Everyone likes to pay as little tax as possible, and the good news is that you don’t have to pay more tax. If you’re wondering how to pay less tax, whether you’re self-employed, a company director looking to reduce corporation tax, landlord, or someone with savings or assets, the UK tax system provides several completely legal options to lower your tax liability.

In this blog, we’ll show you 7 clever, completely legal tax-saving techniques that you can put into practice immediately.

Why Smart Tax Planning Matters (Even If You’re Not Rich)

In this blog, we’ll show you 7 clever, completely legal tax-saving techniques that you can put into practice immediately.

Tax preparation is for everyone who wishes to maximise their financial resources, not just the rich or large organisations. Whether your income is £25,000 or £250,000, tax efficiency can have a significant impact on your financial situation over time.

You can legally lower your tax liability by taking easy actions like making prudent use of your personal allowance, declaring qualified expenses, or making pension contributions. This implies that you will have more money in your pocket to invest, save, or spend on the things that are most important to you. You don’t have to be wealthy to take advantage of wise tax preparation; all you need to do is be aware of the proper tactics.

#1. Understand UK Tax Bands and Allowances First

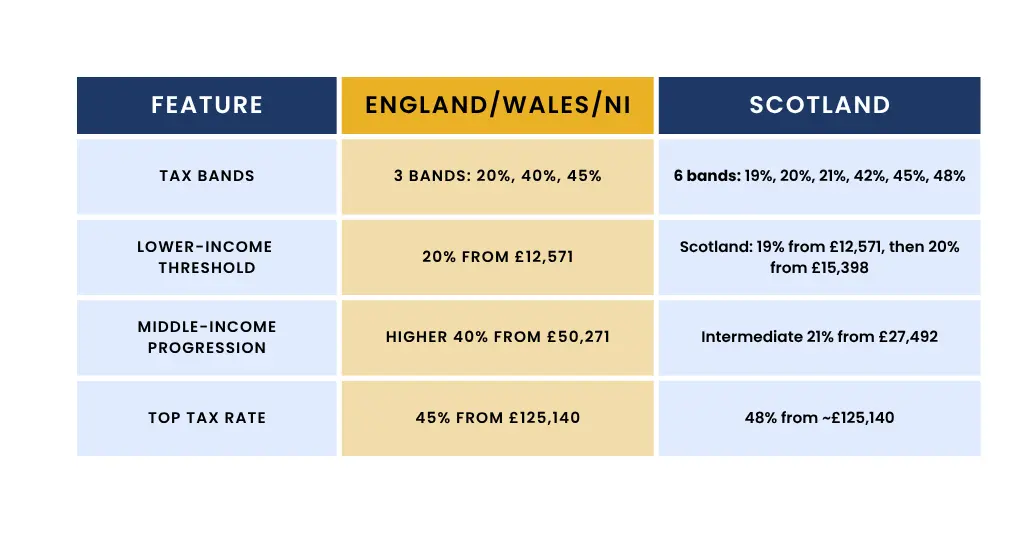

The income tax bands and rates for the 2025–2026 tax year are clearly outlined here, along with the ways that Scotland’s system varies from those of England, Wales, and Northern Ireland.

- England, Wales & Northern Ireland

- Personal Allowance: £0–£12,570 taxed at 0%

- Basic Rate: £12,571–£50,270 taxed at 20%

- Higher Rate: £50,271–£125,140 taxed at 40%

- Additional Rate: Above £125,140 taxed at 45%

- Scotland: The majority of Scottish taxpayers’ income (earnings, pensions, etc.) is subject to six income tax bands (GOV.UK). Savings and dividend income are subject to UK-wide rates.

- Personal Allowance: up to £12,570 → 0%

- Starter Rate: £12,571–£15,397 → 19%

- Scottish Basic Rate: £15,398–£27,491 → 20%

- Intermediate Rate: £27,492–£43,662 → 21%

- Higher Rate: £43,663–£75,000 → 42%

- Advanced Rate: £75,001–£125,140 → 45%

- Top Rate: Over £125,140 → 48%

Due to Scotland’s numerous bands and lower thresholds for higher tax rates, middle-to-high earners may pay more in taxes, particularly when rates like Intermediate and Higher apply earlier than in the UK.

