SIGNUP OUR NEWSLETTER TO GET UPDATE INFORMATION, NEWS, INSIGHT OR PROMOTIONS.

eCommerce Compliance Checklist: Essential Legal Requirements You Need to Know

Author: E2E Accounting Team

Date: January 13, 2025

Category:

eCommerce

Views: 589 views

Table of Contents

“Your curiosity to know about eCommerce compliance have led you here, dive into stories, strategies, and solutions made for you.”

Let’s begin,

Maintaining eCommerce compliance is not just ticking a checkbox activity. It is the core of effective operations and expansion of a company. To put it simply, if you want to grow monetarily in a business, maintaining compliance to changing legislations is the first step. As eCommerce businesses expands, they are met with changing regulations and laws differing states and borders. From data protection laws to GDPR compliance and tax regulations – a seller needs to know various intricacies within eCommerce accounting to effectively and compliantly grow.

Imagine devoting hours and days in creation of your dream website, only to be met with penalties and notices along the way. Why? Because your team indirectly violated the VAT/Sales tax regulations. It is not the fault of your team that majorly deals with the operational aspect. Even seasoned accountants cannot keep up with the changing regulatory realm. This is why our blog is your one stop solution- breaking down key compliances into actionable steps that are easy to understand and at the same time helps you stay compliant.

Why eCommerce Compliance Matters

Before diving into why it matters, it is important to know what is eCommerce compliance? The term explains how eCommerce companies need to mandatory follow the legal specifications of the market in which they are operating. In today’s digital first world, digital literacy is not just limited to effective usage, but also understanding the rules and regulations set in place to protect both the parties involved.

Whether you’re a small eCommerce store, or a larger international retailer, meeting compliance requirements is not just a legal obligation – it’s a business necessity. The blog will explore the critical areas of eCommerce compliance and how to tackle them.

#1 GDPR Compliance for eCommerce Businesses

The General Data Protection Regulation (GDPR) entails the protection of the data and privacy of the individuals within the UK/EU region. It is the most significant compliance affecting eCommerce businesses.

Maintaining GDPR Compliance is the basic type of regulation imposed by the government for all levels of businesses, and the eCommerce sector happens to be one of them, where millions of transactions/transfer of data happens every second – making it prone to GDPR non-compliance. Let us understand the key step a business can take to stay GDPR compliant.

- Update Your Privacy Policy to display up-to-date clear, concise information to customers regarding their rights and what part of their data will be collected.

- Obtain Explicit Consent from users, including those that will be used for email marketing and user-enhancement purposes.

- Use cookie consent banners that allow users to accept or reject tracking cookies on your site.

- Appoint a Data Protection Officer (DPO) if your business processes large volumes of personal data or sensitive data.

- Provide customers with the ability to request their personal data, and ensure it is easy for them to opt-out or delete it.

By integrating these practices into your eCommerce business, you will have one less thing to worry about.

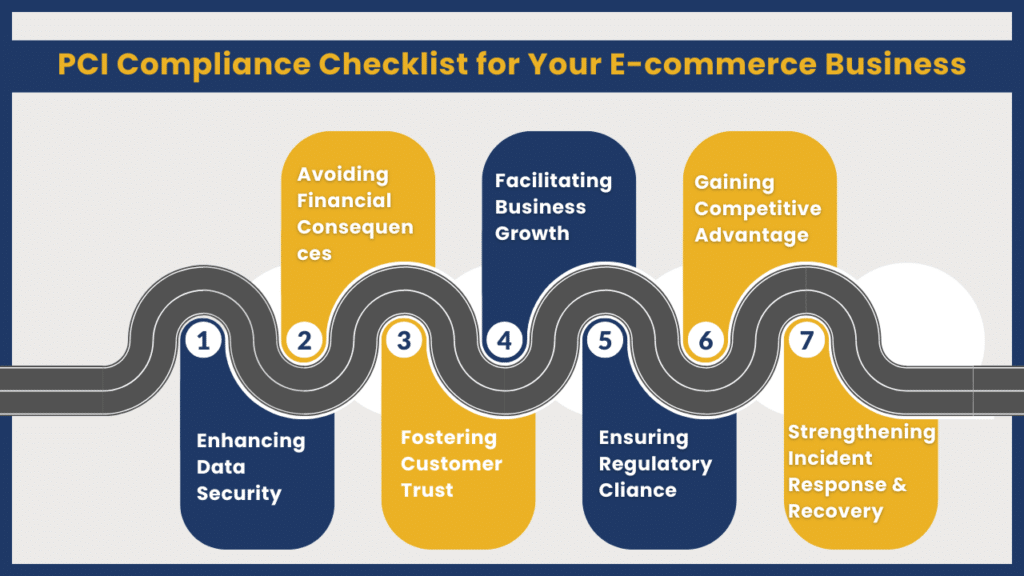

#2 PCI DSS Compliance for eCommerce Businesses

The Payment Card Industry Data Security Standard (PCI DSS) sets the benchmark for security when handling credit card transactions. Regardless of the data going out or coming in, PCI DSS strictly calls for security all the way, whether it be over the internet network, POS, or other online modes of transactions. The PCI compliance demands the business to take necessary steps to protect the customer payment information.

How to Achieve PCI DSS Compliance:

- Secure Payment Systems: Use secure payment gateways and ensure that all payment data is encrypted.

- Access Control: Limit access to payment data to authorised personnel only and monitor access regularly.

- Regular Audits: Conduct periodic audits to assess your compliance with PCI DSS requirements.

- Tokenization and Encryption: Implement tokenization to replace sensitive payment information with secure, non-sensitive tokens.

