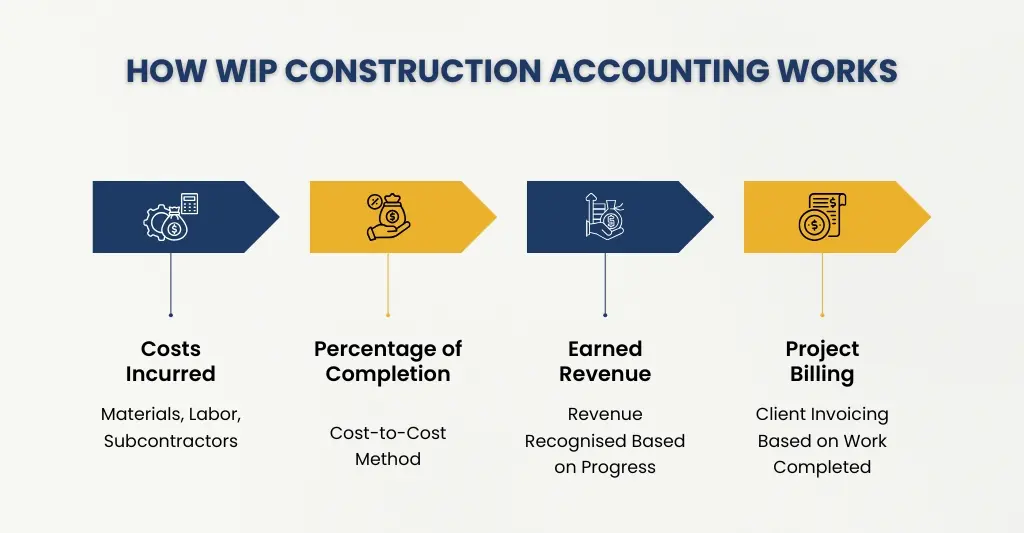

WIP construction accounting is a construction-specific accounting technique that monitors expenses and income throughout building projects. Work in progress (WIP) accounting records the direct labor, materials, subcontracting, and allocated overhead expenses of construction work as it is completed, as opposed to waiting for the project to be finished.

A key financial document, the work in progress (WIP) report, also known as the WIP schedule, provides a comprehensive picture of current work versus the budget by summarising the expenses and income generated for a project during a given period.

Financial information and project milestones are two essential elements in the construction industry that are connected by the work-in-progress schedule. In-depth discussions of WIP reports’ components, applications, and the critical function that WIP accounting plays in construction project management are covered in this article.

What is WIP Construction Accounting & Why It’s Important?

The financial performance of current construction projects is monitored using WIP (Work-in-Progress) construction accounting. Comparing actual progress to the budget allows for real-time expense, revenue, and profit monitoring. In addition to preventing excess expenses, this approach guarantees accurate financial reporting and improved cash flow management. If you’re new to this concept, understanding the basics of construction accounting can offer a helpful foundation before diving deeper into WIP — learn more in our guide on how to do construction accounting.

WIP (Work-in-Progress) Construction Accounting is crucial for:

- Accurate Financial Reporting: Ensures that the ongoing project’s expenses, income, and profit are tracked in real time.

- Better Cash Flow Management: Maintains a healthy cash flow by assisting with billing and spending management.

- Preventing Cost Overruns: Detects budgetary differences early on so that corrective measures can be taken.

- Improved Decision-Making: Gives project managers information on how to best allocate resources.

- Compliance & Transparency: Guarantees compliance with legal and accounting obligations.

- Progress Tracking: Improves project control by comparing the budgeted plan with the actual work done.

