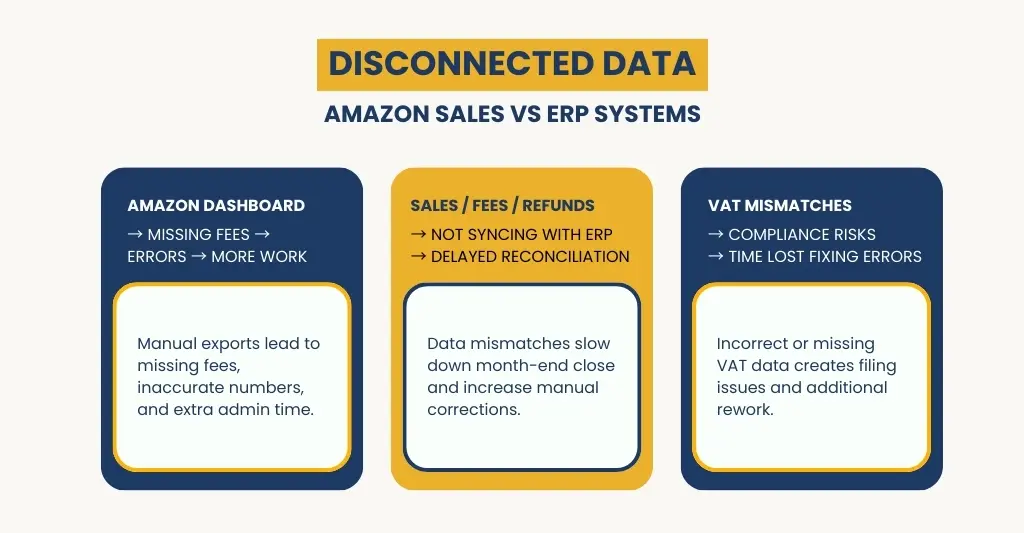

Selling on Amazon is easy, but managing your accounts can be challenging. Your sales happen on one platform, your fees and payouts appear elsewhere, and your ERP or accounting software generally doesn’t match the numbers.

The result?

Disconnected information, missing transactions, inaccurate revenue reports, mismatches in inventory, and VAT headaches. Additionally, your financial team is forced to manually solve the puzzle of the reality behind your figures, download statements, and reconcile spreadsheets when month-end rolls around.

In this blog, we will discuss why this gap develops and how it can be avoided so that your eCommerce sales and financial reporting stay accurate and in sync.

The Challenges of Managing Amazon Sales Data Separately

Managing Amazon sales data outside of your ERP or accounting system can easily get messy. Sales, refunds, fees, taxes, shipping credits, promotions, and rewards are all part of every Amazon order. Separating this data from your bank records leads to some issues:

- Numbers mismatch: Your Amazon dashboard may show one figure, while your bank shows another. Fees, deduction amounts, and scheduling variations make reconciliation challenging.

- Manual downloads take too much time: Pulling settlement reports, statements, and order-level data every week becomes a repetitive and error-prone operation.

- Missed fees and expenses: Amazon deducts numerous fees, referral fees, FBA charges, storage fees, and returns expenses. If tracked manually, these are simple to overlook, resulting in inaccurate profit estimates.

- Errors increase during busy seasons: Errors increase when sales volume is large, particularly on occasions like Prime Day or holidays, if data isn’t routinely synchronised.

- Poor cash flow visibility: Amazon doesn’t pay quickly; payments go on cycles. If sales data isn’t integrated into your ERP, forecasting becomes unreliable.

- VAT and tax issues: VAT errors and compliance concerns may result from incorrect fee classification or missing transactions.

Overall, maintaining Amazon data separately slows down your month-end process, increases workload, and reduces accuracy.

The Challenges of Managing Financials in an ERP System Separately

When your ERP system isn’t connected to your Amazon or eCommerce sales platforms, your financial data becomes incomplete and tougher to handle. Despite their strength, ERPs depend on timely and correct data, and handling them independently presents several difficulties:

- Incomplete or delayed financial information: Your ERP only shows what you manually enter without the ERP + accounting integration. Without real-time sales, fees, and refunds from Amazon, your financials are constantly a step behind.