Personal Allowance, Tapering & the 60% Tax Trap

What Is the Personal Allowance?

- The first £12,570 of everyone’s income is tax-free, unless they have extremely high incomes.

- This allowance covers the majority of income sources, including wages, pensions, rental profits, and self-employed incomes, and it is applicable throughout the United Kingdom, including Scotland.

The Tapering Rule: Income Over £100,000

Your personal allowance is gradually deducted if your adjusted net income surpasses £100,000 per year. This is known as tapering.

You lose £1 of your Personal Allowance for every £2 earned beyond £100,000 in total.

The 60% Tax Trap

Many refer to the range between £100,000 and £125,140 as the “60% effective tax rate zone.”

Here’s why:

Normally, the higher-rate tax is 40%.

But in this income band, you’re not just paying 40% tax — you’re also losing £1 of tax-free allowance for every £2 you earn. That lost allowance is worth 40% of £1 (i.e., 40p), so:

40p (standard tax) + 20p (tax due to lost allowance) = 60p per £1 → 60% marginal tax rate.

Example:

Meet Jamie, a project manager living in Welwyn Garden City. Jamie earns a salary of £100,000 a year. Jamie also has a small freelance side-gig but normally keeps total income at £100,000.

Step 1 — Jamie’s position at £100,000

- Personal Allowance = £12,570 (this is tax-free).

- Jamie’s taxable income = £100,000 − £12,570 = £87,430.

- So at £100,000 Jamie keeps the full £12,570 tax-free and pays tax only on £87,430.

Now imagine Jamie gets a £10,000 bonus. That pushes total pay to £110,000 (If you’re a first-time filer, register for Self Assessment) Here’s what happens next.

Step 2 — The taper rule kicks in

- Taper threshold = £100,000. Any income above that reduces the Personal Allowance by £1 for every £2 earned above £100,000.

- Jamie’s extra income above the threshold = £110,000 − £100,000 = £10,000.

- Personal Allowance lost = £10,000 ÷ 2 = £5,000.

- So Jamie’s new Personal Allowance = £12,570 − £5,000 = £7,570.

Step 3 — New taxable income after the bonus

- In normal higher-rate band situations you pay 40% tax on extra income. So on £10,000 extra you’d normally pay £10,000 × 40% = £4,000 tax, keeping £6,000.

- But inside the taper you also lose allowance worth £5,000, and that lost allowance is taxed at 40%: that’s £5,000 × 40% = £2,000 tax.

- Total extra tax on the £10,000 bonus = £4,000 + £2,000 = £6,000.

So Jamie pays £6,000 of tax on the £10,000 bonus — an effective marginal tax rate of 60% (because £6,000 ÷ £10,000 = 60%). Jamie only keeps £4,000 of the bonus.

Many employees are unaware of this tax trap until they file a Self-Assessment return– because it is not visible in basic PAYE tax codes. If you’ve overpaid, you may also be due an income tax refund / P800. (Further understanding how PAYE is calculated can help clarify this process, and if you’re a first-time filer, make sure to register for Self Assessment to report your income correctly).

Smart Use of Other Allowances

The UK tax system offers several additional allowances in addition to the Personal Allowance that, when used properly, can drastically lower your tax liability. These benefits, which cover dividends, capital gains, income splitting, and savings, are particularly beneficial for people who have several sources of income or are close to tax thresholds.

Key allowances for 2025–2026 are broken down here, along with tips on how to maximise them:

A] Savings Allowance:

Depending on your income tax band, you may receive a tax-free savings allowance on interest income:

| Taxpayer Type | Savings Allowance |

| Basic-rate (20%) | £1,000 |

| Higher-rate (40%) | £500 |

| Additional-rate (45%) | £0 |

How to use it smartly:

- Maintain funds in ISAs or high-interest savings accounts.

- If the partner with the lesser income is in a lower tax bracket, move the funds into their name.

- For tax-free returns, think about NS&I products or Premium Bonds.

B] Dividend Allowance:

Every taxpayer is entitled to a tax-free dividend allowance, which is £500 in 2025–2026 (down in half from £1,000 in 2023–2024).

