Imagine that when the financial year is over, you discover that you have provided your personnel with a few extra benefits, such as a staff party or a gift card. Excellent for morale, but the question now is: how do you deal with the tax on all of that?

Presenting the PAYE Settlement Agreement (PSA), your go-to tool for expediting the procedure. You can settle specific tax and National Insurance amounts on behalf of your employees all at once rather than managing several forms.

To keep things organised and hassle-free, this guide explains how to apply for a PSA, what it covers, and when you need to submit it.

What is a PAYE Settlement Agreement (PSA)?

Employee benefits often include gifts, entertainment, and relocation packages, which are frequently offered by many companies. Numerous benefits are subject to income tax and NIC, despite certain exemptions.

Through an administrative agreement known as a PSA, businesses can pay the income tax and NIC on behalf of their workers on specific items instead of including them in payroll or returning them as benefits in kind on P11D forms.

Why use a PSA? (Benefits for Employers and Employees)

A PAYE Settlement Agreement (PSA) is a useful tool to make life easier for you and your employees, not merely a way to check a compliance box. Here are some reasons to think about it:

Simplifies Admin for Employers: Using a PSA allows you to combine all of your minor or irregular benefits into one annual payment, eliminating the need to complete several P11Ds or process them through payroll. This results in a more efficient year end procedure with less paperwork and computations.

Keeps Things Fair and Hassle-Free for Employees: Workers don’t have to be concerned about self-reporting small benefits or unforeseen tax deductions. With a PSA, you take care of their national insurance and taxes so they can benefit without having to deal with the administration.

Great for One-Off or Irregular Benefits: PSAs are perfect for those occasionally occurring or difficult-to-value items that don’t cleanly fit into payroll reporting, such as staff parties, gift vouchers, and little “thank-you” bonuses. It makes sure that all of those moments of acknowledgment remain constructive rather than burdensome with paperwork.

Demonstrates a Supportive Company Culture: Paying for these expenses demonstrates your appreciation for your staff and your desire to ease their stress. It’s a little act that can enhance your employer brand and build trust.

Helps You Stay Compliant with HMRC: When properly implemented, a PSA lowers the possibility of mistakes or fines and maintains you in compliance with HMRC’s reporting guidelines. It’s an easy and authorised way to manage employee benefits in a clear and uncluttered manner.

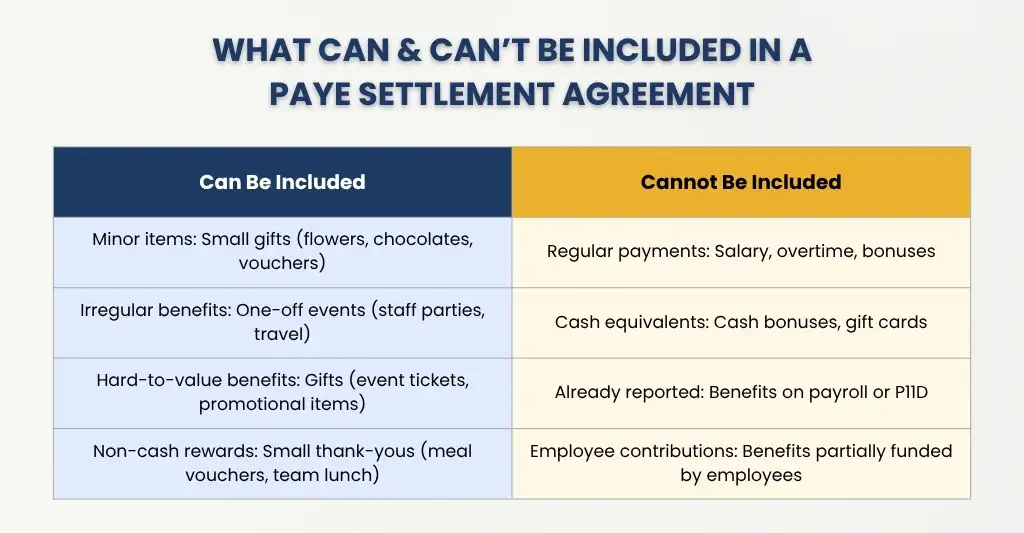

What can be included in a PSA?

Although a PAYE Settlement Agreement cannot cover every employee benefit or expense, it can cover many modest, irregular, or difficult-to-value things. HMRC permits you to include certain advantages to maintain simplicity and equity for all.

