Managing VAT on logistics services is one of the most underestimated but costly difficulties for eCommerce companies. Logistics expenditures are fundamental to your operations, from warehousing and fulfillment to shipping, returns, and cross-border deliveries,and VAT mistakes here can quietly eat away at margins or spark HMRC inquiry.

Many online sellers struggle to understand when VAT should be paid, which country’s VAT applies, and how to effectively recover VAT on logistics invoices, especially when dealing with various carriers and fulfillment partners. This comprehensive blog breaks down VAT on logistics services in simple, practical terms, assisting eCommerce firms in remaining compliant, avoiding frequent traps, and maintaining cash flow control as they scale across the UK and beyond.

Types of Logistics Services and How VAT Applies

Understanding how VAT applies to logistics services begins with determining the type of service being delivered. Each logistics activity is evaluated differently for VAT reasons, and using the incorrect rate is a regular problem for eCommerce organisations.

Warehousing and Storage Services:

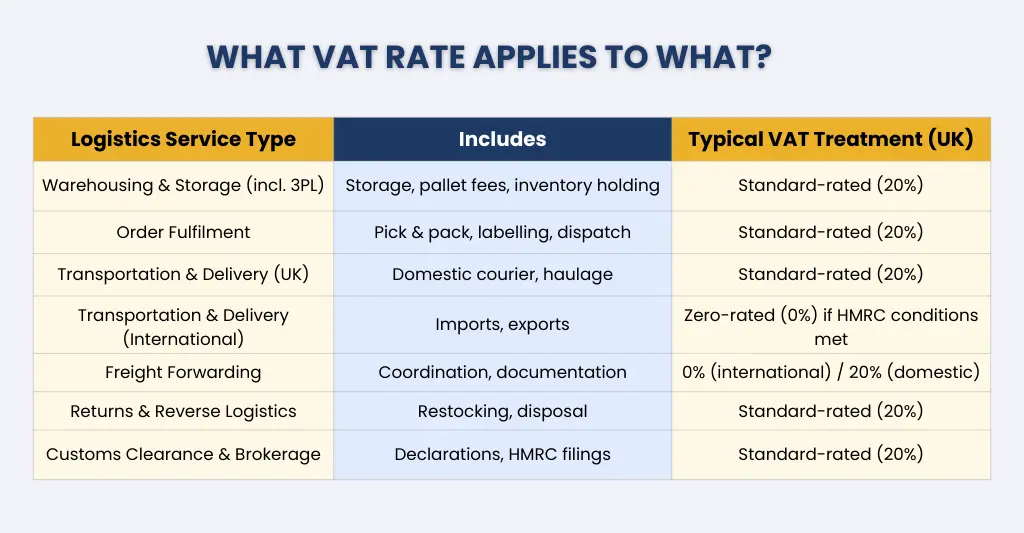

In the UK, warehousing and storage services provided by a VAT-registered supplier are commonly liable to standard-rate VAT. This includes storage fees, handling charges, and pallet storage expenses. VAT can usually be reclaimed if the business is VAT registered and the expenditure is related to taxable sales.

Third-party logistics (3PL) providers frequently combine warehousing with other services such as inventory management, order fulfillment, packing, and distribution; these services are also typically subject to standard-rate VAT, with recovery available under the same rules when used for taxable business activities.

Order Fulfilment Services:

