It may be difficult to calculate your PAYE (Pay As You Earn) tax in the UK, particularly if you don’t understand how tax codes, deductions, and allowances operate. If you’ve ever wondered how is PAYE calculated, this guide will help. Understanding PAYE is crucial, and can help you pay less tax -whether you are a salaried worker looking at your payslip or a new employer attempting to figure out payrol

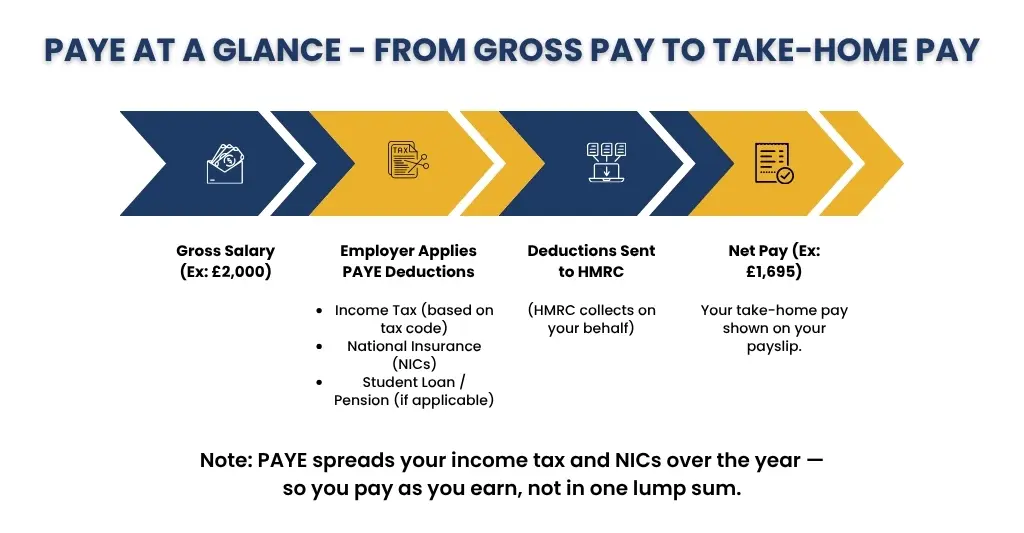

We will take you through every stage of the process in this guide so you understand how PAYE is determined, what influences it, and how it appears on your payslip. We will go over a basic example to further clarify the process of converting gross income into take-home pay after taxes and national insurance.

You will be able to determine whether your deductions appear to be accurate by the conclusion, in addition to understanding how PAYE works.

What is PAYE?

The method used by HM Revenue & Customs (HMRC) to deduct income tax and national insurance from your pay cheque or pension is called PAYE (Pay As You Earn). Your tax liability is spread out and automatically subtracted from each pay cheque rather than being paid in full at the end of the tax year.

Your employer or pension provider determines how much to deduct under PAYE depending on your income level, tax code, and any personal allowances you are eligible for. After that, HMRC receives these deductions directly on your behalf.

This means:

- You are not required to file a tax return unless you have extra income.

- Your taxes are progressively collected over the course of the year.

- Net (take-home) pay, deductions, and gross pay are all broken down on your payslip.

In summary, PAYE is intended to make tax payment precise, automatic, and hassle-free for the majority of UK citizens.

Gross pay vs Net pay

There are two terms that you will always see on your payslip: gross pay and net pay. The first step to understanding your PAYE deductions is knowing the difference.

- Gross Pay: This is your entire income before any deductions are made. It consists of your base pay plus bonuses, overtime, and other taxable perks. Consider it the “headline” sum that your company has agreed to pay you.

- Net Pay: In reality, this is what ends up in your bank account. Income tax, national insurance, pension contributions, student loan repayments, and other deductions are subtracted from your gross earnings.

Gross pay = before deductions

Net pay = after deductions (your take-home pay)

Components of PAYE Calculation

Income tax is not the only thing being used for PAYE deductions. There are many components that are deducted from your gross pay before you receive your take-home pay – which are often displayed on your payslip. Now let’s review the most important ones:

Income Tax:

When you earn more than your Personal Allowance, which is presently £12,570 for most people, you have to pay income tax. The appropriate tax rate is applied by HMRC according to your income band:

- Basic rate (20%) on earnings between £12,571 and £50,270.

- Higher rate (40%) on earnings between £50,271 and £125,140.

- Additional rate (45%) on anything above £125,140.

To make sure the correct amount is withheld, your tax code informs your employer of the portion of your income that is tax-free.

National Insurance Contributions (NICs):

NICs are not included in income tax and are used to pay for the NHS, the state pension, and other benefits. Employees typically pay:

- On incomes between £12,570 and £50,270, 12%.

- 2 percent of income over £50,270.

Always check HMRC’s most recent numbers because the thresholds and rates can change every tax year.

