In the UK, filing your first tax return might be difficult, particularly if you don’t know where to begin. The first step in submitting your Self Assessment is to complete your online tax return registration with HMRC. In order to submit returns, pay taxes, and maintain your records, this procedure grants you access to your personal tax account and a Unique Taxpayer Reference (UTR).

This guide will help you set up quickly and save last-minute stress by taking you step-by-step through the first-time taxpayer registration process, including who must register, how to do it, and what information you will need.

Why Online Tax Return Registration Is Important?

Anyone who needs to file a Self Assessment tax return in the UK must first register online with HMRC. You won’t be able to access your digital tax account, file your return, or pay the correct amount of tax without it.

Here’s why it matters:

- Legal requirement: You must register if HMRC anticipates that you will file a tax return. Penalties and fines may result from not completing this on time.

- Get your UTR: Obtain your UTR, or Unique Taxpayer Reference. To follow your tax data and file your return, you must have this 10-digit number.

- Availability of internet services: You may view payments, control deadlines, and file returns using your own tax account after registering.

- Prevent delays: By enrolling early, you can avoid last-minute worry as the process may take several weeks (as HMRC posts your activation code).

- Maintain control: It’s simpler to keep track of your earnings, outlays, and any taxes due when you register online.

Who Must Register — Are You Eligible?

- Sole Traders & Self-Employed: If you are self-employed or own your own company, you need to register with HMRC for self-assessment. This guarantees that you pay the appropriate personal income tax and national insurance on your earnings. Registration is necessary even if your company is small or operates part-time.

- Company Directors: Even if a limited company’s director receives their compensation through PAYE, they typically still have to file a self-assessment tax return. This enables HMRC to determine whether you are liable for any additional taxes, including those on dividends or benefits.

- People with Foreign or Untaxed Income: If you have income that isn’t taxed at source (such as investments, rental income, or some pensions) or if you make money outside of the UK, you must register for self-assessment to disclose it and pay any taxes owed.

- Commonly Missed Cases (Freelancers, Gig Workers): Individuals who operate in the gig economy, are freelancers, or have side projects- often neglect to register. If HMRC is unaware of this revenue, you may be subject to fines. Registration is required to maintain compliance, as even small amounts can be significant.

To know more about various business structures, read our blog Choosing a Business Structure in the UK: A Complete Guide.

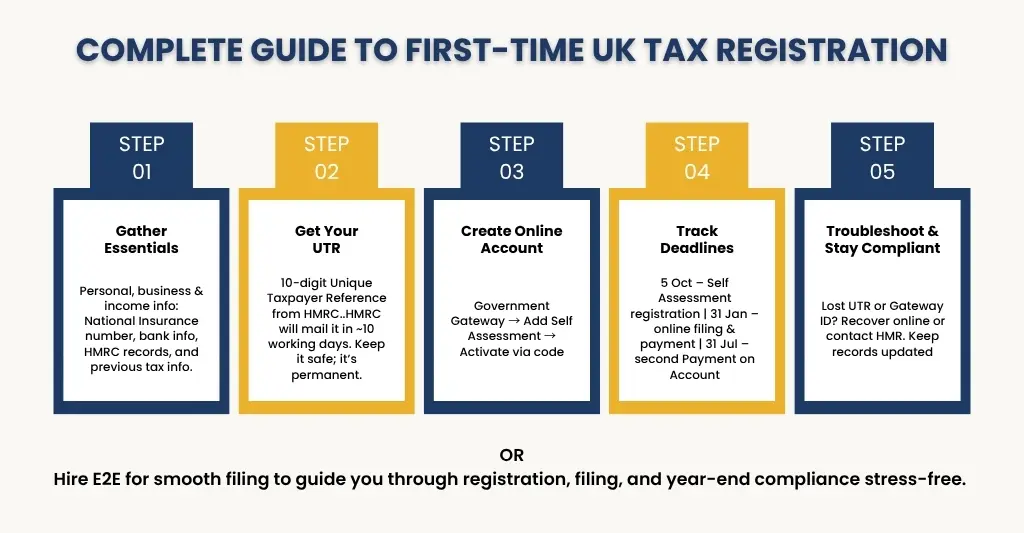

Step 1 — Quick Start Checklist for Registration

Getting all the necessary information together before starting the self-assessment registration process with HMRC is beneficial. This guarantees a seamless workflow and prevents delays. You should have the following on your checklist:

- Personal Details – Full name, date of birth, National Insurance number, and contact information.

- Business Information (if self-employed) – Business name, start date, and nature of your business.

- Income Details -Any income from employment, self-employment, pensions, savings, or investments.

- Existing HMRC Records – PAYE reference, previous tax returns (if any), and UTR (Unique Taxpayer Reference) if already assigned.

- Bank Details – For potential refunds or payments to HMRC.

Having this information on hand speeds up the registration process and guarantees that your tax records are correct from the beginning.