- Heavy manual data entry: Orders, rewards, and modifications are ultimately manually entered by teams. This is slow, repetitive, and raises the danger of human mistakes.

- Difficulty matching sales to deposits: Due to costs and time differences, Amazon reimbursements rarely exactly match sales. Without automated mapping, reconciliation becomes a daily struggle.

- No visibility into product-level profitability: ERPs alone can’t demonstrate which SKUs are profitable unless precise marketplace data is linked. Decision-making gaps result from this.

- VAT and tax complexities: If fees, returns, or adjustments are not entered accurately, VAT computations can be inaccurate – causing compliance issues.

- Slower month-end closing: Finance teams spend days pursuing missing reports, resolving mismatches, and reconciling manually, delaying the closing cycle.

Managing finances independently in your ERP may look structured, but without integration, the data is inadequate. This involves unnecessary work, decreases accuracy, and makes it difficult to gain a true view of your eCommerce performance.

Is eCommerce Accounting Software Sufficient Without an ERP System?

If you are a small business owner, you can consider using basic accounting software. Or else, if you are a large or established business, you must use ERP without any second thought. Accounting software can handle invoices, reconciliations, and basic bookkeeping, but it is unable to handle the operational complexity of eCommerce.

Where Accounting Software Falls Short:

- No real-time inventory tracking, unless you integrate with a third-party inventory management system

- No multi-channel order syncing (Amazon, Shopify, eBay, Etsy)

- Some accounting software does not automate the handling of fees, refunds, or chargebacks

- No procurement, stock planning, or warehouse controls.

- Manual reconciliations increase as order volume grows.

When You Need an ERP:

- 1,000+ orders per month

- Multiple sales channels

- Large SKU range

- Inventory issues (stock-outs, overstock)

- Too much manual work in spreadsheets

Accounting is just one module within ERP.

Curious about the cost of streamlining your accounting and system integrations? Find out your custom price in 60 seconds – try our free calculator now!

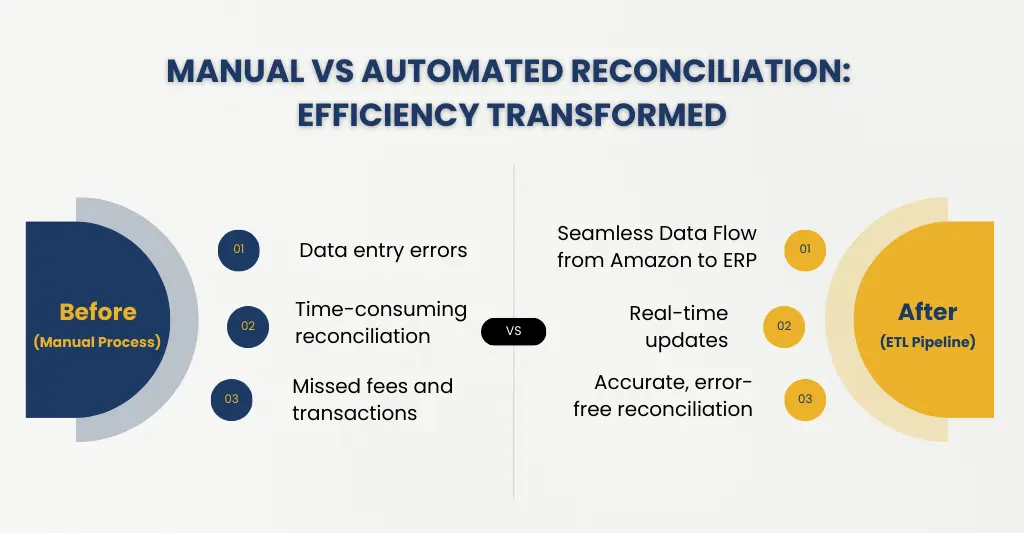

Bridging the Gap: Building an ETL Pipeline for Seamless Amazon to ERP Integration

You need a procedure that moves data precisely and automatically in order to seamlessly connect your Amazon sales data with your ERP system. This is where an ETL pipeline, which stands for Extract, Transform, Load, becomes vital. It acts like a bridge that keeps your sales and financial data in sync without manual work.