Student Loan Repayments:

Repayments for student loans may also be deducted from your pay cheque via PAYE. These only begin when your income reaches a certain level, which is determined by your repayment plan (Postgraduate Loan, Plan 1, Plan 2, or Plan 4).

For instance:

- Plan 2: You pay back £27,295 plus 9% of your salary.

- Repayment of a postgraduate loan is 6% of income over £21,000.

After HMRC informs your employer that you have a loan to repay, your employer computes this automatically.

Benefits in Kind (BIK):

Perks or non-cash rewards that your employer offers are known as benefits in kind. These are items that have a monetary value and might be subject to taxes. The following are typical examples:

- Company car or fuel allowance.

- Private medical insurance.

- Interest-free or low-interest loans.

- Subsidised living accommodation.

A P11D form is typically used to report the taxable value of these benefits to HMRC, and additional tax is collected through direct deductions or an adjusted tax code.

PAYE Calculation Example:

Scenario:

- Monthly salary: £2,000.

- Tax code: 1257L (standard personal allowance)

- No student loan or benefits in kind.

Step 1 – Determine taxable income:

- Annual salary = £2,000 × 12 = £24,000.

- Personal allowance = £12,570.

- Taxable income = £24,000 – £12,570 = £11,430.

Step 2 – Calculate income tax:

- Basic rate: 20% of £11,430 = £2,286 per year.

- Monthly income tax = £2,286 ÷ 12 ≈ £190.50.

Step 3 – Calculate National Insurance (NICs):

- NICs apply to earnings above £1,048 per month.

- Taxable NICs = £2,000 – £1,048 = £952.

- NIC rate = 12%

- NICs = £952 × 12% ≈ £114.24 per month.

Step 4 – Calculate take-home pay:

- Gross pay = £2,000.

- Total deductions = £190.50 (tax) + £114.24 (NICs) ≈ £304.74.

- Net pay = £2,000 – £304.74 ≈ £1,695 per month.

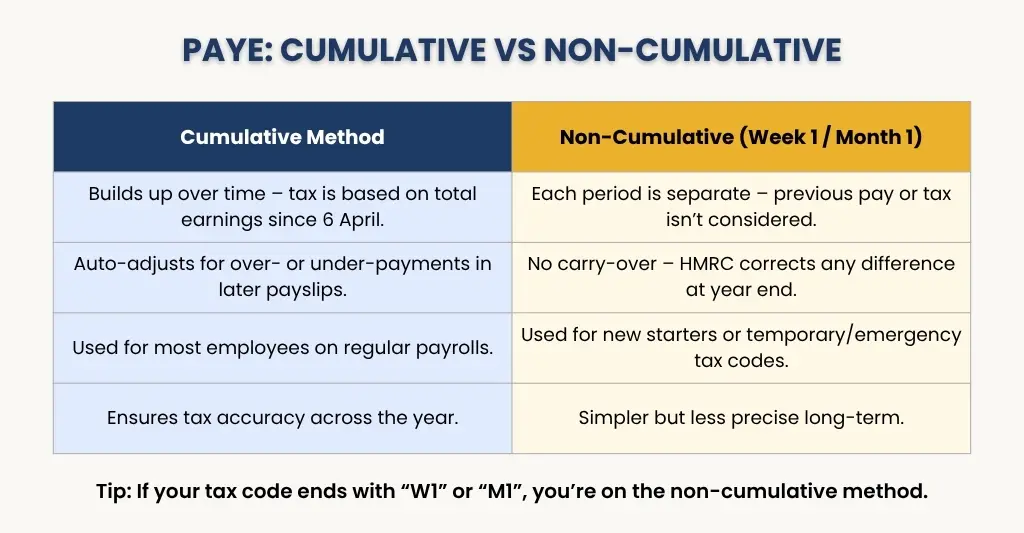

PAYE Calculation Methods

Employers can calculate PAYE in different ways approved by HMRC. The method you choose decides how income tax and National Insurance are taken from each payslip.

Cumulative Method (Most Common):

The most popular approach is the cumulative method. This is how it operates:

- Since the beginning of the tax year (6 April), HMRC has maintained a record of your total earnings and taxes paid.

- Every week or month, your employer computes your taxes by subtracting the entire amount of taxes you have already paid from your total earnings to date.

- This implies that subsequent payslips automatically fix any under- or over-taxed amounts from previous months.

Non-Cumulative Method (Week 1 / Month 1):

The Week 1 / Month 1 non-cumulative approach operates differently:

- Tax is only computed on the earnings for that particular pay period.

- Prior income and taxes are not taken into account.

- When there are temporary arrangements or new hires and cumulative records are not yet available, this approach is frequently utilised.

Pay Frequency and Its Effect on PAYE

Pay As You Earn (PAYE) calculations and reporting are directly impacted by how frequently you pay your employees, weekly, bimonthly, or monthly:

- Calculation of Tax: Every pay cycle is used to compute PAYE. While monthly pay may yield higher deductions all at once, shorter pay periods (weekly or bimonthly) distribute the tax deduction over more regular installments.

