Managing a small online store presents both opportunities and problems. It’s a fascinating experience but without proper accounting for small eCommerce business, the complexities can turn overwhelming. Accounting is a crucial component that can make or break your success as you negotiate the quick-paced world of internet commerce. A lot of business owners undervalue the need of precise money management, which frequently causes anxiety and uncertainty later on.

Imagine starting each day confident about where your money is going, how much you’re earning, and what to expect from your taxes. You will learn all there is to know about accounting for small eCommerce business from this blog. We’ll go over key tactics that can help you organise your money so you can concentrate more on developing your business.

What is eCommerce Accounting?

eCommerce accounting describes the record-keeping and financial management procedures unique to companies that conduct all or most of their business online. This entails keeping tabs on earnings and sales, controlling spending, filing income taxes, generating financial reports, etc.

Understanding UK-Specific eCommerce Taxation and Compliance

Now with your understanding of eCommerce accounting, let’s delve into its tax aspect. UK tax laws have evolved over the years for the greater public good as well as helping minority and SMEs grow and prosper. For businesses under the threshold of £90,000 in a 12-month period, there is no need to register for VAT. Once you exceed the threshold, you need to charge VAT on sales and submit VAT returns on a regular schedule.

Let’s understand this with an example of Sophie — a startup seller producing handmade soaps. Initially, with her online sales, she made £50,000 last year. Since this was below the VAT threshold, she did not have to register for VAT for that year. Now, her sales have soared to £90,000 — demanding that she charge standard 20% VAT on each sale, along with filing VAT returns on a regular schedule.

With this, she also has to digitalise her record-keeping and start submitting VAT returns online using MTD-compatible software. Separately, she must keep up with post-Brexit selling rules. She can no longer rely on the old distance-selling thresholds. Instead, she has the option to register under the non-Union OSS scheme if she sells to EU customers — simplifying VAT reporting and compliance.

Understanding these rules, taxation, and compliance can help her dutifully and confidently continue her eCommerce journey.

For a comprehensive guide on VAT regulations, including OSS and IOSS schemes, visit tour blog on OSS, IOSS & VAT for eCommerce.

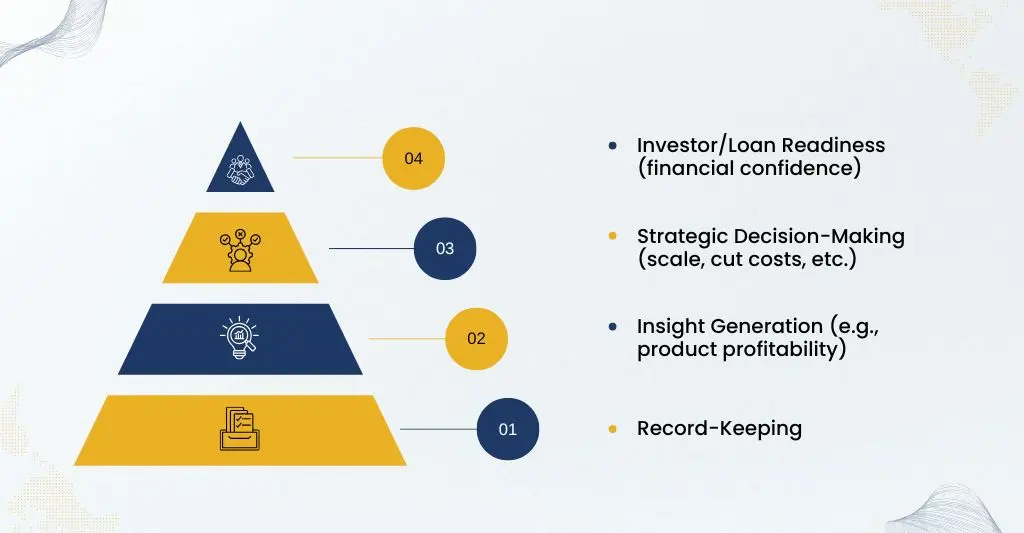

The Importance of Accurate Accounting for Small eCommerce Business

The foundation of any small business, particularly in e-commerce, is accurate accounting. It makes information about operational effectiveness and financial health clear.

With precise accounting for small eCommerce business, you can easily track revenue and expenses. Using this knowledge, firms can expect growth that stands against time.

Furthermore, tax preparation is made easier with correct accounting. Having ordered finances,lowers errors and decreases stress during tax season.

