In the UK, managing a small business requires careful attention to detail, including knowing when your income and expenses occur. Prepayments and accruals are two accounting ideas that frequently lead to misunderstandings. Understanding how these adjustments operate can significantly impact your financial accuracy and tax efficiency, regardless of whether you manage your own bookkeeping or collaborate with an accountant.

We will explain what accruals and prepayments actually mean, why they are important for small and medium-sized businesses, and how to accurately record them in your accounts in this comprehensive UK SME FAQ guide. This article will assist you in keeping your company’s finances transparent, in compliance, and prepared for expansion by providing real-world examples and highlighting typical mistakes to avoid.

What Are Accruals And Prepayments In Plain English?

Basically, accruals and prepayments are methods to ensure that your accounts reflect your company’s actual financial situation, not merely what has been paid or received in person.

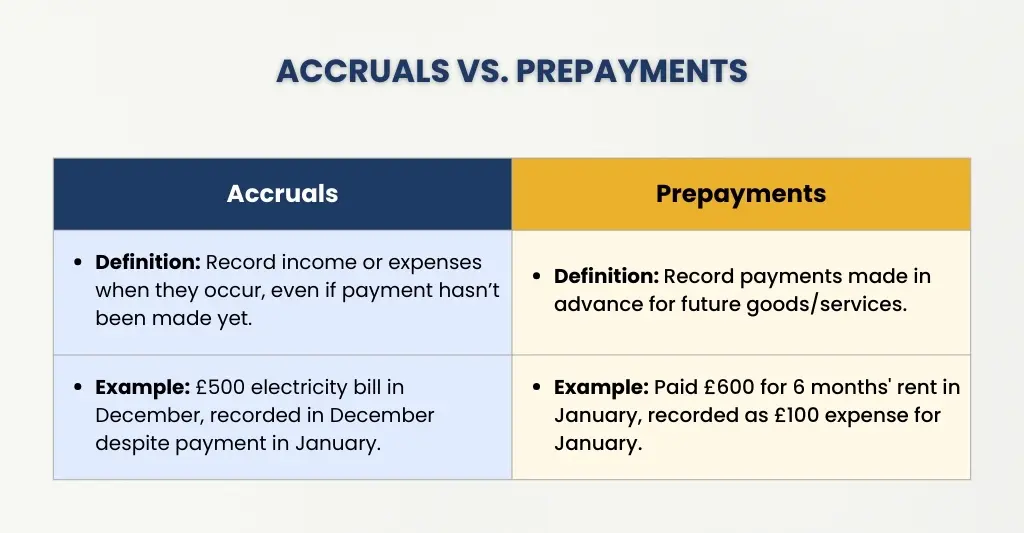

- Accruals: Expenses or income related to the current accounting period that have not yet been paid or received, while its benefits/service is utilised are known as accruals.

For example, A company uses electricity in December, but the bill of £500 is received and paid in January.

Even though payment happens later, the £500 electricity expense is recorded in December as an accrued expense, because that’s when the cost was incurred. - Prepayments: Expenses paid in advance for goods or services that the company will get in the future are known as prepayments. The prepaid sum appears as an asset on the balance sheet because the benefit has not yet been utilised.

Example:- Suppose a company pays £600 on January 1 for 6 months of rent (January–June).

- The rent cost per month = £600 ÷ 6 = £100.

- By the end of January, only £100 of rent has been “used.”

- The remaining £500 is for future months (February–June), so it’s recorded as a prepayment (asset).

Applying the accruals basis of accounting, which matches income and costs to the period in which they actually occur rather than just when cash moves, is achieved by documenting accruals and prepayments. This provides a more realistic and accurate picture of your company’s actual performance.