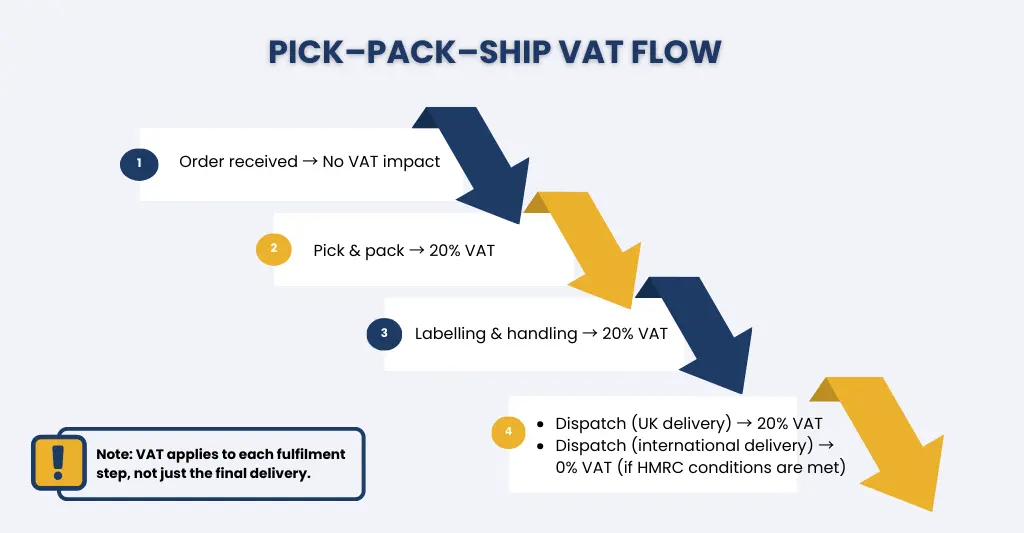

Order fulfillment services, such as choosing, packing, and shipping items, are often standard-rated for VAT. Fulfilment invoices sometimes combine several services, so it’s critical to understand how VAT is applied across each cost line.

Transportation and Delivery Services:

How goods should be transported or delivered completely depends on its type of supply. Domestic UK deliveries are usually standard-rated, however certain overseas transport services may be zero-rated provided they meet HMRC requirements and are properly recorded.

Returns management and reverse logistics:

Returns management and reverse logistics, which include customer returns, restocking, and disposal, are often standard-rated for VAT. These expenditures are typically neglected, yet they have considerable impact on VAT reclaims and reporting.

VAT on Freight Forwarding Services:

Freight forwarding services include the organisation and coordination of commodities transported by air, sea, or land, which sometimes involves several carriers and nations. The VAT treatment is determined by where the service is provided and whether the freight is for domestic or international transportation.

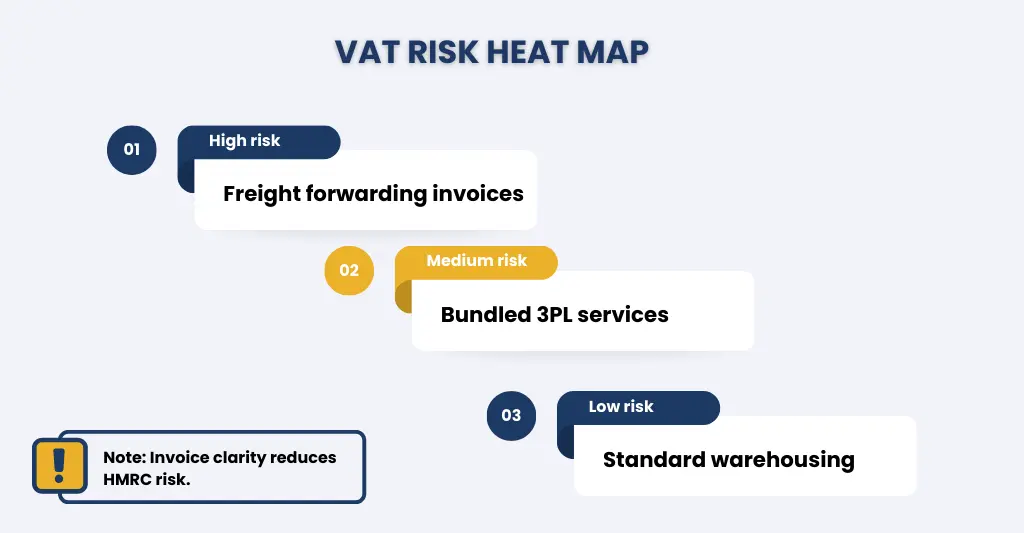

In the United Kingdom, freight forwarding related to international goods transportation is frequently zero-rated, provided the agent meets HMRC standards and has the necessary evidence, such as shipping papers and contracts. Freight forwarding for UK-only movements is typically standard-rated for VAT. It is also worth noting that administrative costs charged by freight forwarders may be subject to the same VAT treatment as the principal transport service, but poorly formatted invoices can result in blocked VAT reclaims.

For example, end-to-end VAT reporting should follow the same VAT treatment (zero-rated) as the principal transport service.

