Paying taxes is inevitable — but paying too much tax doesn’t have to be. Every year, thousands of UK taxpayers discover that they’ve overpaid income tax due to misapplied tax codes, duplicate PAYE entries, or errors in self-assessment returns.

The HMRC Overpayment Relief Claim is a formal mechanism that allows you to reclaim tax you’ve overpaid when standard correction routes (like amending a tax return) are no longer available. However, strict time limits, documentation requirements, and specific legal provisions mean this is not as simple as requesting a refund.

In this blog, we’ll cover:

- What overpayment relief is and when it applies,

- How to file your claim step-by-step,

- The checklist you’ll need for accuracy,

- How long refunds take, and

- What to do if HMRC refuses your claim.

Let’s get started.

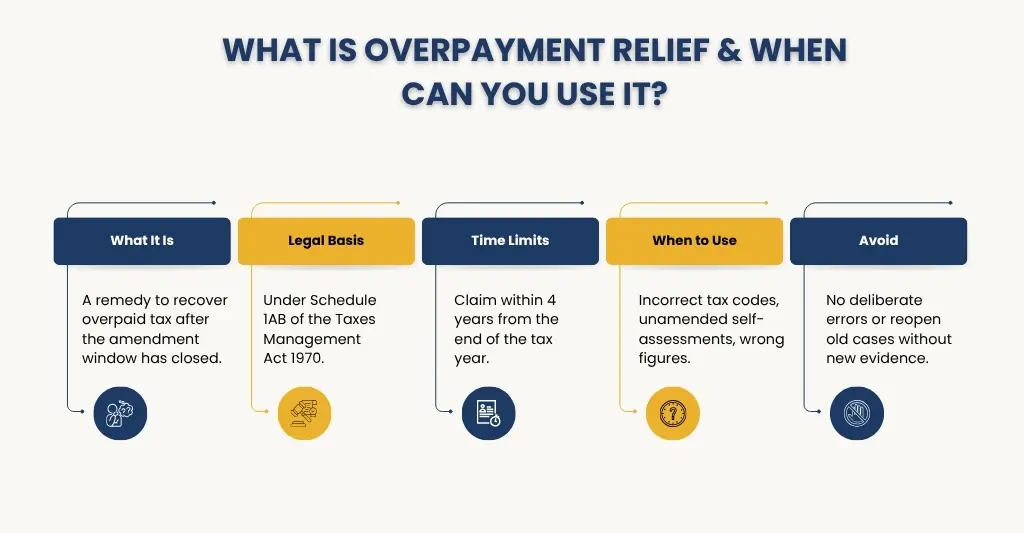

What Is Overpayment Relief? Legal Basis, Time Limits & When To Use It

Overpayment relief is a statutory remedy that allows individuals or businesses to recover overpaid tax after the normal time limits for amending returns or PAYE corrections have passed.

It is governed by Schedule 1AB of the Taxes Management Act 1970 (TMA 1970). In essence, this relief applies where:

- You’ve overpaid tax,

- You’re out of time to amend your return, and

- The overpayment is not already being repaid through another process (like a Self Assessment amendment).

Legal Basis:

HMRC’s internal guidance (SACM12155) states that overpayment relief can only be claimed for specific taxes, including Income Tax, Corporation Tax, and Capital Gains Tax. The claim must:

- Be made in writing,

- Be submitted within the statutory deadline, and

- Include all relevant evidence to demonstrate the overpayment.

Time Limits:

You must make your claim within four years from the end of the relevant tax year (for individuals) or accounting period (for companies).

For example:

- For the 2021/22 tax year, your deadline to claim is 5 April 2026.

- For company’s year ending 31 December 2021, the deadline is 31 December 2025.

Claims made after this period will be automatically rejected unless there is a valid “reasonable excuse,” which HMRC considers only in exceptional cases.

When To Use It:

You can claim overpayment relief if:

- You paid tax on income that should have been tax-free.

- HMRC used incorrect figures in a closed Self Assessment.

- You had the wrong tax code applied for several years.

- You paid Corporation Tax on income later adjusted.

