Scaling an eCommerce brand in the UK is no longer just about outstanding products and eye-catching marketing; it’s also about having financial data you can rely on. Generic accountants may overlook the complexities of internet selling, including marketplace payouts, foreign currency fees, and fluctuating VAT restrictions.

This 2026 guide to the top ten eCommerce accountants in the UK showcases specialists who understand platforms such as Amazon, Shopify, and Etsy, ensuring that your statistics remain accurate while you focus on growth.

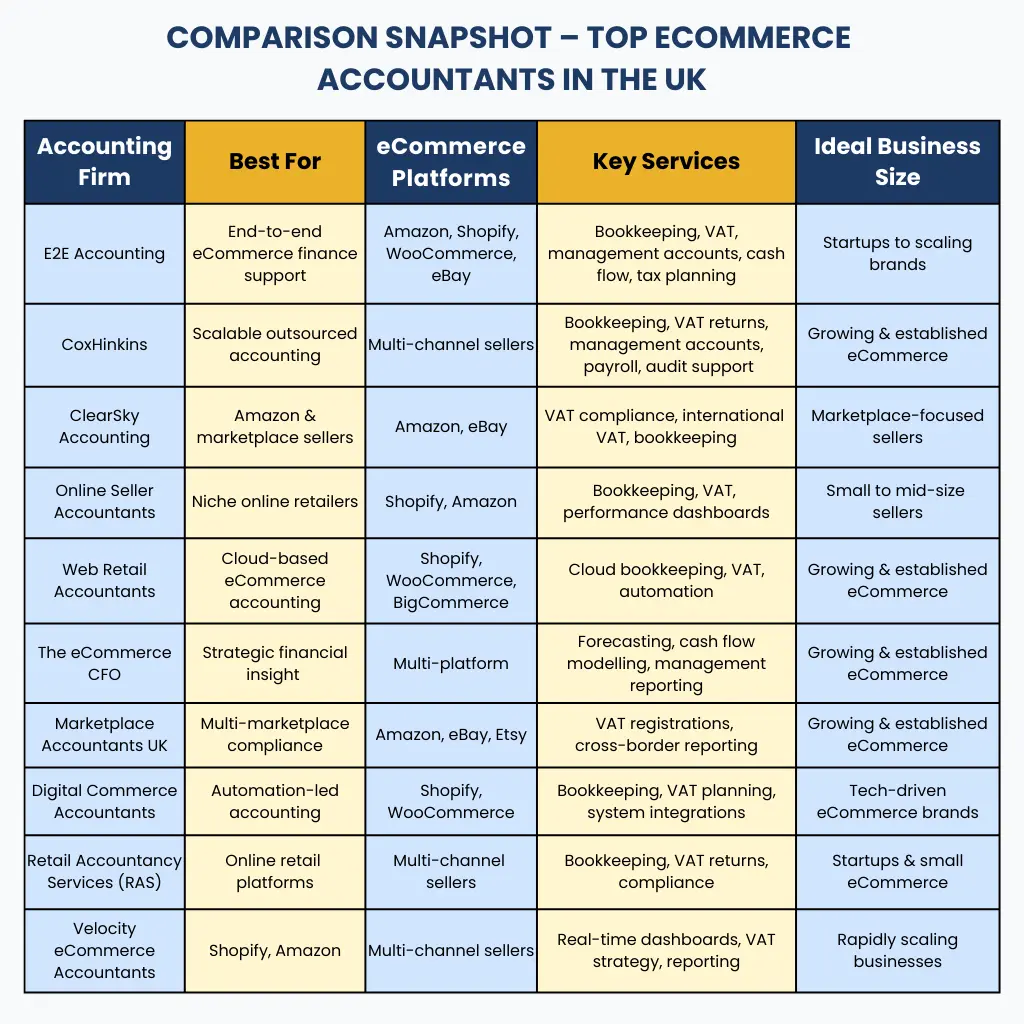

Top 10 eCommerce Accountants in the UK

Here’s a handpicked list of the UK’s top eCommerce accounting firms and specialists, chosen for their extensive knowledge of online retail, multi-channel platforms, VAT complexity, and growth-oriented financial support.

#1 E2E Accounting UK:

E2E Accounting is a top choice for eCommerce businesses looking for proactive, tech-enabled financial help. With expertise in cloud accounting (Xero, QuickBooks, and Sage), VAT planning, digital-first bookkeeping, and cash flow forecasting, eCommerce accountants assist online sellers in keeping their finances in order while focusing on growth. Their services include tailored reporting for platforms such as Shopify and Amazon, controller-level analytics, and smart tax planning, making them suited for both new and growing eCommerce firms.