- Extract: Pulling data from Amazon

The first step is collecting the right data from Amazon, such as:- Orders

- Fees

- Refunds

- Settlement reports

- Inventory changes

This removes the need for manual downloads.

- Transform: Cleaning and organising the data

The raw data from Amazon is complicated. In order for your ERP to comprehend it, the ETL procedure cleans it, eliminates duplicates, and formats information.

Example: Grouping sales, matching fees, mapping SKUs, modifying taxes, and aligning payout timings. - Load: Sending the data to your ERP

Once the data is cleansed and formatted, it is automatically uploaded to your ERP system – daily, hourly, or in real time. This guarantees that your financial reports and multiple business operations are current at all times.

Why You Should Build an ETL Pipeline Between Amazon and Your ERP

Building an ETL pipeline between Amazon and your ERP isn’t just a technological update – it’s a smarter, cleaner method to operate your eCommerce finances & your business as a whole. Here’s why it matters:

- Eliminates manual work: No more downloading reports, copying data, or matching transactions manually. Everything runs smoothly.

- Reduces errors and mismatches: Manual entries often lead to missing fees, inaccurate sales statistics, or duplicated transactions. Data accuracy and cleanliness are guaranteed by an ETL process.

- Real-time financial visibility: Without having to wait until the end of the month, you may view updated sales, fees, refunds, and payouts within your ERP.

- Faster and easier reconciliations: Your finance team won’t have to spend hours resolving discrepancies because fees and payouts are already accurately recorded.

- Better decision-making: Accurate, up-to-date financial data helps you assess product profitability, track performance, and forecast cash flow effectively.

- Stronger VAT and tax compliance: A proper ETL pipeline ensures all transactions are classified appropriately, decreasing the chance of VAT problems and HMRC concerns.

- Smooth month-end closing: With clean data streaming into your ERP every day, closing your books becomes quicker and significantly less stressful.

- Scalable for growth: As your Amazon sales expand, the ETL pipeline can handle bigger volumes automatically, no more manual work needed.

To put it briefly, an ETL pipeline gives you dependable financial insights whenever you need them by making your eCommerce business run more efficiently, quickly, and accurately.

How to Ensure Your Amazon-ERP Integration Is Secure and Compliant?

For SAP Users:

Strong governance and role-based access controls are already included in SAP settings; however, your Amazon data pipeline must also meet these requirements. Important procedures consist of:

- Use Secure APIs and OAuth Tokens: When connecting Amazon Seller Central to SAP, always use encrypted APIs and time-bound tokens rather than keeping credentials in plain text.

- Enable Field-Level Controls in SAP: Restrict who can read or alter critical financial data coming from Amazon, including revenue, inventory valuation, and fee reports.

- Activate SAP GRC (Governance, Risk & Compliance): Create automated warnings for strange transaction patterns, failed syncs, and inventory mismatches.

- Maintain an Audit Trail: Ensure that every Amazon-to-SAP update – logs the user, timestamp, and data change- for complete transparency.

- Comply with HMRC & VAT Requirements: Ensure that SAP accurately collects Amazon fees, VAT on sales, refunds, and marketplace-facilitated tax to support Making Tax Digital (MTD) compliance.

For Other ERP Users (NetSuite, Zoho, Tally, Odoo, QuickBooks, Xero, Sage, etc.):

Non-SAP ERPs may not have the same built-in compliance capabilities, necessitating extra effort to protect the integration layer.

- API Keys & Encryption: Rotate API keys regularly and verify that data transfers between Amazon and your ERP employ SSL/TLS encryption.

- Role-Based Permissions: To avoid errors and fraud, limit who can override imported data, update inventory, or amend sales numbers.