You’re eligible for this allowance if you receive dividends from shares you own in a company. Simply joining a company as an employee does not make you eligible unless you hold shares and receive dividend payments.

Dividend tax rates above the allowance:

| Tax Band | Dividend Tax Rate |

| Basic Rate | 8.75% |

| Higher Rate | 33.75% |

| Additional Rate | 39.35% |

Smart use:

- Dividends within the £500 allowance are one way for business owners to compensate themselves.

- To maximise both allowances, split ownership with a spouse.

C] Capital Gains Tax (CGT) Annual Exempt Amount:

Before taxes are applied, you can make a specific amount of capital gain, or profit. The yearly CGT-free amount for 2025–2026 is £3,000 per person.

Gains above this are taxed at:

- 10% (basic-rate taxpayer)

- 20% (higher/additional rate)

- 18%/24% for residential property gains

Smart moves:

- To use your annual allowance, sell assets gradually over several tax years.

- To take advantage of both exclusions, transfer assets to a spouse before sale (totaling £6,000 tax-free).

- To completely protect investments from CGT, use ISAs or pensions.

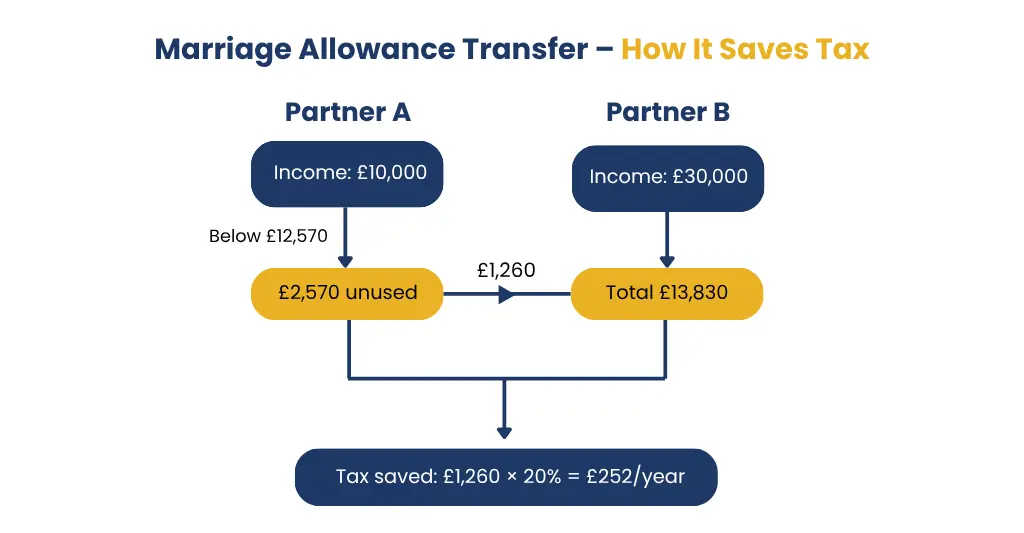

D] Marriage Allowance:

You can give your partner £1,260 of your unused allowance if one spouse makes less than the Personal Allowance (£12,570) and the other is a basic-rate taxpayer. This can save you up to £252 in taxes each year.

Tip: Apply retroactively for up to 4 previous years if eligible, giving up to £1,200 back.

E] ISA Allowance:

An ISA (Individual Savings Account) allows an adult to invest up to £20,000 annually; all income, interest, and capital gains within the ISA are tax-free.

Types include:

- Cash ISAs (tax-free savings interest)

- Stocks & Shares ISAs

- Lifetime ISAs (LISAs): great for home-buyers and retirement

Smart strategies:

- Make the most of your tax-free growth by using your ISA allocation early in the tax year.

- Children can save up to £9,000 annually tax-free with a Junior ISA.

#2. Maximise Pension Contributions & Use Salary Sacrifice

Why Pensions Are the Ultimate Tax Shelter?

Some of the greatest tax benefits available in the UK are provided by pensions:

- Tax Relief on Contributions:

- Automatically receive 20% basic-rate relief

- Through Self Assessment, higher and additional-rate taxpayers can claim 40% or 45%.

- Reduce Taxable Income:

- For tax purposes, contributions reduce your income.

