A single digit in your tax code can change how much you pay HMRC. Yet, most taxpayers rarely double-check it. In the long run, minor errors or outdated tax regulations may result in a significant overpayment or, more accurately, a substantial tax bill.

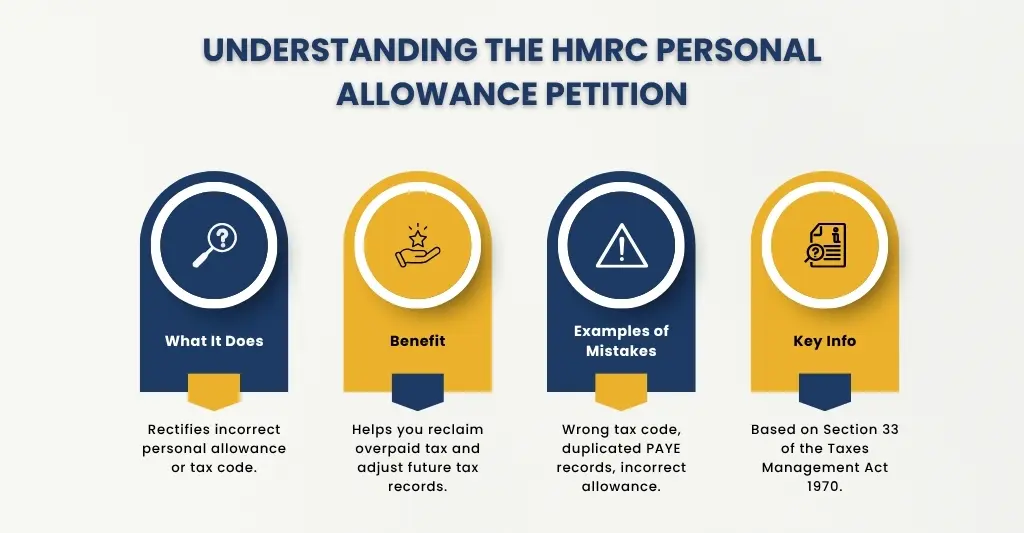

HMRC Income Tax Personal Allowance Petition is the official procedure that allows individuals to rectify such mistakes. With this procedure, individuals can correct their personal allowance (tax-free income) that has been incorrectly reduced. Regardless of whether you are working, self-employed, or have other sources of income, it is necessary to understand how to file this petition so that you can retrieve what belongs to you and remain compliant.

In this blog post, we have simplified the process of understanding what a petition is, when to use it and how to file it step by step. It also explains income tax limits (thresholds), what you should expect after filing your return, and how professional accountants such as E2E Accounting can assist you during end-of-year reconciliation and with HMRC correspondence.

What Is an HMRC Income Tax Personal Allowance Petition?

The amount that you can earn annually before paying the income tax depends on your personal allowance. The standard personal allowance in the UK for the tax years 2024/25 and 2025/26 is £12,570.

But this concession is not necessarily applied accurately for all taxpayers. Tax codes (e.g., 1257L, BR, D0) are used by the HMRC to communicate with you on how your allowance should be used. But the codes are based on the correct information furnished by your employer, pension provider or the HMRC systems.

When you feel that your personal allowance is wrongly calculated, or reduced incorrectly or entirely missed, you can send a formal application to HMRC for reviewing your allowance in the form of “HMRC Income Tax Personal Allowance Petition”. In practice, this petition can:

- Reinstate your correct allowance if it was removed in error.

- Correct an incorrect PAYE tax code.

- Lead to a tax refund if overpayment has occurred.

- Trigger an adjustment to your future payslips and tax records.

It’s not a casual complaint — it’s an official route to amend your tax position under Section 33 of the Taxes Management Act 1970, which governs overpayment relief and tax code corrections.