Here’s a breakdown of what usually fits under a PSA:

Minor Items: These are minor, insignificant advantages that aren’t worth the administrator’s time to report on separately. Among the examples are:

- Gifts for employees, such as chocolates, flowers, or tiny coupons

- Entertainment for employees (such as team lunches or sporadic dinners)

- Small expressions of appreciation

Try to think of it as the “little things” that contribute to a welcoming and encouraging work environment, but they aren’t necessarily significant enough to be paid.

Irregular Benefits: You can normally include a perk in your PSA if it is irregular or one-time rather than a regular element of your job. As an example,

- A company-paid staff party or annual social event

- A relocation allowance is paid on rare occasions

- Non-cash prizes or rewards for competitions

Here, “irregular” is crucial, meaning it doesn’t occur regularly or consistently.

Hard-to-Value Benefits: Sometimes you provide a benefit that is difficult to quantify, like:

- Hospitality or event tickets

- Shared-use items or services

- Gifts from suppliers or promotional giveaways

HMRC can agree on a reasonable estimate thanks to a PSA, which relieves the burden of accurately assessing items.

What cannot be included in a PSA?

A PAYE Settlement Agreement (PSA) is not a one-size-fits-all solution for all benefits or payments, despite its stated aim to simplify matters. You can stay in compliance and avoid expensive errors by being aware of the exclusions, which are clearly outlined in HMRC’s guidelines.

Here’s what you can’t include in your PSA:

Regular or Contractual Payments: Anything that constitutes a regular or guaranteed portion of your employees’ compensation must be processed through regular payroll, not a PSA. This contains:

- Salaries and wages

- Overtime pay

- Bonuses and commission

- Regular allowances (e.g., car or clothing allowances)

It must be taxed using PAYE as usual if it is a regular payment or a component of the employment contract.

Cash Payments or Cash Vouchers: A PSA is limited to non-cash benefits. Payroll processing is required for all cash payments and easily convertible cash payments. As an example:

- Cash bonuses or tips

- Gift cards that can be exchanged for cash

- Reimbursed expenses paid directly in cash

These cannot be included in a PSA since HMRC considers them to be earnings.

Benefits Already Reported via Payroll or P11D: Benefits that have already been reported on payroll or on employee’s P11D forms, for example, cannot be included. Since each benefit may only be reported once, your PSA will not be able to use it if you have already disclosed it.

Benefits with Employee Contributions: Your PSA cannot mention a benefit if employees have contributed to its cost. Only things that you, the employer, completely fund are covered by the agreement.

Benefits That Don’t Meet HMRC’s PSA Criteria: HMRC typically expects PSA items to be:

- Minor (small value)

- Irregular (not part of regular pay)

- Hard to value (difficult to assign an exact cash equivalent)

If a benefit doesn’t fit those categories, HMRC may reject it from your PSA request.

Unsure how much managing a PAYE Settlement Agreement will cost your business? Get an estimate in 60 seconds with our free calculator – try it now.

How to submit a PSA to HMRC?

The procedure of submitting a PAYE Settlement Agreement (PSA) is simple, but in order to maintain compliance and prevent delays, it’s critical to complete each step correctly. This is how it operates:

Apply for a PSA Agreement: If this is your first time, you must apply to HMRC, either in writing or through your HMRC company tax account.

Provide information about any perks or costs you would like to pay for, such as social gatherings or staff gifts.

You will get a PSA agreement (Form P626) from HMRC after it has been approved. This contract typically stays in effect for another year unless you modify or terminate it.

Calculate the Tax and National Insurance: Determine the total amount owed on April 5, the end of the tax year:

- Income tax increases as you pay for your staff.

- Both benefits and taxes owed are covered by Class 1B National Insurance.

HMRC offers guidelines to assist you with these computations, or you can double-check with the assistance of your accountant.

Submit PSA Details to HMRC: After calculating your numbers, send HMRC:

A description of the benefits is included, and

- the entire amount owed for taxes and national insurance.

- You only need to state the total sums covered by the PSA; there is no need to list specific employees.

Pay Your PSA: You must pay the total amount due by:

- 22 October (if paying electronically), or

- 19 October (if paying by post).

Example: For the 2024/25 tax year ending 5 April 2025, payment must reach HMRC by 22 October 2025.

Keep Records: Copies of your computations, communication with HMRC, and evidence of payment should be kept. These will be useful for any HMRC reviews and the PSA for next year.