WIP Construction Accounting Journal Entries

- Record Direct Costs (Materials/Labour)

Dr WIP (Construction in Progress)

Cr Cash / Accounts Payable - Apply Overheads

Dr WIP – Overheads Applied

Cr Overheads Control / Indirect Costs - Recognise Revenue (POC Method)

Dr Accounts Receivable / Progress Billings

Cr Construction Revenue - Progress Billing to Client

Dr Accounts Receivable

Cr Billings on Construction Contract - Underbilling Adjustment (Revenue > Billings)

Dr WIP – Underbilling

Cr Revenue Adjustment - Overbilling Adjustment (Billings > Revenue)

Dr Revenue Adjustment

Cr WIP – Overbilling - Close WIP at Project Completion

Dr Cost of Goods Sold (COGS)

Cr WIP / CIP - Customer Payment

Dr Cash

Cr Accounts Receivable

Construction Work-in-Progress Accounting Example

Project Details:

- Contract Value: £100,000

- Estimated Total Cost: £70,000

- Costs Incurred to Date: £28,000

- Percentage Completion = 28,000 ÷ 70,000 = 40%

- Revenue to Recognise = 40% × 100,000 = £40,000

- Client Billing Issued: £30,000

Step-by-Step Journal Entries:

- Record Costs Incurred (Materials + Labour + Subcontractors)

Total cost so far = £28,000

Journal Entry

Dr WIP (Construction in Progress)…….. £28,000

Cr Accounts Payable / Cash ……..£28,000 - Recognise Revenue (Percentage of Completion)

Revenue allowed = £40,000

Journal Entry

Dr Accounts Receivable / Progress Billings…….. £40,000

Cr Construction Revenue…….. £40,000 - Record Progress Billing to Client

Client billed = £30,000

Journal Entry

Dr Accounts Receivable…….. £30,000

Cr Billings on Construction Contract…….. £30,000 - Adjust for Underbilling

Revenue recognised: £40,000

Billings raised: £30,000

→ Underbilled = £10,000 (Asset)

Journal Entry

Dr WIP – Underbilling…….. £10,000

Cr Revenue Adjustment…….. £10,000

How Accountants Specialising in Construction Improve WIP Management?

Construction accountants enhance work-in-progress (WIP) management in the following ways:

- Accurate Cost Tracking: Guaranteeing accurate recording of all project expenses to represent actual work-in-progress figures.

- Regular WIP Reports: Producing comprehensive reports to monitor advancement, detect delays, and modify projections.

- Revenue Recognition Compliance: Accurately reporting income by using completed-contract or percentage-of-completion methodologies.

- Budget vs Actual Analysis: Planned budget is compared with real-time expenses to detect differences early.

- Cash Flow Optimisation: Controlling invoices and payments to avoid cash shortages.

- Ensuring Compliance: Adhering to tax and accounting rules that are particular to the industry.

- Profitability Forecasting: WIP accounting data is used to predict project profitability and avoid financial risks.

WIP Report Components & Best Practices

By monitoring expenses, billings, profitability, and progress in real time, a construction WIP reports provide companies with an accurate view of project performance. Underbilling, overbilling, cash flow problems, and whether projects are ahead or behind time can all be found with a solid WIP report. The essential elements of each WIP report are listed below, along with recommended procedures to guarantee precision and dependability.

Key Components of a WIP Report:

- Contract Value: The total agreed project price, including approved variations and change orders.

- Estimated Total Cost: The approximate cost needed to do the entire task. Profitability and completion percentage are determined in this way.

- Costs Incurred to Date: All direct expenses up to the reporting date, including labor, supplies, and subcontractors, as well as applied overheads.

- Percentage of Completion: Calculated using the cost-to-cost method:

% Completion = Costs Incurred ÷ Estimated Total Cost

- Earned Revenue: Revenue that should be recognised based on progress rather than what has been billed.

- Billings to Date: Total invoices raised for the project. This may not match earned revenue.

- Underbilling or Overbilling:

- Underbilling = Earned Revenue > Billings (asset)

- Overbilling = Billings > Earned Revenue (liability)

- These variances help analyse financial health and cash flow alignment.

- Projected Profit or Loss: Shows whether the project is on track to achieve its expected margin.