Step 2 — What Is a UTR & How to Apply

HM Revenue & Customs (HMRC) assigns a 10-digit number known as a UTR (Unique Taxpayer Reference) to identify people and companies in the UK tax system. It is necessary for filing self-assessment tax returns, registering as self-employed, and dealing with certain income reporting requirements.

Why You Need a UTR?

- To submit your self-assessment tax return each year.

- To demonstrate your tax position to accountants, banks, or clients.

- To guarantee that HMRC can accurately trace your tax obligations and payments.

- To become a sole proprietor or self-employed person.

When will you receive a UTR?

As soon as you register with HMRC for Self Assessment, you will automatically receive a UTR. This occurs for most people when they:

- Start working for yourself or as a freelancer.

- Make money that is not subject to taxes, such as through investments, rental properties, or side gigs.

- Income over a specific criterion must be reported.

How to Apply for a UTR?

- Register for Self Assessment with HMRC: You can apply by mail, over the phone, or online at the HMRC website. You will require your personal information, including your name, address, date of birth, and National Insurance number.

- Wait for HMRC to Process: Within ten working days of your registration, HMRC will mail your UTR (longer if you’re abroad).

- Keep It Safe: The UTR you have is permanent. It stays connected to you even if you stop working for yourself. It can be found on tax returns, HMRC correspondence, or by accessing your HMRC account online.

Key Tips:

- Apply for a UTR number as soon as you can because a UTR is required to file a tax return. Once registered, you can explore strategies to pay less tax legally and efficiently.

- You can retrieve your UTR if you’ve misplaced it by getting in touch with HMRC or reviewing previous communications.

- Don’t apply more than once because each person or company only receives one UTR.

Step 3 — Complete Your Online Tax Return Registration

To file your Self Assessment tax return digitally, you must first create an HMRC online account after obtaining your UTR (Unique Taxpayer Reference).

Why Register Online?

- This method is the simplest for submitting your self-assessment.

- Deadlines, refunds, and tax payments can all be tracked.

- Processing and payback times for digital submissions are frequently quicker.

How to Register Online for Self Assessment?

- Create a Government Gateway Account: Visit the HMRC website. Set up a Government Gateway user ID and password (this becomes your login for HMRC services).

- Add Self Assessment to Your Account: Choose “Self Assessment” as a service after logging in. Your National Insurance number and UTR are required.

- Receive Your Activation Code: Your registered address will receive an activation number from HMRC by postal mail, typically within seven days. Your online account cannot be fully activated without this code.

- Activate Your Account: Enter the activation code, verify that your account is set up, then log in using your Government Gateway ID. Now you can file a tax return online.

Step 4 — Key Deadlines to Remember

- Register for Self Assessment: by 5 October following the end of the tax year (which runs from 6 April to 5 April).

- Submit Online Tax Return: by 31 January after the end of the tax year.

- Pay Any Tax Owed: also by 31 January.

If you are filing for the first time, you need to know of common scams targeting people filing self-assessment tax returns. Read our blog on the Potential Scams Warned by HMRC and How to Protect Yourself.

Payments on Account

HMRC may request that you pay on account if your tax bill exceeds £1,000 and less than 80% of your tax is collected through PAYE.

You will pay in two instalments:

- 31 January (with any tax still owed for the previous year).

- 31 July (second instalment).

50% of your most recent tax bill is typically paid each time.

You can request a payment reduction if your income declines. HMRC credits or returns any excess money you pay. To know more about the Second Payment on Account Deadline, read our blog post.

Step 5 — Troubleshooting Common Problems

First-time online Self Assessment registration can be complicated. Despite the process’s relative simplicity, many first-time taxpayers in the UK have similar problems. Here’s how to identify them:

- Not Receiving Your UTR (Unique Taxpayer Reference): HMRC mails your UTR in ten working days (longer if you live overseas). Make sure your HMRC address is current if it hasn’t arrived. You can make another request through your HMRC online account or by getting in touch with HMRC personally.

- Lost or Forgotten Government Gateway ID: You can access it online, so don’t worry. On the HMRC login screen, select the “Recover your ID” option. You’ll need information such as your account’s email address and National Insurance number. After that, HMRC will assist you in resetting or recovering your login.