PSA Submission Deadline and Key Dates

To maintain compliance and prevent late payment penalties, it is crucial to monitor your PAYE Settlement Agreement (PSA) deadlines. You should be aware of the following:

End of the Tax Year – 5 April: From April 6 to April 5, the UK tax year is in effect. After the tax year is over, you can begin figuring out what perks and expenses you want to include in your PSA for that time frame.Understanding how PAYE is calculated in the UK helps you accurately estimate the tax and National Insurance amounts due on these benefits.

Agree Your PSA with HMRC – Before 6 July: Before the sixth day after the end of the tax year, you must have your PSA agreement (Form P626) in place. This guarantees that the PSA for that year will cover the costs and benefits you have selected.

Submit Calculations and Details – By Early October: After your PSA has been approved, complete your calculations and provide a breakdown of the entire amount of tax and National Insurance due to HMRC. To allow for payment processing, it is advisable to complete this before the beginning of October.

Payment Deadline – 22 October (or 19 October by Post):

This is the most important date:

- 22 October if paying electronically (e.g., bank transfer or online).

- 19 October if paying by cheque or post.

Review Your PSA Each Year: Unless you cancel or modify it, your PSA automatically renews every year. To ensure that it continues to represent the advantages and costs of your business today accurately, it is advisable to review it annually.

PAYE Settlement Agreements Example

ABC Ltd gives its staff a few small treats during the year:

- A £25 gift voucher at Christmas

- A taxi home after the late staff party, costing £20 per person

ABC Ltd decides to include these in a PAYE Settlement Agreement (PSA) so employees don’t pay tax on them.

Step 1: Add up the costs

- 10 employees × £25 gift voucher = £250

- 10 employees × £20 taxi fare = £200

Total = £450

Step 2: Work out tax and NIC

Assume employees are higher-rate taxpayers (40%) and Class 1B NIC is 13.8%.

Tax:

£450 × (40 ÷ 60) = £300

NIC:

(£450 + £300) × 13.8% = £103.50

Step 3: Total to pay HMRC

£300 (tax) + £103.50 (NIC) = £403.50

SME Perspective

Yes, much like major corporations, small and medium-sized firms (SMEs) are able to employ a PAYE Settlement Agreement (PSA).

Since a PSA streamlines tax reporting for small or one-time employee benefits, it can actually make life easier for SMEs.

Why PSAs Help SMEs?

Less admin: The employer pays HMRC a single amount rather than figuring out taxes for each employee or disclosing minor perks on P11D forms.

Simpler budgeting: Instead of keeping track of little, irregular spending all year long, you can budget for a single annual payment.

Better staff morale: Small benefits (such as meals or vouchers) are given to employees tax-free, which feels like a real incentive.

Example:

During a busy project, a small marketing business provides each of its five employees with a £15 dinner coupon and a £20 gift voucher for Christmas.

The business pays the entire tax and NIC to HMRC in one payment, so employees don’t have to worry about additional tax deductions. The corporation includes these in a PSA.

Conclusion

If you wish to manage minor, irregular, or difficult-to-value employee benefits straightforwardly, a PAYE Settlement Agreement (PSA) is a good solution.

Both businesses and employees benefit from the time savings, decreased paperwork, and simplicity it provides.

A PSA is particularly useful for SMEs since it enables them to provide employees with occasional treats or events without adding to their tax or reporting burden.

By signing a PSA with HMRC, companies may pay all taxes and National Insurance in one annual payment, which will keep workers satisfied and make compliance simple.

People Also Ask:

Do I need to apply for a new PSA every year?

No. Once your PAYE Settlement Agreement has been approved by HMRC, it typically renews itself annually. You only need to get in touch with HMRC if you wish to modify the coverage or discontinue using the PSA.

If I want a PSA for this year’s benefits, when is the deadline to submit one?

You have until July 5th, after the end of the tax year in which the benefits were given, to apply for a PAYE Settlement Agreement (PSA).

For instance, you have until July 5, 2025, to file your PSA application for benefits provided during the 2024–2025 tax year, which ends on April 5, 2025.

Does a PSA save me money on taxes?

No. A PSA typically costs more because you pay your employees’ taxes and NICs. Its purpose is not to lower taxes, but to simplify things and save administrative time.

Can trivial benefits (under £50) or reimbursed expenses go on a PSA?

No. Trivial benefits under £50 don’t require a PSA because they are already tax-free. Additionally, since reimbursed business expenses (such as travel expenses) are not taxable if they are genuine business expenses, they shouldn’t be included on a PSA.