The deadline for second payment due on account is July 31st, which is a crucial date that self-employed people in the UK cannot afford to miss. A vital component of the Self Assessment system, this contribution goes toward your next tax bill and is often disregarded until it is too late by independent contractors, freelancers, and business owners.

Managing your cash flow and avoiding HMRC fines requires an understanding of how payments on account operate and how they impact your income tax and national insurance (NI) obligations. We’ll go over the definition of the second payment on account, who is responsible for paying it, how it’s determined, and what to do if your income has changed since your last statement or payment deadline.

Here’s everything you need to know to be compliant and prevent an unexpected tax shock, regardless of whether you’re new to self-employment or just want to stay ahead of your tax obligations.

What Is Payment on Account?

An advance payment toward your future tax bill, which is determined by your income tax and Class 4 National Insurance contributions from the prior year, is known as a payment on account. This approach makes it easier for self-employed people and those whose income is not subject to source taxation to spread out their tax payments throughout the course of the year.

One of the first advantages of working for yourself as a sole proprietor is that, in contrast to the PAYE system, which deducts taxes from employee’s wages at the source, you do not have to pay taxes as they are received. To properly manage your cash flow and tax obligations, it is essential to comprehend how payments on account operate.

Example — How It’s Calculated for a Sole Trader

- Name: Sarah, a freelance graphic designer

- Tax year: 2023/24

- Total tax and Class 4 National Insurance owed for 2022/23 (previous year): £6,000

Sarah submitted her tax return by the January 31, 2024, deadline. Based on her 2022/23 income, she is required to make two payments on account toward her 2023/24 bill.

Payments on Account Breakdown:

- First Payment on Account (paid by 31 January 2024): £3,000 (50% of last year’s bill)

- Second Payment on Account (due by 31 July 2024): £3,000 (the other 50%)

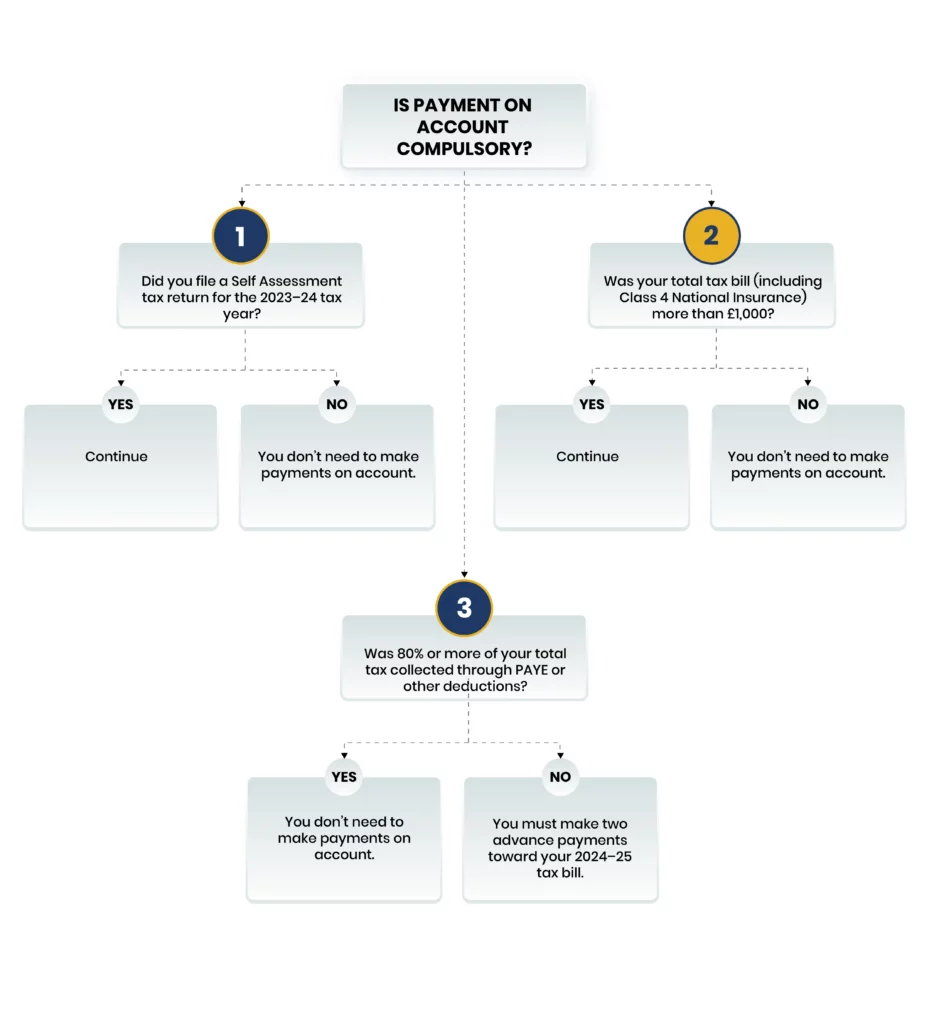

Is Payment on Account Compulsory?

