TL;DR

Whether you’re stuck comprehending the payout structure, marketplace and currency reconciliation, or compliance with domestic and international VAT – selling on Amazon is truly ‘liberating, convenient, and factually cultured’, letting you take on different roles with gritted teeth. This guide will help you hop on to the impulsive buying trends, and ease your compliance needs by letting you choose the best Amazon accountant in the UK who can take care of your accounting & tax needs, end-to-end.

Introduction

Amazon can be a very profitable place to sell, but handling your company’s finances is not simple. Managing Amazon fees, inventory accounting, VAT compliance, and foreign tax laws are some of the components that need professional attention. Without the proper financial advice, sellers may quickly face problems like incorrect bookkeeping, cash flow challenges, or tax fines.

This is where accountants with expertise in Amazon may help. In contrast to typical accountants, these experts are aware of the complexities of selling on Amazon, such as marketplace fees, multi-currency transactions, and Fulfillment by Amazon (FBA). They support the maintenance of your accounts, the fulfillment of your tax responsibilities, and the optimisation of your earnings.

You have come to the correct place if you are a UK Amazon seller seeking an accountant who genuinely knows your industry. Based on the industry understanding, client testimonials, and level of experience, we have investigated and selected the best five Amazon accountants UK. These professionals can help you stay compliant and organised financially while concentrating on expanding your company, regardless of how big or small your eCommerce brand is.

Let’s begin with the blog and find the perfect Amazon accountant for your Amazon business.

Why Amazon Sellers Need Expert Accountants?

Selling on Amazon is a profitable opportunity, but there are complicated tax and financial obligations as well. Amazon sellers face fluctuating sales, marketplace fees, VAT obligations, and multi-currency transactions, unlike typical enterprises. Managing all of this without professional advice can result in financial mistakes, non-compliance, and even lost revenue.

Here are some reasons why Amazon sellers must hire a qualified accountant:

- VAT Compliance & Tax Efficiency: There may be VAT obligations in some countries for Amazon sellers, particularly those that use Fulfillment by Amazon (FBA). To avoid penalties, a specialist accountant makes sure you handle EU VAT through the One-Stop Shop (OSS) program, adhere to UK VAT regulations, and minimise your tax obligations.

- Accurate Bookkeeping & Financial Records: It can be quite difficult to keep track of earnings, spending, and Amazon fees when thousands of transactions occur every day. Professional Amazon accountants guarantee that your records are correct and current, and they interface with programs like Xero or QuickBooks, offering automated bookkeeping solutions.

- Maximising Profit Margins: Comprehending Amazon’s charge structure is essential for profitability, as it includes advertising expenses, FBA storage prices, and referral fees. A skilled accountant assists in reducing these expenses, pinpointing areas where costs can be reduced, and enhances your overall financial plan.

- Cash Flow Management & Growth Planning: The inventory costs and Amazon’s payout structure cause cash flow issues for many sellers. An accountant assists you in predicting sales, effectively managing inventory levels, and making financially stress-free plans for future company growth.

- Handling Multi-Currency Transactions: Currency exchange fluctuations can affect profits for vendors who operate in different marketplaces (US, EU, USA). Currency conversion and tax adherence in different nations are guaranteed by an accountant with experience in eCommerce.

Selling on Amazon is competitive, and poor money management can drastically reduce your profits. You may concentrate on expansion while maintaining compliance and optimising profitability by working with a knowledgeable accountant who specialises in Amazon businesses. Investing in expert accounting helps you make better business decisions and ensure long-term success, not merely comply with regulations.

