A tax calculation known as a P800 form is sent by HMRC to let you know if you overpaid or underpaid income tax during the tax year. It is generally sent after the tax year ends, usually between June and October. It is sent after HMRC has reviewed your income, tax paid, and benefits using the PAYE system. The P800 will explain the process for requesting a refund if you have overpaid taxes. If you have underpaid, it will explain how HMRC intends to recover the money.

Who receives a P800, how it’s determined, what it means for your finances, and what to do if you receive one are all covered in this article.

What Is a P800 Form?

HMRC uses a P800 tax calculation to ensure everyone pays the correct amount of tax. You will receive a letter along with a P800 Form detailing the amount owed and the payment or refund procedures if it is determined that you have either overpaid or underpaid.

Since P800s are often sent out at the start of the next tax year, if you are eligible, it is likely that it will arrive at your door sometime in the middle to end of April. However, it’s not a strict rule, and you could get P800 at any time of the year.

Understanding P800 Tax Calculations

When HMRC thinks you have overpaid or underpaid the income tax in the given tax year, they issue a P800 tax computation. It’s critical to understand the data that HMRC uses and how it computes this.

How HMRC Calculates Your P800?

The Pay As You Earn (PAYE) system provides information that HMRC uses to determine if you have overpaid or underpaid taxes. This includes:

- Your whole earnings from jobs and pensions

- Already-deducted taxes by pension providers or employers

- Employment Support Allowance, Jobseeker’s Allowance, and other state benefits.

- You are eligible for tax-free allowances, such as the Personal Allowance.

- Benefits in kind that your employer reports, such as health insurance and a company car.

HMRC compares all of this information with the amount you should have paid according to your tax code and allowances. A P800 is issued if there is a difference.

Example: Let’s say that because HMRC was unaware of the change -that you had worked two jobs during the tax year, and each employer used your entire tax-free Personal Allowance. Because you can only receive one Personal Allowance, this would result in underpaid taxes. After the year ends, HMRC would discover this and send you a P800 that would show the underpayment.

What’s Included in the P800 Letter?

Your P800 letter will include:

- Your income and taxes paid( broken down)

- Your tax code and its application

- The amount of taxes paid is more or less.

- How to submit a refund claim (if applicable)

- How underpaid tax will be recovered by HMRC, usually by changing your tax code for the following tax year.

- Any personal allowance that is exempt from taxes.

- Any expenses you may have incurred that are deductible from taxes.

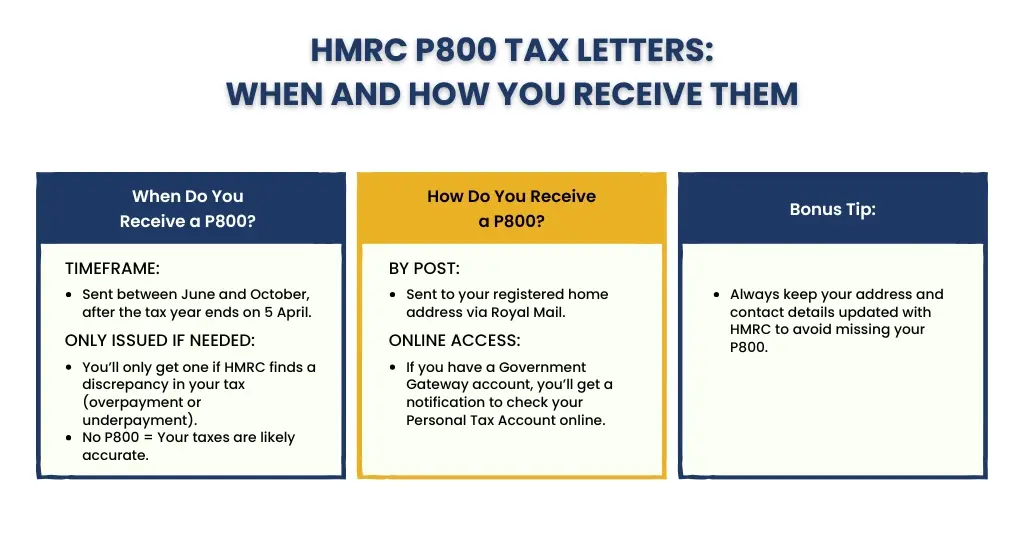

HMRC P800 Tax Letters: When and How You Receive Them

When Do You Receive a P800?