Yes, most self-employed people and others who file through Self Assessment are required to make payments on account if their tax bill from the previous year was more than £1,000 and less than 80% of the tax was previously collected at source.

Example: Sarah receives £18,000 annually through PAYE from her part-time job as a marketing assistant. In addition, she earns an extra £15,000 from her side job, a tiny internet store, from which no taxes are deducted at the source.

Her total tax bill for the year is £4,000:

- About £1,200 is collected automatically via PAYE from her job.

- The remaining £2,800 is due on her self-employed income.

Given that less than 80% of her total tax was paid at source (£1,200 out of £4,000), or 30% of it, Sarah must make Payments on Account for the upcoming tax year, according to HMRC.

She must pay:

- £1,400 by 31 January (first payment), and

- £1,400 by 31 July (second payment)

By distributing the amount of your tax burden over the next year, these advance payments from HMRC assist you in avoiding having to make a hefty lump sum payment in January.

Scenario — How the Deadlines Fit Together

To understand how account payments align with key tax dates, let’s review a typical schedule for an independent contractor using the Self-Assessment method.

Example: Emma, a Sole Trader

- Tax year 2023/24: Runs from 6 April 2023 to 5 April 2024

- Tax return due: 31 January 2025

- Total tax owed for 2022/23: £4,000→ This triggers payments on account for 2023/24

Timeline of Deadlines:

- 31 January 2024:

- First Payment on Account of £2,000 (50% of previous year’s bill)

- Any balancing payment due for 2022/23 (if she underpaid)

- Tax return filing deadline for 2022/23

- 31 July 2024:

- Second Payment on Account of £2,000 (the remaining 50%)

- 31 January 2025:

- Submit the 2023/24 return

- Make a balancing payment if the total 2023/24 tax is more than £4,000 already paid

- Payments on account will also begin for 2024/25 (if required)

What If You Pay Late?

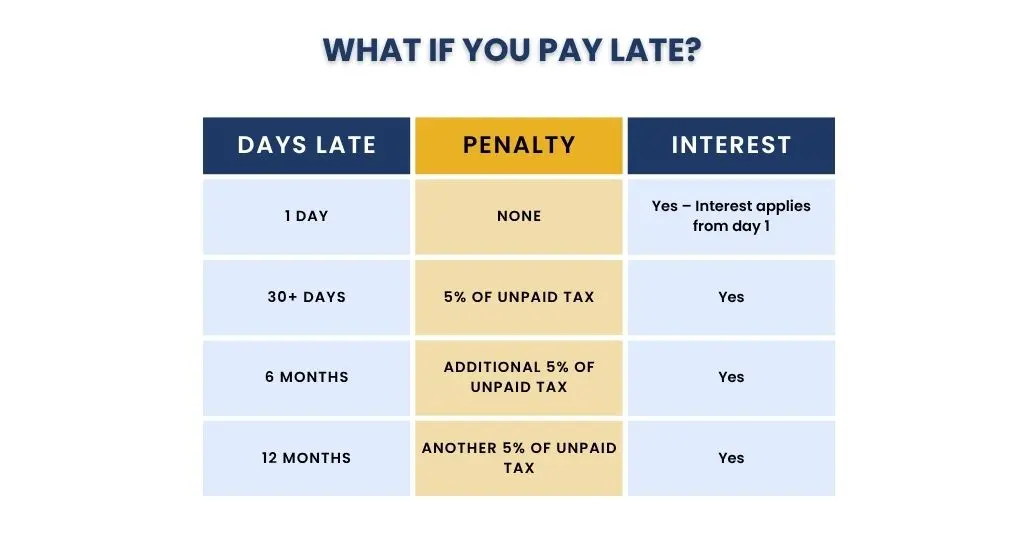

The second Payment on Account deadline for income tax and national insurance for self-employed people in the UK is July 31 of each year. Financial penalties and interest charges can mount up quickly if you miss this deadline or make your payment after the due date. What you should know is as follows:

- Interest Charges: Interest on any unpaid taxes will be assessed by HMRC starting the day following the deadline, which is August 1. Usually set at a few percentage points higher than the Bank of England base rate, the interest rate is flexible. This implies that the longer you delay paying, the more you will have to pay.

- Penalties: Penalties for late payments typically appear later, although interest is applied immediately:

- If the tax is not paid within 30 days of the due date, a 5% penalty is imposed.

- At six and twelve months past due, there are additional 5% fines.

