The UK Autumn Budget 2025 which was presented by the Labour Government, with Rachel Reeves, Chancellor of the Exchequer, overseeing the measures- proposed economic reforms, in an effort to boost UK productivity and investments domestically.

From statement promises on improving the living standards, and cutting the NHS waiting line, to ultimately cutting down the borrowing debt as a share of GDP each year – the budget brings along investment opportunities and economic reforms, aiming to put the infamous legacy of the Conservative Government behind.

For the people, to what’s right, and never the return of austerity as a mean of ‘so-called’ progress, the budget resolves to help Businesses and SMEs evolve, and not just survive.

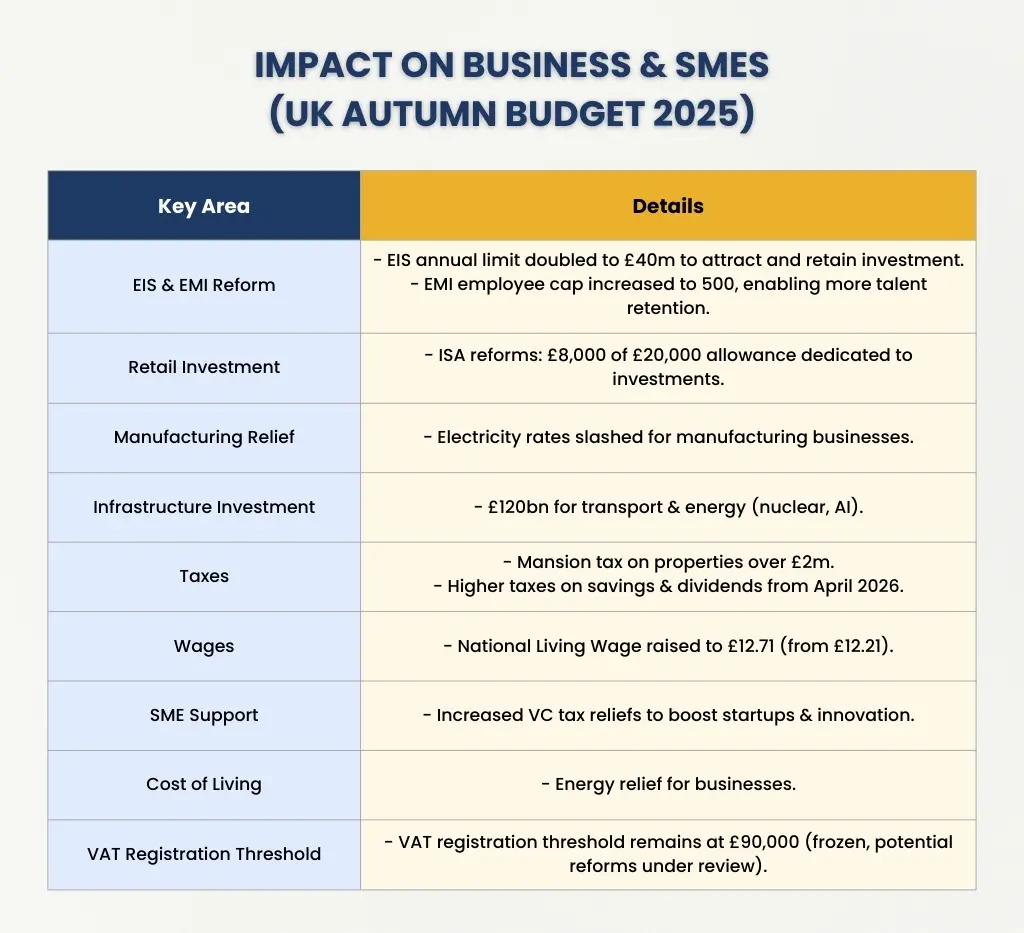

With doubling down on Enterprise Investment and Venture Capital Schemes from 10 million pound as annual limit, to now – 40 million pounds, it is made sure the businesses are here to stay and thrive. As for the employees, the right talent will be recognised and incentivised by offering EIS shares which can now be given to a total of 500 employees, as compared to before (250 employees).

From April 2027, there’s going to be a reform in the ISA system as well. The UK is set to improve public trading by allowing taxpayers to keep their full share of £20,000 allowance. Out of this, £8000 will specifically be designated for investment. This means, people will invest more and get higher returns.

