Focused Mind & Financial precision help achieve goals

E2E Accounting has got your back when it comes to offering valuable assistance in bookkeeping and other accounting services through our experts at a reasonable cost.

services

Bookkeeping Service

From journaling everyday transactions in chronological order to posting them in the ledger and cross-verification with the bank, we prepare accurate financial records free from misstatements or errors of any kind. We combine the latest technologies and human expertise to deliver comprehensive bookkeeping services.

VAT Services

Our team of professionals combines the latest software with a human touch to deliver customised Value Added Tax calculation, compliance, efficiency, and legitimate service to all. Whether you are a service-type business or a product type, E2E ensures your VAT calculations are right and filed on time.

Year End Services

Moving forward with strict compliance to local laws and policies and preparation and analysis of accurate financial records at the end of a fiscal year, E2E accounting professionals take care of all the accounting and financial processes required to close the book of account while analysing scope for optimisation. E2E, as the name suggests, offers end-to-end accounting services to all businesses in the UK.

Management Services

From offering periodic data-driven suggestions to reduce overhead costs and optimise operations, our seasoned financial experts help you effectively manage scarce resources and guide strategic decision-making to achieve the organisational objectives and vision. E2E offers management services tailored to individual companies, offering valuable insights to the stakeholders and decision-making bodies on improving business performance.

Payroll Services

If you are overwhelmed with increased HR responsibilities and want to outsource payroll operations to a trusted firm that can not only offer accurate salaries to each contributing employee but also comply with all tax laws while calculating the correct amount of the tax to deduct, E2E Accounting can take care of all the business’s accounting and financial needs.

Personal Tax

E2E Accounting provides Personal tax services to individuals looking to maximise their tax deductions through accurate tax planning and avoiding penalties and errors while filing and reporting taxes. Our certified accountants can help individuals with personal tax, offering tailored services based on their long-term goals and state-specific requirements.

how it works

We provide you access to our Scanning App- Amoeba Scan where you can scan all your documents.

We set you up

- We will register your business entity with us.

- We will also provide you the access to our Scanning App- Amoeba Scan, where you can scan all your documents.

- We basically collect previous year accounts and current year accounting data or bank statements to bring your accounts up to date.

- Moreover we will connect your bank with an accounting application to get automatic bank feeds, and you do not have to struggle to provide us with bank statements.

- We set up a payroll process for you if you have any employees.

Business As Usual

- You can raise invoices by yourself within the system, or send us copies of invoices raised by you.

- You can also scan the purchase invoices through our Amoeba Scanning App.

- We account for your sales invoices, purchase invoices, and bank statements to keep your books up-to-date.

- We query for any missing details.

- We account for missing details post your reply.

- We basically process payroll and send payslips to your employees.

Post Accounting

- We also provide you with Profit and Loss Account and Balance sheet analysis. We will review your business performance for the first 3 months & provide you with a brief explanation of your financial health over the phone.

- In case you need any assistance prior to this period, we will always be happy to get on a call whenever you need it.

- You can also review your business performance anytime on the portal, including sales and expense analysis.

- We will basically file your VAT returns and RTI submissions with HMRC.

- We will also file your Year End Accounts and help you plan Corporate and Personal Tax.

Customer Support

- We will remind you of all essential compliance dates.

- You can get in touch with us through email/ phone or messaging services for any queries you may have.

- You can also contact us anytime for accounting and bookkeeping services, also if you face issues with the Ameoba software. We will help you address the problems and concerns on time.

- If you have any difficulties while subscribing to our services, you can request a call back from our team at any time.

Get a qualified bookkeeper

At an affordable price and robust financial reporting with a zero learning curve.

Our Promise

1. Dedicated Bookkeeper

2. We take End to End responsibility

3. 24 hours TAT support

4. Professional Team

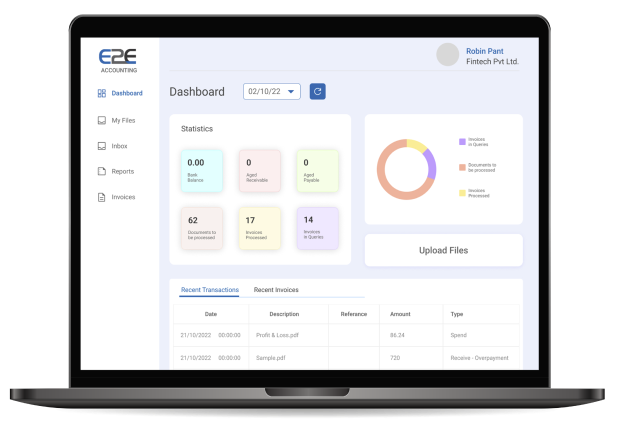

5. Interactive Customer Dashboard

6. Pocket-friendly fixed prices & payment plans.

7. No hidden charges.

8. Immediate updates on any changes in regulations.

Data Security

1. ISO 27001 certified company with data residing on Best in Class Services which are certified for PCI, ISO 27001, SSAE Type II certification.

