An essential component of operating a profitable dentistry office is financial management. The term “dental accounts” describes the specific financial administration of a dental office, including payroll, tax compliance, budgeting, and bookkeeping. Because dental businesses are special, managing finances effectively guarantees development, sustainability, and adherence to constantly changing laws.

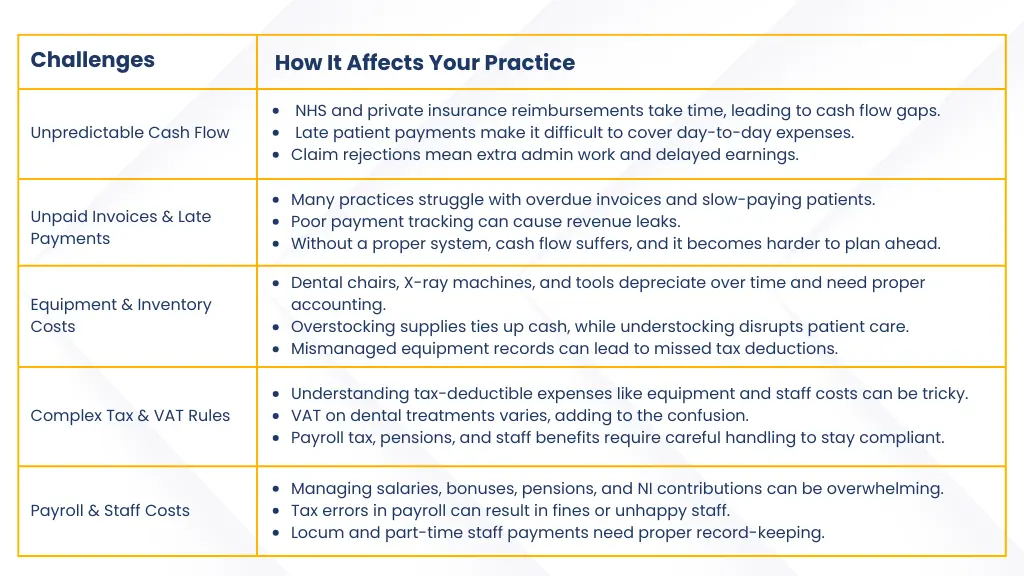

Dentists frequently face financial difficulties including controlling overhead expenses, addressing insurance claims, adjusting earnings, and making sure taxes are filed on schedule. Maintaining correct financial records can be challenging between administrative duties and patient care. Stress can also be increased by cash flow problems and complicated tax regulations unique to healthcare workers. Dentists may find it difficult to maximise income and uphold financial compliance without adequate financial oversight.

It is essential to work with qualified dental accountants to navigate these obstacles successfully. These professionals have industry-specific knowledge, which guarantees effective financial planning, tax optimisation, and accurate financial reporting. A dental accountant may help ensure tax compliance while streamlining billing procedures, enhancing cash flow management, and optimising deductions.

By hiring experts to handle financial management, dentists can concentrate on giving their patients high-quality care without having to worry about complicated financial duties. Dental practices can attain long-term growth, operational efficiency, and financial stability with professional advice.

Understanding Dental Accounts

The financial administration of a dental office, including bookkeeping, payroll, taxes, and general financial planning, is referred to as dental accounts. Compared to traditional corporate accounts, dentistry accounting includes particular difficulties such as managing insurance claims, handling NHS and private revenue sources, and complying with tax laws unusual to the sector.

Financial reporting is made more difficult by the variety of services provided by dental practices, some of which may be taxable or VAT-exempt. Dentist’s financial management differs from that of other businesses since they also have to account for the acquisition of specialist equipment, payments to associate dentists, and adherence to healthcare legislation.

Several important financial issues need to be monitored by a well-run dental office. Monitoring income comes from a variety of sources, such as NHS contracts, insurance reimbursements, and patient payments. Overhead expenses including rent, utilities, equipment upkeep, and employee wages are covered by expense management.

Tax responsibilities are another important consideration because dentists need to ensure their dental accounts are accurate, claim the appropriate deductions, and, if necessary, adhere to VAT laws. In addition to managing National Insurance and pension contributions, payroll administration is crucial for guaranteeing that employees, associates, and administrative personnel receive their salaries on schedule. Efficient financial planning in these domains guarantees seamless operations and sustained profitability.

Common Accounting Challenges for Dentists

Fluctuating cash flows:

It can be difficult for practices to maintain consistent cash flow because insurance companies frequently take their time to reimburse claims. Operations are disrupted, and the daily grind is made more stressful by late payments. Denials of claims also result in more time spent battling for payments, which can cause a months-long delay in earnings. Cash flow management gets even more difficult when you include irregular patient payments.

Inventory and equipment depreciation:

Dentistry equipment such as chairs, X-ray machines, and other various equipment are often ignored. Accurate financial reporting depends on all of this equipment being monitored. Mismanagement of inventory can lead to overspending or the unneeded storage of materials, which is a waste of money. To maintain compliance and save money during tax and dental office audits, proper depreciation is also required. However, it’s crucial to differentiate these from clinical audits that prioritise patient care over financial compliance.