But what does all this mean for businesses and SMEs?

UK Businesses, be it a micro entity or a scaling startup can now get tax reliefs and people support, without having to worry about higher tax rates and controlled government initiatives. UK investors can now invest without any worry. Businesses can now lean towards sustainable development, indirectly resolving the ever-lasting productivity problem.

As rightly said by Rachel “Low investment is the cause of low productivity, not the solution”. Business sectors are bound to grow and contribute to over 8000 jobs within AI and other infrastructure projects. Manufactures are going to see a sharp reduction in the electricity rates – slashing their complete dependence on energy, both as an operational productivity measure, and financial evaluation.

The budget also proposes to align the UK’s retail investment system with those of other G7 countries. Buying, selling and distribution are set to become more integrated within the UK, much like India’s ‘Swadeshi’ movement – thereby reducing dependence on external markets.

There is good news for the UK listing market as well. 3 years of exemption from stamp duty tax are to be provided to companies that list here in the UK. This is clearly conveyed in a sentimental, yet clear voice- when she says “If you build here, Britain will back you up”.

The Autumn Budget intends to increase its financial reserves to 21.7 billion pounds, with the aim of protecting the people, while matching private ambitions with public. Even with the loss incurred within the stock market by the accidental leak of information by the OBC, you can see a positive outlook from investors, founders and entrepreneurs towards the budget. There is an invisible, encouraging line binding them towards a hopeful future.

The Labour government is all set to fight the Tories’ legacy and continue defying the OBR’s predictions. It is committed to providing targeted support across various sectors like nuclear, energy, hospitality and more, inter-connect the nation’s infrastructure with 120 billion pounds investment, and keep innovators/founders at heart to boost economic output.

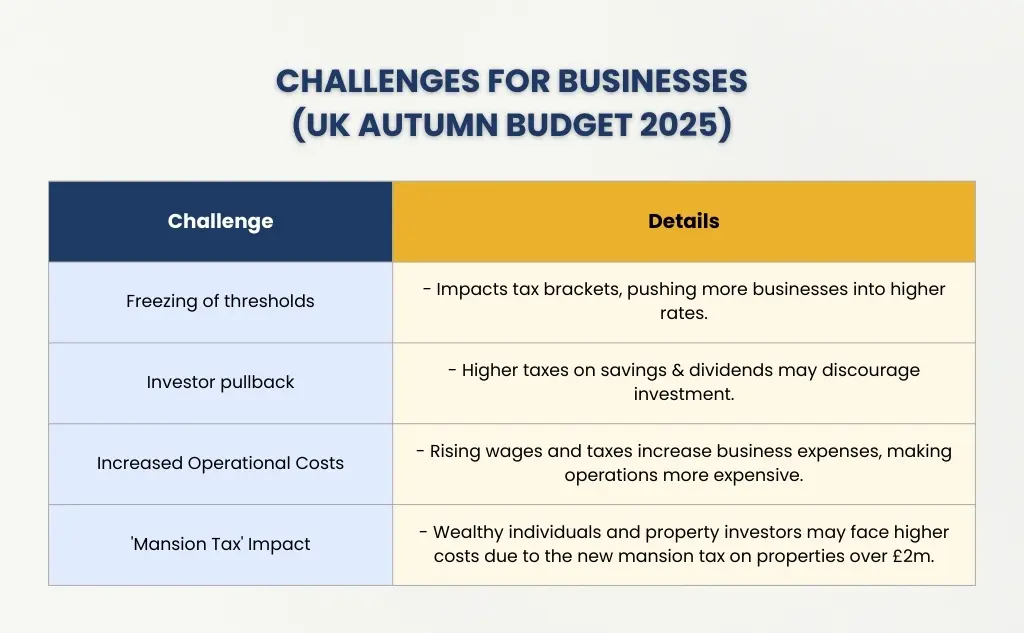

Though this budget comes with the freezing of thresholds, higher taxes on savings, and mansion tax for the wealthy; from an SME and business perspective – the reaction remains mixed. Businesses may face increased costs due to higher basic pay and potential investor pullback. However, the budget also lays a solid foundation of economic decisions and support that could prove beneficial for them in the coming years.

Wondering how much professional accounting would cost your business? In just 60 seconds, our free calculator will give you a custom price range – try it now

People Also Ask:

What exactly changes under the EIS & EMI reforms, and who benefits most?

