Side hustles are no longer a trend; they are a financial necessity for many full-time employees in the United Kingdom. Earning income outside of PAYE employment has become increasingly common, whether through contract labor, online business, or independent consulting.

A side hustle is a great way to increase your income, but it frequently raises questions that full-time employees don’t expect. Do you have to tell HMRC? When do taxes become due? At what point is VAT applicable?

These questions have become more common as many working class people manage self-employment. As you will read this blog further, you will get simple solutions to handle VAT and tax compliance to effectively manage different income streams.

Self-Employed vs Full-Time PAYE: What’s the Difference?

| Aspect | Full-Time PAYE Employee | Self-Employed (Sole Trader/Freelancer) |

| Legal status | Employees work for their employers under a contract of employment. | Runs their own business and is accountable for its success or failure. |

| How is tax paid? | PAYE automatically deducts income tax and national insurance from monthly pay. | Pays income tax and Class 2/4 National Insurance through Self Assessment twice a year (payments on account may be required). |

| Responsibility for tax records | The employer handles payroll, tax calculations, and HMRC reporting. | Personally responsible for maintaining business records and reporting all income and expenses to HMRC. |

| Registration with HMRC | If you are employed under the PAYE system, you do not need to register separately. | Must register as self-employed with HMRC and submit an annual Self Assessment tax return. |

| VAT Obligations | No VAT responsibilities as an employee. | If your taxable business revenue exceeds the UK VAT registration level, you must register; otherwise, you can register voluntarily. |

| Multiple income sources | You can work a side hustle in addition to PAYE, but any extra income must still be reported to HMRC. | There may be multiple clients and projects; however, all business income must be declared on a single Self Assessment return. |

| Compliance focus for VAT & tax | For accuracy check the tax code and understand any in-kind advantages or underpayments. | Monitor turnover against the VAT threshold, maintain correct bookkeeping, file VAT returns (if registered), and satisfy Self Assessment dates. |

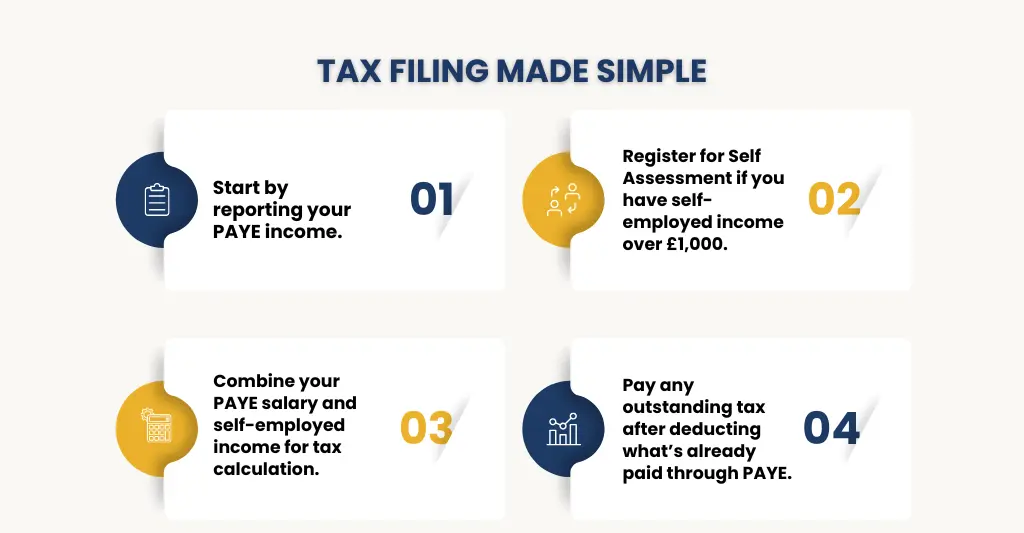

Managing Tax Filing for Both PAYE and Self-Employment Income

To manage tax filing with both PAYE and self-employment income, use Self Assessment to combine all income on a single tax return. HMRC calculates your total tax owed by adding your PAYE and self-employed profits and subtracting the tax already taken through PAYE. You only pay the remaining balance.

When you Must Register and File?

- If your self-employed income exceeds £1,000 in a tax year, you should register for Self Assessment, even if you currently pay tax through PAYE.

- Each year, you submit a Self Assessment tax return that includes both your job income (from your P60/P45) and self-employment profits.

How is the tax Calculated?

- HMRC determines your total income tax liability by combining your taxable PAYE income and self-employed profits, applying the personal allowance and bands.

- Any tax already deducted through PAYE is deducted from this bill, and you only pay the additional tax and Class 2/4 National Insurance required on your profits.

