In the UK, operating a small or medium-sized firm necessitates closely monitoring performance and profitability, yet typical profit metrics don’t necessarily provide the whole picture. Adjusted EBITDA is useful in this situation.

We will explain what Adjusted EBITDA is, why it’s important to know your company’s actual financial health, and how UK SMEs can use it to make better business decisions. This guide will help you understand the jargon and concentrate on what truly counts, whether you’re getting ready for an investment, a sale, or just want better insights into your performance.

What Is Adjusted EBITDA?

Earnings Before Interest, Taxes, Depreciation, and Amortization (adjusted for one-time or non-operational expenses) is known as Adjusted EBITDA.

Simply said, it displays a business’s core profitability by eliminating expenses that don’t accurately represent day-to-day operations. For small and medium-sized enterprises (SMEs) in the UK, this means that you can see how your company actually operates before factors like financing, tax regulations, or extraordinary costs come into play.

For example, adjustments might include removing:

- One-time legal or restructuring costs

- Gains or losses from asset sales

- Non-cash expenses like share-based payments

Adjusted EBITDA provides a more transparent and equitable view of your continuous business performance by concentrating on these “normalised” results, making it perfect for lenders, investors, and owners evaluating growth prospects. Because it is a non-GAAP metric, the exact adjustments differ between businesses – which is why clear documentation is crucial when presenting results to lenders, buyers, or investors.

How Is Adjusted EBITDA Different From EBITDA?

Adjusted EBITDA goes beyond EBITDA, which assesses a company’s operating performance by excluding interest, taxes, depreciation, and amortization. It eliminates extraneous, irregular, or non-recurring factors that affect the real image of a company’s daily profitability.

In other words:

- Operating profit before interest, taxes, amortization, and depreciation is known as EBITDA.

- To reflect typical business performance, adjusted EBITDA is equal to EBITDA plus or minus one-off or unexpected items.

For instance, a government grant or a one-time restructuring expense for your business would be subtracted from EBITDA.

Because of this, UK SMEs looking to demonstrate consistent, comparable results, whether for internal planning, obtaining financing, or attracting investors, will find Adjusted EBITDA particularly helpful.

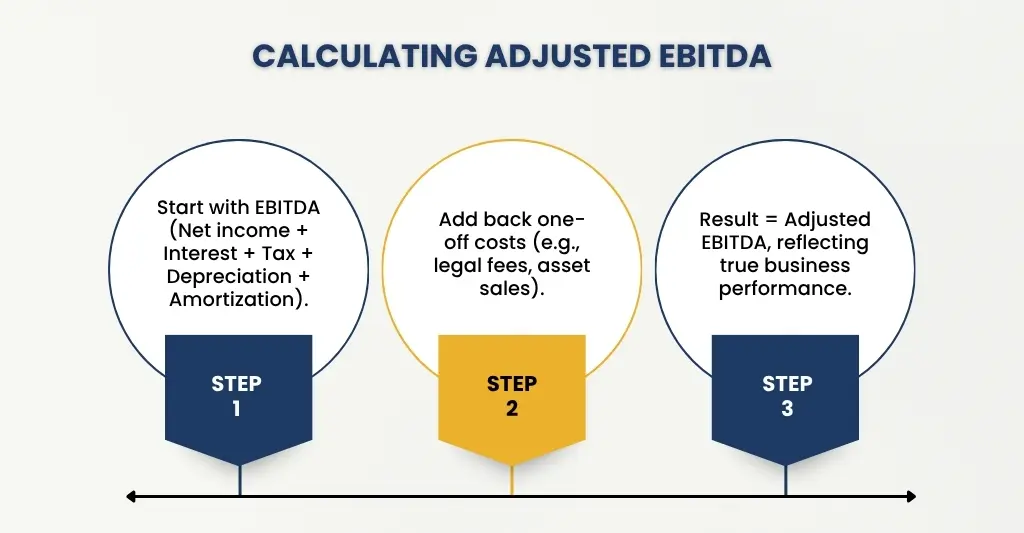

How Is Adjusted EBITDA Calculated?

Add back items that don’t accurately reflect operations after starting with normal EBITDA. To obtain a normalised earnings figure, businesses eliminate one-time costs, non-cash charges, and unusual items.

Adjusted EBITDA Formula

Adjusted EBITDA = Net Income + Interest + Taxes + Depreciation + Amortization + Adjustments

The methodical approach used to calculate adjusted EBITDA expands upon the basic formula. Start with the financial statements’ net income and proceed through each adjustment.

The typical EBITDA computation is where you start. Next, determine what doesn’t belong in regular business and add it back.