- Avoid the 60% tax trap and get your Personal Allowance back.

- Tax-Free Growth:

- Capital gains and income taxes do not apply to investments as they increase.

- 25% Tax-Free Lump Sum: You can withdraw up to 25% of your pension fund tax-free when you retire.

- Inheritance Benefits: Pensions are usually outside your estate for inheritance tax (IHT)

How Salary Sacrifice Schemes Lower Your Taxable Pay?

An arrangement whereby you and your employer agree to trade a portion of your gross pay for a non-cash benefit, usually pension contributions, is known as salary sacrifice.

How does it work step-by-step?

- Agreement is made: You and your employer mutually decide to take out a certain amount from your salary. This is completed before your income is taxed or your NI is determined. The reduction is given in exchange for a benefit (for example, daycare vouchers, an electric car lease, more pension contributions, employer contributions, or a bike through Cycle to Work).

- Salary is reduced: The amount you sacrificed is subtracted from the original pay to determine your new pay.

Example: Your taxable salary is £37,000 if you make £40,000 and provide £3,000 for pension contributions.

- Benefit is provided: Your company offers or pays for the agreed benefit directly, rather than giving you the cash equivalent of the sacrificed wage. An example of this would be if your company paid the sacrificed sum directly into your pension fund.

- Tax & NI savings happen automatically: Because your taxable income is lower, you pay less Income Tax and NI. Your employer also pays less employer NI, and in some cases, they may share some of that saving with you.

Tax benefits:

- You don’t pay income tax or NI on the sacrificed amount.

- Your employer saves NI too — some of this saving is passed back into your pension.

- It can help bring your income below key thresholds, like:

- The 40% tax band.

- The £100,000 taper zone

- Child Benefit tax charge thresholds

#3. Use ISAs to Shield Savings and Investments from Tax

What Is an ISA and How Is It Different from a Traditional Savings Account?

A unique savings or investment account in the UK that lets you earn interest, dividends, or capital gains entirely tax-free is called an ISA (Individual Savings Account). This means you are exempt from paying income tax, dividend tax, or capital gains tax on all of your profits.

An ISA allows you to keep every penny you earn, unlike a traditional savings account where interest beyond your Personal Savings Allowance (up to £1,000 for basic-rate taxpayers) may be taxed.

How do ISAs Work?

- You receive a fixed ISA allowance per tax year (6 April to 5 April), which is currently £20,000 (as of 2025).

- This allowance can be divided across other ISA kinds, but the total cannot be exceeded.

- You cannot carry over your allowance if you do not utilize it in full by the end of the tax year.

ISA vs Traditional Savings Account

| Feature | ISA | Traditional Savings Account |

| Tax on earnings | All interest, dividends, and gains are tax-free | Interest above the Personal Savings Allowance may be taxed |

| Annual limit | £20,000 per person (2025/26) | No limit |

| Types available | Cash, Stocks & Shares, Lifetime, IFISA | Usually just cash |

| Risk levels | Can be low (Cash ISA) or high (Stocks ISA) | Mostly low risk |

| Withdrawals | Varies (flexible/non-flexible) | Generally flexible |

#4. Plan Your Capital Gains and Dividend Income

The timing of your income receipts and asset sales might have a significant impact on your tax liability when it comes to investment management. Both dividend income and capital gains are taxable in the UK, but with proper preparation, you can safely minimise or completely avoid these taxes by utilizing tax-efficient accounts, timing techniques, and allowances.

What Is Capital Gains Tax?

If you sell or “dispose of” an item, such as shares, real estate (apart from your primary residence), or even cryptocurrencies, for more than you originally paid for it, you are subject to capital gains tax (CGT). Instead of the entire transaction price, the tax is applied to the profit.

How to Plan Capital Gains?

The key to managing CGT is timing and strategy:

- Before the tax year finishes, make use of your annual allowance. It cannot be carried over if it is not used.

- To always stay within the limit, if you intend to sell substantial assets, think about distributing the transactions over two or more tax years.

- You may deduct losses from other investments against your taxable earnings.

- Think about keeping investments in tax-free wrappers, such as pensions or ISAs, where CGT is not applicable.

What Is Dividend Income?