- Your loss relief or allowances were not correctly applied.

However, you cannot claim overpayment relief if:

- You could have appealed the original assessment, but didn’t.

- The overpayment arises from a deliberate act (e.g., false return).

- You’re trying to reopen an old case without new evidence.

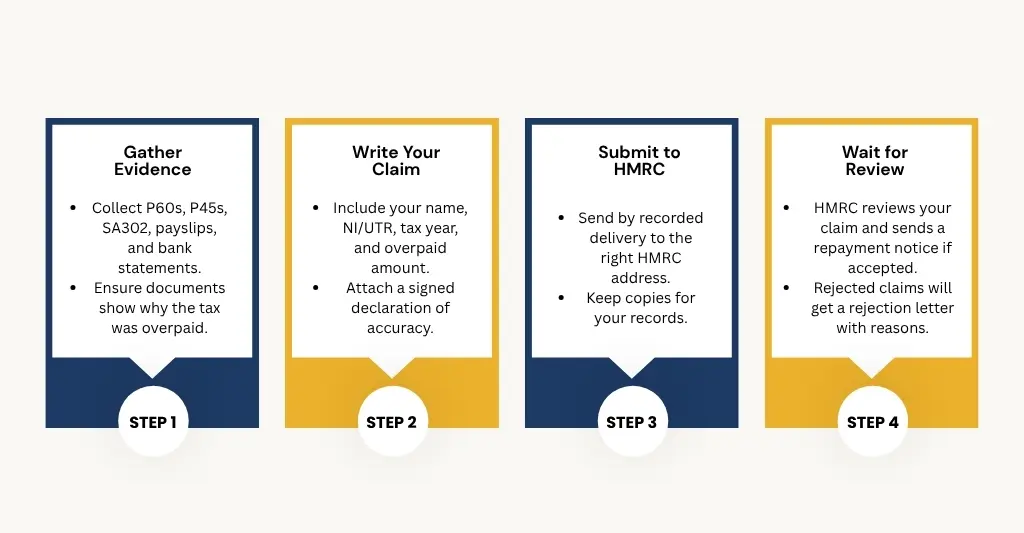

How To Claim Overpayment Of Tax

Documentation and accuracy are important so that your claim can be done without any difficulties. Following is a breakdown of the process:

Step 1: Gather Evidence

You’ll need to collect supporting records that prove the overpayment occurred. This typically includes:

- Tax calculation statements (SA302)

- P60s or P45s

- Payslips or PAYE records

- Bank statements showing income received

- Copies of past correspondence with HMRC

- Amended computations prepared by your accountant

Make sure your evidence clearly shows why the tax was overpaid – for instance, double-counted income or incorrect tax code use.

Step 2: Write Your Claim

HMRC requires a written claim that contains all relevant details. A valid overpayment relief claim must include:

- Your full name, address, and National Insurance number (or UTR for companies).

- The tax year or accounting period to which the claim relates.

- The amount of tax you believe you’ve overpaid.

- The grounds for your claim — why you think the tax was overpaid.

- A declaration of accuracy signed and dated.

- Evidence supporting your claim.

In case you have a representative, such as an accountant or tax agent, then he must be authorised by HMRC so that he can mark correspondence on your behalf.

Step 3: Send Your Claim to HMRC

You can send your claim by post to:

HM Revenue & Customs

Pay As You Earn and Self Assessment

HMRC, BX9 1AS

United Kingdom

Or, for companies, to:

Corporation Tax Services

HM Revenue and Customs

BX9 1AX

United Kingdom

It’s advisable to send your claim via recorded delivery and keep copies of all documents for your records.

Step 4: Wait for HMRC Review

Once received, HMRC will examine your claim to verify that it:

- Meets all statutory conditions under TMA 1970, Schedule 1AB.

- Falls within the allowable four-year window.

- Includes sufficient documentary evidence.

In case of the claim being accepted, HMRC will send out a repayment notice and interest (where applicable).

In case of rejection, a written letter will be sent to you giving the motivation of rejection and the possibility to review or appeal.