Can You Reduce Payments on Account?

Yes, if you think your tax bill will be less than it was last year, you can ask to have your Payments on Account reduced. For self-employed people whose circumstances have changed or whose income has decreased, this is especially beneficial.

When Might You Reduce It?

You might consider reducing your Payments on Account if:

- Profits for your company are down from the previous year.

- You are no longer self-employed.

- You’ve incurred a lot of authorised costs.

- You have already paid more tax through PAYE.

- You have taken advantage of reliefs or deductions that were previously unavailable.

How to Reduce It?

You can apply to lower your account payments by:

- Accessing your HMRC online account and logging in

- Using your tax return for self-assessment

- Submitting SA303 form

This can be completed as soon as feasible, preferably before the second payment deadline of July 31.

How Payments on Account Affect Big Purchases

If you work for yourself and are preparing a major purchase, such as purchasing a home, a vehicle, or equipment, it is critical to understand how Payments on Account may affect your cash flow and financial planning.

Reduces Available Cash: Advance payments for your upcoming tax bill are made on account, and they are due in two installments on January 31 and July 31. These can be large sums, typically half of your tax bill from the prior year.

This implies:

- You can receive a sizable bill in July if you have already paid your January taxes.

- When attempting to make a down payment, fund a deposit, or invest in business assets, you can run out of money.

Affects Mortgage Applications: Lenders review your tax and income data carefully when evaluating mortgage applications.

- Your net income and available money may be diminished by account payments.

- If you fail to make or postpone tax payments, it may cause concern for lenders, particularly if they ask for SA302s or tax year summaries from HMRC.

Planning is Key: To avoid surprises, be prepared.

- As part of your yearly cash flow, set aside money for your account payments.

- To set aside money each month for taxes, think about opening a separate savings account.

- Consult a financial advisor or mortgage broker if you plan to make a significant purchase soon.

Staying Under £1,000 — Does It Work?

Many self-employed people try to avoid Payments on Account entirely by keeping their tax bill under £1,000. What does that mean for the second payment that is due on July 31st, and does it work?

A] How do Payments on Account Work?

HMRC will demand two advance payments for the following year’s taxes if your income tax bill exceeds £1,000 and less than 80% of your tax has already been paid through PAYE:

- First Payment: 31 January

- Second Payment: 31 July

Each is usually 50% of your previous year’s tax bill.

B] The £1,000 Threshold

You do not need to make payments on account if your tax liability is £1,000 or less. This implies:

- You only make payments by January 31st.

- There is no second payment due in July.

- It prevents big surprise bills and streamlines cash flow.

C] Can You Legally Stay Under the Threshold?

Yes, but it needs to be sincere. Some possible strategies are:

- Claiming all allowable business costs

- Making use of tax breaks (such as the Marriage Allowance and the Trading Allowance)

- When revenue or invoices are due close to the conclusion of the tax year

However, if HMRC looks into underreporting or intentionally lowering income, there may be fines and interest.

D] Why It Matters for the Second Payment?

A second payment on account must be made by July 31 if your tax bill exceeds £1,000. However, if you lawfully remain below £1,000, you:

- Avoid the July payment entirely

- May improve your short-term cash flow

- Reduce the risk of underpayment penalties or interest.

Key Self-Assessment Tax Return Dates

For self-employed people in the UK, it’s critical to meet Self Assessment dates. Important dates that are missed might result in fines, interest, and needless worry. Below is a summary of the most crucial dates you should be aware of:

- 5 October – Register for Self Assessment

You have to register with HMRC by October 5th, after the end of the tax year. You need to report if you’re a new self-employed person or need to begin filing tax returns.

- 31 October – Paper Tax Return Deadline

Your tax return must be received by HMRC by October 31 if you are filing it on paper. You must submit your application online after this date.

- 31 January – Online Tax Return & First Payment on Account

The Self Assessment calendar’s most important date is this one:

- The deadline for filing your previous year’s online taxes

- The due date for any taxes

- The date of the current tax year’s first payment is due on account.

For instance, the return needs to be filed and paid by January 31, 2025, for the tax year that runs from April 6, 2023, to April 5, 2024.

- 31 July – Second Payment on Account

If your tax bill for the previous year was over £1,000, and less than 80% of it was collected through PAYE, you’ll need to make a second payment on account by 31 July.

What Is Class 2 National Insurance?

In the UK, the majority of self-employed individuals pay a weekly flat-rate contribution to Class 2 National Insurance (NI). Your eligibility for benefits such as the Employment and Support Allowance (ESA), Maternity Allowance, and State Pension is improved.

- If your gains exceed the Small Gains Threshold, which is presently £6,725, you must pay it.

- It is £3.45 per week for the 2024–2025 tax year.