- Timing: Typically, this occurs from June to October after the tax year finishes on April 5th.

- Issued only when necessary: Only if HMRC discovers a discrepancy will you be given a P800. You won’t get any money if your taxes are accurate.

How Do You Receive It?

- By post: Your registered address is where the majority of P800s are delivered as actual letters.

- Via Personal Tax Account: You can receive an alert to access your P800 online if you have created a Government Gateway account.

P800 Refunds: Why You Might Get and How to Claim

In the UK, HMRC can owe you money if you overpaid taxes through PAYE (Pay As You Earn). To find this overpayment, a P800 tax calculation is used.

Why You Might Get a P800 Refund?

Overpayment of taxes can occur in several circumstances throughout the year, such as:

- Changing positions in the middle of the year.

- Being subject to taxes under an emergency or wrong tax code.

- Working only a portion of the year.

- Obtaining taxable benefits for which HMRC failed to account fully

- Not claiming tax benefits or allowances relating to one’s job.

Sometimes these changes are not immediately detected by HMRC’s system, so a P800 may be issued following a review at the end of the tax year.

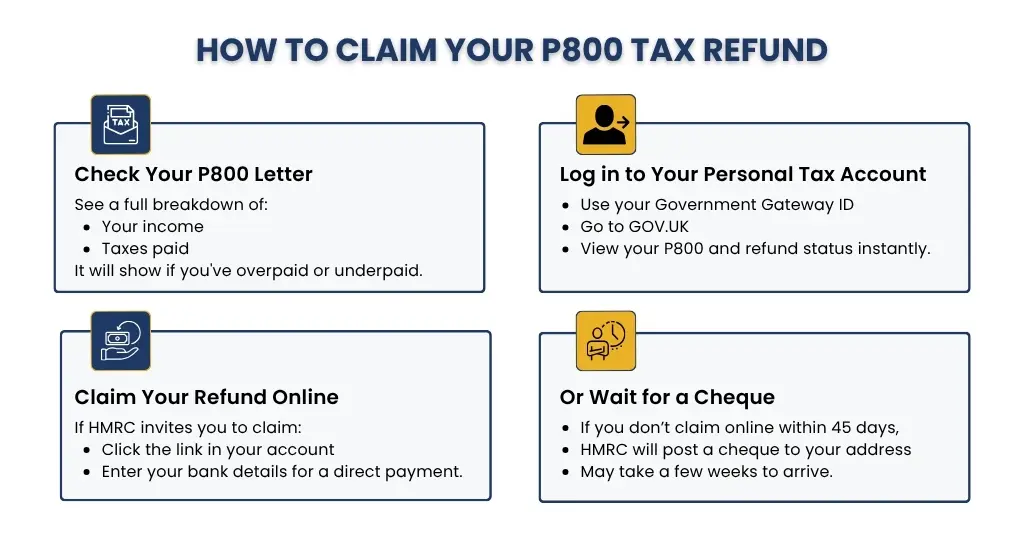

How to Claim Your P800 Refund?

HMRC will specify the procedures in your P800 letter if you are eligible for a refund. This is how to make a claim:

- Check Your P800: A detailed breakdown of your income and taxes paid will be displayed on the P800. It will inform you if your payment was excessive or insufficient.

- Log in to Your Personal Tax Account: Use your Government Gateway ID to log in when you visit GOV.UK. Through the portal, you can instantly access your P800 and request your reimbursement.

- Claim the Refund Online: If you receive an invitation from HMRC to submit a refund claim, click the link in your account. For direct payment, your bank information will be requested.

- Or Wait for a Cheque: HMRC will automatically send a cheque via postal service, which could take a few weeks to arrive, if you don’t claim the refund online within 45 days.

What Happens If You Owe Tax on Your P800?

If your P800 tax calculation indicates that you underpaid taxes, HMRC will notify you of the amount you owe and the method of collection.

Here’s what typically happens:

- Automatic Tax Code Adjustment: HMRC will typically adjust your tax code for the following tax year to collect the debt if it is less than £3,000. This implies that every month, a small sum will be taken out of your salary or pension.