- Error Handling & Validation Rules: Create rules to detect mismatched order totals, duplicate transactions, missing VAT data, or inaccurate currency formatting.

- Automated Backups & Version Control: Maintain daily backups of both ERP data and ETL scripts to guard against corruption or sync failures.

- Marketplace Compliance: Ensure that your ERP accurately captures all Amazon settlement components, fees, chargebacks, reimbursements, VAT, and marketplace-collected taxes, ensuring accurate filings.

- GDPR & Data Privacy Checks: If you store client data from Amazon, make sure you meet GDPR guidelines, such as limited storage, access logs, and clear data retention policies.

Real Pain Points We Encountered: How We Can Help eCommerce Businesses Streamline Financial Reporting

We have worked with eCommerce firms on platforms like Amazon, Shopify, eBay, Etsy, and WooCommerce. Despite adopting strong ERPs and sales platforms, most companies faced comparable financial and reporting issues. Here are the most prevalent problems we’ve encountered – and how our solution addresses them.

- HR & Payroll Challenges:

Painpoints: It might be difficult to keep track of contractor payments, commissions, and employee salaries across several sales channels.

How We Help: ERP integration ensures precise tax deductions, timely payments, and efficient HR reporting by automating payroll inputs from sales and commissions. - Procurement & Supplier Management:

Pain Point: Purchasing products from several markets and warehouses may result in over-ordering, delayed shipping, or inconsistent stock levels.

How We Help: The ETL pipeline helps ERP procurement modules generate buy orders, handle supplier payments, and maintain ideal stock levels by providing correct sales and stock data. - Inventory & Operations Management:

Pain Point: Accounting, fulfillment, sales forecasting, and profitability tracking are all impacted by delays or mistakes in inventory updates.

How We Help: Real-time inventory updates from automated syncs between Amazon/Shopify and ERP enhance fulfillment accuracy, COGS reporting, and operational decision-making. - Reporting & Business Insights Across Departments:

Painpoint: Dashboards only display incomplete or delayed information in the absence of a centralised ERP, making it challenging to make strategic decisions.

How we help: ERP modules, including accounting, procurement, inventory, and HR, rely on clean data from all sources to generate comprehensive, cross-departmental reporting that facilitates quicker, better-informed business decisions.

Benefits of Partnering with E2E Accounting UK

The following are the benefits you will gain by partnering with E2E.

- Eliminates Manual Data Transfers Across Systems: No more entering data by hand and exporting reports from Amazon. Your ERP’s information flow is automated via the ETL pipeline, which saves time in operations, finance, inventory, and procurement.

- Ensures Accuracy Across Departments: Manual entry errors can have an impact on operations, inventories, and stock planning in addition to accounting. Clean, consistent data across all of your ERP modules is ensured by an ETL pipeline- built by the E2E IT Department.

- Accounting Made Seamless: Our Amazon accountants possess the expertise to work on ERP and various accounting software. Therefore, they can seamlessly manage Amazon sales, fees, and refunds- lowering reconciliation errors and guaranteeing VAT and tax compliance.

- Provides Real-Time Business Insights: Your team can see what’s selling, which SKUs are successful, and how money is moving in real time. Because of this, you may decide on pricing, stock replenishment, and marketing campaigns more quickly without having to wait for month-end reports or manually correct inconsistencies.

- Streamlines Reporting and Month-End Closures: E2E guarantees that data enters your ERP and accounting system straight from Amazon in a clean, organised manner. This eliminates the need for your finance team to reconcile spreadsheets, pursue missing reports. Because all of the areas, such as stock maintenance, procurement, accounting, and operations, are already in sync- your financial closing cycle is shortened, and reporting is far more dependable with E2E foreseeing the data flow.

- Supports Strategic Planning Across the Business: By creating integrations that maintain all departments operating from the same source of truth, E2E empowers leadership to confidently plan using real-time information rather than antiquated spreadsheets or manual assumptions.

