It can be unpleasant to be placed on an emergency tax code; all of a sudden, more taxes are deducted from your paycheque than you anticipated, leaving you with less money. This frequently occurs when someone starts a new job, quits working for himself, or receives extra money from a pension or other company benefits.

The good news is that emergency tax codes are often only in effect temporarily, and you may be eligible for a tax refund from HMRC if you overpaid. What an emergency tax code is, why it occurs, how it impacts your take-home pay, and most importantly, the easy procedures you may take to get your money back will all be covered in this blog.

What is an Emergency Tax Code?

HMRC uses an emergency tax code, which is a temporary code, when they don’t have enough information to compute your taxes accurately. Until your information is updated, HMRC uses a default code to ensure that tax is collected, without applying your full personal allowance or taking your individual circumstances into account.

Why Does HMRC Put You on an Emergency Tax Code?

HMRC employs an emergency tax code when it does not have all the information required to determine your accurate tax status. This is common in circumstances like:

- You’ve started a new job, but your new employer hasn’t received your P45 from your former employer.

- HMRC has not yet changed your records when you go from self-employment to employment.

- Getting advantages from the employer that aren’t included in your code, such as a car or health insurance.

- Receiving a pension or having several sources of income that are not clearly divided.

- Missing or delayed information from your employer or yourself.

As soon as HMRC has the accurate information, your tax code is usually changed, and any excess money is reimbursed.

Types of Emergency Tax Codes Explained

Common Emergency Tax codes are:

#1. 1257 W1 / M1:

It is the most common emergency tax code. This means your personal allowance (the tax-free amount) is applied on a weekly or monthly basis, rather than being spread across the entire year.

Example: Sarah just started a new job in April. She earns £2,000 a month.

- With the 1257L W1/M1 emergency code, HMRC treats every month separately. She gets £1,047.50 tax-free for April, and pays tax on the rest (£952.50).

- In May, the same thing happens again:

Another fresh £1,047.50 tax-free, and she pays tax on the rest.

It’s like every month, Sarah’s allowance resets, and HMRC doesn’t add things up across the year.

#2. 0T (Zero- Tcode):

This tax code is used if your Personal Allowance has already been reduced or if HMRC is unsure of your remaining balance. There is no tax-free element of your income; all of it is subject to taxes.

Example: Sam recently switched jobs again, and his employer put him on the 0T tax code since HMRC wasn’t sure how much of his Personal Allowance remained. As a result, his whole monthly salary is taxed without any tax-free allowance, guaranteeing that HMRC will collect the proper amount of tax until they verify the amount of his remaining allowance.

#3. BR W1/M1:

All of your income is taxed at the basic rate of 20% with no tax-free allowance if you have BR W1/M1. The computation is made only for the current week or month and does not take into account prior earnings.

Example: Alex has a second job and earns £500 this week.

- His employer uses the BR W1 code.

- All £500 is taxed at 20%, so £100 goes to tax.

- Alex keeps £400.

The tax is solely computed for this week or month because it’s W1/M1, disregarding any income from his other employment.

How Emergency Tax Codes Affect Your Pay

Your take-home pay will typically be lower than expected if you are on an emergency tax code while HMRC changes your records. The specific effect is determined by the type of code used:

#1. 1257 W1 / M1:

This means your allowance (£12,570 per year) is given in slices each pay period, as HMRC ignores any income you earned before.

Example:

- Allowance = £1,047.50 per month.

- If you start a job in July earning £2,000:

- Normal 1257L (cumulative): unused Apr–Jun allowance carries over, so all £2,000 may be tax-free.

- 1257L M1: only July’s £1,047.50 is tax-free, so £952.50 is taxed.

#2. 0T (Zero- Tcode):

You are not given a personal allowance, so all of your earnings are subject to taxes. This often results in reduced take-home pay.

Example: Sarah has just started a new job and has been assigned to the 0T tax code.

- Sarah earns £2,000 a month.

- On the 1257L code, the first £1,047.50 would be tax-free, so only £952.50 would be taxed.

- But on the 0T code, Sarah gets no allowance, so the whole £2,000 is taxed.

The good news is that once HMRC has updated your information and issued the proper code, any additional tax you have paid will be automatically returned. This is sometimes repaid at the end of the tax year; otherwise, it appears on your next month’s payslip.

Common UK Tax Codes vs Emergency Codes

In the UK, the majority of people are on a regular tax code rather than an emergency one. How your tax-free allowance is used makes the difference.

#1. BR:

This code, which stands for “Basic Rate,” charges a 20% tax on all of your income. HMRC presumes that your tax-free allowance is being used in other places, and it is typically applied if you have multiple jobs or pensions.