#2 ClearSky Accounting:

ClearSky Accounting is well-known for its work with Amazon sellers and marketplace enterprises, and it specialises in VAT, worldwide tax compliance, and multi-platform bookkeeping. Their focus on eCommerce operations enables vendors to increase profitability while remaining compliant across jurisdictions.

#3 Online Seller Accountants:

Online seller accountants is a specialty accounting firm dedicated to online retailers, combining eCommerce platform experience with traditional accounting discipline. They manage sales tax, digital VAT, custom bookkeeping packages, and performance dashboards for fast-growing online retailers.

#4 Web Retail Accountants:

Web Retail Accountants combines cloud accounting and eCommerce analytics to assist sellers manage accounts, automate operations, and prepare proper VAT reports. Their proactive strategy makes them ideal for Shopify, WooCommerce, and BigCommerce business.

#5 The eCommerce CFO:

The eCommerce CFO specialises in strategic finance beyond basic compliance, providing management accounts, cash flow modeling, and performance analysis targeted to online enterprises. This approach is especially useful for scaling brands that require insight-driven financial planning.

#6 Marketplace Accountants UK:

Marketplace Accountants UK is one of the go-to accountants for businesses selling on multiple marketplaces like Amazon and eBay. They take care of the tricky stuff like VAT registrations, foreign sales reporting and bookkeeping that’s tailored to your specific needs. They are experts at helping merchants comply with all the rules and regulations, and also help them squeeze every last bit of profit from their sales.

#7 Digital Commerce Accountants:

Digital Commerce Accountants offer the full range of services for online shops – from cloud accounting to VAT planning and bookkeeping. They get that digital platforms and automation tools can make a real difference to your business. They help eCommerce organisations cut through the manual labour and boost the accuracy of their numbers – freeing up time and resources to focus on what really matters.

#8 Velocity eCommerce Accountants:

Velocity eCommerce Accountants are well-known for providing hands-on support to direct-to-consumer brands. They link cloud accounting with eCommerce systems, offer complex VAT tactics, and create unique financial dashboards that provide merchants with real-time performance data. Their method is practical for businesses dealing with rapid growth and international sales.

#9 Retail Accountancy Services (RAS):

RAS provides an affordable way for small eCommerce businesses to get the accounting support they need – including VAT returns and bookkeeping. But what really sets them apart is their ability to combine a personal, boutique service with some seriously cool digital integration. That makes them a great fit for new and growing online retailers who want a reliable partner to help them get to the next level.

#10 Elevate Online Accountants:

Elevate Online are the go-to experts for digital retail finance. They offer custom bookkeeping, VAT prep and cash-flow optimisation tailored to their clients’ specific needs. But what really sets them apart is their expertise with subscription-based eCommerce models and businesses with recurring revenue – where accurate, dynamic financial reporting can be the difference between success and failure.

Curious about the accounting costs for your eCommerce business? Use our free calculator to get a custom price range in just 60 seconds. Try it now!

Common Mistakes to Avoid

Choosing the wrong accountant can quietly drain your income, stifle growth and leave your eCommerce business wide open to some very major regulatory headaches. So let’s cut to the chase and make sure you avoid making some of the common mistakes that can end up costing you a pretty penny when choosing the Top 10 eCommerce Accountants in the UK.