Common Accounting Challenges for Amazon FBA Sellers

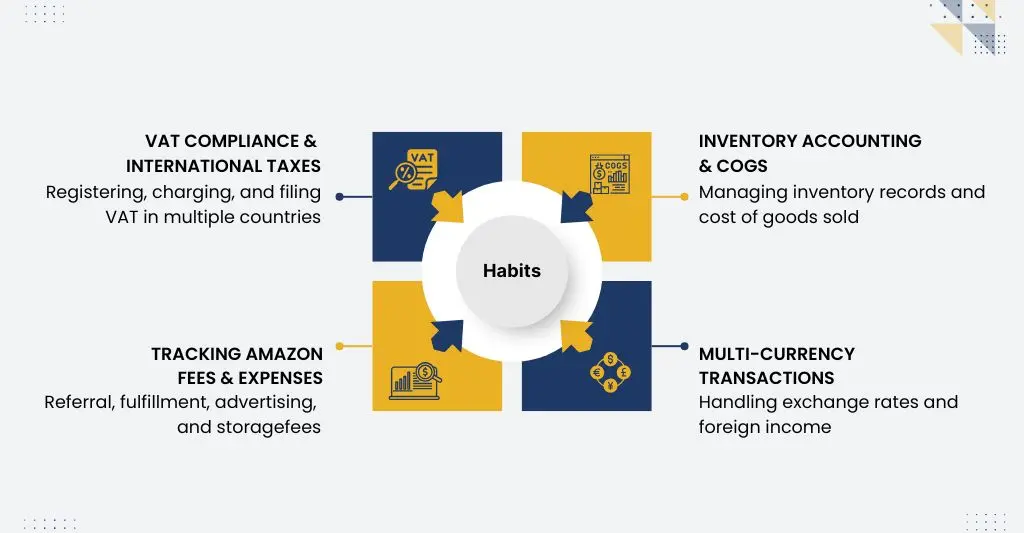

Scalability and convenience are two benefits of selling through Fulfillment by Amazon (FBA), but there are also certain accounting challenges. To preserve profitability and stay out of trouble with the law, FBA sellers need to keep a close eye on their money- from managing VAT compliance to monitoring Amazon’s numerous fees. The following are some of the most typical accounting issues that Amazon FBA sellers deal with:

- VAT Compliance & International Taxes: VAT (Value Added Tax) compliance is a major difficulty because many FBA sellers operate in numerous countries. The key concerns are:

- VAT registration in many nations (e.g., UK, EU, and beyond).

- Comprehending EU sales through the One Stop Shop (OSS) concept.

- Timely filing of VAT returns to prevent fines.

- Correctly charging VAT on cross-border transactions.

- Tracking Amazon Fees & Expenses: Several fees are subtracted by Amazon before payments are released, including:

- Referral fees (a percentage of each sale).

- FBA fulfillment fees (storage and shipping costs).

- Advertising costs (PPC campaigns).

- Long-term storage fees for slow-moving inventory.

- Inventory Accounting & Cost of Goods Sold (COGS): FBA sellers need to effectively manage their inventory, but typical problems include:

- Maintaining precise records of Cost of Goods Sold (COGS) to compute profit margins.

- Addressing inventory changes for Amazon (stuff that has been lost, damaged, or misplaced).

- Taking care of inventory write-offs for defective or outdated goods.

- Multi-Currency Transactions & Foreign Exchange Losses: Managing several currencies can be challenging for merchants that operate on various Amazon marketplaces. Among the difficulties are:

- Exchange rate fluctuations that affect profit margins.

- Accurately converting sales income in accounting software.

- Recognising the tax consequences of foreign income.

5 Best Amazon Accountants UK

Amazon sellers in the UK must choose the appropriate Amazon accountants UK to maintain compliance, maximise tax positions, and efficiently handle cash. These are five trustworthy companies that offer accounting services for Amazon:

E2E Accounting:

E2E Accounting offers professional services to Amazon sellers, assisting companies in efficiently managing their finances and lowering their tax obligations. They serve a variety of customers, including big eCommerce businesses and aspiring business owners. E2E Accounting is an ACCA-approved organisation, and they have 200+ accountants. Apart from this, they have experience working on 75+ software, ensuring seamless integration for real-time insights & forecasting.

eCommerce Accountants LLP:

eCommerce Accountants LLP is an online business consulting firm that provides customised services for Amazon sellers, such as financial planning, bookkeeping, and VAT compliance. Their proficiency with platforms such as Amazon, Shopify, and TikTok has earned them recognition, and in 2024, they were selected as the Innovative Firm of the Year.

123 Financials:

For Amazon sellers, 123 Financials offers complete accounting services, such as cash flow management, VAT registration, and bookkeeping. Their services are intended to help e-commerce companies reduce their accounting burden and streamline operations.

Sterlinx Global:

Sterlinx Global is an Amazon accounting specialist that provides services specifically designed for Fulfillment by Amazon (FBA) merchants, with an emphasis on maintaining compliance and maximising financial performance for Amazon companies.

IBISS & CO:

IBISS & CO. provides Amazon sellers with specialist accounting services that simplify taxes, VAT, and bookkeeping for their clients while also helping with financial planning, tax compliance, and other financial elements of eCommerce firms.

