In accounting, depreciation is a technique used to distribute an asset’s cost over its expected or useful life. This can also be taken as indicating the amount of an asset’s worth that has already been utilised. Because depreciation can affect profitability, businesses must consider it.

Many of the assets a business purchases and owns are expensive. A business can spread the asset’s cost across time and earn money from it in the meantime by using depreciation. Depreciation addresses the reality that an asset’s value will decrease over time.

This blog provides straightforward, useful explanations of depreciation accounting for SMEs in the UK. It explains how to allocate the cost of an asset across its useful life, why this is important for profitability, and how doing it correctly can aid in cost management, planning, and informed financial decision-making for firms.

What Is Depreciation Accounting And Why Should UK SMEs Care?

A company asset’s cost is allocated over its useful life using depreciation accounting, which shows how much of the asset’s worth has been consumed over time. Depreciation spreads the cost across years rather than recording it all at once, providing a more realistic view of costs and profitability.

UK SMEs need to comprehend and use depreciation. It influences taxable profits, aids in cash flow planning and budgeting, and ensures that financial statements are realistic. Understanding when assets need to be replaced is also facilitated by proper depreciation accounting, which promotes long-term growth and informed company decisions.

How Do I Calculate Depreciation?

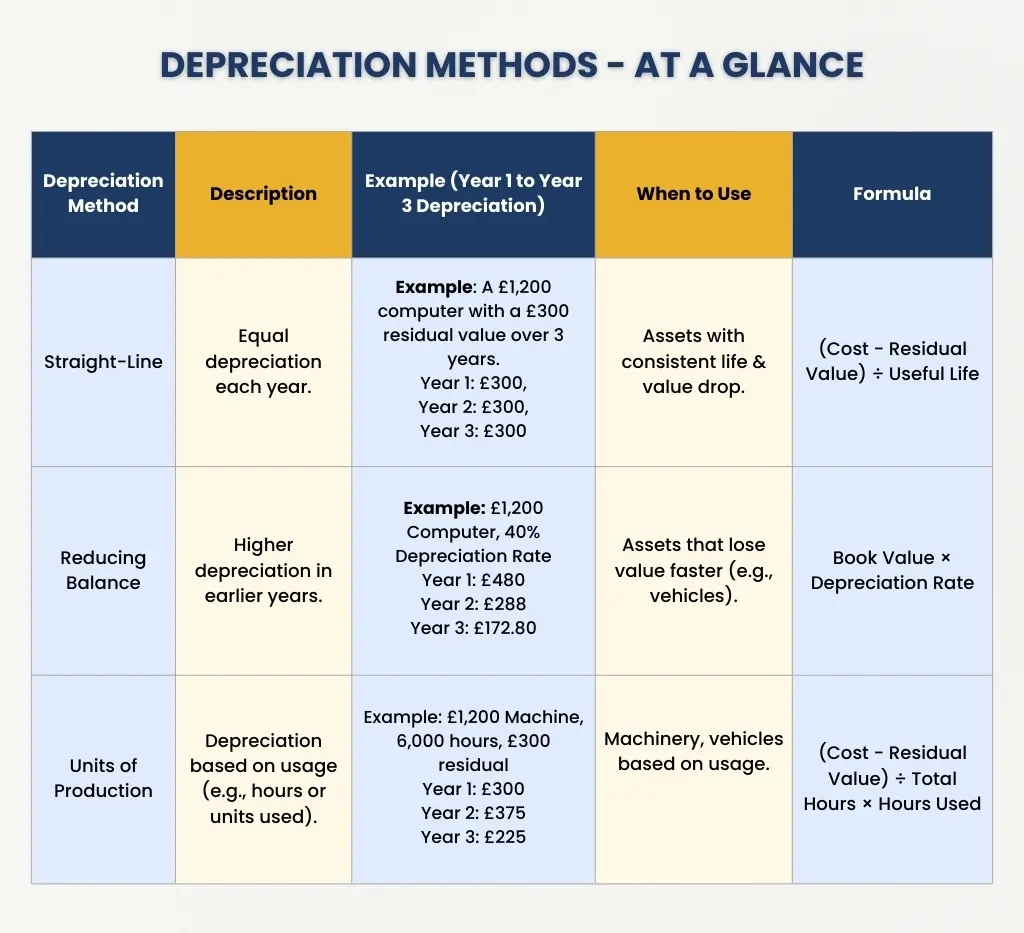

SMEs in the UK may utilise several common techniques:

- Straight-Line Depreciation – The most straightforward approach. The asset’s residual value is deducted from the purchase price and distributed equally over the asset’s useful life.