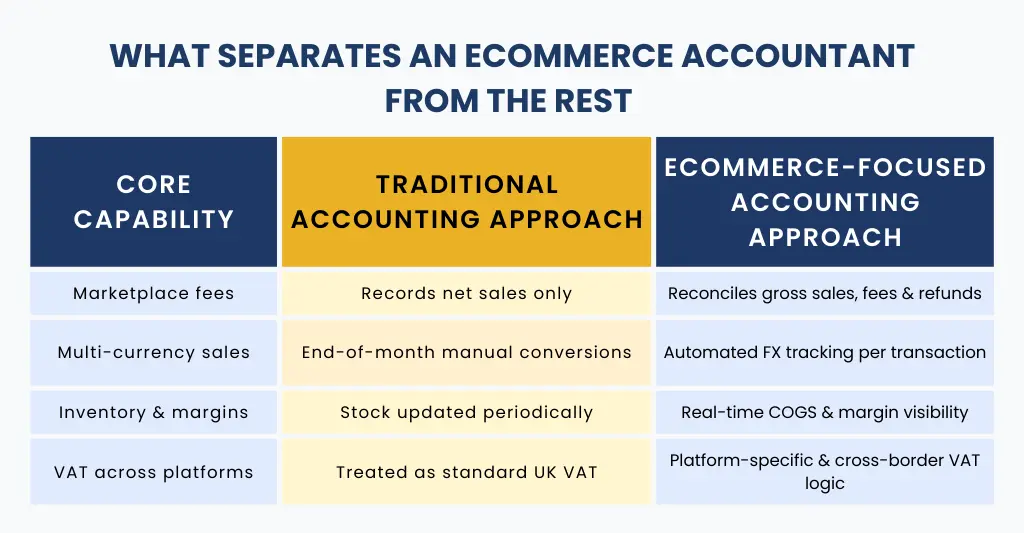

- Choosing a General Accountant Instead of an eCommerce Specialist: eCommerce accounting is a whole different ball game from traditional bookkeeping. You’ve got to think about stuff like inventory values, selling across multiple channels, payment gateways and those pesky marketplace fees – all of which demand a pretty deep level of expertise. A generalist accountant might just end up missing some of the key points that are so vital to selling online.

- Ignoring Marketplace-Specific Knowledge: Each platform – Amazon, Shopify, everything has its own reporting system, its own fees and its own settlement times. If your accountant isn’t familiar with the specifics of these platforms then they’re not going to be able to get your reconciliation right and you’re probably going to end up with some nasty VAT issues.

- Focusing Only on Price, Not Value: Low cost accounting may look like a great deal at first but the reality is that it will usually come with a whole lot of compromises. You may end up with limited support, a really slow turnaround, or just plain wrong figures – all of which can have a major impact on your cash flow and your decision-making.

- Not Asking About Inventory & COGS Management: If your inventory tracking is all over the shop then your profit margins are going to be all over the place too. So, your accountant needs to have a really solid understanding of stock valuation methods, landing costs and cost of goods sold (COGS) – the lot.

- Ignoring Automation & Tech Stack Compatibility: Modern eCommerce accounting relies on cloud-based tools and all sorts of integrations. If your accountant isn’t using things like Xero, QuickBooks, or eCommerce connectors then you’re more than likely going to end up with some major delays in your operations.

- Poor Communication & Slow Response Times: You can bet your bottom dollar/pound that delayed responses in the middle of a VAT deadline or a cash flow crisis are going to cause a lot of damage. eCommerce businesses need to be able to communicate clearly and proactively – it really is that simple.

Conclusion

Choosing the Top 10 eCommerce Accountants in the UK is more than just ticking a checklist; it’s about finding a long-term partner who understands how online businesses work. With rising VAT complexity, tighter HMRC scrutiny, and fast-moving sales channels, eCommerce accounting in 2026 will require accuracy, speed, and strategic insight.

The appropriate eCommerce accountant will help you stay compliant, increase cash flow visibility, manage inventory profitably, and make sound growth decisions. More significantly, they will adapt as your firm grows, whether you are entering new markets, selling worldwide, or preparing for quick expansion.

People Also Ask:

How can accounting help maximise my eCommerce profits?

Accounting helps to maximise eCommerce revenues by displaying your genuine margins after fees, VAT, shipping, and returns. It identifies unprofitable goods, lowers expenses, improves cash flow, and supports smarter pricing and inventory decisions, allowing you to keep more of your earnings.

How much does an eCommerce accountant cost in the UK?

In the United Kingdom, an eCommerce accountant normally charges between £60 and £300 per month, depending on your sales volume, platforms, and services required (bookkeeping, VAT, reporting). Larger or more complex eCommerce enterprises may pay over £250 per month for specialised help. Go for E2E. Explore our pricing and take a 60 second estimator.

Do eCommerce businesses in the UK need specialist accountants?

Yes. UK eCommerce businesses require specialised accountants since online sales entail complex areas such as marketplace fees, inventory management, VAT (including cross-border restrictions), and multi-channel reporting. A specialist provides more precise accounts, HMRC compliance, and greater profit visibility than a typical accountant.

How can I find a reliable ecommerce accountant near me?

Here’s how to discover a trusted eCommerce accountant near you (UK):

– Ask for recommendations from other eCommerce business owners or online seller forums.

– Look up accountant listings in specific directories such as ACCA, ICAEW, and eCommerce.

– Check out reviews and case studies from online stores (Shopify, Amazon, etc.).

– Verify VAT and digital sales competence, especially if you’re selling globally.

– Interview the shortlisted accountants about their technologies (Xero/QuickBooks), reporting frequency, and fees.

Focus on eCommerce experience and good communication, rather than proximity,many accountants operate remotely and get excellent outcomes.

Are remote eCommerce accountants reliable in the UK?

Yes, remote eCommerce accountants in the UK are trustworthy if they possess good expertise, positive recommendations, and use secure cloud accounting solutions (such as Xero, QuickBooks, or DEAR).