How do They Help Amazon FBA Sellers?

Selling products is only one aspect of running an Amazon FBA business; maintaining profitability and compliance demands sound financial management. Amazon accountants UK are experts in managing the particular difficulties faced by FBA sellers, such as managing cash flow, tracking Amazon fees, and complying with VAT. How they can assist is as follows:

- VAT Registration & Compliance: UK Amazon FBA sellers are required to abide by VAT laws, particularly when selling throughout Europe. Amazon accountants UK can help with:

- VAT registration in the UK and EU countries.

- Filing VAT returns accurately and on time.

- Navigating the OSS (One Stop Shop) scheme for cross-border EU sales.

- Avoiding penalties and overpaying VAT.

- Managing Amazon Fees and Profitability: Before paying merchants, Amazon deducts several fees, which makes it difficult to monitor true profits. An accountant assists:

- Match up sales reports with Amazon deposits.

- Determine and minimise expenses for promotion, storage, and Amazon FBA fees.

- Increase profit margins by making sure all costs are accurately recorded.

- Cash Flow Management & Business Growth: Amazon frequently pays its vendors after an event, which can lead to cash flow issues. Dedicated Accountants will help with the following things:

- Assisting with cash flow forecasting to guarantee efficient business operations.

- Helping with financial planning and budgeting so that money can be reinvested in expansion.

- Advising on strategies for growing a firm, such as converting to a limited corporation to save money on taxes.

- Multi-Currency Transactions & Tax Planning: Accountants help vendors who are growing into foreign Amazon marketplaces with:

- Managing exchange rate swings when getting payments in many currencies.

- Provide tax advice for sales made abroad.

- Arranging funds to boost profitability and reduce tax obligations.

- Inventory Accounting & Cost of Goods Sold (COGS): One of the most valuable assets for Amazon sellers is inventory, because poor inventory management can result in losses. Accountants assist with the following:

- Guaranteeing precise profit calculations, keep an eye on the cost of goods sold (COGS).

- Overseeing inventory changes for returned, damaged, or lost goods.

- Reducing needless storage costs by optimising supply levels.

Why Choose E2E Accounting for Amazon FBA?

Managing VAT compliance services, monitoring Amazon fees, and maintaining accurate bookkeeping services are just a few of the particular financial difficulties that come with operating an Amazon FBA business. E2E Accounting focuses on assisting Amazon sellers with financial optimisation, tax liability reduction, and profit maximisation. E2E is the best option for your Amazon FBA accounting requirements for the following reasons:

- Amazon FBA Expertise: E2E Accounting is aware of the challenges associated with selling on Amazon, such as the need to comply with international VAT regulations, FBA storage fees, and referral payments. Our team has expertise working with eCommerce companies and can streamline Amazon sellers’ financial procedures.

- VAT Compliance & International Tax Support: Dealing with VAT in many countries is a necessary part of expanding across multiple marketplaces. E2E Accounting assists with:

- UK & EU VAT registration and compliance.

- Managing the One Stop Shop (OSS) scheme for EU sales.

- Filing VAT returns accurately and on time to avoid penalties.

- End-to-end Financial Solutions: From cash flow management and profit analysis to bookkeeping and tax preparation, we take care of everything so you can concentrate on expanding your company.

- Hassle-Free Reconciliation: Settlements on Amazon may be difficult. But E2E Accounting ensures accurate reconciliation between your accounting software, bank statements, and Amazon reports.

- Scalable Support for Growth: E2E provides customised solutions to increase profit margins, inventory finance, and cost efficiency, regardless of your company’s size.

Why Your Amazon Accountant Choice Matters?

The profitability, compliance, and long-term expansion of your Amazon FBA business depend on your choice of accountant. Because of Amazon’s complicated price structure, which includes referral fees, storage fees, delivery costs, and advertising expenses, an accountant with knowledge of these aspects is necessary to maintain correct financial records.

A specialist Amazon accountant can also assist you in maximising tax savings while maintaining compliance with various tax requirements, including sales tax, VAT, and GST in various areas. They are essential partners in your Amazon FBA business, helping you to maximise revenues, steer clear of tax problems, and obtain financial clarity. They are more than just accountants for your business. With their guidance and strategic insights, your business will have a scope for growth.