Deadlines and Payments:

- The regular UK tax year runs from April 6 to April 5, with the online Self Assessment filing and payment due on January 31 following the end of the tax year.

- If your self-employment tax is high enough, you may need to make “payments on account” in January and July for the next year’s bill.

Records you Need to Keep:

- Keep payslips, P60/P45s, and P11Ds from employers, as well as accurate records of business income and costs for self-employment.

- If you have proper records you can legally claim valid expenses, lower your taxable earnings, and avoid errors or penalties for faulty or late returns.

Common Pitfalls to Avoid:

- It is your responsibility to inform HMRC about side-hustle income, not your employer’s.

- Keep a track of your combined income, pushing you into a higher tax bracket, and save away money on a monthly basis to avoid surprises in the January bill (and possibly a July payment).

VAT Considerations for Self-Employed Side Hustlers

Here are the pointers self-employed side hustlers need to keep in mind regarding VAT:

- VAT registration threshold: If your total taxable turnover (including your side hustle) exceeds £90,000 in a rolling 12-month period, you must register for VAT (HMRC).

- Multiple income sources count: HMRC considers combined turnover, not just your side business.

- Voluntary VAT registration: You can register below the threshold if it benefits you (for example, reclaiming VAT on expenses or boosting credibility).

- VAT schemes to consider: Flat Rate Scheme, Cash Accounting Scheme, or Standard VAT, each affects cash flow differently.

- Charging VAT correctly: Once registered, VAT must be added to qualified sales and reflected on bills.

- VAT returns & deadlines: Usually filed quarterly using MTD-compliant software,late filing carries penalties.

- Expenses & VAT reclaim: You can only refund VAT on acceptable business expenses accompanied by legitimate VAT invoices.

- Employment vs side hustle: Your PAYE work is separate, yet VAT compliance applies to your entire self-employment income.

How to Manage End-to-End Accounting for Full-Time Employees and Self-Employed Side Hustlers

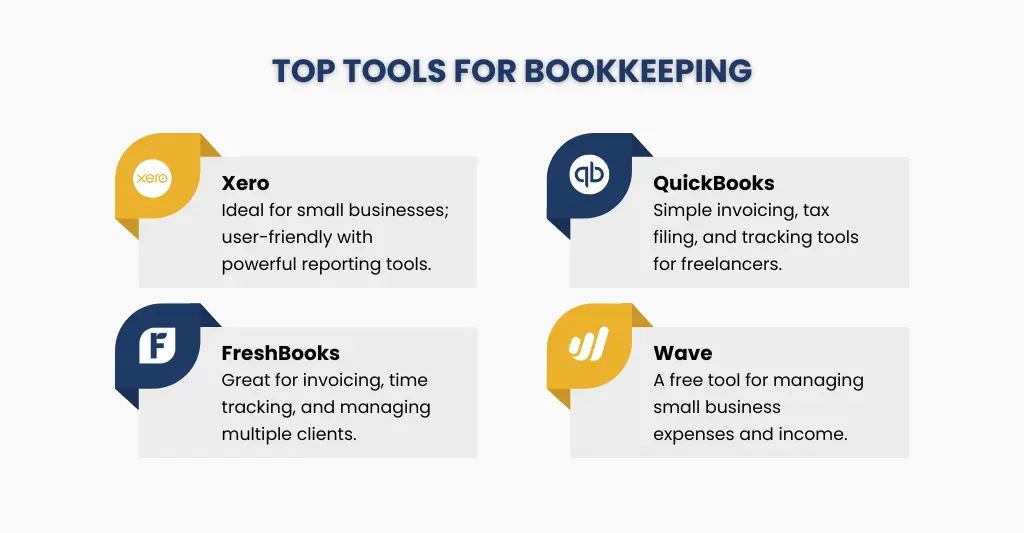

Managing a salaried job, having a side hustle and maintaining accurate accounting records solely can be a tough task. If you are the one who is doing everything like a robot you must follow some below mentioned guidelines:

- Keep finances separate: Use a separate bank account for your side job to properly track income and expenses, and avoid combining personal salary income with company transactions.

- Maintain accurate records: Regularly maintain record of all invoices, receipts, and cash transactions. If you don’t like manual bookkeeping you can use digital bookkeeping tools. It makes tracking easier and reduces errors.

- Understand your tax obligations: Employment income is taxed under PAYE, whereas side hustle income must be submitted through Self Assessment. Both are assessed jointly to determine your overall tax liability.