- Cash Flow Impact: Regular payments result in reduced tax deductions each time, which helps both the business and the employee’s cash flow.

- Reporting Requirements: PAYE must be recorded in accordance with your payroll schedule to HMRC (or your local tax authority). Filing deadlines and reporting accuracy may be impacted by changes in pay frequency.

- Employee Perception: Workers may observe minor variations in tax deductions, dependent on the frequency of their paycheque, because of rounding and period-based computation.

UK Payroll Responsibilities:

Payroll management in the UK entails a number of significant legal obligations to guarantee that PAYE is calculated and reported accurately. Important responsibilities include:

- Registering as an employer with HMRC: To obtain the required PAYE reference and tax codes from HMRC, you must register before paying your first employee. Also, take into consideration any emergency tax codes that may apply until the correct code is confirmed by HMRC.

- Calculating PAYE correctly: In addition to any other deductions, this covers income tax, student loan repayments, and National Insurance contributions. It is necessary to apply the appropriate tax regulations and take into account any in-kind benefits.

- Reporting to HMRC in real time (RTI): Every time you pay a salary to employees, you must submit a Full Payment Submission (FPS) to HMRC detailing wages, tax, and deductions.

- Providing pay slips: Employees must receive a payslip showing gross pay, deductions, and net pay each pay period.

- Paying HMRC on time: Depending on the size of your company, you must pay HMRC income tax and national insurance either monthly or quarterly.

- Keeping accurate records: Records of payroll must be retained for a minimum of three years. Wages, taxes, NICs, and other deductions are included in this.

- Handling year-end responsibilities: Employees should receive P60 forms, which provide a summary of their annual compensation and deductions. If any benefits in kind are available, report them using P11D forms.

Common PAYE Considerations for Employees

PAYE Tax Code Explained

One important factor in determining how much income tax is withheld from your pay cheque is your PAYE tax code. It informs your employer of the portion of your income that is exempt from taxes during a specific tax year. You may identify mistakes and make sure you’re not overpaying taxes by being aware of the tax law.

How tax codes work:

- A typical tax code looks like 1257L.

- The number (1257) represents your tax-free Personal Allowance divided by 10. For example: 1257 × 10 = £12,570 tax-free allowance.

- The letter (L, M, N, etc.) indicates your personal situation:

- L – Standard Personal Allowance.

- M – Married, receiving part of partner’s allowance.

- N – Married, transferring part of your allowance to partner.

- K – When deductions exceed allowances.

Why tax codes change:

- Change in job or income level.

- Benefits in Kind (company car, health insurance)

- Repayment of tax overpaid in a previous year.

- Adjustments for student loans or other deductions.

Checking your tax code:

- A P2 coding notice is sent by HMRC whenever your code changes.

- You may see the current tax code on your payslip.

- Contact HMRC right away if you believe it is incorrect to prevent paying too much or too little in taxes.

Key Takeaways

In the UK, both employers and employees must comprehend PAYE. Understanding how your pay is impacted by income tax, national insurance, student loans, and benefits in kind will help you better manage your money and identify any inaccuracies on your payslips.

Regardless of whether you choose the Week 1 / Month 1 technique or the cumulative method, PAYE guarantees effective tax collection all year long. By being aware of your payroll obligations and paying attention to your tax code, you can avoid overpayments and maintain compliance with HMRC regulations.

You now know how your gross pay is converted into net pay, so figuring out your take-home pay doesn’t have to be difficult after reading this guide and understanding examples. If you need any kind of assistance regarding personal taxation, or payroll, just reach out to E2E Accounting’s team.

People Also Ask:

Is PAYE calculated monthly or yearly?

PAYE is deducted from each pay cheque, whether it is weekly or monthly, and is determined by your annual income. By doing this, you avoid paying a large lump sum at the end of the year, and your taxes are distributed equally.

Why does my tax change if my salary stays the same?

Even if your pay is constant, your taxes may change as a result of changes to your tax code, benefits, or National Insurance.

How are student loan deductions collected through PAYE?

Repayments for student loans are automatically taken out of your pay cheque through PAYE as soon as your income surpasses the plan-specific level. Based on your salary beyond the threshold and the percentage for your loan plan (e.g., 9% for Plan 2, 6% for a Postgraduate Loan), your employer determines the repayment and sends it straight to HMRC.

Do all employers use the same method?

No, the majority of employers adopt the cumulative technique; nevertheless, some, particularly for new hires or temporary pay agreements, use the non-cumulative (Week 1 / Month 1) method.

What responsibilities do employers have under UK payroll when processing PAYE?

Employers must:

– Register with HMRC as an employer

– Calculate PAYE correctly (tax, NICs, student loans, etc.)

– Submit payroll reports to HMRC in real time (RTI)

– Provide payslips to employees

– Pay HMRC on time

– Keep accurate payroll records

– Submit year-end forms like P60s and P11Ds

These steps ensure employees are taxed correctly and the business stays compliant.