Receiving a letter from HMRC doesn’t always mean you’ve made a mistake. The P800 refund letter is good news-it means you have overpaid taxes through the PAYE system which will be returned to your account once processed. In this blog we will discuss the entire process of claiming and receiving your refund. We will also look into how to claim your p800 refund safely online, while avoiding common scams.

Before diving into the mistakes and tax code, let the users who have received the P800 tax refund letter navigate the claiming landscape at this instant.

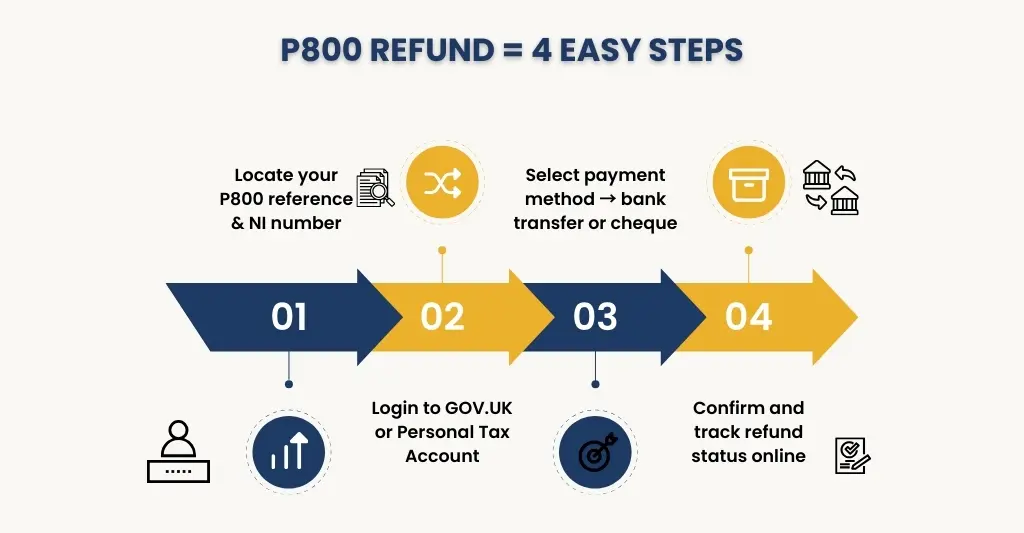

Follow these 4 easy steps to claim your P800 tax refund online:

- Once you had received your P800 letter, check for the reference number and your National Insurance Number.

- Sign into your Personal Tax Account on GOV.UK or use the link in your P800 letter.

- Choose “Claim refund” and select bank transfer (fastest) or classic cheque.

- Confirm the details. HMRC usually pays within 5 working days when bank transfer option is selected.

Now, back to the cause-effect narration style for the rest of us UK taxpayers who want to spread the facts on bread and eat them (literally!).

Common Reasons British Workers Overpay Tax

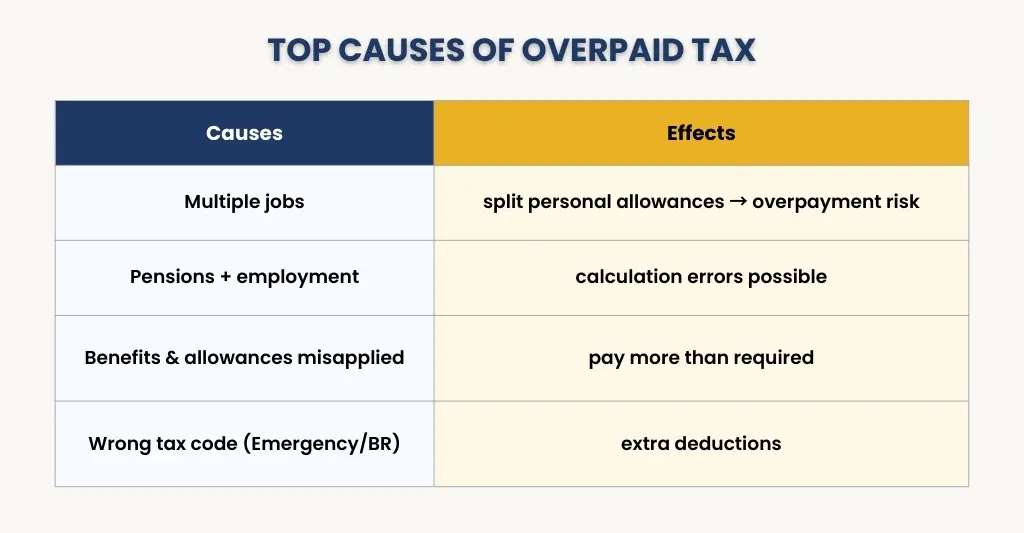

Employment Changes Throughout the Tax Year:

Workers who juggle multiple jobs throughout the tax year frequently encounter this issue. If you started or had left a job mid-year, HMRC’s system can sometimes struggle to divide your personal allowances between different employers. This can lead to excessive deductions and taxes being taken by HMRC.

Pension and Employment Combinations:

While you receive your income through the PAYE system, drawing state pension alongside can create confusion within HM Revenue & Customs system leading to errors in tax calculations. This can later trigger a P800 refund.

Benefits and Allowances Miscalculations:

Working from home expenses, certain benefits, or allowances such as uniform costs, job-related expenses, mileage claims, and professional subscriptions are sometimes applied incorrectly by HMRC. If these aren’t accounted properly, you end up paying more tax than you should. To ensure you pay the right tax every time while utilising allowable expenses- read our blog-on what expenses you can claim for different industries.

Find out what professional accounting could cost your business in just a minute. Enter your sector, turnover, VAT registration, and employee details for a tailored estimate.

HM Revenue & Customs Tax Code Overpayment

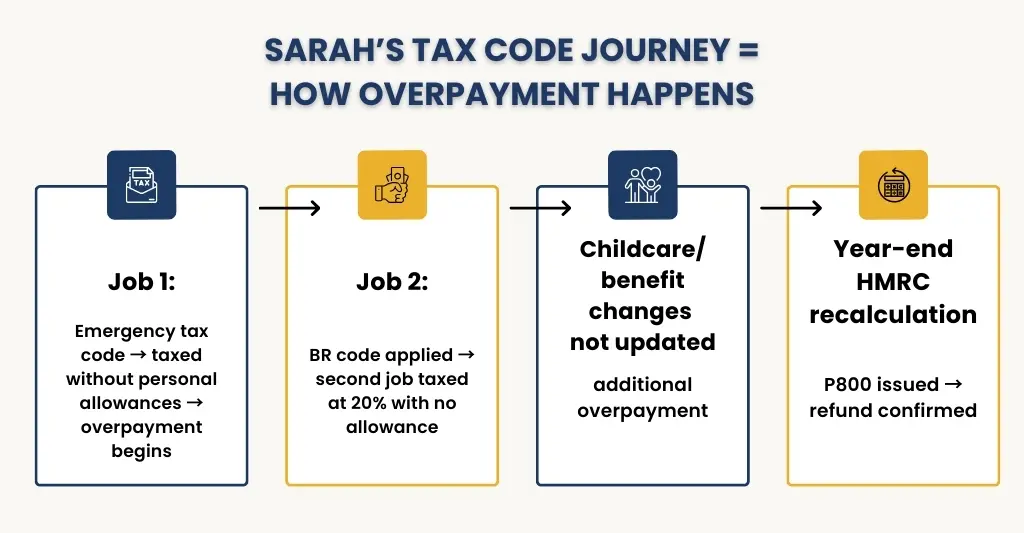

One of the biggest causes of a P800 refund is an HMRC tax code overpayment. This happens when HMRC assigns the wrong tax code to you, and your employer applies it through payroll. As a result, you may end up paying more tax than you should. Let’s understand with an example-

- Emergency tax code

Sarah started her new job. She is excited to receive her first paycheck. When it arrived, she noticed that her take-home pay was lower than expected. What she didn’t realise was that HMRC had put her on emergency tax code.

This happens when HMRC doesn’t yet have all your details like your P45 from your old job. In the case of Sarah, her wages were taxed as if she didn’t have any personal allowances, leading to her paying too much tax each month.

- BR tax code

Later on, when Sarah picked up a second part time job on weekends to earn some extra money, HMRC gave her second employer a BR tax code, assuming that her personal allowance was already used by her first job. This meant that whatever she earned from her second job was taxed at 20% with no tax-free allowances.

