Managing an eCommerce company’s finances is a difficult task. Balancing cash flow, figuring out profit margins, and keeping up with ever-changing tax rules may leave even the most experienced business owners buried in spreadsheets and questioning their figures. In contrast to traditional companies, eCommerce operations have particular accounting difficulties, including complicated sales tax compliance across states and nations, multi-channel sales reporting, and foreign transactions.

This is the role of eCommerce tax accountant. Comprehending the complexities of online transactions, these experts are prepared to assist you in optimising your financial situation, lowering your tax obligations, and guaranteeing adherence to constantly evolving legislation. In this guide, we’ll look at how hiring skilled eCommerce tax accountant can help you save money, streamline your business, and free up time to concentrate on expanding your company. Finding the appropriate financial partner can be crucial, regardless of how quickly you’re growing or how new the business is.

Who Are eCommerce Tax Accountant?

eCommerce tax accountants are experts in financial reporting, sales tax compliance, and tax management for online companies. They guarantee proper bookkeeping, assist with international and multi-state tax regulations, and maximise tax methods to maintain firms’ profitability and compliance.

When Do You Need an eCommerce Tax Accountant?

As your eCommerce business grows, managing taxes and financials can become more complicated. An eCommerce tax accountant can help streamline your finances, ensuring compliance and optimizing tax strategy. Here are some key situations where you may need expert help:

- Multi-State or International Sales: Managing diverse sales tax regulations (such as nexus, VAT, and GST) when selling in different states or nations.

- Rapid Business Growth: The complexity of your finances rises as your platforms, orders, or revenue increase.

- Multiple Sales Channels: You may require assistance in balancing your earnings and fees if you sell on sites like Etsy, eBay, Shopify, Amazon, etc.

- Inventory & COGS Tracking: Accurate profit margins, cost of goods sold, and stock level management become challenging.

- Tax Filing & Strategy: To minimise taxes, guarantee proper corporate structure, and stay clear of state and IRS fines.

- Lack of Time or Expertise: When expanding your business is more important to you than keeping track of accounts and taxes.

- Financial Clarity Needed: To obtain precise and clean financial reports for loan applications, investments, and planning.

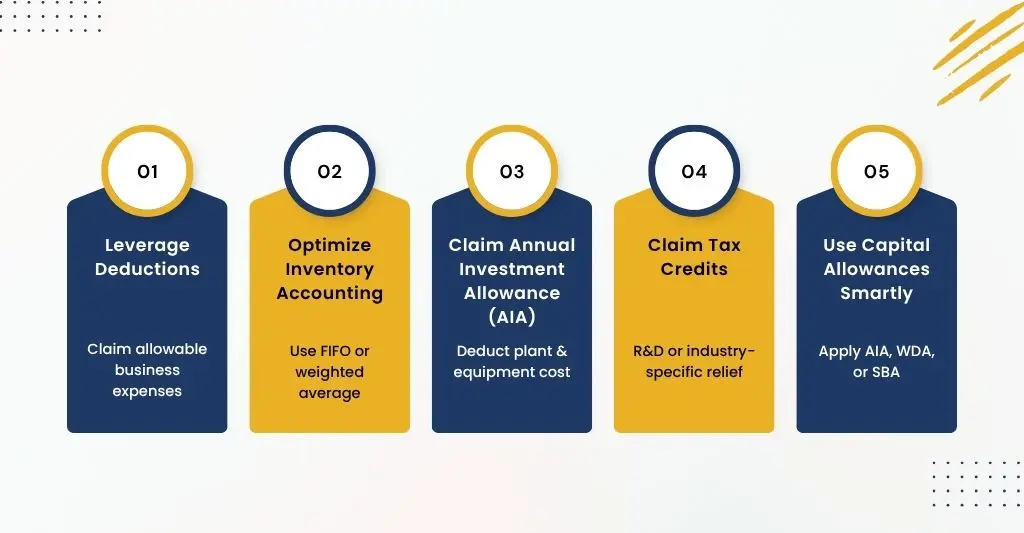

Top Strategies to Save More This Tax Season

eCommerce businesses frequently have to manage complicated tax rules, arrange financial records, and identify last-minute deductions as tax season approaches. Smart tax planning, however, aims to maximise savings and position your company for long-term success, not only to meet deadlines.

The following are some of the finest strategies eCommerce businesses can use to boost their tax savings this year:

Leverage Every Eligible Deduction:

eCommerce companies have a variety of deductible expenses, including platform fees (such as those paid through Amazon, Etsy, or Shopify), advertising expenses, software subscriptions, and home office costs. Don’t forget:

- Fees associated with payment processors (PayPal, Stripe, etc.)

- Costs of shipping and packaging

- Business-related phone and internet services

- Premiums for business insurance

Optimise Inventory Accounting:

An important asset, inventory can also be a hassle during tax season. Selecting the appropriate inventory accounting method (weighted average, LIFO, or FIFO) might affect your total taxable income and cost of goods sold (COGS). Take into account year-end inventory evaluations to record merchandise that is no longer needed or able to be sold.

eCommerce Tax Accountant can help choose the right method for your business and ensure proper inventory tracking.