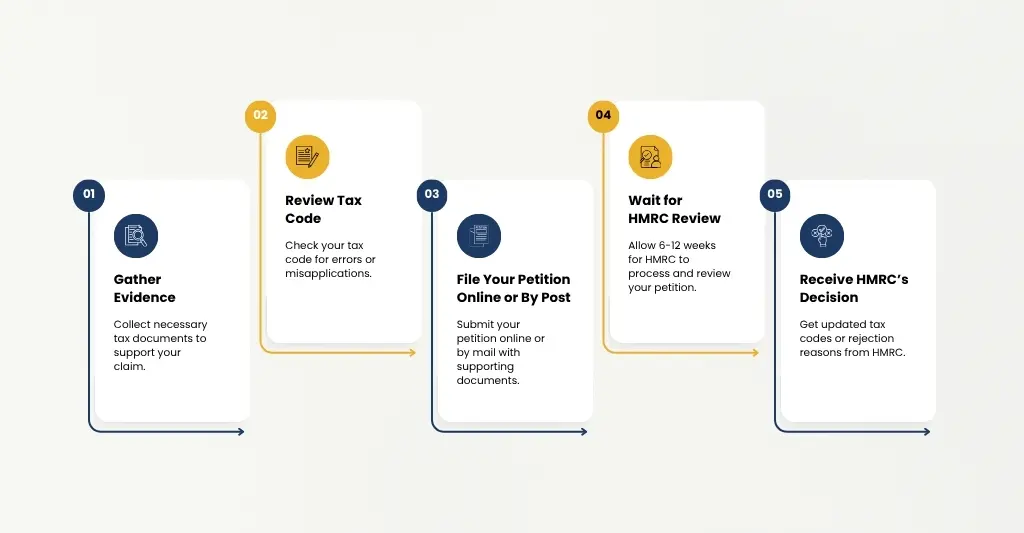

How to File an HMRC Income Tax Personal Allowance Petition

One must file this petition with evidence and precision. Even a minor omission can cause a major delay in processing or rejections. Below is the complete sequence of steps for the entire process from start to end.

Step 1: Gather Supporting Documentation

To begin with, you need to gather all the records of your actual earnings and the amount of tax you paid. These documents can include:

- P60 (end-of-year summary showing total earnings and tax deducted).

- P45 (if you’ve changed jobs within the tax year).

- Payslips from all employment sources.

- Self-Assessment Tax Return (if self-employed).

- P11D for any benefits-in-kind, such as company cars or medical insurance.

- HMRC coding notices (Form P2) that show which tax code has been applied.

Generally, accountants suggest having a digital folder of historical records of at least six years, as HMRC is allowed to ask about their verification during inspection.

Step 2: Review Your Current Tax Code

Your tax code determines how much of your personal allowance is applied to each source of income. The most common ones are:

- 1257L – Standard tax-free allowance for most employees.

- BR – Basic rate (20%) applied to all earnings (used incorrectly for second jobs at times).

- D0 – Higher-rate (40%) applied to all income.

- K codes – Indicate that deductions (benefits, underpaid tax, etc.) exceed your allowance.

If your tax code begins with K, or if you’re on BR when you only have one job, your allowance may not be applied correctly. These are the first red flags for filing a personal allowance petition.

You can find your code on your payslip, P60, or by logging into your HMRC Personal Tax Account.

Step 3: Determine Whether You’re Eligible to File

You can file a personal allowance petition if:

- You believe your allowance has been reduced without cause (for instance, no benefit-in-kind but coded as if you had one).

- HMRC applied your allowance to the wrong income source (e.g., pension instead of salary).

- You’ve overpaid tax due to duplicate PAYE records.

- You’ve changed jobs, and your new employer hasn’t updated HMRC correctly.

You cannot file if:

- The tax year in question is more than four years old (per HMRC’s overpayment relief time limit).

- The allowance was reduced because of a verified high income or unpaid tax from a prior year.

Step 4: File Your Petition

Currently, there’s no separate online “HMRC Income Tax Personal Allowance Petition Form”, but the process can be completed through one of three methods:

- Online through your HMRC account:

- Log in to your Personal Tax Account.

- Navigate to “Check your Income Tax for the current year.”

- Select ‘Update or correct your employment details’.

- Submit a secure message detailing your issue and attach evidence.

