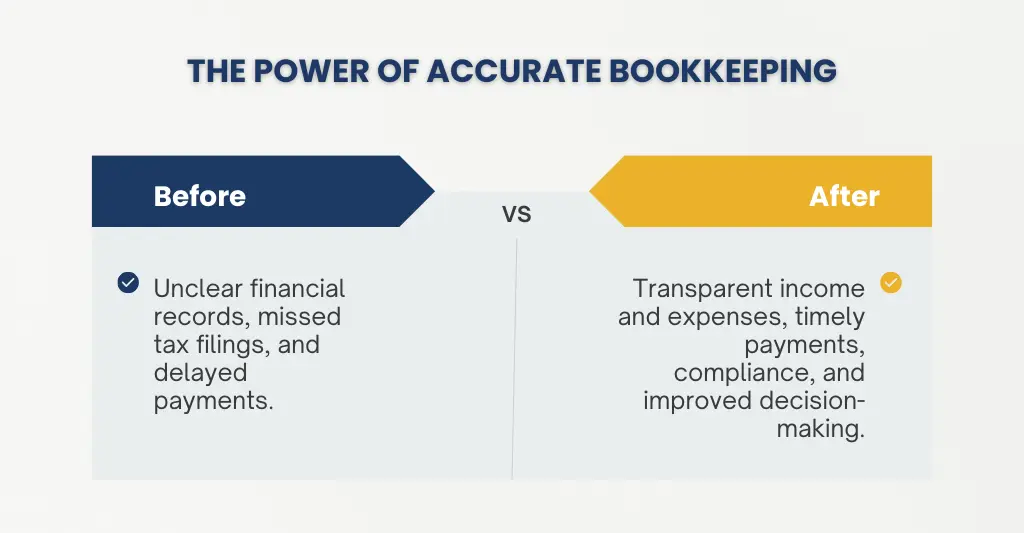

The construction business is not just about constructing roads and buildings. Keeping track of money flowing in and out of the business is equally important. Without proper bookkeeping, it is impossible to keep an accurate record of your income and expenses.

A construction company needs good bookkeeping for construction industry, just like a structure needs a strong base. Without it, projects may suffer, expenses may get out of control, and profits may vanish without adequate financial monitoring. Changing labor rates, shifting material costs, and complex project budgets are some common difficulties construction companies face. Long-term success, compliance, and financial stability are all guaranteed by sound bookkeeping for construction industry.

Effective bookkeeping for the construction industry is a strategic method that guarantees long-term profitability, compliance, and financial stability. It goes beyond simply keeping track of numbers. The foundation of a structure determines its strength, and sound financial management is essential to the expansion and survival of a construction company. Construction companies can lower financial risks, increase productivity, and create an excellent future by investing in excellent bookkeeping procedures. In this blog, we will understand more details about bookkeeping.

“Bookkeeping for Construction Industry is a foundation of strong business”.

Importance of Accurate Bookkeeping for Construction Industry

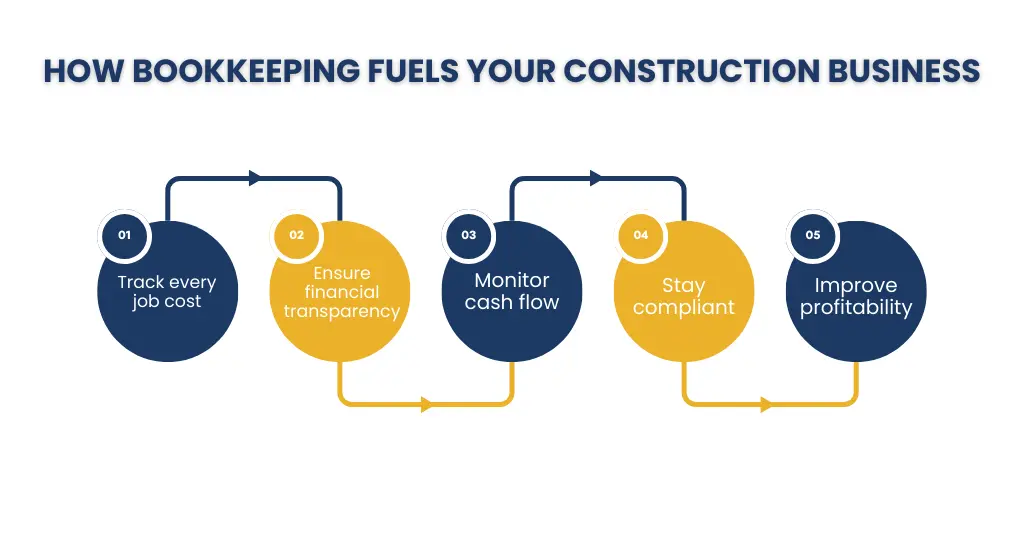

Financial Transparency:

For the infrastructure industry, financial transparency is essential since it provides a clear picture of the company’s financial situation. Real-time tracking of income, expenses, liabilities, and assets is made possible by accurate bookkeeping. Making educated decisions is facilitated by this transparency, which also helps to spot any financial gaps that would need to be closed to prevent further losses.