Essentially, the annual limit on Enterprise Investment Scheme (EIS) investments just got doubled. This should give investors a lot more flexibility and a bigger allowance – to invest in those early-stage and fast-growing companies that need it.

The Enterprise Management Incentive (EMI) share-option scheme is also getting a boost, with a higher cap now allowing up to 500 employees to be eligible. This should let a lot more companies – especially scale-ups and smaller businesses – offer equity to a wider range of staff.

Who Benefits: Startups, scale-ups and smaller businesses all stand to gain from this as they’ll have better access to funding, and it’ll be easier for them to retain staff when more employees qualify for EMI share-option. It will also be attractive to investors who are looking for companies with long-term growth potential.

What does the ISA reform mean for ordinary savers and how could it affect funding for businesses?

From April 2027, the annual ISA allowance is staying at its current £20,000, but a chunk of that – £8,000 – is being set aside specifically for investments (like stocks and shares).

The idea behind this is to encourage more people to put their savings into the UK capital markets rather than just sticking with cash savings.

Implication for businesses/SMEs: More retail-level investment into publicly listed firms or investment funds could increase capital availability, improve liquidity in markets, and enhance potential funding pools for SMEs seeking growth capital.

How exactly will the electricity rate cut for manufacturers actually impact UK manufacturing businesses?

The budget includes a tweak to make electricity rates cheaper for manufacturing firms. And with energy costs making up a huge chunk of the bills for many energy-intensive manufacturers, this could make a real difference.

What it means: A lower energy bill should free up some much-needed cash in the business, allowing them to reinvest in the business, or look at expansion plans, wages, or even R&D.

What are the major risks or challenges for SMEs under UK Autumn Budget 2025?

– Frozen thresholds: Some tax thresholds have stayed the same, and with inflation rising (and wages not exactly falling), this could mean more people – including SME owners and employees – finding themselves in the higher tax bracket.

– Stricter conditions for investors: The budget include a bit of a tax grab on savings and dividends, and the mansion tax – which could put off investors who rely on dividend income or interest.

– Higher labour costs: The National Living Wage is going up, which should be a help to many. But for SMEs that rely on a lot of staff, like those in hospitality, retail or services – this could be a real struggle to pay their wages.

– Investor uncertainty: All those tax charges might put off some investors from taking on the risk of investing in UK businesses, which could be a problem for businesses looking for funding.

Does the budget do anything to help SMEs directly, beyond incentives for investors and large‑scale infrastructure spending?

Yes – it’s not all about incentivising investors and splashing out on big spending plans. There are tax breaks (via EIS/VC schemes), and the government is sticking to its commitment to keep the investment-friendly environment.

The big infrastructure plans – transport, energy, AI, nuclear – should all help improve the business environment over time. And that should be a help to SMEs in areas such as logistics, manufacturing, tech and services.

However, SMEs in certain sectors – those with very low margin or high labour cost might find it hard to cope with the wage and cost increases.

What does “no return to austerity” really mean for businesses?

It suggests that despite the necessary revenue‑generating taxes (savings, dividends, property), the government intends to continue investing in public infrastructure, supporting sectors, and stimulating growth, rather than cutting spending drastically.

Is this budget favourable for startups, or is it more geared toward established businesses?

It is quite favourable for startups and scaleups with EIS/VC limit reforms, EMI reforms, and retail‑investment push. However, startups with labour-intensive operations may still feel the effects of wage rises and increased cost pressures.

Overall, the incentives tilt toward innovation, investment, and growth – aligning well with startup needs, especially in sectors like tech, clean energy, manufacturing, AI.

How can E2E Accounting UK help businesses navigate the changes in the 2025 Autumn Budget?

E2E Accounting UK can help you understand the benefits and drawbacks from the 2025 Autumn Budget changes, from EIS and Venture Capital Scheme reforms to National Living Wage and tax changes. We’ll guide you on managing operational costs, tax reliefs and compliance with the new rules so your business can thrive in a changing world.

What should business owners and entrepreneurs do now?

– Review your funding options (use EIS/VC schemes to attract investment).

– If hiring or expanding staff, look at EMI share-option schemes to retain talent.

– Check your energy usage & manufacturing businesses should look at electricity cost reductions – and long-term energy plans.

– Plan your workforce costs with the National Living Wage increase in mind.