Formula: Depreciation Expense= Cost of Asset – Residual Value / Useful Life

Example: James buys a computer for £1,200.

He expects it to last 3 years and be worth £300 at the end.

- Step 1:

Depreciable amount = £1,200 − £300 = £900 - Step 2:

Annual depreciation = £ 900 ÷ 3 = £300 per year

So James will record £300 depreciation each year for 3 years. After 3 years, the computer’s book value will be £300.

- Reducing Balance Depreciation: Depreciation is larger in the early years and lower in the later years with this system, which applies a predetermined percentage annually.

Example: James bought a computer for £1,200.

He decides to depreciate it at 40% per year using the reducing balance method.

- Step 1: Year 1:

Depreciation = 40% × £1,200 = £ 480

Book Value after Year 1 = £1,200 − £ 480 = £ 720 - Step 2: Year 2:

Depreciation = 40% × £ 720 = £ 288

Book Value after Year 2 = £ 720 − £ 288 = £ 432 - Step 3: Year 3

Depreciation = 40% × £ 432 = £172.80

Book Value after Year 3 = £ 432 − £172.80 = £259.20

- Units of Production Depreciation: Here, depreciation is based on the asset’s usage and is best for vehicles or machinery.

Example: James buys a computer for £1,200.

He thinks it will be useful for 6,000 hours and worth £300 at the end.

- Depreciation per hour = (1,200 − 300) ÷ 6,000 = £ 0.15 per hour

- If James uses it 2,000 hours in the first year, Depreciation = 2,000 × £ 0.15 = £ 300

- So, in the first year, James records £ 300 depreciation for his computer based on how much he used it.

The kind of asset and its planned usage determine the best approach. For most SMEs, a straight line is the simplest, but for tax purposes, a reduced balance is typical. Your accounts will accurately reflect the exact value of your assets if the calculations are accurate.

What Depreciation Accounting Entry Should I Post?

Depreciation lowers the value of the associated asset on your balance sheet and is reported as an expense in accounting. The standard journal entry for SMEs in the UK looks like this:

- Debit: Depreciation Expense (income statement) – records the cost of using the asset for the period

- Credit: Accumulated Depreciation (balance sheet) – reduces the asset’s book value

Example – Depreciation Accounting Entry For A UK Restaurant

Let’s say a restaurant in the UK spends £5,000 on cooking equipment that has a five-year useful life and no residual value. The annual depreciation calculated with the straight-line technique would be:

£5,000÷5=£1,000 per year

The accounting entry at year’s end would be:

- Debit: Depreciation Expense £1,000

- Credit: Accumulated Depreciation £1,000

This item indicates that the restaurant spent £1,000 on cooking equipment over the course of the year, and the asset’s book value on the balance sheet is decreased by the cumulative depreciation. Since the restaurant industry is complex with TRONC accounting and weekly/monthly payroll, we would advise you to go for outsourcing your restaurant accounting services to someone with experience, characterised by affordable and quality client-first services.

How Does Depreciation Affect My Year End Accounts And Taxes?