Best Practices for Accurate WIP Reporting:

- Update Costs Regularly: To preserve real-time visibility, rapidly record labor, material, and subcontractor costs.

- Review Estimates Frequently: As the scope, variances, or site conditions change- make adjustments to the predicted expenses.

- Align Accounting & Project Teams: To prevent misstatements, make sure accountants and project managers interact regularly.

- Use Reliable Percentage-of-Completion Calculations: For accuracy, stick to cost-to-cost; do not rely solely on invoicing or timeliness for measuring success.

- Separate Billings from Revenue: Make sure your WIP report shows earned revenue rather than invoiced amounts because billing does not equal revenue.

- Flag Underbilling Early: Underbilling frequently indicates scope creep, unapproved changes, or invoicing delays.

- Use a Standardised Format Across Projects: Confusion between teams is decreased, and comparability is enhanced with a consistent WIP template.

- Review WIP Monthly: Monthly assessments assist in identifying cash flow problems, estimating modifications, and cost overruns before they become more serious.

Fraud Risks in Construction – Why Expert Accountants Are Essential

The complex financial transactions and project-based nature of the construction business make it extremely susceptible to fraud. Professional accountants are essential in identifying and stopping fraud because they have expertise in the following scenario.

Common Fraud Risks in Construction:

- Cost Misallocation – Charging personal or unrelated expenses to a project.

- False Invoicing – Creating fake vendor invoices or misrepresenting costs.

- Payroll Fraud – Ghost employees, falsified work hours, or misrepresentation of wages.

- Change Order Manipulation – Misusing project modifications to hide fraud.

- Price fixing – Unethical agreements between contractors and suppliers.

- Material & Asset Theft –Wastage, misuse, or theft of construction materials and equipment.

- Underreporting Revenue – Hiding income to avoid taxes or manipulating profits.

Why Expert Accountants Are Essential:

- Fraud Detection & Prevention: Implement strict internal controls, monitoring, and audits.

- Accurate Financial Reporting: Make sure that revenue recognition and work-in-progress reports are transparent.

- Forensic Accounting: Examine disparities to find instances of fraud.

- Regulatory Compliance: Make sure that accounting standards and tax regulations are followed.

- Budget & Cost Control: Avoid financial mismanagement and identify warning signs.

Managing Variations & Change Orders in WIP Accounting

Construction projects frequently involve variations and change orders, but if they are not handled properly, they can have a big impact on revenue recognition, profitability, and Work-in-Progress (WIP) reporting. Every adjustment, whether it comes from a customer request, a design change, or an unanticipated site circumstance, needs to be precisely recorded, approved, priced, and represented in the work-in-progress schedule. Maintaining compliance with financial statements and protecting margins is guaranteed by proper handling.

How Variations Affect WIP Accounting?

- Changes to Contract Value: The initial contract value may be increased or decreased by approved modifications. To maintain the accuracy of earned revenue and percentage-of-completion calculations, this revised amount should be incorporated into the WIP report.

- Impact on Estimated Costs: Labor, materials, subcontractor fees, and project overheads may increase due to variations. To prevent inaccurate revenue recognition, new cost estimates must be made promptly.

- Influence on Percentage of Completion: Any modification to the expected cost will affect the completion percentage since % completion = expenditures incurred ÷ updated estimated cost.

- Timing of Approval Matters: WIP should only reflect approved variations.To avoid overstating income, pending or disputed modifications must be tracked separately and not included in the WIP until formally approved.

Best Practices for Managing Variations in WIP:

- Document Variations Immediately: Make a variant log that includes the description, justification, cost impact, supporting documentation, and approval status.

- Use Written Approval Before Recognising Revenue: Until you have the client’s or contractor’s signed consent, do not add amounts to the contract value or recognise revenue.

- Recalculate Project Profitability After Each Change: Make sure your WIP report reflects the updated margins, revised total cost, revised revenue, and predicted profit.