Cash Flow Management:

In the construction industry, cash flow is a major challenge because of the delay between project spending and payment receipts. Businesses can track cash inputs and outflows, forecast future cash requirements, and guarantee enough liquidity by keeping precise financial records. Proactive planning is made possible by proper bookkeeping,helps avoid financial burdens during times of low cash flow.

Compliance with Regulations:

The infrastructure sector must comply with strict tax laws and reporting requirements. Costly fines and legal problems may result from inaccurate financial reporting. Accounting for construction firms guarantees that all financial transactions are documented in compliance with tax regulations, such as income tax, payroll tax, and sales tax. Furthermore, proper financial records are essential for adhering to industry-specific regulations like bonding and licensing.

Project Cost Management:

Construction projects are complicated in nature as there are numerous variable costs associated, including materials, labor, subcontractors fees, and equipment rentals. Accurate bookkeeping assists in managing these costs by keeping precise job costing, a system that allocates all expenses to specific projects. This makes it easier to stay within budget and sustain profitability by guaranteeing that the financial position of each project is transparent and preventing cost overruns.

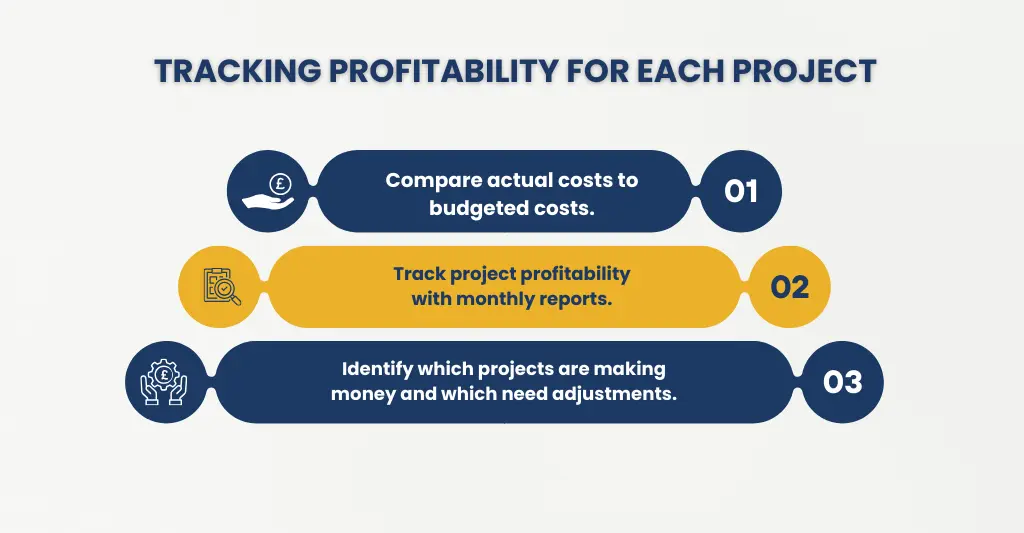

Project Profitability:

The infrastructure industry frequently manages several projects at once, so monitoring each one’s profitability is essential. Construction companies can produce job cost reports that compare actual and budgeted expenses by maintaining accurate records. Which projects are more profitable and which would require modifications are determined by these studies.

Improve Resource Allocation:

Allocating resources effectively is essential to guaranteeing that projects are finished on schedule and within budget. Precise financial monitoring via bookkeeping facilitates the effective distribution of labor, supplies, and machinery. Through cost monitoring, construction firms can make well-informed decisions regarding the deployment of these resources, resulting in reduced expenses and enhanced efficiency.