- Clear reference to the export shipment: The invoice should include the following:

- Shipment reference number

- Air waybill (AWB) / Bill of Lading number

- Export entry reference (MRN)

- Route details (e.g. UK → USA)

- Shipping date

Your invoice sample should include the following:

Shipment ref: AWB 123-45678901

Route: London (UK) → New York (USA)

Wrong invoice include:

Admin fee

- Clear link between admin charges and transport: Admin charges should be described properly not generically.

Good descriptions:- “Export documentation and admin services directly related to international air freight shipment AWB 123-45678901”

- “Booking, coordination, and processing charges ancillary to international freight transport (UK–USA)

Bad descriptions: - Admin charges

- Service fee

- Handling cost

- Note: HMRC trusts proper descriptions, not assumptions.

- Consistent VAT treatment across related services: If the primary transportation service is zero-rated, the administrative charges should reflect the same VAT rate, with a clear explanation.

Good VAT presentation:- International air freight transport (UK → USA) – £2,000 – 0% VAT

- Documentation & admin charges directly related to above export shipment – £300 – 0% VAT

- Evidence that supports the invoice (not always on the invoice itself): HMRC doesn’t need all documents with the invoice, but the supplier or customer should maintain the documents in case any inspection happens.

- Air waybill / bill of lading

- Export declaration (MRN / C88)

- Transport contract

- Customer agreement

The invoice must be accountable to these records.

Customs clearance & Brokerage Services:

Customs clearance and brokerage services assist firms in importing and exporting goods efficiently by handling customs declarations, compliance checks, and cooperation with customs officials to prevent delays or penalties.

When items are imported, import VAT is levied on the whole worth of the products plus shipping, insurance, and customs duty, which VAT-registered businesses can usually reclaim (sometimes through postponed VAT accounting), whereas exports are generally zero-rated for VAT if sufficient documentation is provided. The customs brokerage service, on the other hand, is usually liable to standard-rate VAT, regardless of whether the products are zero or exempt.

Key VAT Considerations for eCommerce Logistics

- Place of supply rules: The VAT treatment is determined by the location of the logistics service provider as well as the supplier and customer. Getting this wrong can result in inaccurate VAT charges or missed responsibilities.

- Correct VAT rates on services: Storage, handling, and domestic transportation are typically standard-rated, however certain international freight services may be eligible for zero-rating provided specific conditions are met.

- Invoice structure and clarity: Most of the time logistics invoices include numerous services. Poorly categorised invoices might cause VAT reclaims to be rejected during HMRC reviews.

- VAT recovery and eligibility: VAT on logistics costs can normally be reclaimed if your company is VAT registered and the expenditures are for taxable supplies. Exemption or mixed supplies may limit recovery.

- Cross-border logistics complexity: Using international warehouses, fulfilment facilities, or transporters complicates VAT and necessitates meticulous documentation and compliance inspections.

- Record keeping and evidence: Contracts, invoices, and shipping documentation must be kept on file, especially when applying zero-rated VAT to international services.

Managing VAT on Logistic Services: Best Practices for eCommerce Businesses

- Work with VAT-aware logistics partners: While looking for logistics partners, carriers, and freight forwarders check if they understand VAT requirements and implement them consistently across services.

- Review invoices in detail: As mentioned above, HMRC rejects the invoice if it’s poorly categorised. Ensure that logistics invoices properly identify storage, handling, transportation, and administration costs. These will make VAT easy to check and recover.

- Understand place of supply rules: VAT treatment varies depending on where services are performed and billed, especially when employing international eCommerce logistics solutions.

Example: If a UK-based eCommerce company employs a third-party logistics provider to keep products in a UK warehouse, the place of supply is the UK, and UK VAT is charged on storage and handling services. However, if the same UK corporation utilizes a logistics provider to store products in France and fulfil EU orders, the place of supply switches to France, and French VAT may apply, even if the company is registered in the UK.

- Maintain accurate documentation: Keep contracts, invoices, shipping paperwork, and export documentation to support VAT zero-rating and avoid HMRC inquiries.