When Cash‑Basis Accounting Vs Accrual Basis: What UK SMEs Need To Know

| Aspect | Cash-Basis Accounting | Accrual-Basis Accounting |

| How Income Is Recorded | When cash is actually received | When the income is earned, even if the payment comes later |

| How Expenses Are Recorded | When money is paid out | When the expense is incurred, even if unpaid |

| Best For | Small sole traders, freelancers, micro-businesses | Growing SMEs with regular credit sales and purchases |

| Cash Flow Visibility | Shows real cash position | Shows financial performance more accurately. |

| Complexity Level | Simple and easy to manage | More detailed, requires adjustments (accruals & prepayments) |

| Suitable For VAT-Registered Businesses? | Not always ideal, sometimes may complicate VAT. | Fully aligned with VAT rules and reporting |

| Financial Accuracy | Useful for day-to-day cash management. | Gives a true picture of profits and liabilities. |

Note: Sometimes, people think cash-basis accounting and prepayment are the same. But in reality, they are different from each other.

Why Do Accruals And Prepayments Matter For My Small Business?

Accruals and prepayments aren’t just accounting speak for small businesses; they are essential to comprehending the true financial health of your organisation. You can see your business performance, cash flow, and profitability more clearly when you precisely record transactions for the appropriate time period.

Here’s why they matter:

- More accurate financial reports: If accruals and prepayments aren’t in place, your accounts may display unexpected increases or decreases in revenue and expenses that don’t correspond to reality. Your profit and loss statement will tell the truth if you smooth out such discrepancies by accounting for timing variations.

Example: Let’s say a business purchases insurance for a year in January for £1,200.- The next eleven months will appear to be more successful than they actually are if the entire £1,200 is recorded as an expense in January.

- The company only records £100 per month (£1,200 ÷ 12) when prepayments are used.

- Better decision-making: You can make better company decisions with clear, current data, from pricing and cost control to tax and expansion planning.

Example: If the business reports the entire £1,200 insurance payment in January, it appears that costs were quite high during that month and then decreased. Even though it’s only a time issue, this could lead management to believe that they must reduce expenses.

However, people may see their monthly spending clearly and accurately if they use prepayments and record £100 per month.

Using this precise information, managers can:- Knowing the actual monthly expenses will help you set better prices.

- Improve your ability to control spending, and

- Make growth and tax plans based on actual profits rather than misleading numbers.

- Compliance with accounting standards: To remain in compliance, accruals and prepayments must be included if you utilise the accruals basis of accounting, which is mandated for the majority of limited firms under UK GAAP or FRS 105/FRS 102.

- Improved cash flow planning: Planning for future costs and avoiding unpleasant surprises is made easier when you know which expenses are already “owed” or “paid in advance.”

Example: Using prepayments enables the business to realize that when they pay £1,200 for a year’s worth of insurance in January:- The money has already been transferred, however

- The monthly expense is only £100.

The business is better able to plan its cash flow as a result of knowing:- For the next eleven months, no further insurance payments are required, and

- You can put that money aside for other future costs.

Need help with accruals and prepayments? Get a custom estimate in 60 seconds with our free calculator — try it now.

Accruals And Prepayments Examples

Accrual Example: In April, you get a £500 water bill for March. You list £500 as an accrual for March even though you pay in April.

Prepayment Example: In January, you purchase a 12-month business insurance coverage for £1,200. Just £100 of each month is considered an expense; the other £1,100 is noted as a payment for subsequent months.

Accruals and Prepayments Double Entry

What is Double Entry Accounting?

Every transaction in double-entry accounting impacts two accounts, one of which is credited and the other is debited, ensuring that the accounting equation is always balanced:

Assets = Liabilities + Equity

This system ensures that for every value that goes out, an equal value comes in.

Why is it essential for Accrual and Prepayment?

Prepayments and accruals depend on matching revenue and expenses to the appropriate time, not only when money flows. Accurate recording of these timing modifications is aided by double-entry accounting.