- Track Approved vs. Pending Variations Separately:

- Approved variations → adjust contract value + WIP

- Pending variations → track in a memo or separate column, not the main WIP

- Align Project & Finance Teams: Before submitting entries, accountants must confirm price and approvals, and project managers should promptly report site modifications.

- Maintain a Clear Audit Trail:

- Keep copies of:

- Client approvals

- Revised drawings

- Emails

- Pricing breakups

- Supplier quotes

- Keep copies of:

- Communicate Variations to the Billing Team: Ensure billing aligns with updated contract values to prevent underbilling or overbilling errors.

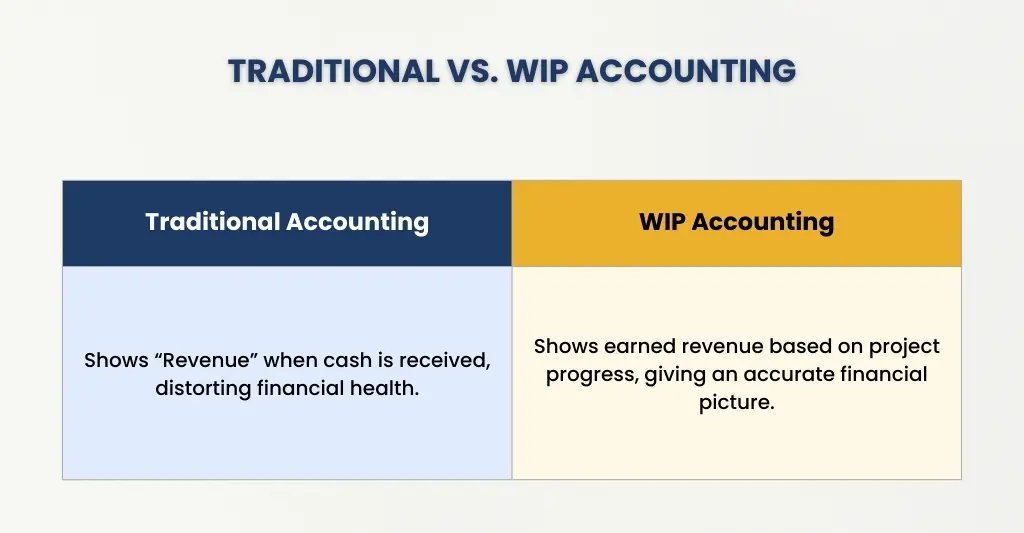

Example of why WIP Construction Industry Accounting is Necessary

Suppose a construction business spends eighteen months constructing a $5 million office tower. The client only pays when progress goals are met, even if they finish some of the job each month.

A general accountant will record income when cash comes in and expenses are incurred. However, even if the project is generally on schedule, this can provide the wrong result; some months may appear to be very successful while others show significant losses.

On the other hand, a WIP construction accountant keeps track of the project completion percentage, revenue (even if it hasn’t been paid yet), expenses, and profit for the period. They provide a more realistic picture of financial health by correcting for overbilling or underbilling.

Why it matters: Without WIP accounting, a business may seem profitable but be losing money on projects. In long-term, multi-phase building projects, WIP accountants help prevent that by ensuring that financials reflect actual progress.