Common adjustment categories:

- One-time legal expenses

- Asset write-downs

- Unrealised foreign exchange losses

- Non-cash stock compensation

- Goodwill impairments

Each change should be carefully recorded, along with thorough justifications for each item eliminated from the original computation.

Step-by-Step Calculation Process

Data collection from the cash flow statement and other financial documents is the first step in the calculation procedure. To maintain accuracy and consistency, businesses typically adhere to an organised strategy.

- Step 1: Determine standard EBITDA. Add interest, taxes, depreciation, and amortization to net income.

- Step 2: Examine financial statements for any anomalous items that appeared throughout the time frame.

- Step 3: Recount valid one-time costs and non-cash charges

In a genuine example, a business with a net income of $25,000 adds back goodwill impairments, litigation expenses, and foreign exchange losses to arrive at an adjusted EBITDA of $53,650.

Businesses should provide strong documentation for every modification. Investors may see what was eliminated and why, thanks to this transparency.

What Is An Adjusted EBITDA Example For An SME?

Let’s look at a simple example to see how Adjusted EBITDA works in practice for a UK SME.

Example:A small manufacturing company reports the following for the year:

- Net profit: £150,000

- Interest expense: £20,000

- Tax: £30,000

- Depreciation: £25,000

- Amortisation: £10,000

EBITDA = £150,000 + £20,000 + £30,000 + £25,000 + £10,000 = £235,000

Now, suppose the company had:

- One-off legal costs of £15,000 (non-recurring)

- A gain from selling old equipment of £5,000 (non-operational)

To find Adjusted EBITDA, you remove the impact of these one-off items:

Adjusted EBITDA = £235,000 + £15,000 − £5,000 = £245,000

This provides owners, investors, and lenders with a clearer picture of the company’s sustainable profitability by displaying its underlying performance without the noise of extraordinary or unusual events.

Mini Illustrative Adjusted EBITDA Reconciliation Table

Here’s a simple reconciliation table- showing how Adjusted EBITDA is calculated from net profit, using the SME example above:

| Item | Amount (£) | Notes |

| Net Profit | 150,000 | Reported after all expenses |

| Add: Interest Expense | 20,000 | Financing cost excluded from EBITDA |

| Add: Tax Expense | 30,000 | Excluded to focus on pre-tax earnings |

| Add: Depreciation | 25,000 | Non-cash expense |

| Add: Amortisation | 10,000 | Non-cash expense |

| EBITDA | 235,000 | Core operating profit before adjustments |

| Add: One-off Legal Costs | 15,000 | Non-recurring expense |

| Less: Gain on Sale of Equipment | (5,000) | Non-operational income |

| Adjusted EBITDA | 245,000 | Reflects ongoing, sustainable performance |

This table shows how, by eliminating exceptional or non-core items, Adjusted EBITDA offers a clearer picture of the company’s underlying earnings.

Looking to optimise your financial strategy? Find out how much accounting services could cost with our free 60-second calculator – get your custom estimate now.

How Does Adjusted EBITDA Relate To Cash Flow?

Although cash flow and adjusted EBITDA are closely related, they are not the same. A corporation’s operating profitability is indicated by adjusted EBITDA, whereas cash flow depicts the actual flow of funds into and out of the organisation.

Because EBITDA (and its adjusted version) eliminates non-cash expenses like amortization and depreciation, it frequently seems larger than real cash flow. Nevertheless, it ignores significant cash transfers like:

- Changes in working capital (like stock, debtors, and creditors)

- Capital expenditures (spending on new equipment or assets)

- Loan repayments or interest payments.

In simple terms:

- The amount of profit your company makes from regular operations is displayed by adjusted EBITDA.

- Cash flow displays the actual amount of money that your company has on hand.

Understanding both is crucial for SMEs in the UK. While cash flow guarantees that you can pay daily bills and maintain financial stability, adjusted EBITDA helps you evaluate performance and draw in investors.

What Are The Benefits Of Adjusted EBITDA For SMEs?

- Clearer View of Core Profitability: Adjusted EBITDA provides a more realistic view of your company’s performance under typical circumstances by excluding one-time or unexpected factors.

- Better Comparability: It enables SMEs to compare outcomes over time or with those of other companies without being distorted by irregular expenses or discrepancies in accounting.

- Improved Valuation and Investor Confidence: When evaluating a company’s worth or creditworthiness, lenders and investors frequently favor Adjusted EBITDA since it shows potential for sustained profits.

- Useful for Growth and Planning: Adjusted EBITDA assists business owners in making well-informed decisions regarding pricing, scaling, and operational enhancements by emphasizing recurring performance.

- Enhanced Credibility in Negotiations: Using Adjusted EBITDA strengthens your position by demonstrating professionalism and transparency when presenting financials to banks, purchasers, or investors.

