SIGNUP OUR NEWSLETTER TO GET UPDATE INFORMATION, NEWS, INSIGHT OR PROMOTIONS.

How Do Dental Accountants Scotland Give Financial Peace?

Author: E2E Accounting Team

Date: February 14, 2025

Category:

Dental

Views: 387 views

Table of Contents

A dentist’s primary focus is on providing top-quality care for your patients. However, managing the financial side of your dental practice can become challenging. Financial challenges, including fluctuating cash flow, tax compliance, payroll management, and ever-changing regulations, can quickly become frustrating. This is where dental accountants scotland can make a significant difference by providing expert financial management tailored to dental practices.

Every financial task requires specific knowledge and experience. Hence, managing everything yourself becomes difficult. Even if you balance accounting responsibilities simultaneously with the smooth operation of your practice, it can cause stress and distractions from patient care. That’s where expert dental accountants come into the picture.

They understand the unique challenges faced by dental practices and offer specialised support to help navigate financial complexities. This ensures your practice operates smoothly without interruptions, allowing you to focus fully on your patients’ well-being, which is the core goal of your profession.

Further, we will discuss more about dental accountants and how they can assist you in easing your workload. If you are located in Scotland, this blog will guide you on how Dental Accountants Scotland can assist you in effortlessly managing dental accounting.

Why do Dental Practices Need Specialist Accountants?

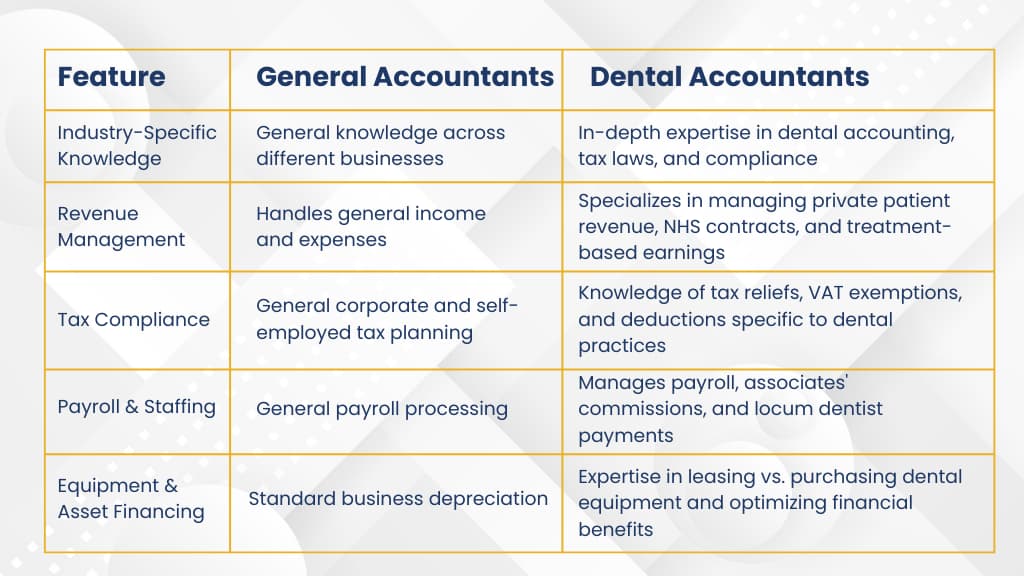

Every patient’s health history differs from another patient’s, so each patient’s treatment method is also different. Similarly, dental practices have different financial requirements compared to other industries. Managing private patient income, National Health Service (NHS) contracts, and tax regulations specific to the dental sector can be difficult to handle without professional expertise.

Specialist dental accountants Scotland with experience in the dental industry understand accounting complexities and provide expert guidance. They ensure tax efficiency, regulatory compliance, and financial stability, allowing dentists to focus on patient care without taking financial stress.

Key Accountancy Services for Dentists in Scotland

Careful bookkeeping is essential in dentistry, where accuracy and attention to detail are vital. With E2E Accounting, get a detailed understanding of the important tasks under bookkeeping and taxation.

Essential Bookkeeping Tasks

- Maintain a chart of accounts:

The financial base of your dental practice is the chart of accounts. It gives you an easy way to classify and arrange your financial transactions. You also get a clear picture of how financially sound your clinic is.

- Track Income and Expenses:

Accurate income and expense tracking is necessary to understand the financial health of your dental clinic. It will provide you with a clear understanding of your cost structures, income streams, and overall profitability.

- Manage Cash Flow:

The daily operations of the dental clinic depend on how effective your cash flow management is. It ensures that your clinic has enough cash in hand to invest, cover emergency expenses, and buy essential equipment for dentistry.

- Reconcile Bank Statements:

Bank reconciliation involves comparing bank statements with your clinic’s financial records. This can help you be confident that your records appropriately depict your current financial situation.

Essential Tax Planning and Compliance Tasks

Tax Planning includes:

- Entity Structure Selection:

When it comes to your dental practice, selecting the right business structure whether a partnership, S-Corp, C-Corp, or sole proprietorship can have a significant impact on reducing tax liabilities and ensuring long-term financial success.