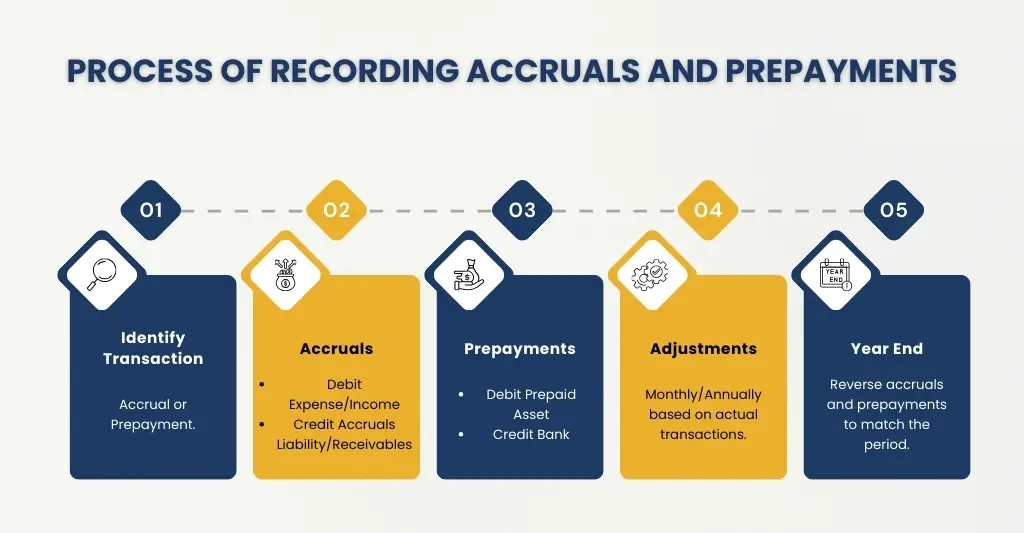

- For Accruals (Expenses or Income Owed)

Example: Electricity used in December (£500), but the bill was paid in January- Electricity Expense …………. Dr £500

- Accrued Expenses Payable ………. Cr £500

- This guarantees that a liability is displayed until payment is received, and the expense appears in December.

- For Prepayments (Expenses Paid in Advance)

Example: £1,200 rent paid in January for 12 months- Prepaid Rent ………………. Dr £1,200

- Cash ……………………………… Cr £1,200

- Accruals and prepayments are really about aligning revenue and expenses with the time to which they truly pertain, not when money is transferred. The accruals basis of accounting, which the majority of SMEs in the UK adhere to, is based on this.

To sum it up,

Accruals: These are sums that you owe or are owing for products or services that have already been delivered or received but have not yet been paid for or invoiced. Your income and costs will show up in the appropriate accounting period if you record accruals. “I owe this money for last month’s activity, even if I haven’t paid it yet,” is what you’re essentially saying.

- Another Example:

In April, Sam’s company gets a £600 phone bill for calls made in March. The £600 is listed as an accrual in March even if he pays in April. This guarantees that March’s expenditures accurately represent the actual cost of operating the company.

Prepayments: These are amounts that you have already paid or received for goods or services that you may need in the future. Prepayments should be recorded to prevent future costs from being counted as current. Think of it like this, I should not be charged for this month’s accounts because I have already paid for next month’s service.

- Sam purchases a 12-month software subscription for £1,200 in January. Just £100 a month is considered an expense; the other £1,100 is a payment for months to come. This stops the accounts for January from displaying an excessively high expense.

Accrual and Prepayment Journal Entries

Ensuring that accruals and prepayments are entered into your journal guarantees that each expense or income is shown in your accounting at the appropriate time. Here’s an example of how it operates using Sam’s small business:

Accrual Journal Entry:

Sam receives a £500 electricity bill in April for March usage.

- March (when expense applies):

- Debit: Electricity Expense £500

- Credit: Accrued Liabilities £500

- April (when the bill is paid):

- Debit: Accrued Liabilities £500

- Credit: Bank £500

Prepayment Journal Entry:

Sam pays £1,200 in January for a 12-month insurance policy.

- January (payment made):

- Debit: Prepaid Insurance £1,200

- Credit: Bank £1,200

- Monthly adjustment (moving cost to expense):

- Debit: Insurance Expense £100

- Credit: Prepaid Insurance £100

A true picture of profits and liabilities is provided by these journal entries, which guarantee that expenses are recorded in the appropriate month.

How Do Accruals & Prepayments Affect My Year End Accounts And Tax (UK)?

Prepayments and accruals are essential for making sure your year end financial statements appropriately depict your company’s financial status and adhere to the accruals method of accounting. In the accounting period, accruals are income or expenses that have been generated or incurred but have not yet been paid or received.