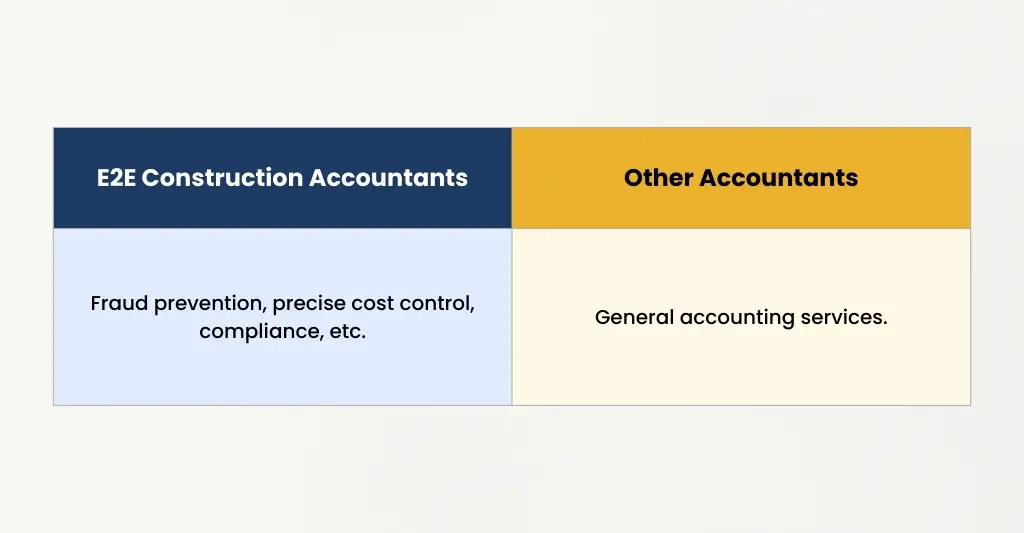

Why Choose E2E’s Construction Accountants?

The skilled financial solutions offered by E2E’s construction accountants are customised to meet the particular requirements of the sector. To avoid overruns and increase profitability, we guarantee precise work-in-progress and cost control. We assist in protecting your company from financial dangers with our robust fraud prevention strategies and compliance knowledge. Through effective invoicing and wise budgeting, our staff maximise cash flow and offer personalised financial reports to help with decision-making. For accuracy and efficiency, we simplify financial management with cutting-edge accounting software. E2E provides individualised service with committed professional support to keep your construction company successful and financially stable.

Get Started with Expert WIP Construction Accounting Today

Maintaining financial accuracy and project profitability in construction accounting requires a thorough understanding of work-in-progress (WIP) reporting.

It lowers financial risks, keeps your projects on schedule, obtains real-time insights, and makes well-informed decisions by putting expert WIP construction accounting into practice. Start using Expert WIP right now to take charge of your construction finances with confidence and avoid being held back by inaccurate reporting.

People Also Ask:

What journal entries are typical for WIP?

Typical journal entries for WIP include:

1. Recording costs:

Dr WIP (Construction in Progress)

Cr Cash / Accounts Payable

2. Applying overheads:

Dr WIP – Overheads Applied

Cr Overheads Control

3. Recognising revenue (POC):

Dr Accounts Receivable / Progress Billings

Cr Construction Revenue

4. Progress billing:

Dr Accounts Receivable

Cr Billings on Construction Contract

5. Underbilling/Overbilling adjustments:

Underbilling → Dr WIP / Cr Revenue Adj

Overbilling → Dr Revenue Adj / Cr WIP

6. Closing WIP at completion:

Dr COGS

Cr WIP

How often should I run a WIP report?

A WIP report should be run monthly, preferably at the conclusion of each month. Many contractors evaluate WIP weekly for high-value or fast-moving projects to monitor expenses, billing, and profitability.

What happens if we ignore change orders?

Your WIP report will become inaccurate if you disregard change orders. Misstated revenue, expenses, and contract values will result in underbilling, cash flow problems, reduced margins, and possible customer conflicts. It may also result in issues with audits and financial reporting.

What are the key benefits of using WIP accounting for my construction business?

Tracking project progress, identifying cost overruns early, accurately recognising revenue, lowering under/over-billing, and maintaining improved cash flow and profitability across all ongoing projects -are all made possible by WIP accounting.

Why should I choose E2E for my construction accounting needs?

To keep you profitable and compliant, E2E provides precise work costing, real-time WIP reporting, professional change order handling, and efficient bookkeeping. You get a dedicated construction accounting team that saves you time, reduces errors, and keeps every project financially on track.