Common Mistakes When Preparing Adjusted EBITDA (And Quick Fixes)

Adjusted EBITDA is a valuable indicator, but only if it is computed accurately. A lot of finance teams make mistakes that affect outcomes and damage their reputation with lenders or investors. Some of the most frequent mistakes are shown below, along with quick fixes.

- Including Non-Recurring Items Incorrectly:

The mistake: Teams sometimes include recurring expenditures (such as regular legal bills or small consultation expenses) under the category of “one-time” modifications.

Quick fix: Each change should have a clear explanation, and only genuinely non-recurring expenses, such as a one-time purchase cost or restructuring fee, should be eliminated.

- Ignoring Non-Cash Items:

The mistake: EBITDA tends to be biased when non-cash items (such as stock-based remuneration or unrealised foreign exchange gains/losses) are not taken into account.

Quick fix: Look for any non-cash charges on the income statement and ensure that they are consistently included or adjusted out in accordance with your reporting rules.

- Double-Counting Adjustments:

The mistake: Adjusting for something that has already been shown elsewhere (e.g., eliminating depreciation twice).

Quick fix: Verify that each adjustment isn’t already included in the EBITDA line by tracing it back to the financial statements.

- Mixing GAAP and Non-GAAP Treatments:

The mistake: Combining non-GAAP adjustments with GAAP operating performance without a clear reconciliation.

Quick fix: Start with GAAP net income, display each adjustment in detail, and keep an open reconciliation plan.

- Inconsistent Period Comparisons:

The mistake: Trends are unreliable because different adjustment logic is applied during different reporting periods.

Quick fix: To guarantee consistency from quarter to quarter and year to year, standardise adjustment criteria and keep a checklist.

- Not Documenting Rationale:

The mistake: Displaying revised numbers without explaining each modification.

Quick fix: To build trust with auditors and stakeholders, keep a brief note or schedule outlining each adjustment’s nature (recurring or non-recurring) and financial impact.

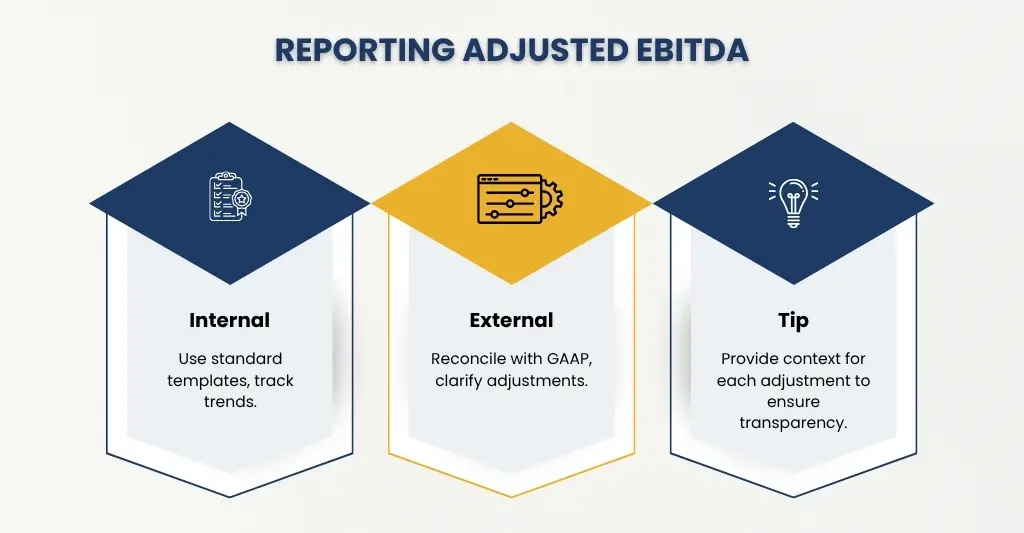

How To Report Adjusted EBITDA – Internal & External Best Practice

The actual value is in how you portray and explain Adjusted EBITDA; calculating it is only half the battle. Regardless of whether you are reporting to lenders, investors, or management, reliable and transparent reporting procedures build trust.

- Maintain a Standardised Calculation Template: Make use of the same format for all entities and reporting periods. This helps prevent manual errors and guarantees comparability.

Best practice: Make a master Adjusted EBITDA worksheet with thorough line descriptions and sources that clearly distinguish GAAP items from non-GAAP adjustments.

- Reconcile Back to GAAP Financials: Adjusted EBITDA should always be linked to the official GAAP income statement.

Best practice: Include a reconciliation table showing:

Net income

Plus: Interest, Taxes, Depreciation, and Amortization

Plus/Minus: Approved adjustments

This transparency makes it easier for external reviewers to validate the numbers.