Bookkeeping Software for Construction Companies

It’s critical to examine your company’s needs while deciding which construction accounting software to utilise. Even though all of them are excellent choices, some may be more appropriate for your particular situation. For effective bookkeeping for construction industry, selecting the right software is key to ensuring accurate financial management. A summary of the best choices currently available is provided below:

It’s critical to examine your company’s needs while deciding which construction accounting software to utilise. Even though all of them are excellent choices, some may be more appropriate for your particular situation. A summary of the best choices currently available is provided below:

| Features | QuickBooks Online | Foundation |

| Core Purpose | General accounting and bookkeeping are appropriate for independent contractors, small enterprises, and independent contractors working on basic projects. | Designed for full-fledged contractors overseeing numerous projects and comprehensive work costing; specialised accounting |

| Job & Project Costing | Basic support, “Projects/Jobs” can be created, and income and expenses can be assigned. This works well for minor projects. | Advanced support keeps track of labor, supplies, machinery, subcontractor expenses, modification orders, and retentions for each task or project. |

| Billing & Invoicing | Excellent for routine billing and invoicing; simple to send bills to customers. | Handles billing in the construction industry, including retainage, draw schedules, progress billing, and change orders. |

| Subcontractor & Payroll Handling | Payroll and subcontractor payment management is sufficient for small teams. | Strong subcontractor management, labor payroll, certified payroll compliance and assistance, and thorough subcontractor cost monitoring. |

| Equipment, Materials & Inventory | Purchases and expenses can be tracked, but manual labor or add-ons may be needed for inventory, materials per task, or equipment depreciation. | Materials, inventory monitoring, equipment prices, depreciation, and job-based allocation are all supported automatically. |

| Scalability | Excellent for smaller to medium-sized companies with fewer tasks | Better for medium-sized to large businesses that require strict bookkeeping and have several overlapping projects. |

To learn more about which software might be the best fit for your construction business, check out our detailed blog on Accounting Software for Construction

Step-by-Step Guide to Bookkeeping for the Construction Industry

Due to job costing, subcontractor payments, varying material pricing, and project-based billing, infrastructure industry bookkeeping is more comprehensive than normal bookkeeping. Any construction company can use this step-by-step guide for precise, compliant-friendly books:

- Set Up a Construction-Friendly Chart of Accounts: Create different categories for labor, materials, subcontractors, equipment rental, overhead, and costs associated with the job. This enables you to precisely monitor every expense for every project.

- Track All Income and Expenses by Project (Job Costing): Assign each transaction to a single job, including labor hours, purchase orders, invoices, receipts, and subcontractor costs. This provides you with an accurate view of project profitability.

- Record Material Purchases Properly: Construction materials fluctuate in price, and unused materials may be returned or moved between sites.

- Record:

- Vendor invoices

- Delivery notes

- Inventory movement between projects

(This ensures cost accuracy and avoids overbilling or underbilling.)

- Record:

- Manage Subcontractor Payments & Compliance: Subcontractors are a huge part of construction bookkeeping.

- Keep detailed records of:

- Contracts

- Work completed

- Invoices

- Retentions

- Tax compliance (CIS for UK, 1099s for USA)

(Late or incorrect payments can stall project timelines.)

- Keep detailed records of:

- Track Equipment & Machinery Costs: Whether you own or lease equipment, record:

- Fuel

- Maintenance

- Depreciation (you can refer to our practical guide on Depreciation Accounting for SMEs if you need a refresher)

- Rental charges

- Repairs

Allocate these costs to jobs wherever possible to maintain accurate job costing.

Best Practices

- Track Every Cost by Job: Assign all costs to the appropriate project, including labor, supplies, equipment, and subcontractors. This avoids budget overruns and maintains obvious job profitability.

- Keep Daily or Weekly Records Updated: Costs associated with construction move quickly. You may prevent cash flow surprises, inaccurate entries, and missing receipts by regularly updating your books.

- Maintain Clear Documentation: Keep track of change orders, payroll logs, gasoline receipts, delivery notes, and invoicing. Having enough paperwork shields you from audits and legal disputes.

- Monitor Change Orders Closely: Change orders should be noted as soon as they happen. Inaccurate financial reporting and revenue loss might result from unmonitored adjustments.

- Use Bookkeeping Software Designed for Projects: To track work progress, material usage, and expenses in real time, select tools with job-costing functionality.

- Track Equipment Costs Properly: Keep track of your fuel, routine maintenance, repairs, and rental costs. To achieve actual work profitability, assign these expenses to projects.

- Review Job Reports Regularly: Examine reports on work profitability, cost-to-complete, and budget versus reality. This keeps projects on schedule and enables you to identify problems early.