Such Businesses are preferred by lenders and investors. It also aids in recognising patterns over time. To maintain accuracy in accounting, you can take assistance of our eCommerce accountants who have good expertise and experience in eCommerce accounting concepts.

Good accounting procedures are necessary for long-term viability in a cutthroat market like eCommerce. Early adoption of them will provide a solid basis for future achievement.

Common Challenges Small Business Owners Face with eCommerce Accounting

- Many small business owners frequently face a variety of difficulties when it comes to accounting for small eCommerce business. The difficulty of keeping track of several revenue streams is one of the main obstacles. Since each transaction may come from a different platform, much care must be taken.

- Efficient cost management is another prevalent concern. Accurately classifying expenses related to marketing, inventory, and shipping is a challenge for many small firms. There may be large financial disparities as a result of this misunderstanding.

- Additionally, a difficult duty for many firms is complying with sales taxes. It’s simple to make mistakes that could lead to fines or audits because rates differ between states and nations.

- Compiling accounting software into current systems might be challenging as well. There may be data inconsistencies and more human labour if tools do not sync with eCommerce systems seamlessly.

- One persistent difficulty is time limits. Since small business owners sometimes take on several obligations, it may not always be possible to devote enough time to precise accounting for small eCommerce business.

Multi-Channel and Marketplace Accounting Challenges

Small UK sellers often operate across multiple marketplaces such as Amazon UK, eBay UK, Etsy, and social media platforms. While this expands sales opportunities, it also introduces significant accounting complexities. Sophie, whose business had reached a turnover of £90,000, has just moved from managing her tax compliance to a more troublesome task: compiling her sales, reconciling bank accounts, tracking all her marketplace fees, processing refunds, and preparing accurate financial reports.

She has to deal with multiple reimbursements from different platforms, handle delayed Amazon payments, and must manually apply the correct VAT invoicing and sales tax rules on eBay. As for Etsy, she needs to keep track of the platform’s commission and refund policies. To manage both common and platform-specific challenges, she integrates her marketplaces with accounting software that automates reconciliations, fee and commission tracking, and refunds across all her channels. This effective system not only helps keep her business sustainable and profitable long-term, but also allows her to maintain her composure, build client relationships, and grow her brand.

Tips for Setting up an Effective eCommerce Accounting System

- Start by outlining your organisational structure precisely. Whether you run a business as an LLC or as a sole proprietor, knowing your legal status affects how you handle money.

- Next, make sure to carefully classify your earnings and outgoings. For various sources of income and expenses, open distinct accounts. Over time, this will make tracking performance easier.

- Try to automate as much as you can; this reduces errors in manual data entry and ensures transaction accuracy while saving time.

You can also go deeper into the day-to-day financial recording aspect by checking out our guide on eCommerce Bookkeeping: All That You Need to Know!. It breaks down how to maintain clear and organised records that support better decision-making.

Choosing the Right Accounting Software for Your Business

It can be intimidating to choose the best accounting software. It’s important to choose an option that fits your specific business demands out of the many that are accessible.

- First, determine your desired features and budget. Does inventory control become necessary? connection to eCommerce websites? Think about the features that make things run smoothly.

- Another important component is ease of use. The program ought to be user-friendly so that you and your group can browse it with ease. Errors or delays in the processing of financial data can result from a complex interface.

- Recall the importance of scalability. Your tiny eCommerce firm will expand, and with it, so will your accounting needs. Select a solution that will grow with you and won’t require a complete system redesign. Examine your alternatives for customer service. Reliable support makes sure you have support when problems happen, minimising interruptions and maximising productivity.

Best Practices for Managing Sales and Taxes in eCommerce

- Managing sales and taxes is a complex yet crucial aspect of accounting for small eCommerce business. First, be sure to carefully record every transaction. Having a well-organised strategy helps avoid surprises during tax season.

- Keep up with local tax laws that apply to both where you sell and where you are located. Research is essential because different states have different laws pertaining to the collection of sales taxes.

- When feasible, use automated solutions. Numerous solutions for accounting software have functions that automatically determine and apply the appropriate sales tax rates. This greatly lowers the chance of human error.

- Examine your finances on a regular basis. An audit, either monthly or quarterly, makes sure you stay on top of any changes in income or expenses that can have an impact on your taxes.

