Accounting is the backbone of every business, whether it’s operating on a small or large scale. Small businesses, like a neighborhood store or service provider, typically deal with simple sales, expenses, and bills.

However, accounting for eCommerce is more intricate. Online companies manage large numbers of transactions, several payment gateways, platform fees, refunds, and sales in various geographical areas. It’s essential to comprehend these distinctions because employing regular accounting techniques for an eCommerce company may result in errors, missed opportunities, and compliance issues.

These are some basic points that highlight the differences between traditional accounting and eCommerce accounting. Further, in this blog, we will understand in detail why eCommerce accounting can’t be done in a traditional way.

Key Differences Between eCommerce Accounting and Traditional Business Accounting

The fundamental ideas of traditional accounting and eCommerce accounting are the same. Both adhere to the same basic accounting principles, which include keeping correct financial records, recording income and expenses, creating financial statements, and adhering to tax laws. The way these ideas are put into practice makes a difference.

While traditional accounting typically involves fewer transactions and simpler payment and tax procedures. eCommerce accounting deals with increased transaction volumes, different payment gateways, online sales taxes, and platform fees.

- Transaction Volume and Complexity: Traditional companies handle fewer transactions, mainly via direct payments or invoices. Whereas, every day eCommerce companies deal with hundreds or thousands of tiny transactions, such as chargebacks, discounts, partial payments, and refunds, which complicates reconciliation.

- Sales Channels and Platforms: A traditional firm usually uses one or two channels for sales. eCommerce companies sell on a variety of platforms, including marketplaces, Amazon, Shopify, eBay, and their own website. Fees, payout schedules, and reporting formats vary by platform.

- Payment Gateways and Timing: Payments are usually received straight into a bank account in traditional accounting. However, gateways like Stripe, PayPal, Klarna, or Razorpay handle payments in eCommerce. Transactions must be closely monitored and reconciled through eCommerce accounting because these suppliers frequently deduct fees and release payments after a delay.

- Inventory Management: Traditional companies with little stock movement find it easier to track their inventory. To prevent supply mismatches and overselling, eCommerce needs real-time inventory tracking across several platforms, warehouses, and delivery centres.

- Tax and Compliance Requirements: Conventional companies typically deal with local tax regulations. eCommerce companies frequently have to deal with complicated tax duties like digital sales tax, multi-state or multi-country VAT/GST, and platform-specific compliance needs.

- Data and Automation Dependency: Manual procedures can still be used in traditional accounting. But handling large, complex data in eCommerce is a tough job. Automation, integrations, and AI-driven technologies are important to eCommerce accounting’s data integrity, reporting, and scalability.

In summary, ecommerce accounting vs traditional accounting differ by greater automation, stricter controls, and real-time information.

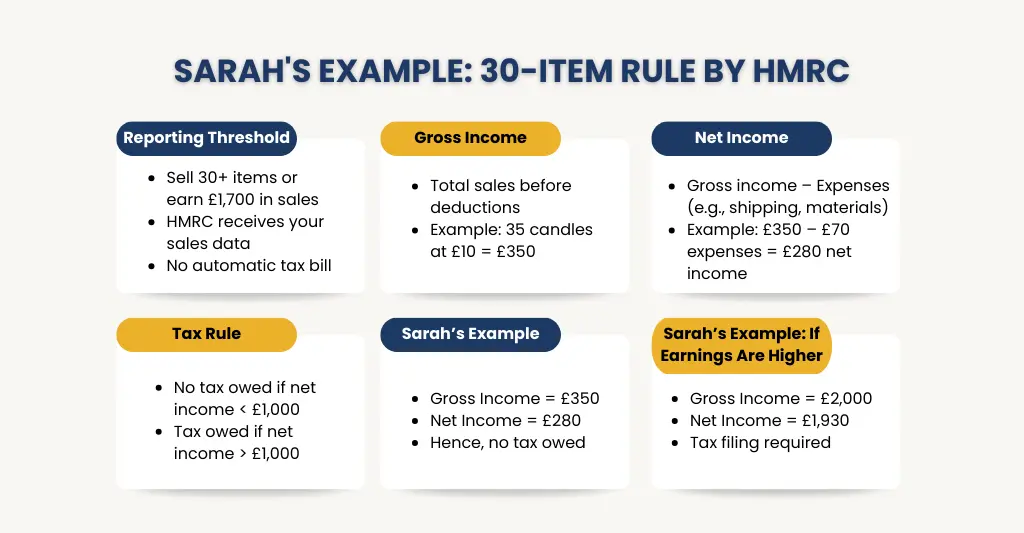

The Impact of the 30-Item Rule by HMRC for Online Selling Platforms

In the UK, the “30-item rule” refers to a reporting level that online marketplaces utilise, not a new tax that you have to pay all of a sudden. Online marketplaces such as eBay, Etsy, Vinted, Amazon, Depop, and similar sites are required by new digital-platform reporting regulations that went into effect in January 2024 to gather and share particular sales data with HM Revenue & Customs (HMRC), provided a seller satisfies certain requirements. This covers vendors who:

- Sell 30 or more items in a single calendar year, or

- Earn more than about £1,700 (≈ €2,000) from sales on the platform.

The platform will send information to HMRC, including your name, contact details, and total earnings for the year, once it reaches these levels for you. You will also receive a copy of the information.

What does this mean for Sellers?

- No automatic tax bill: You do not automatically have to pay taxes if you sell thirty products. It simply means that HMRC can now identify more precisely who is using online platforms to make money. The tax laws themselves remain unchanged.

- Trading income rules still apply: If your gross income exceeds the £1,000 trading allowance in a given tax year and your revenue from selling things or performing paid services on these platforms qualifies as trading, you just need to notify HMRC or pay tax.