Dividends are sums of money paid to you from company stock as a percentage of earnings. Direct shares, investment funds, or business ownership (if you are a director or shareholder of your own company) are all possible sources of dividend income.

How to Plan Dividend Income?

Dividend tax can mount up even though the tax rates are lower than those on ordinary income. Here’s how to make it smaller:

- Ensure that both you and your spouse or civil partner make full use of your individual allowances and take advantage of the £500 dividend allowance each year.

- Invest in dividend-paying securities in an ISA or pension plan, where profits are fully tax-free.

- If you are a business owner, you can avoid higher-rate thresholds by carefully timing your dividend withdrawals.

- Instead of taking all of your dividend income at once, think about reinvesting it or spreading it out if you’re nearing the basic/higher-rate line.

#5. Use Employer Share Schemes and Tax-Free Benefits

Utilising employer-sponsored benefits to the fullest can improve your total pay while drastically lowering your tax liability. Numerous businesses provide tax-free benefits and share plans that are both practical from a tax perspective and financially appealing.

With the help of employer share schemes like Save As You Earn (SAYE), Share Incentive Plans (SIPs), or Company Share Option Plans (CSOPs), you can purchase company stock at a reduced price or without having to pay income tax or national insurance on the share value. These plans may be a wise tax investment in the expansion of your business.

You can also take advantage of tax-free perks like childcare vouchers (under previous programs), season ticket loans, cycle-to-work schemes, and even some health benefits (like yearly health checks). Compared to conventional salaries, these benefits are either taxed at a lesser rate or are completely free.

For example, if you join a Save As You Earn (SAYE) scheme, you might save £200 a month for 3 years and then use that money to buy company shares at a 20% discount, without paying Income Tax or National Insurance on the gain. Or, through a Cycle to Work scheme, you could get a £1,000 bike via salary sacrifice — meaning the cost is taken from your pay before tax, saving you hundreds compared to buying it outright.

#6. Invest in VCTs and EIS for Tax Relief on Investments

EIS vs VCT – What’s the Difference?

Although both venture capital trusts (VCTs) and the Enterprise Investment Scheme (EIS) provide alluring tax advantages, they vary in terms of structure, degree of risk, and method of investor access.

| Feature | EIS | VCT |

| Tax Relief | 30% Income Tax relief | 30% Income Tax relief |

| Maximum Investment | £1 million per year (or £2 million for knowledge-intensive companies) | £200,000 per year |

| Holding Period | Minimum 3 years | Minimum 5 years for tax relief |

| Dividends | Taxable | Tax-free |

| Capital Gains Tax (CGT) | Gains are CGT-free after 3 years; CGT deferral and loss relief are available | Gains are CGT-free, but no loss relief |

| Risk Level | Typically higher – investing in individual startups or early-stage companies | Typically, lower VCTs spread risk across a portfolio of companies |

| Liquidity | Less liquid – unlisted shares | More liquid – VCTs are listed on the stock market |

| Who it suits | Experienced investors seeking higher risk/reward and tax planning | Investors seeking tax-efficient income and diversification |

To know more about EIS Tax Relief, read our blog : How Does EIS Tax Relief Work? Explained with Real Life Examples

Example: EIS vs VCT in Practice

- EIS Example:

Sarah invests £50,000 in an early-stage biotech startup through the EIS scheme.

She receives £15,000 back as Income Tax relief (30%).

If the company grows and she sells her shares after 3 years for £100,000, there’s no Capital Gains Tax.

If the company fails, she can claim loss relief, reducing the downside.

- VCT Example

James invests £100,000 in a Venture Capital Trust.

He receives £30,000 Income Tax relief (30%).

He receives tax-free dividends of, say, 5% annually.

After 5 years, he sells his shares at a gain – again, no CGT applies.

- How They Both Differ:

EIS – Invest directly in one small company, get 30% income tax relief, no CGT on gains, and loss relief if it fails , but higher risk as it’s not diversified.

VCT – Invest in small fund holding companies, get 30% income tax relief, tax-free dividends, and no CGT on sale, lower risk due to diversification.