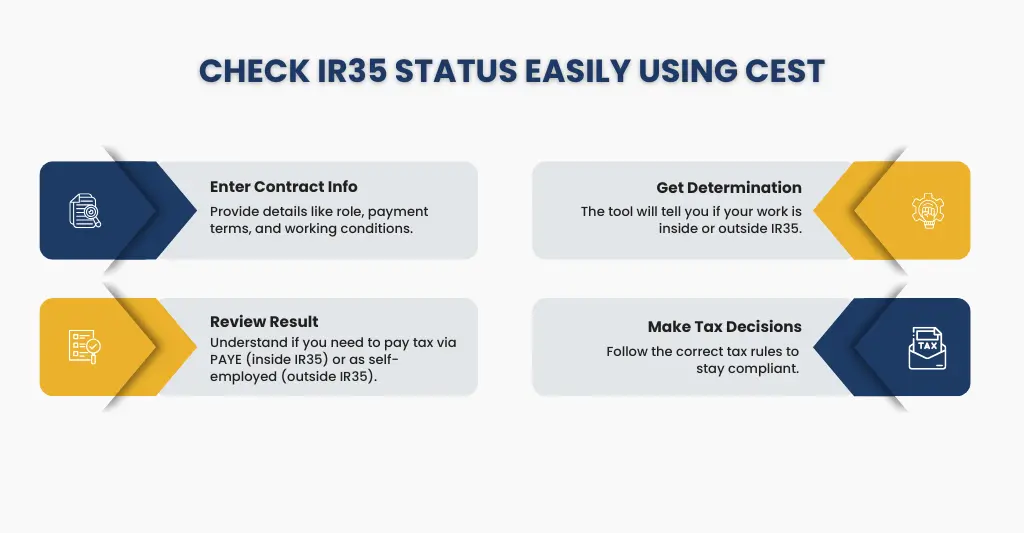

- Use the CEST tool if working as a contractor: If your side hustle involves contract work, utilise HMRC’s CEST (Check Employment Status for Tax) tool to verify whether your earnings fall within or outside of IR35. This helps to determine whether tax should be paid through PAYE or as self-employed income, lowering the possibility of penalties later.

- Set aside money for tax: Unlike PAYE, no tax is deducted at the source from self-employed income. Keep a percentage of your income separate on a monthly basis to minimise cash-flow problems around tax season.

- Track VAT separately (if registered): Ensure that VAT collected and reclaimed is accurately documented and submitted on time in accordance with Making Tax Digital.

- Review accounts periodically: Monthly or quarterly reviews can help you spot issues early on and stay compliant throughout the year.

Conclusion

Managing tax and VAT as a full-time employee with a self-employed side business does not have to be difficult. The key is to understand your commitments early on, keep accurate documents, and follow HMRC rules.

E2E Accounting provides UK professionals and side hustlers with end-to-end accounting services, including bookkeeping, VAT returns, self-assessment, and compliance, allowing you to confidently build your supplementary income. With the right support, you can navigate the world of full time and self employed with confidence, leaving the stress and confusion behind..

People Also Ask:

Can I be Full Time Employed and Self Employed at the same time?

Yes. In the UK, you can work full-time and be self-employed simultaneously. Your salary is taxed under PAYE, but your self-employment income must be disclosed separately on a Self Assessment tax return. You will also be responsible for managing National Insurance and VAT duties (where applicable) for your self-employment.

What Are the Tax Implications of Being Both Self-Employed and PAYE?

Your employer will handle your PAYE tax, but any self-employed income must be declared separately through Self Assessment. Depending on your overall earnings, you may be required to pay additional income taxes and national insurance.

When Do I Need to Register for VAT as a Side Hustler?

If your self-employed turnover is more than the VAT threshold (£90,000), you must register for VAT. PAYE wage does not count toward VAT registration.

What Is the HMRC CEST Tool and How Does It Help Me?

The HMRC CEST (Check Employment Status for Tax) tool assists in determining if your side work is considered employment or self-employment for tax purposes, allowing you to make informed IR35 and compliance decisions.

What Happens If I Don’t Declare My Side Hustle Income?

Undeclared income can result in penalties, interest, and backdated tax payments. HMRC may also look into previous years, adding financial and legal risk.

How Do I Track My Expenses for Both PAYE and Self-Employment?

Separate PAYE expenses from business costs. Use a dedicated company account or accounting software to precisely manage self-employment income and permissible costs.

How Do I Pay National Insurance Contributions for Both Jobs?

You pay Class 1 NICs via PAYE and Class 2/Class 4 NICs via Self Assessment, depending on your self-employment profits.

How Can I Avoid VAT Issues When Shipping Products Abroad?

Understand the rules governing place of supply, zero-rating, and imported VAT. Misclassifying international transactions or using marketplaces as concealed VAT agents might lead to compliance concerns.