Undisclosed agent VAT is a crucial concept that helps eCommerce sellers understand who is ultimately responsible for VAT in a transaction. It discusses how VAT works when a marketplace or platform acts as a middleman between you and the consumer. Understanding this clarifies when you need to charge, collect, and pay VAT personally, rather than believing the platform will handle it all.

In this blog, we will explain what undisclosed agent VAT is, how it affects online transactions, and what UK eCommerce sellers should do to stay compliant and prevent unexpected VAT bills.

What is an Undisclosed VAT Agent?

An undisclosed VAT agent is a middle person who is involved in a sale but they do not disclose to the customer that they are acting on behalf of another business. From a VAT perspective, this means the agent is treated as if they are buying and selling the goods or services themselves, even though they are acting for the original seller behind the scenes.

As a result, two distinct VAT supplies are recognised in the UK: one from the seller to the agency and another from the agent to the final consumer. This distinction is crucial for eCommerce sellers since it directly impacts who is in charge of charging VAT, sending invoices, and reporting VAT to HM Revenue & Customs. Comprehending if a platform or intermediary is functioning as an undeclared agent facilitates accurate application of VAT and mitigates compliance issues.

Why UK eCommerce Sellers Should Care About Undisclosed VAT Agents

UK eCommerce sellers need to care about undisclosed VAT agents because they can be the reason your company bears fines or penalties. These agents may not be registered or open about their activity, making you accountable for unpaid VAT and compliance difficulties. Here’s why it matters.

- VAT Registration Risks: Selling overseas means dealing with VAT in numerous jurisdictions. Undisclosed agents may ignore important details, resulting in inaccurate registrations or filing problems.

- Non-compliance: Undisclosed VAT agents may not seriously adhere to local VAT laws which can result in penalties.

- Reputation Damage: Inconsistent VAT reporting can ruin your company’s reputation, particularly on platforms like Amazon and eBay.

- VAT Recovery Issues: If you unknowingly deal with an undisclosed VAT agent, you may assume the agent or marketplace is handling VAT, when legally you are still responsible. This frequently results in improper VAT handling, which means VAT is charged, recorded, or reclaimed incorrectly. As a result, HMRC may block or claw back VAT reclaims, affecting your cash flow and resulting in unknown obligations.

Disclosed Agent vs Undisclosed Agent – Which Model Should You Choose?

| Aspect | Disclosed Agent | Undisclosed Agent |

| Visibility to Customer | The agent clearly discloses that they are acting on the behalf of the seller. | The customer is not aware of the agent’s role. |

| Who is the supplier? | The seller is the supplier to the customer. | The agent is treated as both buyer and seller for VAT purposes. |

| VAT Treatment | Single VAT supply from seller to customer | Two VAT supplies: seller to agent, and agent to customer |

| Invoicing responsibility | Seller issues VAT invoice to the customer. | Seller invoices the agent; agent invoices the customer |

| Impact on pricing | Seller controls pricing and VAT calculation | Pricing must account for two supplies and VAT implications. |

| Best suited for | Sellers want clarity, control, and simpler VAT compliance. | Sellers using platforms or intermediaries with embedded sales models. |

You can choose any of the models based on your requirement and convenience.

