SIGNUP OUR NEWSLETTER TO GET UPDATE INFORMATION, NEWS, INSIGHT OR PROMOTIONS.

How to Do Construction Accounting?

Author: E2E Accounting Team

Date: February 17, 2025

Category:

CIS

Views: 393 views

Table of Contents

Have you ever questioned why your construction projects appear to be successful on paper but actually struggle with cash flow? Do unexpected cost overruns reduce your profit margins? Is it difficult for you to keep track of costs for several projects while maintaining correct invoicing and compliance?

Construction is a sector where expenses vary, payments are frequently postponed, and each project is run like a separate company. Construction accounting involves more than just keeping the books. It is opposite to traditional accounting, necessitates specific financial management, including revenue recognition, payroll monitoring, job costing, and contract billing. In the absence of a strong financial structure, even the most experienced contractors may face difficulties.

Inaccurate cost monitoring, mismanaged cash flow, or late invoices can result in project delays, lost revenue, and damaged client and subcontractor relationships. Because it guarantees the long-term sustainability of your company and keeps you financially organised, understanding construction accounting is essential.

This blog will provide you with the resources you need to take charge of your construction expenses and create a more successful company, regardless of your role as a contractor, project manager, or business owner.

What is Construction Accounting?

A specific area of financial management designed for the construction sector is construction accounting. It includes keeping checks on cash flow, managing project budgets, recording and evaluating expenses, and making sure that industry-specific rules are followed. Compared to traditional accounting techniques, construction accounting focuses on project-based financial management, frequently addressing variable costs and long-term contracts.

Primary goals of construction accounting include:

- Accurately tracking project costs and revenues

- Managing cash flow effectively

- Ensure profitability of individual projects and the overall business

- Complying with industry-specific regulations and tax requirements

- Provide insights for informed decision-making.

The Role of Construction Accountants

A construction accountant is responsible for more than keeping track of transactions and creating financial reports. They offer insightful information and analysis that help to build projects successfully. Let’s understand the key responsibilities and functions of construction accountants in the construction industry.

- Managing Financial Records and Transactions: Monitoring cash flow and keeping an eye on payments coming in and going out. As well as ensuring that every financial transaction gets properly recorded in the business’s books.

- Ensuring Compliance with Regulations and Tax Laws: Ensuring adherence to tax and financial standards is another important function of construction accountants. By streamlining their financial operations and making sure that every aspect of compliance from tax responsibilities to regulatory adherence is appropriately managed, businesses can reduce risks and possible legal problems using account management services.

Because the construction sector is highly regulated, breaking these rules can have serious consequences, including legal action. An accountant in construction handles the responsibilities of:

- Staying updated on the most recent laws and industry norms

- Tax return preparation and tax liability reduction advice

- Assist construction firms in reducing costs and preventing legal problems of the construction industry.

- Budgeting and Cost Control: Budgeting and cost control for construction projects are essential duties of a construction accountant. They cooperate closely with stakeholders and project managers to create precise project budgets for all possible expenditures, including labor, materials, equipment, and overhead.

They track actual spending against the budget during the project and report any changes or deviations. This is a preventative action in the event of unseen costs or delays guarantee that projects stay under budget.

- Providing Financial Insights for Decision-Making: In the construction sector, construction accountants play a crucial role in providing financial insights to assist in decision-making. They conduct financial data analysis and produce reports that assist management in several ways, such as:

- Financial data analysis and management report preparation

- Assisting in the decision-making process for investments and cost-cutting strategies

- Providing insightful guidance to direct significant business choices.

- Monitoring Cash Flow and Project Expenses: To make sure there is enough money in hand to pay for costs including labor, supplies, and overhead, a construction accountant keeps track of all incoming and departing payments. Through accounting software, they also keep check on project costs, comparing them to the budget and reporting any deviations or possible cost overruns.

This keeps projects financially on track and enables prompt action if cash flow problems or unexpected costs occur. A construction company’s financial stability depends on effective cash flow and project expense management, which makes this duty crucial for a construction accountant.

How Construction Accounting Differ from Basic Business Accounting?

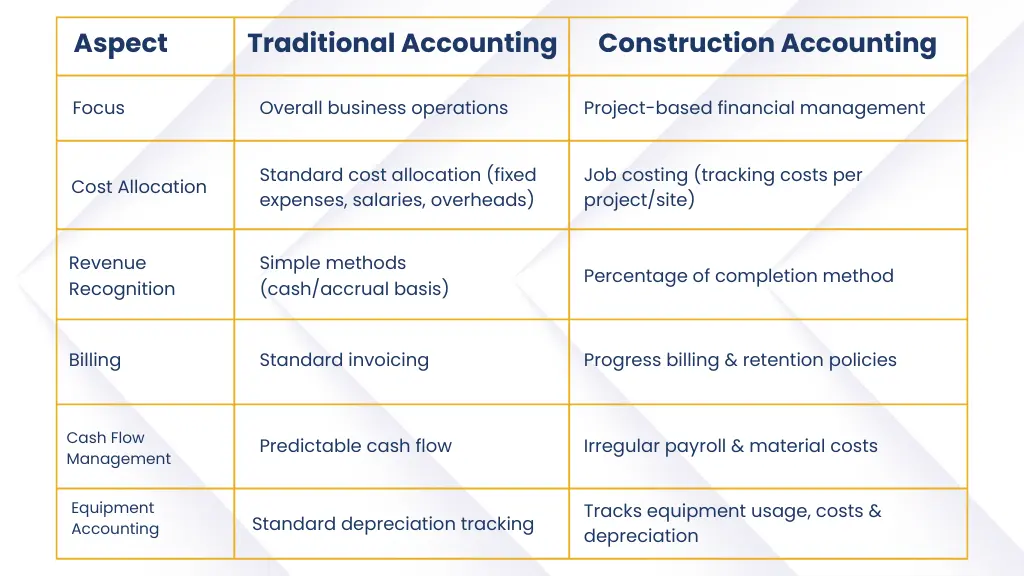

Traditional accounting and construction accounting have certain similarities, but there are also some significant differences:

- Cost Allocation: Job costing, or assigning costs to particular projects, is a primary focus of construction accounting.

- Project-based focus: The focus of financial management is on specific initiatives rather than the general operations of the company.

- Contract considerations: Specialised accounting procedures are needed for progress billing and long-term contracts.

- Revenue recognition: Construction frequently employs specific techniques, such as accounting for percentages of completion.

- Cash Flow Management: Payroll irregularities and retention policies necessitate close attention to cash flow.

- Equipment accounting: Excessive equipment utilisation requires careful monitoring of usage expenses and depreciation.

Despite these variations, construction accounting still follows traditional accounting rules and necessitates accurate financial reporting, tax compliance, and record-keeping. However, following traditional accounting standards can occasionally be a drawback because traditional methods might not adequately account for the intricacies of long-term projects, variable costs, and revenue recognition specific to a contract, which could result in cash flow issues and financial mismanagement.

How to Do Construction Accounting: Best Practices

- Try accounting tools and automated software: To increase efficiency, automate payroll, boost accuracy, and save time, spend money on specialised construction accounting software. Features such as task costing, financial statements, progress billing, and work-in-progress reporting are frequently included in these tools.

- Use project-specific cost-tracking: Use reliable system for project-specific cost-tracking. Materials, labor, equipment, and subcontractor costs are all included in this. Profitability analysis and work costing depend on precise cost tracking.

- Implement percentage-of-completion accounting: The percentage-of-completion method is an appropriate choice for long-term projects regarding revenue recognition. This approach gives you a more realistic view of your financial situation at every project stage.

- Use Progress Billing: Implement a progress billing system to keep cash flow consistent. Make sure your contracts precisely specify the terms and deadlines for payments to prevent disagreements and payment delays.

- Monitor Work-in-Progress (WIP) Reports: Examine WIP reports regularly to monitor project progress, spot possible problems, and make wise decisions. These reports are essential for managing project profitability and overall business performance.

- Maintain Cash Flow Forecasting: Comprehensive cash flow projections are very helpful for planning because of the construction industry’s irregular cash flow patterns. This enables you to plan for times when cash flow is limited and to make well-informed choices regarding the scheduling of projects and the distribution of resources.

Why Choose E2E Accounting for Construction Accounting?

Construction industry financial management is complicated because of project-based accounting, work costing, varying cash flows, and compliance requirements. E2E Accounting is a construction accounting specialist that offers professional services to help developers, builders, and contractors optimise their financial processes for optimal productivity and profitability.

Reasons to choose us:

- Accurately track task expenses: We make sure that all labor, material, and overhead costs are appropriately distributed, providing you with an exact project cost analysis.

- Improve cash flow management: Construction projects’ payment cycles are frequently inconstant. To guarantee that money is accessible for payroll, supplies, and other project requirements, we assist in maintaining a consistent cash flow.

- Enhance financial forecasting: Our team helps you predict project expenses, prevent overruns, and remain below budget by giving you real-time insights into financial performance.

- Improve cost control: We assist contractors in cutting waste, avoiding cost overruns, and optimising project profitability by keeping an eye on expenditures.

Value of Partnering with E2E Accounting:

- Expert Industry Knowledge: Financial management is easy because we are aware of the particular requirements of the construction sector.

- Time & Cost Savings: Businesses can cut down on time and expensive financial errors by hiring professionals to handle accounting.

- Scalability for Growth: Our services grow with your company’s needs, regardless of how big or small your construction company is.

- Technology-Driven Solutions: To optimise financial processes, we interface with construction accounting software such as Procore, Sage, and QuickBooks.

- Strategic Business Advisory: In addition to accounting, we provide advice on investment strategies, financial growth, and profitability.

Reach out to us with any questions or requirements about construction accounting at support@e2eaccounting.com

E2E Accounting Team

The E2E Accounting team combines expert accountants, legal specialists, and industry advisors to provide valuable insights into finance and compliance. With hands-on experience, we create content that informs, educates, and empowers business owners. From financial strategies to legal updates, our content serves as a reliable guide, ensuring accuracy, clarity, and a deep understanding of business challenges.

Recent Blogs

Second Payment on Account Deadline: What UK Self-Employed Must Know About Tax & NI

Cloud Accounting for Dentists – Making Finance and Receivables Simple

How to Relieve Pressure on Your Accounting Team Through an Accounting Outsourcing Partner

How to Start an eCommerce Business in the UK [Step-by-Step Guide]

Hospitality VAT: A UK Guide for Pubs, Restaurants, and Hotels