- Typically, you pay it on your self-assessment tax return.

You are not required to pay if your profits fall below the level, but you have the option to do so voluntarily to maintain your access to benefits.

Example — NI for Low, Mid & High Profits

- Low profits (£6,000): Class 2 and Class 4 NI are not required, although you are free to choose to pay Class 2 to preserve your State Pension.

- Mid profits (£15,000): You will pay approximately £179 in Class 2 NI and £688 in Class 4 NI for mid-profits (£15,000).

- High profits (£60,000): Class 2 NI should be £179, and Class 4 NI should be over £3,300.

Before you get too deep into payments on account, it’s important to make sure your business is set up right from the start.

Not Sure Which Business Structure Fits You Best?

Read our guide on Choosing a Business Structure

Putting It All Together: A Self-Employed Example

Let’s examine how a self-employed person’s income tax, national insurance, and payments on account interact.

Example: Emma, Freelance Designer

- Tax Year: 6 April 2023 – 5 April 2024

- Profit: £30,000

- Tax-Free Allowance: £12,570

- Taxable Income: £17,430

What Emma Owes:

- Income Tax: 20% on £17,430 = £3,486

- Class 2 NI: £3.45/week × 52 = £179.40

- Class 4 NI: 9% on £17,430 = £1,568.70

Total Tax & NI Due = £5,234.10

Payments on Account: Because her tax bill is over £1,000

- 31 Jan 2025:

- £5,234.10 (tax due for 2023/24)

- £2,617.05 (50% advance for 2024/25)

- = £7,851.15 total

- 31 July 2025:

- Second Payment on Account = £2,617.05

Tips to Stay Ahead

Maintaining your commitments to the Self Assessment doesn’t have to be difficult. To be ahead of your tax payments and prevent last-minute surprises, use these wise tips:

- Set Money Aside Monthly: A portion of your income, say 20–30%, should be saved in a different account so that taxes and national insurance may be paid on time.

- Use Accounting Software: Real-time tax bill estimation and profit and spending tracking are made possible by programs like Xero, QuickBooks, and FreeAgent.

- Know Your Deadlines: Put important dates on your calendar, such as January 31 and July 31, and create reminders a few weeks beforehand.

- Check Payments on Account: Apply as soon as possible to lower your payments on account if your income declines; don’t wait until the last minute.

- Pay Early if You Can: To spread the cost and ease your stress, you can pay HMRC in advance at any time.

- Keep Good Records: Organise bank statements, invoices, and receipts. Precise documentation speeds up tax returns and lowers the possibility of mistakes.

- Get Professional Advice: Consult an accountant or tax advisor if you have uncertain income or are unclear about your debt.

Why Choose E2E for Personal Taxation Services?

Our goal at E2E Accounting is to provide professional personal taxation services with a personalised touch. Regardless of your income sources, self-employment, freelancing, or rental properties, we take the time to comprehend your particular circumstances and offer sensible, customised counsel. In addition to managing your self-assessment, our staff actively seeks out methods to lower your tax liability, assists you in making plans, and makes sure that you are never caught off guard by due dates or unforeseen expenses.

We handle everything from calculations and documentation to HMRC submissions, all while making the process easy and free of jargon, saving you time and lowering your stress levels. Our cloud-based, secure technologies make it easy and safe to share documents, allowing you to handle your taxes from any location. You always understand what you’re paying for since we provide clear, fixed pricing with no additional costs. In contrast to many other firms, we are available to you throughout the year, not only during tax season.

When Is the Second Payment on Account Due for 2024–25?

For the 2024–25 tax year, the second payment on account is due on July 31, 2025.

Can I Pay the Second Payment Early?

Yes, you can pay the Second Payment early anytime as per your convenience, but before 31st July.

What If My Income Changes Year to Year?

To prevent overpaying, you can ask to have your payments on account reduced if your income is lower. Prepare yourself for a greater January balancing payment if it’s higher.

How Do I Check If I Owe Payment on an Account?

Visit your HMRC online account to see your most recent Self Assessment statement. Any future account-due payments will be displayed.

How Do I Use an SA303 Form to Reduce Payment on Account?

HMRC accepts Form SA303, which you may submit online or by mail to request a reduction. Along with a current estimate of your tax liability, you must provide a good justification.

Do self-employed individuals in the UK get claimable business expenses?

Yes, to lower their taxable earnings, self-employed people in the UK are allowed to claim allowable business expenditures, which include expenses for things like travel, office supplies, phone bills, and more.

What is the Marriage Allowance, and how does it reduce tax?

The Marriage Allowance allows a non-taxpaying spouse to transfer up to £1,260 of their Allowance to their basic-rate taxpaying spouse, which can result in a £252 annual tax reduction.