Take Advantage of Bonus Depreciation:

It permits you to write off the entire purchase price of business-use automobiles, computers, and warehouse equipment in the year of purchase. Bonus depreciation on eligible assets might also help you swiftly lower your taxable income.

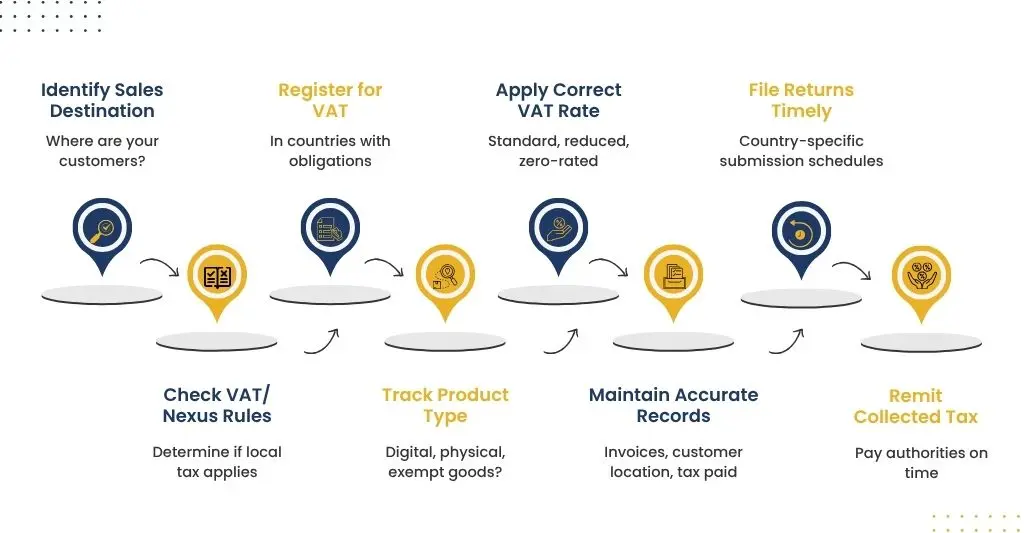

Stay on Top of VAT Compliance:

Even if you don’t have a physical presence in a state, you’re probably still accountable for collecting and sending in VAT due to the emergence of economic nexus regulations. Automate compliance and steer clear of expensive fines by using software like Avalara.

Consider Business Structure Changes:

Potential tax savings may be lost if you continue to conduct business as a sole proprietorship or single-member LLC. If your profits are increasing, you may be able to reduce your self-employment taxes by choosing S-Corp status.

Work With an eCommerce Tax Accountant:

Generic accountants could overlook compliance hazards and deductions unique to a given business. An eCommerce accountant can help you save more money and reduce stress because they are familiar with your IT stack, sales platforms, and the intricacies of online shopping. They have expertise in online retail accounting, delivering custom accounting solutions as per the need.

Avoid Tax Mistakes and Save Money

In eCommerce, taxes can quickly become complex, and even minor errors can result in significant fines or lost savings. Here is a summary of typical tax errors and how to steer clear of them:

- Separate Business & Personal Finances:

Error: Account mixing

Fix: Use a business-specific credit card and bank account.

- Track VAT:

Error: Failure to charge and remit VAT in countries where it is legally required.

Fix: To ensure international compliance, use automated VAT compliance tools like Avalara or Quaderno that calculate, collect, and file VAT based on jurisdiction-specific rules.

- Classify Workers Correctly:

Error: Handling workers like independent contractors.

Fix: To prevent fines, abide by IRS regulations.

- Manage Inventory Properly:

Error: Failure to monitor changes in inventory.

Fix: Perform year-end counts and use inventory software.

- Pay Estimated Taxes Quarterly:

Error: Making all payments at year’s end.

Fix: To avoid fines, make payments every quarter.

Simplify Your eCommerce Financials

Having the correct resources and assistance is the first step towards streamlining your eCommerce finances. Track cash flow frequently, automate reporting, and use accounting software that works with your sales platforms to save time. Use digital tools to manage your spending, and for professional advice, think about hiring eCommerce tax accountant. Simplified procedures will help you feel less stressed and continue to concentrate on expanding your company.

Why eCommerce Accounting Services Are Essential?

For companies that manage large quantities of transactions across numerous sales channels and payment platforms, eCommerce accounting services are crucial to proper financial tracking. Having expert accountants helps prevent costly tax errors and guarantees correct collection and repatriation, especially given the complexity of sales tax and VAT compliance and the differing nexus regulations across states and nations. Furthermore, inventory management services are vital because they allow businesses to monitor stock levels, avoid overstocking or stockouts, and maintain optimal cash flow. eCommerce accounting also facilitates cash flow management, which is frequently difficult because of seasonal variations and payment processor delays.

Automating Your Financial Tasks

Why Automate Financial Tasks?