Checklist + Sample Claim Letter (Downloadable)

Before submitting your HMRC Overpayment Relief Claim, ensure you have:

- The correct tax year or accounting period defined/

- Evidence showing the overpayment (P60s, returns, payslips, etc.)

- A clear explanation of how the overpayment occurred

- Supporting calculations verified by your accountant

- Your National Insurance number or UTR

- Declaration confirming the information is accurate and complete

- Proper authorisation is filed through an accountant or agent.

- Signature and date

Below is a detailed checklist that will assist you in composing a letter to HMRC in order to claim overpayment of tax. This checklist will guarantee that all the essential information, documents, and formatting are addressed to make the claim clear, compliant, and more likely to succeed.

Checklist: How to Write and Submit an Overpayment Relief Claim to HMRC

This checklist will help you to make sure that your completed claim is accurate:

#1. Confirm Eligibility:

Make sure your situation qualifies for overpayment relief:

- The overpayment was made in the last four tax years.

- You’ve not already received a refund or relief for this amount.

- The tax overpayment was due to an error, omission, or misinterpretation of tax law.

- There’s no open appeal for the same tax issue.

- The error was not deliberate or fraudulent.

#2. Gather Supporting Documents:

Collect and attach copies (not originals) of:

- Relevant tax calculations, P60s, P45s, payslips, or Self Assessment returns.

- Bank statements showing tax payments made.

- Correspondence with HMRC (if any).

- Proof of identity or business registration documents (for business claims).

- Any professional calculations or accountant notes explaining the overpayment.

#3. Include Key Information in Your Letter:

Your letter should be formal and structured. Make sure it includes:

- Your full name, address, and National Insurance number (for individuals) or UTR number (for businesses).

- The tax year(s) you are claiming for.

- A clear statement that your claim is being made under Schedule 1AB, Taxes Management Act 1970 (Overpayment Relief).

- A brief explanation of how the overpayment occurred.

- The amount of tax you believe was overpaid.

- A request for repayment or adjustment of the overpayment.

- A signed and dated declaration confirming the information provided is true and complete.

Example declaration:

“I declare that the information provided in this claim is correct and complete to the best of my knowledge and belief.”

#4. Format the Letter Professionally:

- Use a clear and polite tone.

- Address it to the correct HMRC department — usually the Self

- Assessment or Corporation Tax office that handles your account.

- Include a subject line like: “Claim for Overpayment Relief – [Tax Year]”.

- Keep a copy of the letter and attachments for your records.

- Send the claim by recorded delivery or through a tax agent for tracking.

#5. Double-Check Before Sending:

Review your claim for:

- Accuracy of tax years and figures.

- Correct postal address.

- All relevant documents are attached.

- Signature and date.

#6. After Submission:

HMRC typically takes 6–12 weeks to respond.

- They may request additional evidence — respond promptly.

- If your claim is accepted, HMRC will issue a repayment or adjustment notice.

- If rejected, you can appeal within 30 days of the decision.

Quick Summary Checklist

| Step | Task | Completed |

| 1 | Check eligibility (within 4 years, no ongoing appeal) | ✅ |

| 2 | Gather supporting documents (P60s, bank proof, etc.) | ✅ |

| 3 | Include all required details in your letter | ✅ |

| 4 | Add declaration and signature | ✅ |

| 5 | Send to the correct HMRC address | ✅ |

| 6 | Keep copies and track the response | ✅ |

Pro Tip: Attach a concise computation summary showing your correct tax liability — it strengthens your claim and reduces back-and-forth with HMRC.

Download our free Sample Claim Letter to make your overpayment relief submission clear, compliant, and professional.

When Are Tax Returns Paid Out?

Refund timelines depend on how and when the claim was made.

- Online claims through your HMRC Personal Tax Account: typically processed within 2–4 weeks.

- Written overpayment relief claims: Can take 6–12 weeks, depending on complexity and HMRC workload.

- Corporation Tax refunds: Often take up to 8 weeks after HMRC’s final verification.