- Compliance Reports: If required, submit regular compliance reports to the PCI Security Standards Council.

These steps reduce fraud risks and comply with industry standards.E2E can help by providing dedicated eCommerce accountants well-versed in data protection regulations within the payment card industry.

#3 VAT Compliance for eCommerce

Value Added Tax (VAT) compliance is the most challenging amongst the others. When you qualify for VAT, what VAT rate you have to pay, and when can your VAT be reclaimed – are challenging questions that are not everyone’s cup of tea. VAT rules and regulations truly overwhelm businesses in all sectors, specifically the eCommerce industry. Following are the steps to ensure eCommerce VAT compliance.

Steps to Ensure VAT Compliance:

- Understand the VAT Thresholds: Depending on your business location and customer base, you need to charge VAT at different rates. Be sure to check the local VAT thresholds for each country where you have customers.

- Use VAT Calculation Tools: Automate VAT calculations using tools like Xero, QuickBooks, to ensure that your VAT is calculated correctly for each transaction. Or just skip all these steps by partnering with E2E.

- Cross-Border VAT: For eCommerce businesses in the EU post-Brexit, VAT rules have changed. You’ll need to account for VAT on goods sold to EU customers separately.

- Collect VAT on Digital Goods: If selling digital goods or services, ensure that you’re following the appropriate VAT rules for digital transactions, which may vary by region.

#4 Consumer Protection Laws

Laws are for the people, by the people, hence as an eCommerce business; it’s a must to comply with consumer protection laws for ensuring a seamless, fair and transparent shopping experience to the customers.

Key Consumer Protection Measures:

- Clear Return and Refund Policies: Your return and refund policy must be easily accessible and clear. Keep the wording and content without jargons unless necessary.

- Product Descriptions: Provide accurate and clear product descriptions without misleading the consumers.

- Customer Reviews: Allow customers to leave reviews. No matter if it’s positive or negative, the customer can express themselves in relation to your product/service anytime, everywhere. Hence do not try to manipulate the reviews or mislead the buyers.

- Shipping & Delivery Information: Be transparent to the customers about the shipping costs, delivery times, and any potential customs fees when selling internationally.

Following these steps can guarantee customer trust and in-definitely compliance to consumer protection laws. Another less thing to worry about.

#5 Tax Compliance for eCommerce

Another challenging terrain for business owners are tax regulations. eCommerce business owners must comply with updated tax rules and regulations, so as to avoid fines and penalties. The HMRC may pay you a visit if tax is not correctly collected and remitted.

Steps for Tax Compliance:

- Register for Tax: If required, register for VAT/sales tax, or other applicable taxes in the jurisdictions where you conduct business.

- Use Tax Automation Software: Tools like QuickBooks, and Xero when paired with human intervention can ensure the automated reports are precise.

- File Tax Returns on Time: There’s no need to explain this further if you want to avoid penalties and fines.

- Consult a Tax Professional: Tax laws for the fact are complicated. Hence, it requires the consultation of a tax professional that understands local regulations. For the best, try to consult with a professional that has expertise in the eCommerce realm.

#6 How to Stay Updated with Compliance Regulations

Compliance laws and regulations are continually evolving, especially in the eCommerce industry. Staying up-to-date is the need of the hour- demanding calculated steps and strategies. Here’s how to stay informed:

- Subscribe to regulatory websites or newsletters to stay updated to changing laws.

- Join organisations like the eCommerce Trade Association or similar groups to ensure compliance and access to news of the changing regulation realm.

- Consult with legal or compliance experts to ensure that your business is operating within the law.

Conclusion: Why E2E!

With E2E, compliance is not some daunting endless task, rather a simple step to ensure your business is ready for long-term prosperity. By following the steps outlined in the blog, you can ensure your business is always compliant to GDPR, PCI DSS, VAT and more. Speak with one of our compliance experts to tailor a solution that works for your eCommerce store!

What is eCommerce compliance, and why is it important?

eCommerce compliance refers to the adherence of your online business to various legal, regulatory, and industry standards that govern how you handle customer data, transactions, taxes, and consumer rights. It is important because non-compliance can lead to legal penalties, loss of consumer trust, and damage to your reputation.

Do I need to comply with GDPR if my business isn’t based in the EU?

Yes. If your eCommerce business processes personal data of EU citizens or residents, you are required to comply with GDPR, regardless of where your business is located. This includes gathering explicit consent, providing data access rights, and ensuring data protection.

How can I ensure PCI DSS compliance for my eCommerce business?

To ensure PCI DSS compliance, you must implement secure payment systems, encrypt cardholder data, limit access to payment information, and conduct regular security audits

How often should I review and update my eCommerce compliance practices?

It’s important to regularly review and update your compliance practices, especially after changes in regulations, such as GDPR updates or tax reforms. You should conduct internal audits at least once a year and keep an eye on industry news for any regulatory changes.

E2E Accounting Team

The E2E Accounting team combines expert accountants, legal specialists, and industry advisors to provide valuable insights into finance and compliance. With hands-on experience, we create content that informs, educates, and empowers business owners. From financial strategies to legal updates, our content serves as a reliable guide, ensuring accuracy, clarity, and a deep understanding of business challenges.

Recent Blogs

Cloud Accounting for Dentists – Making Finance and Receivables Simple

How to Relieve Pressure on Your Accounting Team Through an Accounting Outsourcing Partner

How to Start an eCommerce Business in the UK [Step-by-Step Guide]

Hospitality VAT: A UK Guide for Pubs, Restaurants, and Hotels