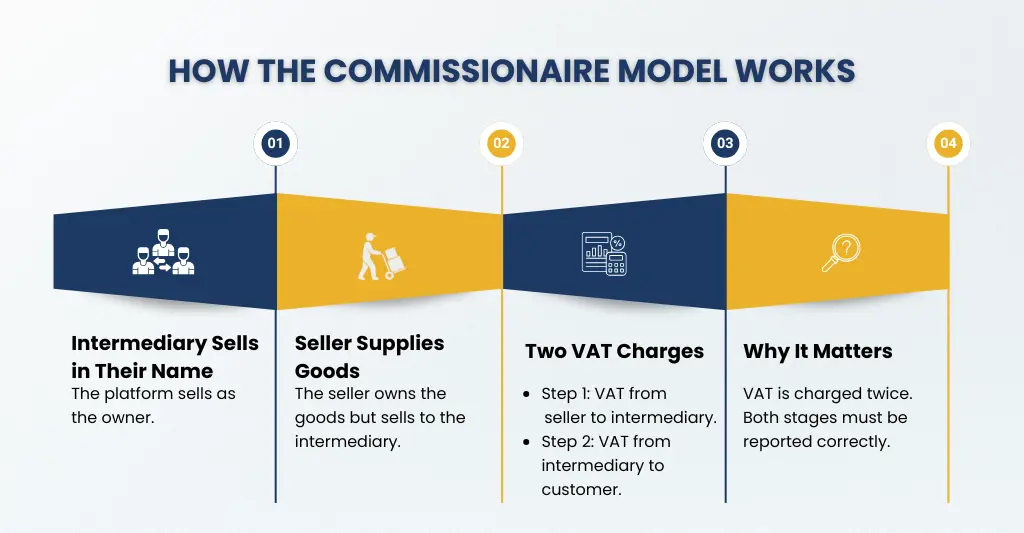

What is the Commissionaire Model and How Does It Affect VAT for eCommerce Sellers?

Here are some pointers that will explain the commissionaire model in an easy way:

- An intermediary sells in its own name: The commissionaire represents himself as a seller to the customer, even if the goods or services belong to another business.

- The customer doesn’t know the original seller: From the buyer’s perspective, the platform or middleman, not the underlying supplier, completes the transaction.

- Two VAT supplies are created: One supply is seen as happening between the commissionaire and the seller. Another supply happens between the commissionaire and the client for VAT purposes.

- VAT is charged at each stage: VAT is charged by the seller to the commissionaire, who then charges it to the final consumer.

- Common in eCommerce and marketplaces: Online platforms frequently adopt this model, particularly when they manage client communications, payments, and checkout.

- Compliance is essential: To ensure accurate reporting to HM Revenue & Customs and prevent penalties, sellers must be aware of their role and VAT requirements.

For example:

Suppose a UK brand “BrightTech Ltd” which sells gadgets through a local partner “ShopFast UK”:

Sarah visits ShopFast website, orders a gadget and gets an invoice from ShopFast. Here, in reality ShopFast is the commissionaire, selling in its own name on behalf of BrightTech Ltd. BrightTech is the actual owner till the product is delivered to the customer. Once the product is sold, ShopFast earns some percent of commission on the real selling price.

- For VAT:

- ShopFast may have to charge UK VAT to the customer, because it is the one shown as the seller.

- BrightTech may have a separate transaction with ShopFast (for the goods or for the commission), which also has VAT consequences.

VAT Self-Billing and Its Relevance to Undisclosed VAT Agents

VAT self-billing is the special invoicing setup where the customer himself creates the invoice instead of the supplier. But keep in mind that, both the customer and supplier must be VAT registered and they must make an agreement in writing.

Why is Self-billing used?

- It can make life easier when the consumer has a better understanding of the ultimate amount (for example, platform commissions, variable fees, or royalties).

- It maintains uniform invoices and can make accounting easier, particularly when there are many little or regular payments.

Why can self-billing be risky with undisclosed agents?

- Wrong supplier shown on the invoice: In a self-billing arrangement, customers should provide the supplier’s name and VAT number on their invoice. If they put the agent’s data (for example, the marketplace or intermediary), it appears that the agency is selling rather than the real supplier.

- VAT claims can be refused: HMRC may declare an invoice invalid if it does not show the actual vendor or the real flow of the transaction. In that situation, the buyer may not be able to claim the input VAT displayed on it, even if they paid it.

- Missing or unclear agreements: As mentioned before, Self-billing requires both parties to agree in writing and be VAT-registered. If there is no proper agreement, self-billing may not be legal for VAT, leading to misunderstanding over who the genuine supplier is and increasing the possibility of VAT problems.

- Higher chance of HMRC checks: There are high chances of HMRC verification if agents or marketplaces are involved.

Common Mistakes with Undisclosed VAT Agents (And How to Avoid Them)

For eCommerce sellers and intermediary models, dealing with undisclosed VAT agents is common, yet sometimes expensive VAT errors happen. Many of the time the major problem is miscommunication rather than intention. Here are the most common mistakes, along with advice on how to prevent them.

- Treating the agent as a disclosed agent:

- Mistake: Assuming that the agent is merely setting up the transaction, even when they are actually working on their own behalf.

- How to avoid it: Check contracts closely to determine if the agent is declared or not. This status is the sole factor of VAT treatment.

