate – requires agreement |

| LLC (Limited Liability Company) | Flexible, can be single or multi-member | Limited liability for members | Default pass-through; can elect corporate tax | High–flexible member structure | Moderate – some filings required |

| Corporation (C Corp) | Separate legal entity | Limited liability for shareholders | Double taxation: corporate + shareholder dividends | Very high – attractive to investors | Highly strict compliance & filings |

| Public Limited Company (PLC) | The company is listed on the stock exchange | Limited liability for shareholders | Corporate tax; shareholder dividends are taxed separately | Very high – open to public investment | Very High – extensive regulation, audits |

| Private Limited Company(LTD) | Separate legal entity owned by shareholders; managed by directors. | Shareholders’ liability is limited to their share capital. | Pays Corporation Tax on profits. Dividends are taxed at the shareholder level. | High scalability | Moderate to high |

Can You Change Your Business Structure Later?

Indeed, as the business evolves, you can adjust its structure, but the process, consequences, and complexity will vary depending on the structure you’re currently using and the one you choose.

Common Reasons for Changing:

- Business growth or expansion

- Need for limited liability protection

- Attracting investors

- Tax optimisation

- Bringing in partners or shareholders

E2E to Help Choosing a Business Structure for Long-Term Success

A successful firm is built on a foundation of choosing the appropriate business structure, and E2E Accounting is here to help you every step of the way.

Why Partner with E2E Accounting?

- Expert Guidance: Our business experts assist you in weighing the benefits and drawbacks of various business structures, including corporations, LLCs, sole proprietorships, and more, in light of your objectives.

- Customised Solutions: Our advice is customised based on your industry, growth goals, tax preferences, and liability issues.

- Hassle-Free Setup: We take care of the documentation, from EIN filing and registration to creating operational agreements, so you can concentrate on growing your company.

- Future-proofing: If necessary, we assist you in smoothly switching to a new structure as your company expands, making sure you remain scalable and compliant.

- Bookkeeping & Financial Management: Our simplified bookkeeping services assist you in tracking expenses, and monthly financial reports can help you stay on top of your finances so you can confidently make wise decisions.

E2E Accounting helps you scale, adapt, and succeed in addition to helping you launch. Whether you are just getting started or getting ready to go public limited company, our support will grow with you.

Develop with assurance. For a business structure that will be strong today and successful tomorrow, go with E2E.