Example: Sam already has one job where his tax-free allowance is being used.

When he takes a second job, his employer doesn’t give him any extra tax-free amount. Instead, they use the BR (Basic Rate) code, which means:

- All of Sam’s pay from the second job is taxed at 20%, right from the first pound.

- It’s HMRC’s way of saying: “Your tax-free allowance is already used up at your main job, so this job is fully taxable.”

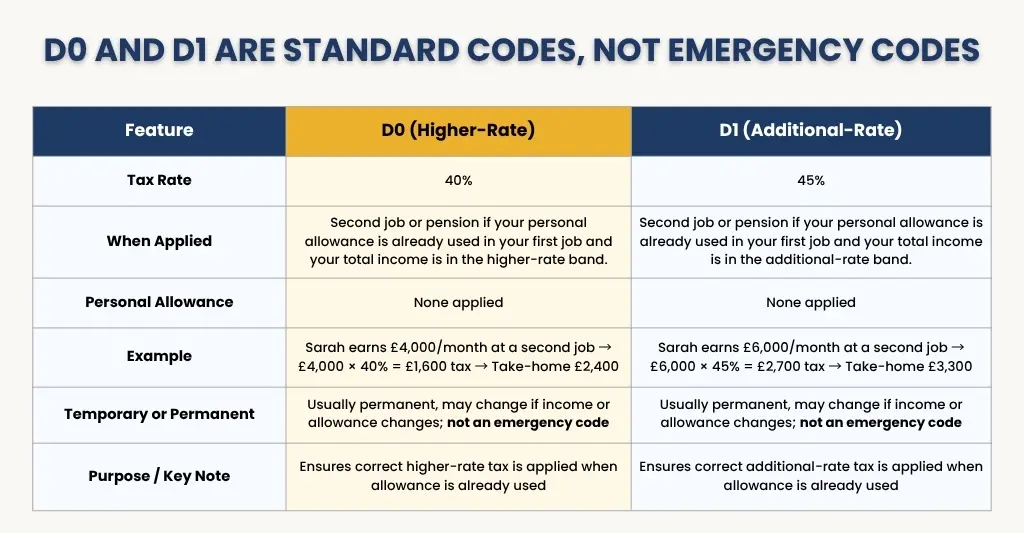

#2. D0(Higher rate):

All of your income is subject to 40% taxation under this code. Usually, it is used when you have already used your personal allowance from a previous pension or job.

Example: Sam’s company uses the D0 (Higher Rate) designation because HMRC determines that his Personal Allowance has already been exhausted after another source of income, such as a pension, has been used.

- What happens: Sarah is subject to 40% tax on all of his income from this source. This guarantees that when there is no more tax-free allowance, the appropriate higher-rate tax is imposed.

#3. D1 (Additional Rate):

All income is subject to the 45% extra rate of taxation, the same as in D0.

Example: Sarah’s employer may use the D1 (Additional Rate) code if Sam accumulates more income than the higher-rate level. In other words, all income from that source is taxed at 45%, just like D0, guaranteeing that when his Personal Allowance is used up, the appropriate extra-rate tax is imposed.

| Feature | Common UK tax code | Emergency code |

| Purpose | Used when HMRC knows your full personal allowance and previous income. | It is a temporary tax code used when HMRC doesn’t have your full income details. It ensures you pay tax right away, but the amount might be higher or lower than it should be until your correct code is applied. |

| Allowance Applied | Your personal allowance (e.g., 1257L) is applied correctly. | Personal allowance may not be fully applied; basic/default allowance is used. |

| Examples | 1257L, BR, D0, D1, 0T | 1257L W1/M1, BR W1/M1, 0T W1/M1 |

| Tax Calculation | Cumulative: considers your earnings so far in the tax year. | Non-cumulative: each pay period is taxed in isolation (Week 1/Month 1). |

| Accuracy of Tax | Usually accurate; reflects your total allowance and income. | May result in overpaying or underpaying tax temporarily until corrected. |

| When Used | When HMRC has your full records and previous jobs’ income. | When starting a new job mid-year, switching jobs, or missing previous income information. |

If you fall under 40 tax bracket, read our blog on How to Avoid 40 Tax UK accompanied by 5 legal strategies for healthcare & construction industry.

Note: Many people mistakenly think that D0 and D1 are emergency tax codes, but they are actually standard tax codes used for second jobs or pensions when your personal allowance is already used. Below is a table summarising their key features, how they work, and example calculations.

How to Check if You’re on an Emergency Tax Code

If you are on an emergency code, it is simple to determine. Below are the guidelines for searching:

- On your payslip: Your fiscal code will appear next to your paycheque and any deductions. The common appearance of emergency codes looks as follows:

- 1257L W1 or 1257L M1

- 0T

- BR W1/M1

- On your P45 or P60: These forms also show your tax code.