- Maximise Deductions:

Maximising deductions is crucial for your dental practice’s financial health. By carefully tracking and deducting expenses like office rent, supplies, equipment, and professional development courses (CE programs), you can reduce taxable income and keep your practice financially efficient.

- Tax Credit Utilisation:

Submit a claim for any relevant Work Opportunity Tax Credit (WOTC) or R&D tax credit.

- Strategic Timing of Purchase:

Plan major purchases of supplies or equipment to take advantage of the most deductions during years with high incomes.

Tax Compliance includes:

- Quarterly Tax Filings: Avoid fines by filing and paying your estimated taxes on time.

- Annual Business Tax Return: Ensure annual tax returns are filed on schedule and accurately.

- Proper documentation of deductions: Maintaining proper documents is essential to get the exact tax deduction cost.

- Employee Classification Compliance: To avoid misclassification charges, correctly categorise workers as independent contractors or employees.

- Business Licenses & Tax Permits: Verify that all necessary business licenses and tax registrations are valid.

- Stay aware of tax law changes: To keep dental practices compliant, be updated on modifications to tax rules.

The list of accounting tasks will go on and on; various minor things must be managed accurately. As a dentist, it is not easy to manage everything by yourself without specific expertise. Therefore, you will need a specialised dental accountants Scotland to manage your accounting tasks.

Why Choose E2E as Your Accounting Partner in Scotland?

Choosing an accountant with experience in the field is essential for your dental practice. If you practice dentistry in Scotland, E2E accounting is the best option for finding dental accountants Scotland.

- Industry Expertise:

E2E Accounting is well-versed in the financial aspects of the dental industry, including private patient revenue, NHS contracts, and tax issues unique to the dental field. We have expert dental accountants who can handle industry-specific financial difficulties and ensure your clinic stays profitable.

- Tailored Approach:

We understand that every dental practice is unique. Our accountants collaborate closely with you to create tailored financial plans that support your company’s objectives. We offer customised solutions to meet your needs, whether you run your practice, are part of a corporate group, or are changing ownership.

- Proactive Financial Management:

Avoiding financial obstacles is the secret to long-term success. We provide proactive financial planning, which includes cash flow optimisation, budgeting, and tax forecasts. Our practical approach guarantees that you’re constantly ready for modifications to laws or market dynamics.

- Transparent & Affordable Pricing:

We at E2E Accounting support competitive, transparent pricing with no hidden fees. We disclose pricing structures up front so you know what to expect. We aim to provide affordable financial solutions without sacrificing product or service quality.

Outsourcing Accounting Services for Dentists

A dental business can cut expenses, simplify financial administration, and guarantee tax compliance by outsourcing accounting services. The following are some essential services that outsourced accounting businesses usually provide:

Bookkeeping and Financial Management

- Recording daily transactions

- Managing accounts payable & receivable

- Bank and credit card reconciliations

- Financial statement preparation

Tax Planning and Compliance

- Tax return preparation and filing (federal, state, and local)

- Tax deductions and credits specific to dental practices

- IRS compliance and audit support

Payroll Processing

- Employee salary calculations

- Payroll tax filings

- Direct deposit and benefits management

Budgeting and Cash Flow

- Expense tracking and reduction strategies

- Revenue forecasting

- Overhead cost analysis

Financial Advisory and Growth Planning

- Profitability analysis

- Business expansion strategies

- Equipment financing and lease vs. buy decisions

Conclusion

Maintaining a dental practice’s financial stability is crucial to offering top-notch patient care. Conversely, managing cash flow, payroll, tax compliance, and bookkeeping alone can be difficult and time-consuming. By collaborating with a specialised dental accountants Scotland, such as E2E Accounting, you can make sure that your financial operations are efficient. You can dedicatedly focus on giving the best dental service to your patients.

You can obtain professional financial advice, comply with changing tax laws, and increase your practice’s profitability by outsourcing your accounting requirements. Having a dedicated dental accountants Scotland can make a big difference, whether you’re preparing for future growth, reducing payroll, or improving tax methods.

E2E Accounting offers specialised financial solutions to maintain your dental practice’s financial stability and stress-free operation. We are one of the most trustworthy and reputable accounting companies in Scotland. Contact us now to learn how our professional accounting services can help your dental practice grow.

E2E Accounting Team

The E2E Accounting team combines expert accountants, legal specialists, and industry advisors to provide valuable insights into finance and compliance. With hands-on experience, we create content that informs, educates, and empowers business owners. From financial strategies to legal updates, our content serves as a reliable guide, ensuring accuracy, clarity, and a deep understanding of business challenges.

Recent Blogs

Second Payment on Account Deadline: What UK Self-Employed Must Know About Tax & NI

Cloud Accounting for Dentists – Making Finance and Receivables Simple

How to Relieve Pressure on Your Accounting Team Through an Accounting Outsourcing Partner

How to Start an eCommerce Business in the UK [Step-by-Step Guide]

Hospitality VAT: A UK Guide for Pubs, Restaurants, and Hotels