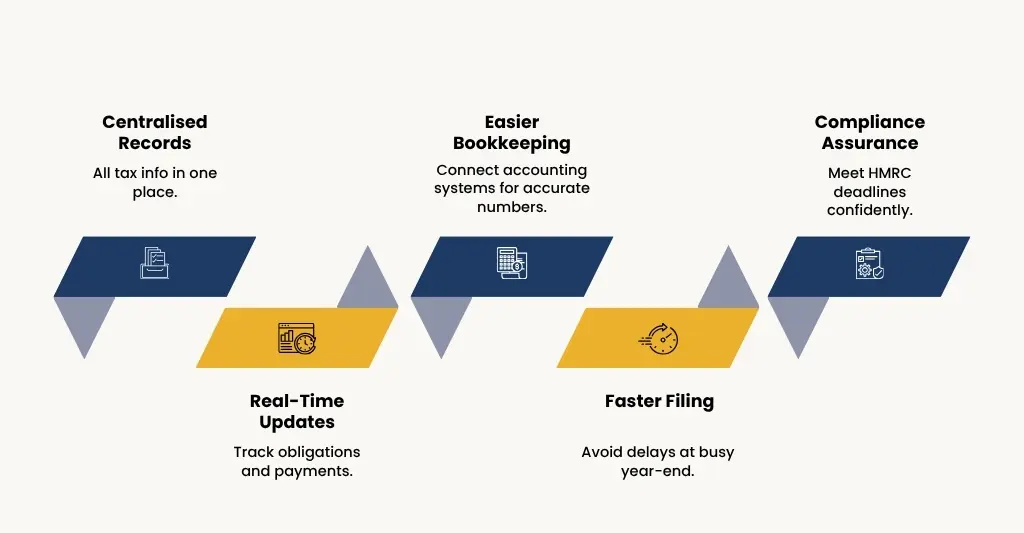

How Online Registration Supports Year End Accounting?

In addition to helping you complete your tax return, Self Assessment registration online- simplifies and speeds up year end accounting. You may access records and resources that streamline the process by creating your HMRC account early.

Key Benefits:

- Centralised records: Every tax document, UTR information, and payment history is kept in one safe location.

- Real-time updates: As they change, you may monitor your tax obligations, account payments, and due dates.

- Easier bookkeeping: Connecting your accounting system to internet tax services helps guarantee correct year end numbers.

- Faster filing: When deadlines are tight in January, you can minimise delays by keeping your account active.

- Compliance assurance: Registering online guarantees that you are prepared to fulfill HMRC deadlines and stay out of trouble.

You may prepare your year end accounts with greater visibility, organisation, and peace of mind if you register online early.

DIY vs Hiring an Accountant

You have two choices for preparing your Self Assessment tax return: either employ a professional accountant or do it yourself. Each has advantages and disadvantages, and the best option for you will rely on your circumstances.

DIY (Do-It-Yourself):

Best for: Simple tax affairs (e.g., one income source, straightforward expenses).

- Free (other than your time).

- Full control over your finances.

- HMRC provides online tools and guidance.

Risks: Time-consuming, higher chance of errors, and possible penalties if you make mistakes.

Hiring an Accountant:

Best for: Self-employed, landlords, freelancers, or anyone with complex income.

- Saves time and reduces stress.

- Ensures accuracy and compliance with HMRC.

- Can advise on tax reliefs, expenses, and savings.

DIY might be a good option if your finances are straightforward. Hiring an accountant, however, is typically worthwhile if you have a business, have several sources of income, or simply want peace of mind.

Conclusion & Next Steps

It doesn’t have to be difficult or time-consuming to manage your year end finances and Self Assessment tax return. You can prevent last-minute anxiety and possible HMRC fines by preparing ahead of time, registering online, and maintaining an organised record-keeping system. The year end accounting services offered by E2E give contractors, freelancers, landlords, and eCommerce companies a comprehensive, hassle-free solution.

We provide end-to-end assistance, guaranteeing that your accounts are correct, in compliance, and prepared for HMRC. In addition to compliance, our team offers helpful guidance on maximising your tax situation and claiming authorised costs, which will help you save money and free up time to concentrate on expanding your company. Give your year end accounting to E2E so you may submit with assurance and comfort.

People Also Ask:

Is online tax return registration the same as registering for Self Assessment?

No. Registering for Self Assessment tells HMRC you need to file a tax return and gives you a UTR number, whereas registering for online tax returns lets you log in and actually file it online. You need both to file online.

Who needs to register for an online tax return in the UK?

If you are a landlord, company partner, self-employed person, receive untaxed income, or are eligible for specific tax breaks, you must register. After HMRC issues a UTR, you can submit your tax return online.

How do I apply for a UTR number for my first online tax return?

You must register for a Self Assessment with HMRC to receive a UTR. You can complete this online by entering your personal information, including your National Insurance number, on the HMRC website. After processing, HMRC will mail your 10-digit UTR, which you can use to submit your online tax return.

What is the deadline for the income tax return in the UK?

For Self Assessment, the deadlines are:

31 October for paper tax returns.

31 January for online tax returns.

31 January is also the deadline to pay any tax owed for the previous tax year.

How do I register for a UTR number if I am self-employed?

If you work for yourself, you have to register with HMRC for Self Assessment. By entering your National Insurance number and personal information, you can complete this online. After processing, your 10-digit UTR will be mailed to you by HMRC, where you may use it to manage your taxes and file your returns.

Can E2E Accounting help me with online tax return registration?

Yes, to guarantee that your year end accounts are accurate and in compliance with HMRC, E2E Accounting can assist you with the online tax return registration process.

If you require assistance for registering your year end accounts or filing your taxes online? Get in touch with E2E Accounting.