- One-Off Payment: HMRC may request a lump sum payment if you no longer have PAYE income or if the amount is excessive. A payment request with instructions or a Simple Assessment will be sent.

- Interest and Penalties: Small underpayments typically don’t result in penalties, although interest may be charged for late or ignored payments. Always answer right away.

- Appeal or Query: You may question or review the P800 computation by getting in touch with HMRC if you think it’s incorrect. Always carefully review your income details and tax code.

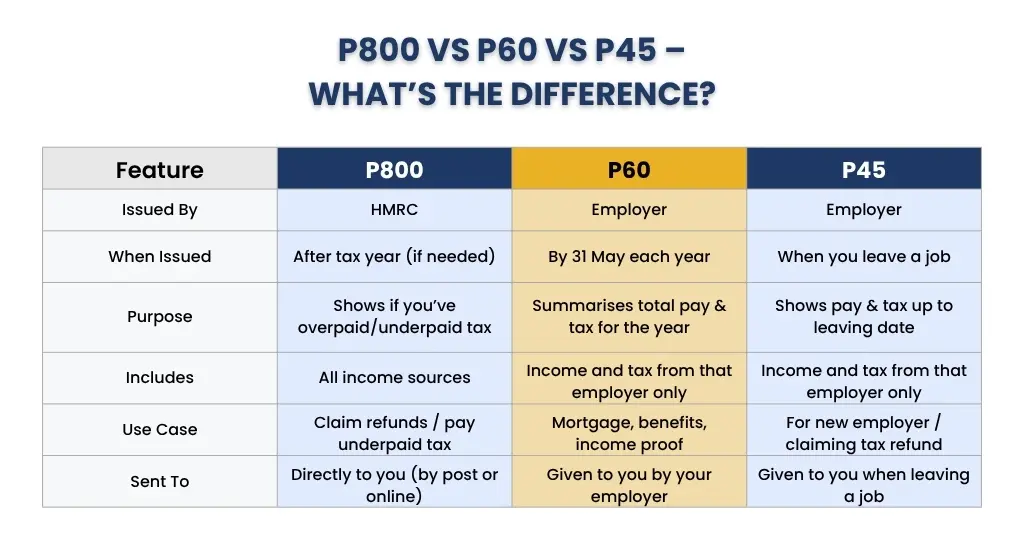

P800 vs P60 vs P45: What’s the Difference?

Although they are all valid HMRC documents, their functions are rather different. Here’s a brief explanation:

P800 – Tax Calculation Notice

- Issued by HMRC (not your employer)

- Sent after the tax year if HMRC finds you’ve overpaid or underpaid tax.

- Shows a summary of your income and tax position across all sources.

- May result in a refund or an amount you owe.

P60 – End of Year Statement

- Provided by your employer by May 31st at the end of each tax year.

- Summarises the total amount of money you made and the taxes you paid for that job during the tax year.

- Your P60 can be utilised to apply for a mortgage, claim tax benefits, or demonstrate income.

P45 – Leaving a Job

- Given by your employer when you leave a job.

- Shows how much you were paid and how much tax you paid up to your leaving date.

- Helps your new employer tax you correctly or helps HMRC issue refunds.

Let’s understand the difference between the forms through an example.

- P45 – When You Leave a Job

When Sarah quit her first job, she was given her P45. It showed her income and taxes paid up until the time of her leaving. Starting a new employment or submitting a benefit claim requires this document.

- P60 – End-of-Year Snapshot

At the end of the tax year, she received a P60 from her second employer. It displayed her annual income and taxes paid to that employer alone (could be limited companies, LLPs, etc). Every employee on April 5th should receive one.

- P800 – HMRC’s Recalculation

Sarah received a P800 from HMRC a few months after the tax year ended. This came straight from the tax office, not her employer. It computed her overall tax status by combining data from her P45 and P60. It turns out that Sarah should have received a refund because she overpaid taxes when she changed jobs.