Here, the important point to note is that – your allowance is meant to cover total income, not just the first job. HMRC applies the BR code during the year as a conservative measure, but at the end of the tax year, they review total income from all jobs to ensure you haven’t overpaid.

- Tax Code Not Updated

During the same tax year, Sarah’s childcare benefit ended. So, if HMRC failed to update her code immediately, she continues paying more tax than necessary.

Receiving the P800 Refund

When HMRC reviewed all of Sarah’s income from her main job, weekend job, and any benefit changes. They spotted that she had overpaid tax in multiple ways. She was then issued a P800 letter showing her total refund and explaining how to claim it.

HMRC Tax Refund Letter

Your P800 Refund, in this case – Sarah will be communicated through an HMRC tax refund letter- outlining her income, tax paid, and what HMRC owes to her after recalculation. Key things to look for are:

- P800 reference number (unique to your case, and required when claiming P800 refund online)

- Letter about tax refund wording (outlining in clear words that Sarah is due money back)

- Details of Overpayment (showing exactly how much taxes Sarah had overpaid after HM Revenue & Customs reviewed her total income. It included extra deductions from her first job (Emergency tax code), her weekend job (BR code), and any adjustments not made after benefits changed)

A genuine P800 letter will arrive by post or appear in your HMRC online account. It will never be sent by mail or text.

HMRC Tax Refund Bank Transfer

After you, or in this case Sarah, had received her P800 letter, she now has the option to get her refund directly into her bank account via an HM Revenue & Customs tax refund bank transfer. To complete this process-

- She has to go to GOV.UK and log in to her government gateway account. Or, she can use the link in her P800 letter and enter her P800 reference number and National Insurance number to see her refund and choose how she wants to get paid.

- She can then select” bank transfer” for direct payment into her account.

- After reviewing the details and confirming the request, HMRC usually processes the bank transfer within a few days.

- She can then check her account for refund, and accordingly keep record of the transactions.

Refunds claimed by bank transfer usually arrive within 5 working days. If you have requested via cheque, it can then take up to 6 weeks.

What to Do If You Haven’t Received a P800 Refund

Most times when you claim a refund via an HM Revenue & Customs tax refund bank transfer, the money owed is processed within 5 working days. However, under complex circumstances, the system cannot finalise everything automatically. Hence, HMRC conducts manual checks to ensure that the refund amount is accurate.

In Sarah’s case, her placement on an emergency tax code when she started a new job, to an incorrect BR code, that taxed her entire second income at 20% allowance – the system flagged her case for manual review.

What You Should Do:

- Check Your Personal Tax Account – by signing with your government gateway details and reviewing your tax calculation

- Look for messages from HMRC

- Contact HMRC if nothing changes, and have your NI number and P800 reference number ready.

- Provide any requested documents quickly.

When Sarah hadn’t received the amount due, even after claiming her refund online, she logged into her personal tax account. There it showed ‘pending review’ status. She contacted HMRC and learned her case needed manual checks because she had two jobs and had been on both an emergency tax code and a BR code earlier that year. HM Revenue & Customs requested to submit her P60 and payslips to verify earning.

After she complied with the request, HMRC approved her refund, and Voila- two weeks later she got the money in her bank account.

Avoiding P800 Refund Scams

Where there is money, there are scams. It is important to remember by heart that HMRC never initiates contact about refund via text or mail. All genuine communications arrive by post or through your secure online tax account.

To claim your refund, always use the official GOV.UK website only. Never click on links within an email or text message no matter how genuine it looks and sounds. Scammers feed on the people’s excitement about receiving money back from HMRC. Also, HMRC does not charge you to claim your refund- the service is completely free. Ignore companies that claim to solve your queries faster with a small percentage of refund to be transferred to them. It’s a scam. Still unsure? call HM Revenue & Customs to confirm the letter is genuine.

With the online Self Assessment deadline of 31 January 2026 approaching, hmrc warns of scams targeting people filing self-assessment tax returns – read our guide to the latest scam tactics and how to protect your refund

Conclusion & Next Step

Once you come to know why you overpaid, take steps beforehand to prevent it from happening again. Keep the HMRC updated about significant life changes – be it- starting or stopping pension, changing employment status or modifications to your employee benefit, revise your information with HMRC and ensure your employer has the correct tax code from day one.