- Better records matter more: Whether you sell casually or as part of a developing side business, it is now even more crucial to maintain accurate records of your sales, expenses, fees, and profit because platforms will share data.

To put it briefly, the “30-item rule” mostly affects reporting rather than taxation. It reduces tax-time shocks and promotes proper filing when income exceeds allowances by assisting HMRC and sellers in maintaining alignment on online income.

For example:

If Sarah sells 35 handmade candles on the Etsy platform in a year for £10 each. Etsy may report her sales to HMRC because she has crossed the 30-item limit. This does not mean she automatically owes tax. HMRC will only look at whether her selling counts as a business and whether her income is above the tax-free allowance.

eCommerce Accounting Challenges and Solutions vs. Traditional Business Accounting

| Category | eCommerce Accounting | Traditional Accounting |

| Transaction Volume | Challenge: Daily deal with a high number of sales, refunds, and chargebacks. Solution: Automated accounting tools and integrations. | Challenge: Lower volume of transactions. Solution: Manual or basic accounting software is often sufficient. |

| Sales Channels | Challenge: Multiple platforms (website, Amazon, eBay, Shopify, etc.) with different reports and fees. Solution: Centralised systems to consolidate all sales data. | Challenge: Usually, there are one or two sales channels. Solution: Simple tracking and reporting. |

| Payment Reconciliation | Challenge: Delayed payouts and gateway fees cause mismatches. Solution: Automated bank reconciliation and regular reviews. | Challenge: Sometimes payments are received in installments. Solution: Regularly reconcile them with bank statements to avoid missing out. |

| Inventory Management | Challenge: Fast-moving stock across multiple platforms and locations. Solution: Real-time inventory management tools. | Challenge: Slower stock movement. Solution: Periodic stock checks. |

| Tax & Compliance | Challenge: Complex VAT/GST, cross-border sales, and platform tax rules. Solution: Specialist eCommerce accounting and tax-ready software | Challenge: Mostly local tax requirements. Solution: Standard compliance processes. |

Accounting Tools and Practices: How eCommerce Differs from Traditional Business Accounting

- Use of Accounting Software: Cloud-based systems with direct interfaces to online stores and marketplaces, such as Xero or QuickBooks, are essential for eCommerce firms. Conventional companies frequently employ simple accounting software with few or no integrations.

- Automation vs Manual Processes: As said before, eCommerce businesses have several transactions,for that purpose-automation is necessary. But in the case of traditional business, manual entries or periodic uploads can still be used in traditional accounting.

- Real-Time Data Tracking: Online companies require almost real-time inventory, cash flow, and sales tracking. Financial data is typically reviewed by traditional businesses on a weekly, monthly, or quarterly basis.

- Payment Gateway Integration: Direct connections with payment gateways are included in eCommerce accounting to monitor deductions and postponed settlements. Payments to traditional enterprises are usually sent directly into bank accounts.

- Inventory Management Tools: eCommerce tracks inventory across several platforms using integrated inventory systems. Traditional businesses frequently use physical counts or simpler stock records.

- Reporting and Insights: The focus of eCommerce accounting is on comprehensive performance reports broken down by platform. Conventional accounting reports are less regular and more general.

These distinctions clarify why eCommerce accounting necessitates more sophisticated instruments and organised procedures than conventional business accounting.

Why Accurate eCommerce Accounting is Crucial for Success

- Clear view of profits: After platform fees, payment costs, refunds, and taxes, accurate accounting displays your actual profit. Sales may appear strong, but profits subtly decline in the absence of this transparency.

- Better cash flow control: eCommerce companies face frequent expenses and delayed payouts. Keeping track of what is owed, what is received, and when money will actually arrive at your bank is made easier with proper accounting.

- Correct tax compliance: Online vendors frequently have to deal with complicated GST or VAT regulations. Maintaining accurate records lowers the possibility of mistakes, fines, or unforeseen HMRC tax bills.

- Smarter business decisions: You can scale with confidence when you know which products, platforms, or markets work best due to trustworthy financial data.

- Easier platform reporting and audits: Sales data may be requested by marketplaces and tax authorities. Audits and reviews are far less stressful when accounts are kept up to date.

- Long-term growth and stability: eCommerce companies can plan budgets, effectively manage inventory, and expand sustainably without financial surprises when they have precise accounting.

People Also Ask:

What is the difference between eCommerce accounting and traditional business accounting?

Managing large volumes of online transactions, multiple sales platforms, payment gateways, refunds, and complex tax regulations is the primary focus of eCommerce accounting. Conventional business accounting often handles direct payments, simplified inventory, fewer transactions, and local tax compliance.

How can accounting help maximise my eCommerce profits?

Accounting helps to manage actual costs, identify successful products, enhance cash flow, and assist with better pricing and business decisions.

What is the 30-item rule by HMRC, and how does it affect eCommerce sellers?

Online platforms may report your sales to HMRC under the 30-item rule if you sell 30 or more products in a year (or make more than the income level). Although it raises HMRC’s visibility and makes proper recordkeeping and correct tax reporting more crucial for eCommerce merchants, it does not automatically indicate you owe tax.

How can I ensure compliance with HMRC when selling on eBay or Vinted?

Maintaining correct records of all sales, fees, and expenses, determining if your sales qualify as trading revenue, registering with HMRC if necessary, and timely filing accurate Self Assessment forms are all ways to guarantee HMRC compliance.

Do I need different accounting practices for selling internationally online?

Yes,different accounting procedures, such as monitoring multi-currency transactions, controlling platform fees by nation, addressing international VAT or sales tax regulations, and guaranteeing accurate reporting for cross-border sales to remain compliant, are necessary when selling internationally online.