- Enhances Compliance and Audit Readiness: Every Amazon transaction and adjustment is precisely recorded, classified, and saved in your ERP via a structured ETL pipeline. Partnering with the E2E team makes internal or external audits easier, and HMRC compliance non-negotiable.

- Scales Effortlessly With Business Growth: The ETL pipeline lowers operational bottlenecks, automatically manages high transaction volumes, and updates your ERP in real time. This lets your company expand without increasing the administrative burden or running the risk of unstable finances.

Conclusion

Selling on Amazon can be simple, but maintaining accurate, well-organized, and system-aligned financial data is hard. Confusion, inconsistent statistics, and a great deal of additional work for your staff result when Amazon sales, fees, and payouts don’t flow seamlessly into your ERP or accounting software. This explains why a lot of companies have trouble at the end of the month, encounter VAT issues, or lose track of their stock and profitability.

These issues are eliminated by developing an appropriate Amazon-to-ERP interface via an ETL pipeline and working with a specialised team like E2E. Your figures remain correct, your data travels automatically, and each department has access to trustworthy data. This results in quicker reporting, simpler audits, improved decision-making, and more time for your team to concentrate on expansion rather than spreadsheet maintenance.

People Also Ask:

What is an ETL pipeline, and how does it help integrate Amazon sales data with ERP systems like SAP, NetSuite, and Microsoft Dynamics?

An ETL pipeline (Extract, Transform, Load) is a process that collects raw sales data from Amazon, cleans and organises it, and then sends it to your ERP system, such as SAP, NetSuite, or Microsoft Dynamics. It guarantees that all orders, fees, refunds, and taxes are properly captured and assigned to the appropriate accounts. This eliminates the need for manual data entry, improves reconciliation, and provides you with real-time, verifiable financial information within your ERP.

Why is it important to reconcile Amazon fees and VAT with my financial system?

Reconciling Amazon fees and VAT with your financial system is critical to ensuring your accounting is correct and compliant. Amazon charges a variety of fees that have an impact on profits, and VAT varies by product, marketplace, and fulfillment method. If these are not properly reconciled, your profitability, VAT returns, and month-end reports may become inaccurate. A clean reconciliation allows you to avoid errors, stay compliant with HMRC, and determine your true product profitability.

What are the benefits of building an ETL pipeline from SAP to Amazon S3 for my eCommerce business?

An ETL pipeline from SAP to Amazon S3 enables the secure export and storage of massive datasets for faster reporting and analytics. It minimises SAP load, centralises data, and simplifies the combination of sales, inventory, and charge data for deeper insights, providing your e-commerce firm with increased visibility and scalability.

How long does it take to integrate Amazon sales data with an ERP system?

Integrating Amazon sales data with an ERP usually takes 2-6 weeks, depending on your ERP configuration, data complexity, and the level of customisation required for the mapping.

Can E2E Accounting UK help me automate the integration of Amazon sales data into SAP or other ERPs?

Yes, E2E Accounting UK has a team of Amazon accountants who can build up end-to-end automation to import Amazon sales, fees, and VAT data into SAP or any other ERP you use. We handle the data extraction, mapping, reconciliation, and posting logic so that your financials remain correct with minimal manual effort.

How does integrating Amazon sales data with ERP systems improve financial reporting accuracy?

Integrating Amazon sales data with your ERP increases financial reporting accuracy by ensuring that all orders, fees, refunds, and VAT are captured and mapped accurately.

Why build an ERP when I already use accounting software for my Amazon business?

Accounting software is ideal for small Amazon sellers because it manages invoicing, reconciliations, and basic bookkeeping. However, an ERP is necessary to handle inventory, operations, fees, payouts, and multi-channel data in one location as your order volume, SKUs, and sales channels increase.

Can I integrate Amazon with ERP and still use accounting software?

Yes, you can surely integrate Amazon with ERP as well as use accounting software. You get accurate books, real-time inventory, manage HR and payroll, procurement management, automated reconciliations, and more seamless month-end procedures, all without having to modify your accounting system.