Payments are made via bank transfer (faster) or cheque (if direct deposit details aren’t on file). Always verify that your bank account details in your Personal Tax Account are accurate to avoid delays.

How Long Should a Tax Return Take

The time taken for a refund isn’t the same as the time taken to process a tax return.

- For Self Assessment, once submitted and verified, refunds are usually issued within 10 working days for online submissions. If HMRC identifies an overpayment through PAYE, you may receive a P800 refund.

- For PAYE adjustments, employers’ corrections may take up to 30 days to reflect.

- For overpayment relief claims, the process may take longer because HMRC performs additional checks and may contact your employer or accountant to confirm data.

In case of more than 12 weeks without a reply, please get in touch with HMRC or get your accountant to call via the Agent Helpline.

What To Do If HMRC Refuses Your Claim: Reviews, Appeals & Next Steps

When HMRC rejects your claim, there is no need to panic because you have other options available as well.

- Request an Internal Review:

Within the 30 days of getting the rejection letter, you may ask them to conduct an internal review of the decision. Attach any missing evidence or explanation that can be useful to your case. - File a Formal Appeal:

In case you are not satisfied with the result of the review, you may appeal to the First-tier Tax Tribunal (FTT) per Section 31A of TMA 1970. Your appeal must:- Be in writing,

- Clearly identify the decision you’re challenging, and

- Provide explanations as to why you think it is incorrect.

- Escalate to the Adjudicator’s Office:

In case of any procedural mistakes (e.g., unreasonable delays, not adhering to policy), you can take up your complaint to the HMRC Adjudicator Office. - Get Professional Assistance:

The majority of claims that are rejected are related to the absence of information or the wrong interpretation of the rules of relief. Tax advisors such as E2E Accounting can assist you in making appeals, keeping everything in line, and getting in direct communication with HMRC to hasten the speed at which a case is resolved.

Key Takeaways for Taxpayers

The HMRC Overpayment Relief Claim provides the taxpayers with a fair opportunity to reclaim the overpaid taxes, but only when it is done accurately and within the limit. Precision plays an important role in such areas as knowing the legal boundaries, compiling proof and writing a non-violating claim, ensures a successful outcome.

In case you feel that you have paid more tax than needed, do not wait before it is too late. Enlist the services of a licensed accountant to audit your past reports and find relief opportunities before the four-year period ends.

Why Choose E2E Accounting’s Personal and Corporation Tax Services

At E2E Accounting, we specialise in personal tax, corporation tax, and HMRC claim management. Our accountants:

- Review PAYE and Self Assessment data for overpayment opportunities

- Prepare and submit compliant overpayment relief claims

- Communicate directly with HMRC on your behalf, and

- Integrate tax refunds into your year end planning for better cash flow management.

Whether you’re an individual taxpayer or a company director, we’ll ensure every pound you’re owed is rightfully reclaimed.

Contact E2E Accounting today for a confidential consultation on your HMRC Overpayment Relief Claim or year end tax review.

People Also Ask:

What Is Overpayment Relief?

Overpayment relief refers to an HMRC tool that enables the taxpayers to reclaim the overpaid tax where their period of normal amendment has elapsed.

How Far Back Can I Claim an Overpayment?

You are entitled to carry forward a maximum of four years, after the termination of the respective tax year or accounting period.

How Long Will HMRC Take to Pay My Refund?

Usually 6 -12 weeks, varied according to complexity and evidence.

Can I Claim If the Wrong Tax Code Was Used?

Yes. Incorrect tax codes are a common reason for overpayment. Include your P60s and HMRC coding notices with your claim.

Are HMRC Income Tax Personal Allowance Petitions and HMRC Overpayment Relief Claims the Same?

No. A Personal Allowance Petition corrects allowance errors within open tax years, while an Overpayment Relief Claim addresses closed years or other finalised assessments.

What Evidence Should I Include?

P60s, Self Assessment returns, PAYE records and correspondence that prove the overpayment.

What If I Need Help Preparing My Claim?

Contact E2E Accounting – our tax people are capable of writing, filing and pursuing your claim to secure prompt refunds and also in accordance with the stipulations of HMRC.