- By post:

Write to:HM Revenue and Customs – Pay As You Earn and Self Assessment ,HMRC, BX9 1AS, United Kingdom. Include:- Your full name, address, and National Insurance number.

- The tax year(s) concerned.

- Explanation of the issue (e.g., “incorrect personal allowance applied to employment income”).

- Copies of supporting documents (P60, payslips, P2 coding notice).

- Through your accountant or tax agent:

- With an authorised tax agent, it is possible to deal directly with HMRC through their Agent Services Account and to have a quicker and more professional representation.

Step 5: Wait for HMRC Review

The time taken is between 6 and 12 weeks, based on the complexity of the cases and the prevailing workload of the HMRC.

HMRC can also communicate with your employer or pension provider so as to verify numbers during review. Once reviewed, you’ll receive either:

- A revised P800 tax calculation; or

- A PAYE Coding Notice (P2) showing your updated allowance and refund confirmation.

Income Tax Threshold: How It Relates to Your Personal Allowance Petition

Understanding income tax thresholds is vital when assessing whether your petition is valid.

For the 2024/25 and 2025/26 tax years, the thresholds are:

- Personal Allowance: £12,570 (tax-free)

- Basic Rate (20%): £12,571 – £50,270

- Higher Rate (40%): £50,271 – £125,140

- Additional Rate (45%): Over £125,140

In case your income is more than £100,000, then your personal allowance will decrease by £1 per £2 above this income. This tapering provision dispenses that on earning £125,140 and above, your allowance is virtually zeroed.

A common HMRC error occurs when the system fails to adjust this taper correctly — particularly for directors, high earners, or those with variable annual income. Submission of a petition guarantees that this calculation accounts for your real taxable income, other than outdated estimates.

What Happens If Your HMRC Personal Allowance Petition Is Accepted?

If HMRC approves your petition:

- Your tax code will be updated immediately.

- Any overpaid tax is refunded, usually within 14–21 working days after confirmation.

- Future PAYE deductions automatically apply your corrected allowance.

- You may receive a letter of adjustment confirming the recalculation basis.

Refunds may be done through direct bank payment, cheque, or by adjusting your payroll (where your employer operates PAYE).

What Happens If Your HMRC Personal Allowance Petition Is Rejected?

In case it is rejected, the HMRC will provide its reason in writing. Typical reasons include:

- The petition was filed beyond the statutory four-year limit.

- Insufficient evidence of overpayment.

- The allowance was reduced correctly under the existing tax law.

- Duplicate claim already processed.

In case you are not happy with the decision, you can appeal within 30 days of the rejection letter by writing to the same address as the HMRC. Provide any other new information or documentation not already provided.

In instances where a case has not been resolved, you can take an appeal to the HMRC Adjudicator Office or the First-tier Tax Tribunal, both of which are more formal and, in most cases, may require professional representation.