For instance, if you pay for services in January but receive them in December, the expense should be shown as an accrual in the December accounts. This guarantees that your profit is accurately depicted by matching revenues and expenses to the time period in which they occur.

Conversely, prepayments are payments made in advance for products or services related to a future accounting period, like rent or insurance premiums. These ought to be listed in your accounting as assets and then distributed as costs for the relevant time frame.

Whether you use cash basis or traditional accrual accounting, accruals and prepayments may have an impact on your taxable earnings for UK tax reasons. Accounting for them correctly helps avoid overstating or understating profits, guarantees adherence to HMRC regulations and accounting standards, and gives you a clear and accurate picture of your company’s financial situation at year’s end.

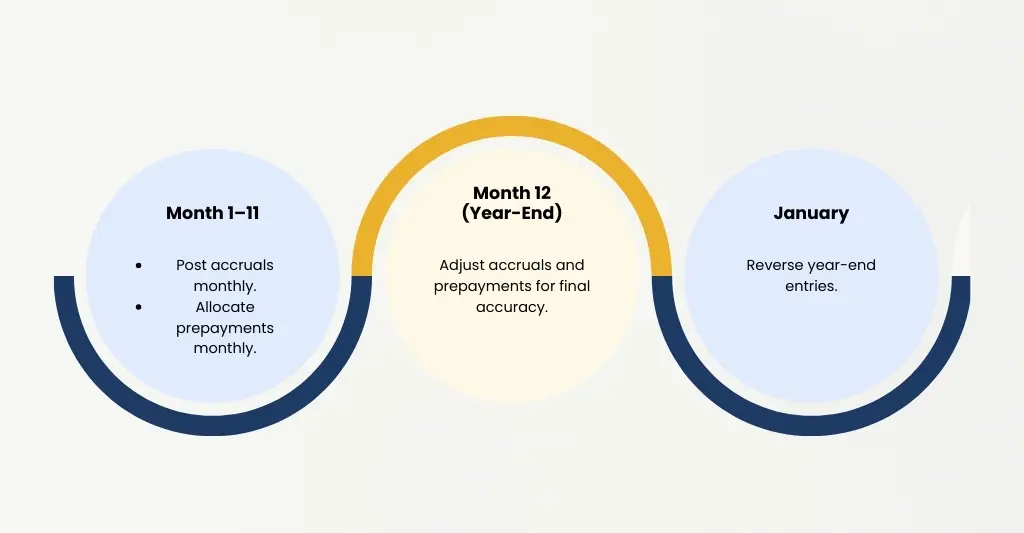

When Should I Post Accruals And Prepayments – Monthly Or Only At Year End?

Instead of only posting at year end, accruals and prepayments should ideally be uploaded every month. Your accounts will give you a current and accurate view of your financial performance throughout the course of the year if you record them regularly. For accruals, this means that even if the money hasn’t yet changed hands, expenses or income should be recognized in the month in which they are incurred or earned.

For prepayments, this means distributing the advance payment cost over the relevant months such that each month represents the appropriate amount of the cost. It can be difficult to track profitability, keep an eye on cash flow, or make wise business decisions if you just post your monthly management accounts at year’s end.

How Do I Record Accruals & Prepayments In Xero / QuickBooks / Sage?

Accounting software like Xero, QuickBooks, or Sage can be used to record accruals and prepayments, ensuring that your accounts accurately reflect the timing of income and expenses.

At the end of each month, accruals are normally manually entered into a journal in Xero. For unpaid expenses, you would debit the appropriate expense account and credit an accruals liability account; for accrued income, you would debit a receivable and credit the income account. To handle prepayments, either the prepayment feature or repeating journals are used to create a prepayment asset and then allocate it to the appropriate expense account during the period it covers.

Depending on the version, Sage manages accruals and prepayments through journals or the prepayments module. Debiting the expense and crediting accruals is how accruals are posted in a journal. To ensure that your profit and loss accurately reflect the monthly expenses, you first create a prepayment invoice or journal and then distribute it across the applicable time.

Accurately recording these entries helps with management reporting, maintains compliance with HMRC regulations, and guarantees the accuracy of your balance sheet and profit and loss statement.

What Are The Most Common Mistakes SMEs Make – And How To Fix Them?