2. All our data processes are GDPR Compliant.

3. We also conduct strict background checks for our employees.

4. Data is exchanged between us and you through 256-bit SSL/ TLS encryption.

5. Any external storage devices are blocked on workstations to avoid any sort of data transfer or misuse of data.

Testimonials

great working relationship

"We have a great working relationship with E2E Accounting Firm, having worked together for a number of years. They have become an integral part of our team."

Ryan Henry

highly recommend

"We have worked with E2E Accounting through an accounting firm, but I would highly recommend E2E as a solution for your bookkeeping requirements."

Ben Donovan

conscientious approach

"E2E Accounting Firm has a conscientious approach to understanding your business and its challenges, allowing them to suggest the appropriate solutions needed to develop the right strategies for your team."

Ravi Toor

Professional and Quick

"E2E Accounting Firm has been professional, quick to respond, and flexible in meeting all our needs. They promptly prepared a report on the applicability of Indian laws to my clients."

Chris Burns

Increase your profit and improve your cashflow

Struggling to manage cash flow positively? The E2E Accounting team will develop a centralised cash flow management strategy especially to help you efficiently manage your business cash.

Certification & Partners

blog

How eCommerce Tax Accountant Help You Save Money and Stay Compliant

Managing an eCommerce company’s finances is a difficult task. Balancing cash flow, figuring out profit...read more

OSS, IOSS & VAT for eCommerce: The No-Nonsense Guide You Wish You Had Earlier

As eCommerce keeps expanding internationally, it’s more crucial than ever to comprehend how VAT (Value...read more

A Complete UK VAT Guide for Online B2B, B2C & Overseas Businesses

In the UK, dealing with VAT may be a bit complicated, particularly if you sell...read more

frequently asked questions

Does E2E Accounting sync with software such as QuickBooks, Xero, or is there any other accounting software?

Our team of professional accountants is Xero & QB certified. Therefore we can work on every software like QuickBooks, Xero, Sage, SAGA, etc. But we do not sync our clients’ financial data from any other bookkeeping software.

E2E Accounting has its own bookkeeping software Ameoba. We will also do the bookkeeping on this software; you do not have to use any other software to work with us. Amoeba is an easy-to-use platform for bookkeeping. Whereas in Xero & QuickBooks, you have to do everything yourself, it is only a tool wherein you have to do your bookkeeping on your own.

If you currently use any such software, we will eventually pick all the closing balances from that software and prepare your books on our Ameoba software. However our team member from Catch Up Bookkeeping will guide you throughout the transfer process in case you have any difficulties or are unsure about your closing balances.

What will my assigned bookkeeper do for me?

The bookkeeper assigned to you will check all the documents uploaded by you, categorise and record all transactions, reconcile your accounts, and produce financial statements for you. They will also process invoices for you. The bookkeeper will ensure that all your books are tax-compliant and the taxes are filed on time.

We are always happy to support you if you have any queries about your bookkeeping, financial statements, or taxes; you can generally book a call with your bookkeeper, and all your questions will be resolved at the earliest.

I am far behind on my books and tax filings. Can you help me complete them and catch up with everything?

Yes, we can help you catch up on your books & filing through our Catch Up bookkeeping package plan. No matter how far behind your books are, we can get you to catch up quickly.

How can I send you my documents? Do I need to provide you with each and every receipt?

At E2E Accounting, we use Ameoba software. Once you complete the entire registration process with us, you will receive the login credentials of the software. Your assigned bookkeeper will also guide you and provide you with a demo of how to use the software.

You can then effortlessly upload all the necessary documents on the software, and we will take care of the rest.

If you have incurred expenses through a bank account, they are picked from the bank statements. However, if the expenses are incurred in cash, you must provide us with receipts for those transactions. It will also help you in acquiring maximum tax deductions.

Also, at times we can request you the documents, such as account statements or receipts, to cross-check the information and ensure that the posting is correct.

Does E2E Accounting support personal accounts used for business purposes?

We can help you accurately record all your business transactions from your personal accounts to capture more tax deductions.

Our team will eventually guide you through a complete understanding of the requirements if you want to use your personal account for business purposes.

Is there any annual contract? How do I make payments to you?

Once you have selected the plan for the services you wish to enroll for, as well as you can add those to the cart and proceed with making payments. We would basically require signing a 12-month contract.

You can make online payments directly to E2E through any debit or credit card such as Visa, MasterCard, American Express etc.

You can also make payments through PayPal or set up direct debits with us.

Whenever you wish to terminate your contract before its completion period, you are then required to notify our team at least 3 months in advance.