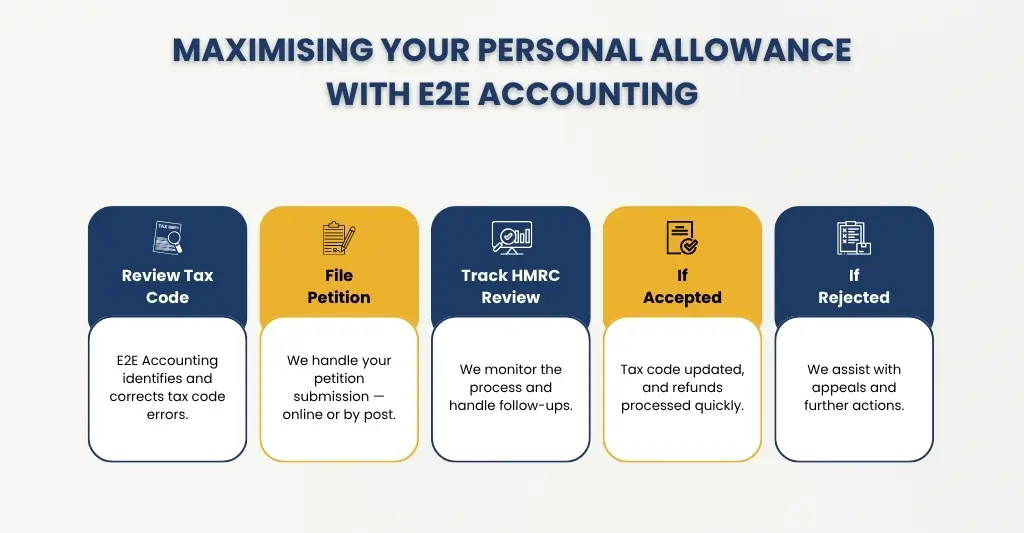

Do You Need a Tax Professional to Help with Your Personal Allowance Petition?

Although you can file yourself, hiring a good accountant or tax advisor will guarantee:

- Correct identification of HMRC errors.

- Professional documentation of the petition.

- Faster communication with HMRC through agent access.

- Integration with other tax adjustments (like overpayment relief or PAYE corrections).

At E2E Accounting, we routinely assist clients in reconciling discrepancies between payroll data and HMRC submissions — preventing minor issues from escalating into compliance risks.

Can I Adjust My Personal Allowance Throughout the Year?

Yes — and doing so is often advisable. You should notify HMRC immediately if:

- You change jobs or take on an additional role.

- You begin receiving a pension or taxable benefit.

- You claim new deductions or reliefs (e.g., professional subscriptions, marriage allowance).

- Your income significantly changes mid-year.

Updating your personal tax account ensures HMRC recalculates your code in real-time, preventing large adjustments or unexpected refunds later.

How to Optimise Your Personal Allowance and Minimise Tax Liabilities

A successful petition fixes the past — but planning ahead ensures long-term efficiency. Here’s how to optimise your position:

- Annual Tax Code Check: Review every April after HMRC updates its systems.

- Monitor the £100,000 threshold: When you are approaching it, an increase in the pension contribution or charity can be adjusted so as to maintain the allowance.

- Leverage transferable allowances: This transferable allowance could be worth £252 a year, but only if one qualifies.

- Claim all deductible expenses: Mileage, work-at-home allowances and professional subscriptions.

- Integrate petitions into year-end planning: Accountants are able to balance off the refunds against the future liabilities, which enhances the cash flow.

Conclusion

Filing an HMRC Income Tax Personal Allowance Petition is more than just a correction — it’s a safeguard against paying more than you owe. By understanding how your tax code and allowance interact, maintaining detailed records, and acting promptly when discrepancies arise, you can ensure your income tax remains fair and accurate.

Year-End Planning with E2E Accounting

At E2E Accounting, we specialise in year-end tax reviews, overpayment relief claims, and HMRC correspondence. Whether you need help filing a petition or preventing future tax code errors, our team ensures your compliance and maximises your savings.

Let’s make sure your personal allowance — and your hard-earned income — work in your favour.

Contact E2E Accounting today to schedule your year-end tax review or discuss your Income Tax Personal Allowance Petition.

People Also Ask:

How Do I File an HMRC Income Tax Personal Allowance Petition Online?

You can file via your HMRC Personal Tax Account by submitting a secure message detailing your issue or through your accountant’s Agent Services Account.

How Long Does It Take to Process My HMRC Income Tax Personal Allowance Petition?

The majority of the petitions are handled in 6-12 weeks, whereas complicated cases can take 16 weeks during the high tax seasons.

Can I Appeal If HMRC Rejects My Petition for Personal Allowance?

Yes. The appeal should be made within 30 days of the rejection notice and may present further evidence to be reviewed.

What Happens If My HMRC Personal Allowance Petition Is Accepted?

You will get a new tax code, a refund of overpayment and a revised P800 or a Self Assessment statement.

How Does My Income Tax Threshold Affect My Personal Allowance?

Incomes over £100,000 allow earning one pound less allowance for each pound of additional income, eliminating it entirely at £125,140.

Where Can I Find the HMRC Income Tax Personal Allowance Petition Form?

There’s no dedicated form. You can write directly to HMRC or amend your Self Assessment return to include your petition request.