Common Mistakes:

- Not recording accruals or prepayments: Enables profits to be overestimated or undervalued, which may result in inaccurate tax payments.

- Forgetting to reverse accruals or prepayments: Enables income or expenses to be repeated in the following accounting period.

- Incorrectly allocating prepayments: Instead of distributing the entire amount over the appropriate months, post it as an expense.

- Using the wrong ledger accounts: Transferring accruals or prepayments from balance sheet accounts to expense accounts.

- Relying only on year end adjustments: Leads to poor corporate decision-making and monthly reports that are inaccurate.

How to Fix Them:

- To find outstanding bills, advance payments, and recurring expenses, schedule a monthly review.

- To reduce human mistakes, use your accounting software (such as Xero, QuickBooks, or Sage) to automate accruals and prepayments.

- In the upcoming period, turn on automatic reversal journals for accruals and prepayments.

- To make sure the numbers on your balance sheet correspond to the underlying income or cost schedules, reconcile your accounts regularly.

- Before year end, work with your bookkeeper or accountant to analyze and promptly fix any misstatements, and ensure you’re properly handling income and expenses with our small business bookkeeping guide.

Practical Checklist – Year End Items Every SME Must Check

- Financial Adjustments:

- Accruals: Keep track of all unpaid bills and earnings that have not yet been received.

- Prepayments: Assign advance payments to the appropriate accounting periods (such as rent or insurance).

- Depreciation: Post the year’s depreciation and update fixed asset registers.

- Stock/Inventory: Take a year end inventory and make any necessary adjustments for damaged or obsolete items.

- Bad Debts: Examine the balances owed to customers and, if required, write off irrecoverable debts.

- Planning:

- Tax Provisions: Compute corporate tax and make any required accruals at the end of the year.

- Dividends: Examine the earnings that can be distributed and, if necessary, compile the necessary dividend documentation.

- Cash Flow Forecast: Create a cash flow plan for the future based on the revised year end numbers.

- Accountant Review: Give your accountant access to all of your data, reconciliations, and supporting documentation for

a last look.

- Compliance & Reporting:

- Bank Reconciliation: Verify the complete reconciliation of all loans, credit cards, and bank accounts.

- VAT Returns: Verify that VAT has been applied accurately and that all returns have been filed on time.

- PAYE & Payroll: Verify the accuracy of all payroll numbers and the completeness of year end filings.

- Director’s Loans: To prevent overdrawn director’s loan accounts and possible tax problems, check balances.

Practical Example – Small UK Café: Before & After Year End Adjustments

Scenario: Consider a small London café getting ready to submit its year end financial statements on March 31, 2025. The café aims to make sure that its profit appropriately reflects business activity for the year and employs the accrual method of accounting.

Before Year End Adjustments:

The café made £45,000 in net profit, according to its profit and loss statement.

But a few things still need to be changed:

- Unpaid supplier invoice: £1,200 for March delivery of coffee beans (not yet recorded).

- Electricity bill: The invoice was not received until April, and the estimated cost for February and March was £600.

- Insurance prepayment: Twelve months are covered by £1,200 paid in January, but only three months apply to this year (£900 prepaid, £300 expense).

- As a result, the café’s true profit is overstated because certain current-year expenses are missing and some future costs are included improperly.

After Year End Adjustments:

- Accruals added:

- £1,200 (coffee beans) + £600 (electricity) = £1,800 additional expenses.

- Prepayment recorded:

- £900 moved to the balance sheet as a prepaid expense.

- Adjusted profit calculation:

- £45,000 – £1,800 (accruals) + £900 (prepayment) = £44,10

Result & Impact:

- The café’s actual performance is now more accurately depicted by its profit of £44,100.

- The adjustment ensures:

- The expenses correspond to the appropriate accounting period.

- Liabilities (accruals) and assets (prepayments) are accurately represented on the balance sheet.

- The correct profit is used to calculate corporation tax, preventing overpayment.

Tip: Use E2E Restaurant Accounting services to specifically ideate and curate a plan that works for your business.

When Should I Contact An Accountant – And What Should I Bring?