- In your Personal Tax Account: To verify your current code and see how it’s being utilised, you can sign in to HMRC’s online site.

Before paying the tax, keep a check on your tax code.

How to Fix an Emergency Tax Code?

No need to panic! It’s usually temporary and can be resolved quickly, so don’t worry if you find yourself on an emergency tax code. This is what you should do:

- Provide your new employer with a P45: The income and taxes paid to date are displayed on the P45 form. If it’s your first job and you don’t have a P45 form, complete a “Starter Checklist” so that your employer can provide HMRC with the correct information.

- Check your Personal Tax Account online: To view your current code, log in to the HMRC website. Additionally, you can edit your information (such as having multiple jobs or pensions).

- Wait for HMRC to update your code: Your employer will receive the updated, accurate code from HMRC. If you have overpaid, you will typically receive a refund in your subsequent paycheque, and your payslip should instantly be corrected.

- If nothing changes: Give HMRC a call and explain the circumstances. They can swiftly review your code and provide an update.

How to Claim an Emergency Tax Refund

If you are on an emergency tax code, you’ve probably paid more tax than you actually owe. There’s no need to panic; HMRC usually rectifies this quickly once your correct tax code is updated.

In most cases, the refund is automatically added to your payslip, so the extra money comes back in your next wages. Before the end of the tax year, HMRC will also review your records and send you a P800 tax calculation, which shows if you’ve overpaid and are due a refund.

If you are eligible, you can claim your refund online or request a cheque. To check if you have any refund due, review your P800 calculation or contact HMRC directly.

Quick tip:

Your payslips, P45, and P60 documents should always be kept secure because they make it simpler to determine whether you have overpaid.

How to Avoid Emergency Tax Codes in the Future

Emergency tax codes are frequently temporary, but there are several things you can do to lessen the likelihood that you will ever be placed again. First of all, your new company must receive your P45 from the previous company, as it displays your salary and tax information.

If you do not have a P45, complete HMRC’s Starter Checklist so that your employer can give HMRC the correct details. Additionally, if you have multiple jobs or receive a pension in addition to your wage, it’s worthwhile to maintain your Personal Tax Account online.

Lastly, immediately inform HMRC of any changes to your personal or professional circumstances that may have an impact on your tax code. You may prevent paying too much tax by following these easy procedures, which help HMRC assign the correct tax code.

Final Thoughts

Emergency tax codes can make your payslip appear confused and make you question whether you’re getting paid appropriately, but they’re not the end of the world. The most crucial thing to keep in mind is that HMRC will reimburse any additional taxes you pay after your code is fixed. Nevertheless, if you don’t know what to look for, handling payroll and tax regulations can be a pain. It is important to have the correct assistance in this situation. You receive situation-specific advice when you use personal taxation services, whether that be for code checks, overpaid tax claims, or year-long planning.

Whereas, our payroll service handles the administrative work and guarantees that your salary and deductions are always correct. When combined, they help you manage your finances stress-free and with peace of mind.

People Also Ask:

Will I get my emergency tax refund automatically?

Yes, HMRC will often automatically return any excess tax you paid on an emergency code. This can occur at the end of the tax year through a P800 tax calculation, or it can appear on your subsequent payslip after your code has been fixed.

How long does it take to fix an emergency tax code?

Once they have the correct information, HMRC will typically amend your fiscal code in about 1 to 2 months. After it’s fixed, your subsequent payslip will often include the refund of any additional tax you paid.

What is tax code BR, and is it an emergency tax code?

The BR (Basic Rate) tax code means all your income is taxed at 20% with no personal allowance applied. It is usually for a second job or pension and is a standard tax code, not an emergency code.

What is tax code 0T, and why would I have it?

All your earnings are taxed because the 0T tax code gives you no tax-free allowance. You may get it if your allowance has already been used, HMRC lacks your information, or you didn’t provide a P45 to your new employer. Until corrected, you could be paying too much tax, as it’s often used as an emergency code.

Do emergency tax codes affect pension or benefits?

The income tax deducted from the salary or pension is the only thing that emergency tax codes impact. Your take-home pay may decrease until the code is fixed, but they do not affect your state pension, workplace pension contributions, or benefits.

Will the emergency tax affect my whole tax year?

No, your entire tax year is typically unaffected by a temporary emergency tax code. HMRC will update your code and modify your pay as soon as they have the correct information.

How can E2E Accounting help me with an emergency tax code?

To avoid overpaying in the future, E2E Accounting can assist you with checking your tax code, reclaiming any unpaid taxes, and making sure your payroll is accurate. Contact us today.