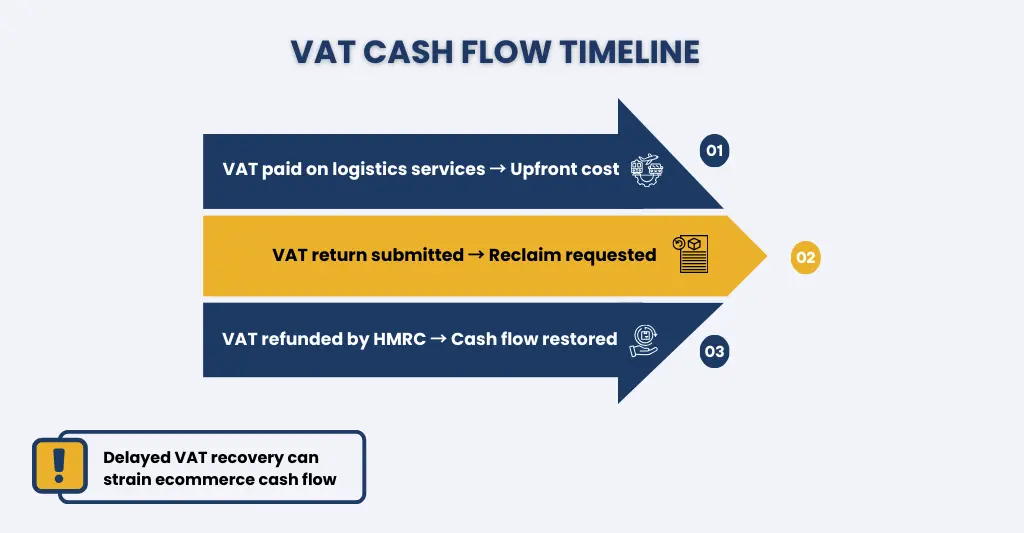

- Plan for cash flow impact: VAT on logistics services is frequently paid in advance, therefore predicting VAT outflows is critical for effective cash flow management.

For example: If a company pays £5,000 for logistics and warehousing services plus £1,000 VAT up front, it must fund the £1,000 VAT immediately and recover it later through the VAT return, so budgeting for this short-term cash outflow helps avoid cash flow problems.

- Monitor VAT recovery regularly: Each VAT period, review VAT reclaims on logistics costs to minimise missed or overclaimed claims that could result in compliance difficulties.

- Seek specialist VAT advice: As order volumes and cross-border activity rise, that time expert advice is of great help. They ensure that your eCommerce logistics solutions stay compliant and cost-effective.

Common Mistakes to Avoid

- Assuming all logistics services are zero-rated: Not all shipping and logistics expenditures are eligible for zero-rated VAT. Storage, handling, and domestic transport are typically standard-rated.

- Incorrect VAT reclaims on bundled invoices: Claiming VAT without checking how costs are itemised may result in blocked reclaims or HMRC modifications.

- Ignoring place of supply rules: A common compliance issue is incorrectly applying UK VAT to services performed overseas, or vice versa.

- Overlooking VAT on returns and reverse logistics: Return processing, restocking, and disposal fees are often standard-rated yet sometimes overlooked in VAT assessments.

- Relying on assumptions: VAT regulations shift, and logistical arrangements change. Failure to assess VAT treatment on a regular basis raises risk and cost. Instead of assuming it is better to seek expert guidance from the experts.

- Failing to review logistics VAT as the business scales: Things that work for domestic sales may not apply when overseas warehouses or couriers are included.

For example: A UK eCommerce vendor moving beyond local deliveries to international scale.The VAT laws that were effective for UK-only sales no longer apply, resulting in missing registrations and unclaimed import VAT. Dedicated eCommerce VAT services assist in identifying these changes early on and ensuring that logistics remain VAT compliant as the firm grows.

How VAT Affects Your Bottom Line: Financial Implications for eCommerce

VAT on logistics services directly affects an eCommerce company’s profitability, cash flow, and pricing considerations. When VAT is wrongly applied or reclaimed late, logistical expenses rise. Paying VAT upfront for storage, fulfilment, and shipping services can put a strain on cash flow for expanding eCommerce firms, especially as VAT is only reclaimed at the end of a VAT period.

In some circumstances, restricted VAT recovery on specific services can result in permanent increases in operational costs. Furthermore, VAT errors may result in HMRC penalties and interest, negatively impacting financial performance. eCommerce organisations that manage VAT correctly across logistical services can maintain margins, increase cash flow predictability, and make more informed pricing and growth decisions.