- Before Your Year End: Talk to your accountant a few weeks before the end of your financial year. This allows time to analyse tax-saving options, plan revisions, and make sure all documents are current.

- At YearEnd: Get in touch with your accountant as soon as your year ends if you do your own bookkeeping. They can prepare your final accounts after reviewing accruals, prepayments, and other changes.

- During Major Business Changes: Please get in touch if you plan to hire employees, change the form of your company, buy big assets, or request financing, as these actions may affect your tax status.

- If You are Unsure About Compliance: If you have any questions concerning VAT, PAYE, or HMRC rules, your accountant can assist you in avoiding expensive errors.

Conclusion

Prepayments and accruals may appear to be minor accounting issues, but they are essential to providing an accurate and balanced picture of your company’s financial situation. Accurately recording income and expenses helps to prevent profit distortions and unpleasant tax shocks by ensuring that they correspond to the appropriate periods. At year end, when accurate numbers are needed for tax returns and financial statements, this is particularly crucial for UK SMEs.

The process can be made smooth by keeping up with regular month-end evaluations, making effective use of accounting software, and speaking with your accountant as soon as possible. Ultimately, maintaining sound accruals and prepayment accounting practices helps you make better financial decisions throughout the year and improves your understanding of your company’s performance. They also help you stay in compliance with HMRC.

How Our Year End Accounting Services Help With Accruals and Prepayments

To provide you with total trust in your financial statements and tax filings, our year end accounting service makes sure that every detail, including accruals and prepayments, is handled precisely. We carefully go over your books to find any outstanding bills, unbilled income, and prepaid expenses. We ensure that your assets, obligations, and profits are all reported within the appropriate time frame by carefully managing these.

To save you time and minimise human mistakes, we also effectively post and automate these modifications using your accounting software (such as Xero, QuickBooks, or Sage). To ensure that your accounts start the following year accurately and clean, our team makes sure that all journals are reversed in the subsequent year.

People Also Ask:

What is the difference between accruals and prepayments?

The timing of the recognition of income or expenses is the primary distinction between accruals and prepayments.

Money that has not yet been paid or received but relates to the current accounting period is known as an accrual. For instance, you would record an accrual to reflect that expense in the appropriate year if you received services in March but paid the invoice in April. Your accounts will accurately show income or expenses that have been incurred but not yet paid for, thanks to accruals.

Paying for goods or services in advance for a future accounting period, like insurance or rent, is known as a prepayment. A portion is recorded as an asset until it is due, and only the portion that pertains to the current year is considered an expense.

Are accruals and prepayments mandatory for small businesses?

Yes, accruals and prepayments need to be documented if your company employs accrual accounting, which is typical for limited corporations. They are usually not necessary if you employ cash accounting, but keeping track of them can still aid in precise financial insight and year end planning.

How do I reverse accruals in the next accounting period?

When the next period begins, start a reverse journal:

– Debit the account for accruing liabilities.

– Make a credit to the initial expense account.

Record it as usual when the payment is really made. The majority of accounting software allows you to automatically reverse this.

What documentation do I need to support accruals for HMRC?

Keep records that show the expense or income relates to the period, such as:

– Supplier invoices or statements

-Contracts or agreements

-Bank statements showing unpaid amounts

-Internal calculations or schedules

-Correspondence confirming outstanding amounts

Do sole traders need to post accruals?

If a sole proprietor uses cash basis accounting, they typically do not need to post accruals because income and costs are recorded at the time money is transferred. However, posting accruals guarantees that their accounts appropriately reflect the time period in which income is produced and expenses are incurred, providing a genuine picture of profit and financial situation, provided they use accrual accounting.

Can I post prepayments after year end?

Prepayments must be documented by year end at the latest. Posting them later may cause the profits from the previous year to be incorrectly reported, and the accounts may need to be adjusted.

What if I find a missing accrual after filing?

Change it for your subsequent accounts. Small mistakes may typically be fixed in the subsequent return, so let HMRC know if it has an impact on taxes.

Example: You discover that a £300 phone charge from December of the previous year was not recorded as an accrual.

That £300 is now included as an expense when creating this year’s accounts.

You just notify HMRC and make the necessary adjustments in your subsequent tax return if this changes your tax.