Common Mistakes in Construction Bookkeeping and How to Avoid Them

- Not Tracking Expenses by Job: Many construction companies keep track of their costs in bulk without allocating them to particular projects.

- Why it’s an issue: You won’t be able to determine which jobs are making money or not.

- How to stay away from it: Assign each invoice, labor hour, and material purchase to the appropriate project using job-costing software.

- Poor Handling of Change Orders: In the infrastructure industry, change orders are common, yet many companies don’t properly document them.

- Why it’s a problem: Disputes and missing income result from unrecorded or delayed modifications.

- How to stay away from it: Update the project budget and billing, obtain written approval, and promptly document each change order.

- Incorrect or Incomplete Subcontractor Records: Lack of compliance papers, unclear scopes, and missing invoices are frequent.

- Why it’s a problem: Can result in erroneous project costs, compliance issues, and payment delays.

- How to prevent it: Contracts, invoices, certifications, and retentions should all be kept in one comprehensive subcontractor file.

- Mixing Business and Personal Finances: One account is frequently used for everything in small construction companies.

- Why it’s a problem: It causes misunderstandings, erroneous reporting, and tax problems.

- How to prevent it: Keep separate business credit cards, bank accounts, and petty cash systems.

- Delayed or Inaccurate Billing: Milestone-based charging is common in the construction industry.

- Why it’s a problem: Payment delays and cash flow disruption are caused by late billing.

- How to prevent it: Establish a regular invoicing schedule that is in line with change orders and project progress.

- Poor Management of Retentions: Retentions are frequently overlooked or manually tracked.

- Why it’s a problem: You can calculate job profitability incorrectly or fail to collect payments that are due.

- How to prevent it: Make use of a system that keeps track of releases, deadlines, and retention amounts automatically.

Why Choose E2E Accounting for Bookkeeping for Construction Industry?

In the infrastructure sector, financial management is a challenging task. Accurate bookkeeping is necessary to maintain operations- from managing several project budgets to monitoring labor and material expenditures. E2E Accounting can help with that by providing specialist bookkeeping services that are suited to the particular requirements of construction companies.

The financial difficulties faced by construction enterprises are something that we understand. Compared to ordinary bookkeeping services, we specialise in project-based accounting, which guarantees that all expenses and income are precisely recorded for every project. Our staff’s extensive industry understanding enables us to precisely manage contract invoicing, payroll administration, job costing, and tax compliance. Regardless of the size of your construction company, we offer bookkeeping services that complement your organisational structure.

Conclusion

A successful construction company is built on its bookkeeping. Without adequate financial monitoring, expenses can grow out of hand and result in overspending, cash flow challenges, and noncompliance with regulations. Construction companies may remain profitable, meet project deadlines, and maintain financial stability by maintaining accurate bookkeeping, which guarantees that every dollar made and spent is tracked.

Manually handling building budgets can be very stressful. Purchasing dependable accounting software facilitates the tracking of expenses, payroll, and invoices. However, hiring qualified bookkeepers to handle financial administration is the ideal choice for companies that seek accurate and hassle-free financial management. Financial issues unique to the business are understood by experts, who guarantee accurate job costing, effective cash flow management, and adherence to tax laws.

People Also Ask:

What Should I Include in My Construction Business Bookkeeping?

Job-specific income and spending, labor and material costs, subcontractor payments, equipment charges, modification orders, billing and retentions, and monthly reconciliations should all be included in your construction bookkeeping.

How Can I Manage Cash Flow in My Construction Business?

Keeping a cash reserve, managing retentions, regulating material purchases, keeping a tight eye on job expenses, billing on schedule, and routinely evaluating cash flow forecasts to prevent surprises are all ways to manage your construction company’s cash flow.

How Can I Track Costs Across Multiple Construction Projects?

Using job-costing software, allocating all expenses (materials, labor, subcontractors, equipment) to a particular work, updating costs in real time, and routinely comparing project-wise budget and actual reports will help you keep track of costs across several construction projects.

Do I Need Specialised Bookkeeping Software for My Construction Business?

Yes, specialised construction bookkeeping software is more accurate than normal accounting tools at tracking job expenses, managing change orders, handling retentions, and streamlining billing.

How Often Should I Update My Bookkeeping Records in the Construction Industry?

You should update your construction bookkeeping records every day or at least once a week.

Should I Outsource My Construction Bookkeeping or Keep It In-House?

Keeping construction bookkeeping in-house works if you have the time and know how to handle intricate construction finances. But outsourcing is the best option if you want precise job costing, regular updates, and professional support without hiring internal staff.