Common Myths About P800 Tax Calculations

P800 forms and tax refunds are frequently confusing. Let’s clarify a few widespread misconceptions:

- Myth 1: A P800 Always Means You’re Getting a Refund

- Reality: Not all the time. A P800 may indicate an underpayment or an overpayment

- Myth 2: You’ll Automatically Get Your Refund

- Reality: In order to receive the funds, you must complete the online claim if HMRC requests it. Without action, your money may remain unclaimed.

- Myth 3: P800s Are Sent to Everyone

- Reality: P800s are only provided if HMRC determines that your tax payment was incorrect. You won’t receive one if your taxes are accurate.

- Myth 4: You Can Only Get a Refund for the Current Year

- Reality: If you believe you overpaid, you may be eligible for refunds for up to four prior tax years.

- Myth 5: All Messages About Tax Refunds Are Legit

- Reality: Scams are widespread. HMRC never sends an email or text message requesting financial or personal information. Always check using GOV.UK.

Who Does NOT Get a P800?

Not everyone is qualified to receive a tax calculation of P800. Only when there is an imbalance in the tax paid through PAYE does HMRC issue them. The following conditions will prevent you from receiving a P800:

- You’re Self-Employed: If you submit a Self-Assessment tax return, HMRC uses that method rather than a P800 to determine your tax. You will repay any overpayment or underpayment as part of your self-assessment.

- You’re a Limited Company or Employer: P800 form are not given to businesses or companies. Under the PAYE system, these forms are only for individual taxpayers.

- Your PAYE Deductions Were Already Correct: You won’t receive a P800 if your tax code was correct and HMRC has no reason to suspect you made a mistake. You don’t need to do anything if your taxes were correct all year long.

- You Already Claimed a Refund Another Way: A P800 for the same overpayment will not be given to you if you have already filed for and been granted a refund directly, for example, using form P87 for work costs.

Should You Hire a Personal Taxation Accountant for P800 Tax Calculations?

Hiring a tax accountant for a P800 is typically not required. Refunds are handled by HMRC and can be claimed promptly and easily for free on the official GOV.UK website. However, it can be beneficial to seek professional assistance if your personal taxation involves various income sources, suspected problems in your P800, or wish to analyse multiple tax years. For things that you can typically handle for free, be wary of third-party businesses that charge exorbitant prices.

Conclusion

To ensure that you pay the correct amount of tax and nothing more, the P800 tax calculation is a crucial component. Understanding the procedure gives you the ability to take charge of your finances, regardless of whether you need to pay back underpaid taxes or receive a refund. Without outside assistance, the majority of consumers can handle their P800 using HMRC’s safe and simple online resources. You can avoid surprises later on by checking your tax code frequently, informing HMRC of any changes in your life or income, and claiming any applicable reliefs. Being proactive guarantees that you are actively avoiding tax problems rather than just responding to them, which will ultimately help save money and time.

How long does it take to receive a P800 refund?

– HMRC normally processes the refund within 5 working days if you make an online claim through your Personal Tax Account, and the funds are deposited straight into your bank account.

– Or, HMRC may automatically issue a cheque if you choose not to claim it online; this cheque typically arrives two weeks after the P800 is sent.

Can I Get a P800 If I Have Left the UK?

Indeed, you can. Even if you paid too much in taxes before you left the UK, HMRC might still issue a P800. You can either submit a P85 form to obtain any refund you’re due, or make sure they have your updated address.

What Should I Do If I Think My P800 Is Wrong?

If your P800 appears to be inaccurate, please get in touch with HMRC right away. Verify the information you have provided, including your income, tax code, and personal details. If an updated calculation is required, HMRC can review it and provide it.

Can an accountant help with a P800 issue?

Yes, if your P800 is complicated or you think it’s incorrect, an accountant can assist. They can look over your tax documents, get in touch with HMRC, and make sure you receive the right refund or settle any underpayment issues.

If my employer handles PAYE, why would HMRC send me a P800?

Even if your employer manages PAYE, if there is a tax difference due to a change in employment, multiple incomes, benefits, or an incorrect tax code during the year, HMRC will send you a P800 form, not to your employer.

What happens if I ignore a P800 and owe tax?

If you neglect your P800 form and you owe taxes:

– To recover it gradually, HMRC could make changes to your tax code.

– They can send a payment demand for larger sums.

– Ignoring it entirely could result in fines or interest.