If you want a more comprehensive understanding of how VAT applies across different eCommerce business models, read our complete eCommerce VAT Guide for online B2B, B2C & Overseas Businesses.

Conclusion

Managing VAT on logistics services is more than simply a legal obligation for eCommerce businesses. It is important to properly manage VAT rules to safeguard profits and promote long-term success. Each logistics service, from storage and fulfilment to freight and overseas shipping, has its own VAT implications, and little faults can quickly result in significant concerns.

Businesses may reduce risk, enhance cash flow, and remain completely compliant as they scale by knowing how VAT applies, maintaining accurate paperwork, carefully checking invoices, and using the appropriate eCommerce logistics solutions. A proactive approach towards VAT administration ensures that logistics operations stay efficient, transparent, and financially sound in today’s increasingly complicated eCommerce world.

How E2E Accounting Can Help with VAT on Logistics Services for eCommerce?

E2E Accounting assists eCommerce businesses in managing VAT on logistics services by guaranteeing proper VAT treatment for storage, fulfilment, shipping, and freight forwarding.We assist with appropriate VAT recovery, evaluates complex logistics invoices, and advises on place-of-supply requirements for UK and overseas companies. Most importantly, E2E Accounting assists firms in navigating Brexit customs laws, such as VAT on imports, postponed VAT accounting, and cross-border logistics documentation. We use particular eCommerce VAT expertise to reduce compliance risk, increase cash flow, and keep logistics VAT aligned as firms scale across borders.

People Also Ask:

Why is understanding VAT on logistics services critical for eCommerce businesses?

Understanding VAT in logistics is crucial since it has a direct impact on profit margins by ensuring shipping expenses are appropriately charged. It avoids customs delays and unexpected fines for clients, which are prevalent when tax obligations are misinterpreted.

How does VAT apply to freight forwarding services in the UK?

Freight forwarding involves arranging transportation, processing documentation, managing customs clearance, and coordinating ports, airlines, and ground operations. This frequently involves freight crew support for cargo handling, loading, and port or airport operations. In the United Kingdom, international freight and closely connected services are normally VAT-free. Domestic (UK-only) freight forwarding and related crew services are typically charged at the usual VAT rate, assuming the supplier is VAT registered.

Is there a difference in VAT treatment for eCommerce logistics solutions within the UK and abroad?

Yes, there is a difference. Storage, handling, and domestic transport services are often standard-rated for VAT in UK-based eCommerce logistics solutions. When logistics services are offered abroad or include foreign movements, VAT treatment is determined by place-of-supply laws and may be eligible for zero-rating if HMRC prerequisites and documentation are met.

How can I manage VAT on international shipping and freight for my eCommerce business?

You can manage VAT on international shipping and freight by recognising when services are eligible for zero-rated VAT, maintaining accurate shipping and export documents, and carefully examining freight bills to ensure VAT is applied correctly. Using specialized eCommerce VAT support also helps you stay compliant, correctly recover VAT, and avoid cross-border commerce concerns.

Do third-party warehouses charge VAT on storage and handling services?

Yes. In the United Kingdom, third-party warehouses typically charge standard-rate VAT for storage and handling services such as pallet storage, picking, packing, and inventory management. If your eCommerce business is VAT-registered and makes taxable supplies, you can usually reclaim the VAT through your VAT return.

What are the common mistakes eCommerce businesses make when managing VAT on logistics services?

Common errors include thinking that all logistics services are zero-rated, mistakenly reclaiming VAT on bundled invoices, misinterpreting place-of-supply regulations for overseas services, inadequate record keeping for international shipping, and ignoring VAT on returns and reverse logistics. These inaccuracies can increase costs and cause HMRC compliance concerns.

How E2E Accounting’s eCommerce Accountants Can Help with VAT on Logistics Services?

E2E Accounting’s eCommerce accountants assist firms in managing VAT on logistics services by analysing logistics and fulfilling invoices, applying appropriate VAT treatment, and ensuring proper VAT reclaims. They also advise on place-of-supply regulations, international shipping VAT, and post-Brexit customs VAT obligations, assisting eCommerce firms in remaining compliant, protecting cash flow, and avoiding costly VAT errors as they grow.