- Saves Time: Time-consuming manual tasks like bill payment and money transfers are eliminated.

- Minimises Errors: Prevent forgotten funds or unpaid bills.

- Creates Positive Habits: Assists you in adhering to financial objectives and budgets.

- Enhances Credit & Savings: Regular investments and payments increase your credit score and long-term prosperity.

Stay Compliant with UK eCommerce Tax Laws

Maintaining compliance with UK eCommerce tax regulations is crucial for avoiding fines and guaranteeing efficient business operations. This entails charging the appropriate VAT rates based on your items and clients’ regions, maintaining thorough records of all transactions, and appropriately registering for VAT if your sales surpass the threshold. Additionally, you have to pay any taxes due to HMRC and submit your VAT returns on schedule. It’s critical to be up-to-date on modifications to tax laws, particularly those about digital services and foreign transactions. Maintaining compliance and streamlining your tax responsibilities can be achieved by using trustworthy accounting software or seeking advice from a tax expert.

How eCommerce Accountants Help You Stay Compliant?

eCommerce tax accountant can assist you in staying compliant in the following ways:

- Utilise precise VAT rates for both domestic and foreign sales.

- Keep neat, HMRC-compliant financial records.

- Timely preparation and submission of VAT returns and other tax documentation.

- Remain informed on evolving tax rules and regulations.

- Advise on appropriate bookkeeping and tax-deductible expenses.

- Lower the chance of HMRC fines, audits, or non-compliance problems

- They take care of tax obligations so you can concentrate on growing your business.

Simplifying Cross-Border Sales Tax

Due to different tax rules in other countries, simplifying cross-border sales tax might be difficult. However, here is a methodical way to make it easier to handle:

- Understand the Basics: Sales tax (or VAT/GST) requirements, when selling goods or services from one nation or state to another, are commonly referred to as cross-border sales tax. In the United States, sales taxes are collected at the state and local levels.

VAT/GST: Are Collected at the national level, used in many other nations.

- Identify Where You Have Nexus: A business’s obligation to collect and submit taxes in a jurisdiction is known as nexus.

Physical Nexus: Having staff, an office, or a warehouse in one place.

Sales volume or transaction count (e.g., $100,000 in sales or 200 transactions in several U.S. states) triggers the economic nexus.

- Register for Tax Collection: After you’ve established a nexus in a certain area:

- Enroll in that jurisdiction’s tax ID program.

- Recognise the registration requirements (local representatives or agents may be required in certain locations).

- Collect and Remit Taxes: At the point of sale, collect the tax.

Send taxes on time to the appropriate authority (monthly, quarterly, or annually). To avoid penalties, appropriately file reports.

- Keep Proper Documentation: Keep track of invoices, exemption certificates, and evidence of tax collection for audit purposes.

- Monitor Changes in Tax Laws: The tax code is always evolving. To keep from being out of compliance, stay current or sign up for a compliance service.

Choose E2E eCommerce Tax Accountant for Your Business

Choosing an end-to-end (E2E) eCommerce tax accountant is crucial for modern online businesses managing the complexities of international transactions. These experts provide all-inclusive tax solutions and compliance checklist that are customised to meet the particular requirements of online retailers, handling everything from determining tax liabilities in various jurisdictions to registering, collecting, and sending sales tax or VAT. E2E eCommerce tax accountant use sophisticated automated techniques and extensive industry knowledge to simplify compliance, lower audit risk, and free up critical time so business owners can concentrate on expansion. Whether you’re growing internationally or selling on sites like Shopify, Amazon, or WooCommerce, working with the best E2E tax accountant guarantees accuracy, scalability, and peace of mind.

Tailored Tax Support for eCommerce Businesses

E2E Accounting offers customised end-to-end tax assistance tailored to eCommerce companies. To track sales, automate tax computations, and process submissions precisely and on schedule, our eCommerce Tax Accountants seamlessly interfaces with your eCommerce systems, like Shopify, Amazon, and WooCommerce. With extensive knowledge of the sector, we customise tax plans for your company’s needs, reducing obligations, preventing fines, and preparing you for audits. Whether you’re growing domestically or internationally, E2E provides the tailored tax assistance you require to do so with assurance.

Can an eCommerce accountant help with international sales tax?

Yes. They can assist with VAT in the EU, OSS/IOSS schemes, and sales tax registration in the US, ensuring you’re compliant with cross-border tax laws.

What tax deductions are available for eCommerce businesses in the UK?

You can claim deductions for business expenses like software, fulfilment costs, advertising, packaging, professional fees, and platform commissions, provided they are wholly and exclusively for business use.

Is eCommerce VAT different from regular VAT?

Yes. eCommerce VAT often involves multiple jurisdictions, marketplace facilitator rules (e.g. Amazon collecting VAT), and digital product rules, which can be more complex than standard domestic VAT.

What makes E2E a good fit for eCommerce businesses?

E2E specialises in platform-specific tax planning, cross-border VAT, and real-time digital reporting. We integrate with Amazon, Shopify, Xero, and more — ensuring you save time and stay compliant.