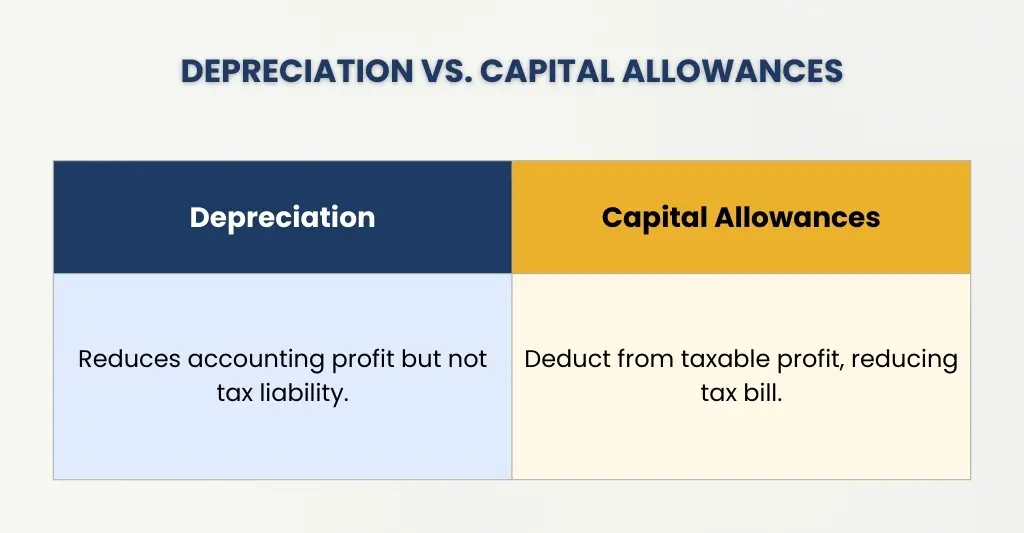

Depreciation appears as an expense in your profit and loss statement and lowers the book value of your fixed assets, which has an impact on your year end accounts. Your stated accounting profit decreases as a result, revealing the underlying value of your assets.

Depreciation is not directly deducted from taxes. Capital allowances, on the other hand, enable you to deduct a portion of the asset’s cost from your taxable earnings. This essentially spreads the tax benefit across the asset’s useful life by lowering your tax liability.

Example: Depreciation vs. Capital Allowances

Scenario:

James buys a delivery van for £40,000, which will last 5 years. He expects a residual value of £5,000.

- Step 1: Depreciation (Accounting)

Using straight-line depreciation: Depreciation per year= 40,000−5,000/5 =7,000- James records £7,000 depreciation as an expense in his profit and loss statement.

- His accounting profit decreases by £7,000, and the book value of the van also goes down by £7,000 each year.

- Step 2: Capital Allowances (Tax)

For tax purposes, James can claim capital allowances instead of using depreciation.- Suppose the tax system allows him to deduct £8,000 per year from taxable income.

- This reduces his tax bill without directly affecting his accounting profit.

- Example: Taxable profit before allowance = £50,000

Taxable profit after allowance = £50,000 − £8,000 = £42,000

Taxes are calculated on £42,000, lowering his tax liability.- If his taxable profit before capital allowances was £50,000, after claiming the allowance, it becomes £42,000.

What Common Mistakes Do SMEs Make With Depreciation – And How To Avoid Them?

Many SMEs make mistakes when it comes to depreciation, which can have an impact on their taxes and accounting. Common errors consist of:

- Not Depreciating Assets at All: When depreciation is neglected, some companies misrepresent their earnings and asset values.

- How to avoid: Apply depreciation regularly and maintain an up-to-date fixed asset register.

- Using the Wrong Depreciation Method: Asset worth may be misrepresented by selecting the wrong method (for example, straight-line vs. declining balance).

- How to avoid: Choose a strategy that takes into account the asset’s actual rate of value loss.

- Mixing Accounting and Tax Depreciation: Tax filing problems may result from confusing tax capital allowances with accounting depreciation.

- How to Avoid: For accounting depreciation (for your profit and loss statement), keep a single record. Keep a separate capital allowances record (for tax reporting).

- Failing to Update Asset Lives or Values: Accounts may become misleading if they are not adjusted for changes in asset usage or impairment.

- How to Avoid: Evaluate assets every year and make necessary adjustments to depreciation schedules.

- Ignoring Small Assets: Low-cost assets are sometimes left out of SMEs, but they may pile up and have an impact on tax and earnings.

- How to avoid: Define bookkeeping policies and guidelines for the expensing of small assets to support accurate depreciation accounting and capitalisation.