Tax Regulations:

Tax preparation can be like navigating a maze for dentist practitioners. For instance, you can be eligible for deductions connected to equipment, but it takes skill to know how to claim them. Dental clinics and other healthcare organisations are subject to complicated regulations, including benefit deductions and employment taxes. Costly fines may follow noncompliance. You may increase your deductions and make sure you don’t miss anything by working with a dental accountants who is knowledgeable in tax preparation for dental practices.

How the Best Dental Accountants Can Help?

- Specialised Tax Planning & Compliance – Maintain dental services VAT exemptions, maximise tax savings, and make sure HMRC rules are followed.

- Accurate Bookkeeping & Financial Reporting– Track income and expenses, keep accurate financial records, and provide thorough financial statements to aid in decision-making.

- Efficient Payroll Management- To guarantee efficient payroll processing and manage NI relief, employee wages, associate payments, and pension plans.

- NHS and Private Income Optimisation- Support the management of several revenue sources, make sure that invoices are accurate, and effectively handle insurance claims.

- Compliance and Risk Management- Reduce the possibility of fines or audits by making sure that tax laws, employment rules, and financial reporting standards are followed.

- Time and Stress Reduction- Allow dentists to dedicate more time to patient care while experts take care of complex financial tasks.

Dental Accountants London: Expert Financial Support for Your Practice

- Tax Efficiency & Compliance: London dental accountants specialise in tax structure optimisation, making sure dentists comply with HMRC requirements and take advantage of all possible deductions and reliefs. To lower liabilities and prevent fines, they offer customised tax preparation techniques.

- Accurate Bookkeeping & Financial Management: Monitoring revenue, costs, and cash flow is essential for a dental business to succeed. Expert accountants keep accurate financial records, which facilitates strategic decision-making and efficient daily operations.

- Regulatory Compliance & Risk Management: London dental accountants make sure your firm stays completely compliant and steers clear of expensive legal concerns by keeping up with changes to tax laws, employment regulations, and financial policies.

- Specialised Payroll Services: Payroll management for associates, administrative personnel, and dental staff can be challenging. Dental accountants in London manage tax deductions, pensions, National Insurance contributions, and wage processing while making sure employment regulations are followed.

- Technology Integration and Efficiency: London-based dental accountants make financial administration easier and more efficient by using contemporary accounting software to automate invoicing, simplify bookkeeping, and deliver real-time financial information.

- Cash Flow and Growth Planning: The secret to sustaining profitability is accurate financial forecasting. To help your practice grow sustainably, dental accountants offer assistance with cash flow management, investment planning, and company expansion ideas.

Why E2E Accounting is the Right Choice for Your Dental Accounts?

E2E Accounting is a reputable name in financial management, with a focus on accurately and effectively managing dental accounts. Having worked with dentists and dental practices for many years, the firm understands the sector’s unique financial challenges, including tax responsibilities, VAT complications, private practices, and NHS revenue sources. With tailored solutions designed to streamline dental accounts, E2E Accounting helps dentists concentrate on patient care while maximising profitability and ensuring compliance.

Range of Services we offer:

- Bookkeeping & Financial Reporting: To ensure financial transparency, E2E Accounting keeps precise records of all earnings and outlays. Dental offices may maintain a healthy cash flow and make well-informed business decisions with accurate bookkeeping.

- Tax Planning and Compliance: Professional accountants assist dental offices in minimising their tax obligations while guaranteeing complete adherence to HMRC guidelines. They minimise risks and maximise savings by managing tax returns, deductible costs, and VAT issues.

- Payroll Management: For dentistry clinics, handling payroll taxes, pensions, National Insurance contributions, and salaries can be challenging. E2E Accounting guarantees smooth payroll processing, ensuring that workers are paid on schedule while adhering to employment regulations.

- Regulatory Compliance Support: Dental clinics have to adhere to tax laws and industry restrictions. E2E Accounting guarantees adherence to employment laws, financial reporting standards, and tax laws unique to the healthcare industry to avoid expensive fines.

Conclusion

A dental practice’s financial management calls for specific skills and knowledge. Financial stability, efficiency, and expansion are guaranteed by hiring a competent dental accountant for everything from tax planning and bookkeeping, to payroll administration and regulatory compliance. Considering the intricacies of private and NHS revenue, VAT laws, and HMRC compliance, professional advice is crucial to preventing expensive errors and optimising profits.

With specialised financial solutions and technology-driven tactics, E2E Accounting is committed to assisting dental professionals in overcoming these obstacles. Their knowledge of the field guarantees your practice’s continued compliance, good financial standing, and long-term viability.

Get a free evaluation from E2E Accounting today to start down the path to improved financial management and see how their professional services can support the success of your dental practice!