#7. Claim All Legitimate Expenses and Allowable Deductions

Making sure you claim all permitted expenses and deductions is one of the best and most lawful strategies to lower your tax liability. Ignoring deductible items could result in you paying more tax than you need to, regardless of whether you are an employee with work-related expenses, a director of a company, or a self-employed person.

For example:

You can lower your taxable profit by deducting some of your residential expenses, including internet and electricity, from your company expenses if you operate a freelance design firm from home. Similar deductions can be made for mileage, rail tickets, and even overnight lodging if you travel for work to meet with clients. These valid claims reduce your taxable income, allowing you to keep a larger portion of your earnings.

Bonus Tip – Review Your Tax Plan Annually

Tax laws, individual situations, and company performance can all vary from year to year. It is essential to examine your tax strategy every year to make sure you are still taking advantage of all applicable deductions, reliefs, and allowances.

An annual review helps you:

- Adjust your strategy in response to legislative changes.

- Identify new opportunities for tax savings.

- Ensure compliance and avoid penalties.

- Plan cash flow around tax deadlines.

Working with professionals who understand your business is key. Our team can assist you with tailored advice and proactive planning through our management accounting services. We also assist in closing your books efficiently and finding tax optimisation opportunities through year end accounting services.

Conclusion: You’re Allowed to Pay Less Tax – Legally

Understanding and using the regulations to your advantage is more important than breaking them in order to reduce your tax liability. Making tax-efficient investments and deducting all of your expenses are just two of the numerous legal strategies to lower your tax liability and keep more of your income.

However, understanding the UK tax system may be challenging, particularly if your company is expanding or your financial situation is changing.

That’s where E2E Accounting comes in.

How to Pay Less Tax With E2E

From bookkeeping and payroll to management accounts, VAT, and corporation tax, E2E offers a comprehensive, end-to-end solution. Our team of qualified accountants makes sure your finances are compliant, optimised, and strategically aligned, regardless of whether you are an investor, limited business, or sole proprietor.

Tax is inevitable. Overpaying isn’t.

Let E2E assist you in maximising all legal savings opportunities while maintaining compliance.

People Also Ask:

How can I legally pay less tax in the UK?

Through the use of tax-free allowances, the claim of all permitted costs, pension contributions, investment through schemes such as EIS or VCT, charity donations, and tax-efficient benefits provided by employers, you can lawfully lower your UK tax burden. Maintaining compliance while preserving a larger portion of your earnings is possible with careful preparation and frequent reviews.

What are the most tax-efficient types of ISA?

All ISAs are tax-efficient, but which is the most beneficial depends on your goals.

– Stocks & Shares ISA – Ideal for long-term growth; no Capital Gains Tax or Income Tax on returns.

– Lifetime ISA (LISA) – Great for first-time homebuyers or retirement savings; includes a 25% government bonus (up to £1,000/year).

– Cash ISA – Tax-free interest; best for low-risk savers.

– Innovative Finance ISA – Offers higher returns via peer-to-peer lending, though with more risk.

How does salary sacrifice reduce tax in the UK?

A salary sacrifice reduces both income tax and national insurance by sacrificing a portion of your pay for benefits (such as bikes or pensions), which decreases your taxable income.

What is the 40% tax bracket in the UK?

In England, Wales, and Northern Ireland, yearly incomes between £50,271 and £125,140 (2025/26 tax year) fall into the 40% tax bracket, also referred to as the higher rate. The tax rate on income in this bracket is 40%.

Can self-employed individuals use ISAs and pensions for tax planning?

Yes, self-employed people can save money tax-efficiently by using both pensions and ISAs. While pension contributions cut taxable income and qualify for tax relief, ISAs offer tax-free returns and help you pay less in taxes overall. They are effective instruments for long-term budgeting.

What are VCTs and EIS, and how do they reduce tax?

Government-backed investment schemes, the Enterprise Investment Scheme (EIS) and Venture Capital Trusts (VCTs), provide substantial tax breaks to entice investment in small enterprises in the United Kingdom.

– VCTs provide tax-free dividends, 30% income tax relief, and no capital gains tax on profits.

– EIS provides loss reduction, CGT deferral, 30% income tax relief, and tax-free gains after three years.

Despite their higher investment risk, they are perfect for higher-rate taxpayers looking for growth and tax efficiency.