Regularly check your personal tax account, particularly after job changes or at the start of a new tax year. Use the official gov.uk channel to avoid scams.

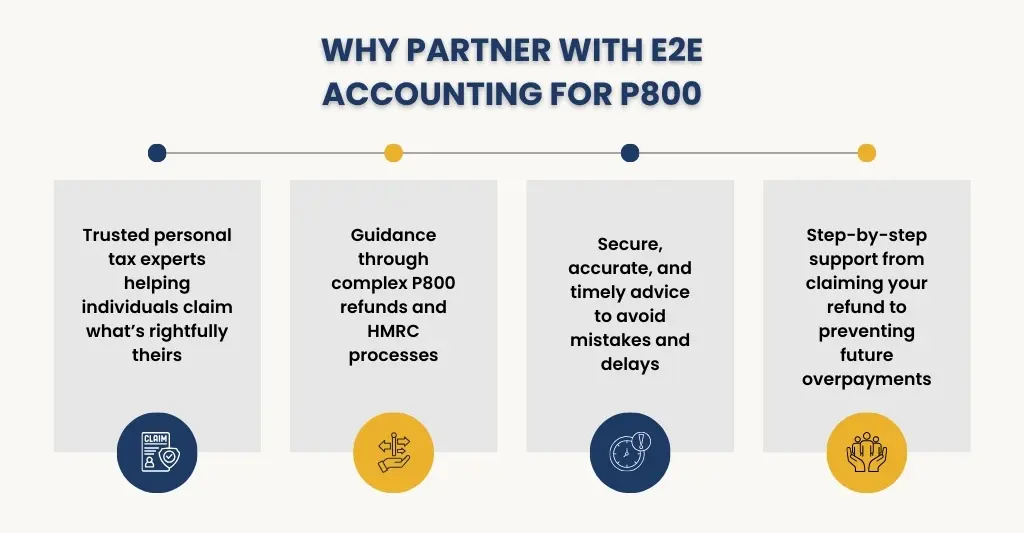

If you want help making sense of your P800 refund, or you are unsure of your personal tax situation, contact the E2e Accounting team to help you. Our personal tax experts help you claim what’s rightfully yours and avoid the stress of dealing with HMRC alone.

People Also Ask:

What is a P800 refund?

A P800 refund is the money returned to you by HMRC if you paid too much tax under PAYE. It happens when HMRC reviews your records after the tax year end, and finds an overpayment.

How do I claim my P800 refund?

Only use the gov.uk P800 refund portal and enter your P800 reference number and NI from the letter. Review your refund details and choose how you want to be paid.

✔ Bank transfer – usually within 5 working days

✔ Cheque – can take up to 6 weeks

How long does it take to get an HM Revenue & Customs tax refund bank transfer?

If there are no delays caused by manual reviewing, HMRC refund by bank transfer usually arrives within 5 working days after your claim is processed.

What does an HMRC tax refund letter look like?

An HMRC tax refund letter (P800 letter) includes your income, the tax you paid, the recalculation, and a P800 reference number. It will arrive by post or appear in your HMRC online account – never by email or text.

When will I get my P800 refund?

Most letters are issued between June and November following the end of the tax year. Once you claim, your refund will be processed within a week if sent by bank transfer, and up to 6 weeks by cheque.

Can HMRC contact me by text or email about a P800 refund?

No, you don’t receive P800 refund notifications by text or email. HMRC P800 letter will arrive by mail on your registered postal address. You can also login to your HMRC personal tax account online to view your details and claim your refund securely.

Any messages with links are potential scams.

Where can I find the P800 reference number on the HMRC letter?

You’ll find the P800 reference number typically located near the date in the top–right corner of your P800 letter. Look for labels like “reference” or “tax reference” to spot it easily

What if I disagree with my P800?

Check payslips/P60, then contact HMRC’s income tax enquiries with supporting documents to challenge the calculation.

How can E2E Accounting help with my P800 tax refund?

We’ll review your P800 calculation, check payslips/P60s, contact HMRC on your behalf if needed, and help claim any refund. Plus we advise on how to avoid future overpayments. Book your free P800 check today.