- Keep lines of communication open with a qualified accountant who understands the subtleties of eCommerce. Their knowledge can offer priceless insights into streamlining your operations while guaranteeing adherence to regional regulations.

Strategies to Improve Cash Flow and Financial Management in eCommerce

The lifeblood of any eCommerce company is cash flow. It takes proactive management and smart planning to keep a healthy cash flow.

- Start by keeping a close eye on your earnings and outlays. This may be automated with accounting software, which can help you identify trends and abnormalities more rapidly. Examine your finances on a regular basis to find out where you’re making less money or spending too much.

- Adopt inventory control procedures that are in line with projected sales. This helps prevent stockouts and overstocking, both of which put a pressure on financial resources.

- Take into account rewarding consumers who make early payments with discounts. This not only encourages faster transactions but also enhances consumer loyalty.

Outsourcing vs In-house: Pros and Cons of Hiring a Professional Accountant

It can be difficult to decide whether to hire someone internally or outsource your accounting services. Every choice has a unique set of benefits. Money is frequently saved via outsourcing. You don’t have to pay for extras like office space or benefits—you just pay for the services you actually use. Small enterprises that might not need full-time support find this flexibility intriguing. If you’re exploring this route further, our blog on eCommerce Accounting Services & Why Go For Outsourcing? offers a detailed look at the benefits and best practices.

Conversely, an internal accountant provides a more profound comprehension of your company’s activities. They swiftly learn about your unique problems and are able to offer customised solutions. Ongoing training and resource investments are necessary to keep an internal team, updated. It can also take some time to locate a suitable applicant.

Think about what best fits your needs right now and your business objectives. Efficiency should be the primary consideration, but the choice should also take long-term growth plans and urgent needs into account—especially when it comes to managing accounting for small eCommerce business operations- effectively and sustainably.

Why Choose E2E Accounting?

E2E Accounting provides professional services specifically designed for internet businesses and specialises in eCommerce accounting. From inventory control and sales tax compliance to financial planning and reporting, we take care of it all. We streamline financial procedures, saving time and improving accuracy through smooth interfaces with systems like Shopify, Amazon, and QuickBooks. Our skilled support helps in decision-making, and scalable solutions that guarantee expansion of your company.

Run Your Business With Ease From Anywhere in the World

You can rest assured about the financial aspect and run your business from anywhere in the world by:

- Knowing Cash Flow: Make effortless decisions about expansion, and reinvestment by having a solid picture of your cash flow. We make sure you can always see how much money is accessible and where it’s going by keeping track of your sales, costs, and payments.

- Access to Real-Time eCom Dashboard: With E2E’s 360 degree eCommerce dashboard, you can view financial data and other KPIs in real time from any location. You can also easily monitor your inventory levels, sales, costs, and know how your company is doing from anywhere, anytime.

- Expertise in Amazon, Shopify, and More: We are expert at handling platform-specific accounting issues, whether you’re running your own store on Shopify or selling on Amazon’s marketplace.

- No Messy Data and Quick Decisions: You can make decisions more quickly because you won’t have to spend time sorting through unclear or insufficient facts.

Onboarding Process

- One-to-One Consultation: We start the onboarding process with a one-on-one meeting. This meeting enables us to:

- Recognise your company’s objectives, present difficulties, and expectations.

- Compile important data regarding your workflows, team composition, and operations.

- Determine the precise domains in which our services can be beneficial.

- Make sure that our solutions and your needs are in line right away.

- Customised Proposal: We create a customised proposal based on the consultation’s findings, which comprises:

- A thorough explanation of the suggested services and products.

- An implementation schedule with important checkpoints.

- Estimates of costs and billing schedules.

- A well-defined plan created to successfully and efficiently accomplish your particular goals.

- Smooth Transitions: To guarantee the least amount of disturbance and optimal effectiveness, we oversee a methodical handover procedure that comprises:

- A strategy for effective communication that outlines roles and duties.

- Integration, data migration, and stakeholder onboarding as required.

- Instructional sessions or records for your internal groups.

- A dedicated contact to handle any urgent questions or issues.

- Monthly Governance: Continuous success is guaranteed by a robust governance structure that includes:

- Frequent reporting and performance evaluations.

- Check-in meetings once a month to monitor progress and address problems.

- Ongoing service optimisation in response to changing requirements.

- Open lines of communication and feedback systems to promote accountability and collaboration.

So, why not E2E Accounting for Your eCommerce Business!