- Issuing invoices in the wrong name:

- Mistake: The incorrect supplier, typically the agent rather than the actual seller, or vice versa, is displayed on VAT invoices.

- How to avoid it: Ensure that invoices accurately represent the VAT supply chain and specify who is responsible for each supply.

- Incorrect VAT charging:

- Mistake: Ensure that invoices accurately represent the VAT supply chain and specify who is responsible for each supply.

- How to avoid it: Correctly apply VAT at every stage of the transaction, not simply the last sale.

- Poor or missing documentation:

- Mistake: There is either no explicit agency agreement or unclear language regarding the ownership and pricing of the commodities.

- How to avoid it: Maintain formal contracts that specify duties, responsibilities, and VAT obligations.

- Ignoring HMRC reviews and guidance:

- Mistake: Assuming that because the system has “always worked this way,” it is acceptable.

- How to avoid it: Regularly assess your VAT setup and stay up to date with HMRC guidelines, particularly if your business model changes.

Example: A UK online vendor has been using the same marketplace settings for years and never checks HMRC guidelines. The vendor subsequently begins shipping to EU clients and uses an EU warehouse, but the VAT settings remain unchanged. Years later, HMRC investigates the business and discovers that VAT was not correctly charged on EU transactions, requiring the seller to pay backdated VAT plus interest.

Practical Steps to Managing VAT With Undisclosed Agents

- Confirm the agent’s status: Verify if the agent is functioning under their own identity and is genuinely undisclosed. The contract should make this very obvious.

- Identify both VAT supplies: The arrangement should be viewed as two distinct supplies: supplier → agent and agent → customer.

- Invoice correctly: The correct supplier, VAT number, and VAT rate must be displayed on VAT invoices. Self-billing must adhere to HMRC regulations.

- Charge VAT at each stage: Don’t handle it as a single sale. At both stages of the transaction, VAT may be owed.

- Keep proper records: Keep invoices , VAT computations, and agency agreements for HMRC checks.

Conclusion

Undisclosed VAT agent agreements are common, especially in intermediary and eCommerce models, you just have to be careful while handling VAT. HMRC examines the legal supply chain rather than commercial convenience. Errors in invoicing and VAT reporting mostly happen when companies fail to acknowledge that undisclosed agents generate two separate VAT supplies. Regular VAT checks, accurate invoices, and clear contracts all assist lower risk and guarantee that the company stays compliant as it expands.

People Also Ask:

What is the meaning of an undisclosed agent?

An undisclosed agent is an agent who acts on the behalf of another person but in their own name, without letting the customer know they are acting as an agent. For VAT purposes, HMRC treats this as two separate supplies, not one.

How do I ensure VAT compliance when using an undisclosed VAT agent?

To ensure VAT compliance when using an undisclosed VAT agent:

– Confirm the agent’s role in the contract

– Treat the transaction as two VAT supplies

– Issue invoices in the correct name

– Charge VAT at each stage

– Keep clear records and review regularly

This helps avoid VAT errors and HMRC penalties.

What’s the difference between a disclosed and undisclosed VAT agent?

A Disclosed VAT agent acts in the name of the supplier, so VAT is charged directly between the supplier and customer. Whereas, an undisclosed VAT agent acts in their own name. So, HMRC treats the arrangement as two separate VAT supplies one to the agent and other to the customer.

What are the common mistakes UK eCommerce sellers make with VAT?

Common VAT mistakes UK eCommerce sellers make include:

– Using the wrong VAT rate on products or services

– Incorrect VAT treatment on marketplace or agent sales

– Issuing invoices in the wrong name, especially with undisclosed agents

– Missing VAT registration thresholds or registering late

– Poor record-keeping for sales, refunds, and expenses

– Incorrect VAT return submissions or late filings

These errors often lead to penalties, rejected VAT claims, or unexpected VAT bills from HMRC.

How can VAT self-billing help UK eCommerce businesses?

VAT self-billing speeds up invoicing and lowers administrative costs for UK eCommerce companies, particularly in areas with high transaction volumes. When combined with a legitimate self-billing arrangement that complies with HMRC, it also increases accuracy.

Is VAT self-billing mandatory for eCommerce businesses?

No, VAT self-billing for eCommerce companies is not compulsory. Invoicing can be made easier with this optional solution, but if it is employed, it must adhere to HMRC regulations.