- Clearly Define What “Adjusted” Means: Adjusted EBITDA is interpreted differently by different businesses, particularly when it comes to non-cash or non-recurring factors.

Best practice: Clearly define which things are eligible for modification and why, in investor decks, footnotes, or management reports.

- Separate Internal vs. External Views: While external users (lenders, investors) seek consistency and comparability, internal management may utilise Adjusted EBITDA for operational choices (bonus plans, performance indicators, etc.).

Best practice: Internal: Pay attention to changes that provide a better understanding of the underlying performance. As for external – adhere to modifications approved by auditors, regulators, and industry standards.

- Provide Context and Narrative: The whole narrative is not conveyed by a raw figure.

Optimal method: To help stakeholders understand why Adjusted EBITDA changed, include commentary on major drivers, such as cost initiatives, margin increases, or temporary obstacles.

Quick Action Plan — 5 Steps SMEs Can Do Today

Enhancing your Adjusted EBITDA approach doesn’t require a complete financial makeover. With a few methodical measures, small and mid-sized enterprises can immediately make significant changes.

- Review Your Current EBITDA Calculation: To begin, determine how your EBITDA is currently determined.

Take Action: Verify that all of the inputs in your calculation are derived directly from verified financial accounts and compare them to conventional definitions (Net Income + Interest + Taxes + Depreciation + Amortization).

- Create a List of Acceptable Adjustments: Uncertain adjustment policies are the root cause of many inconsistencies.

Take action: Determine whether expenses (such as one-time legal fees and restructuring expenditures) are considered “non-recurring” or “non-operational” and record them in a brief internal policy note.

- Standardise the Reporting Template: Credibility is increased by consistency.

Take action: Utilise a single Adjusted EBITDA template for every department and every month. Provide a concise reconciliation section that connects to GAAP numbers.

- Validate with a Second Reviewer: Manual adjustments are prone to human error.

Take action: Make sure the adjustments are legitimate, consistent, and adequately supported by having a controller or financial manager examine them each month.

- Communicate Results with Context: Explain instead of merely reporting the number.

Action: Include a brief commentary on significant changes, such as cost savings, expansion plans, or one-time effects, when communicating Adjusted EBITDA both internally and internationally.

Conclusion & Next Steps

To ensure financial accuracy, transparency, and strategic growth, selecting the right accounting partner is crucial. For companies seeking professional guidance on year end financial management and Adjusted EBITDA calculations, E2E Accounting UK stands out as a reliable partner.

With a team of experienced accountants, E2E provides:

- Accurate Adjusted EBITDA analysis to show the real performance of your company.

- Complete year end assistance, including reporting, compliance audits, and reconciliations.

- Customised financial insights that promote improved investor confidence and decision-making.

- Complete service, including strategic advice and bookkeeping, guarantees a successful financial close each year.

People Also Ask:

What is adjusted EBITDA, and why use it?

After adding back interest, taxes, depreciation, amortisation, and one-time or non-cash charges, adjusted EBITDA shows a company’s core earnings. It’s used to:

– Show true operational performance

– Help investors compare businesses fairly

– Support valuations and funding decisions

– In short, it reveals your business’s real profitability and financial strength.

Is EBITDA the same as operating income?

No, EBITDA is not the same as operating income.

– Revenue less all operating costs, such as depreciation and amortization, equals operational income (also known as operating profit).

– Depreciation and amortization are non-cash charges that EBITDA adds back to reflect results from core businesses before accounting for financing and tax considerations.

To put it in simple terms, operational income is a lower-level measure of profitability than EBITDA, which provides a more accurate picture of cash-generating performance.

Can I add the owner’s salary to adjusted EBITDA?

Only if the price isn’t at market value. When the owner’s salary is abnormally large or low, add it back. Don’t include it in the adjustment if it’s a typical company expense.

Will Adjusted EBITDA affect my tax return?

No. Adjusted EBITDA is not a tax measure; rather, it is a financial metric. It has no bearing on your taxable income or tax return, but it is used to analyse performance or appraisals.

Is adjusted EBITDA accepted by banks?

Sure. Adjusted EBITDA is used by most banks and lenders to evaluate a company’s actual earning potential and capacity for repayment. It provides a clearer picture of their financial health by assisting them in understanding performance without one-time or non-cash items.

How often should SMEs calculate adjusted EBITDA?

At least once a year, usually at year-end reporting, SMEs should compute Adjusted EBITDA. Nonetheless, a lot of companies evaluate it every three months to monitor performance, get ready for funding, or better plan for expansion.

Why should I choose E2E Accounting UK for adjusted EBITDA and year end support?

E2E Accounting UK provides expert financial insight, seamless year end reporting, and precise EBITDA analysis. We assist you in seeing your actual performance, maintaining compliance, and confidently wrapping up the year.