Year End Checklist: How To Prepare Depreciation For Year End (Actionable Steps)

Accurate year end depreciation preparation guarantees accurate accounts and compliant tax returns. Take these actions:

- Update Your Fixed Asset Register: All new purchases, disposals, and completely depreciated assets should be verified. Make sure that the acquisition date, cost, and productive life of every asset are accurate.

- Review Depreciation Methods: For every asset, make sure you are employing the proper technique (straight-line, reducing balance, etc). Make adjustments if an asset’s estimated life or usage pattern has altered.

- Calculate Depreciation for the Year: Give each asset the appropriate depreciation rate. Add any depreciation for assets purchased or sold throughout the year, even if it is partial.

- Record Depreciation in Your Accounts: Depreciation lowers your accounting profit because it is shown as an expense in the profit and loss statement. In addition, it lowers the asset’s book value on the balance sheet.

- Check for Impairments or Write-Downs: Determine whether the value of any assets has decreased more than anticipated. Whenever necessary, write down assets or modify depreciation.

- Prepare for Tax Reporting: Keep tax capital allowances and accounting depreciation apart. To lower taxable earnings, make sure to claim all available allowances.

- Reconcile and Review: Make sure depreciation schedules correspond with your accounts by double-checking calculations. Maintain records for audits and future use.

Depreciation Vs Amortisation — What’s The Difference?

| Feature | Depreciation | Amortisation |

| Applies To | Physical assets that are tangible, such as buildings, cars, and machinery | Non-physical intangible assets such as software, copyrights, trademarks, and patents |

| Purpose | Distribute a physical asset’s cost throughout its useful life as a result of obsolescence or wear & tear. | Divide the cost of a non-physical asset by the time it provides value. |

| Impact on Accounts | Lowers the tangible assets’ book value and is shown as a loss in the profit and loss statement. | Reduces the intangible assets’ book value and is shown as a loss in the profit and loss statement. (basically the same as depreciation) |

| Tax Treatment | Capital allowances are claimed for tax purposes, not depreciation itself. | Depending on local tax regulations, amortization may qualify as a tax deduction. |

How E2E Accounting UK Helps With Depreciation & Year End Services?

E2E Accounting UK simplifies the year end process by precisely controlling your fixed assets and depreciation. In order to represent all purchases, disposals, and modifications, our staff makes sure your fixed asset register is correct and current. By using the appropriate depreciation techniques and rates according to your assets and accounting standards, we make sure that your financial statements accurately depict the health of your company.

To further enhance tax efficiency and lower your taxable earnings, we identify eligible assets and manage capital allowances effectively. In addition to providing competent advice on asset management, tax planning, and compliance, our professionals generate transparent, compliant year end accounts. You can be sure that your finances are precise, well-managed, and in a position to facilitate more intelligent business decisions when you work with E2E Accounting UK.

People Also Ask:

What is depreciation in accounting?

The process of distributing the cost of a physical asset, like machinery, cars, or buildings, over the course of its useful life is known as depreciation in accounting. It shows the amount of value that an asset loses over time as a result of deterioration, aging, or obsolescence.

Is land depreciated in accounting?

No, in accounting, land does not lose value. In contrast to structures, machinery, or automobiles, land does not deteriorate, become outdated, or lose value with time. It is immune to depreciation since its useful life is infinite.

What is the straight-line depreciation formula?

The straight-line depreciation formula is:

Depreciation Expense= Cost of Asset−Residual Value/ Useful Life of Asset

Can I claim AIA and still show depreciation in accounts?

Yes. You may still claim the Annual Investment Allowance (AIA) to lower your taxable profit while recording depreciation in your accounts to reflect asset value. While AIA has an impact on taxes, depreciation has an impact on financial reporting.

How often should I review useful lives?

Every year or whenever usage or conditions change dramatically, you should examine the useful life of your assets.

When should I speak to an accountant about depreciation?

To guarantee correct records and appropriate tax treatment, you should consult an accountant on depreciation when purchasing new assets, examining year end accounts, or preparing tax claims.