Year end accounts are crucial for limited companies in the UK. These accounts record an entity’s transactions and operations throughout the financial year, providing a comprehensive financial summary. To ensure tax compliance, assess financial performance, make informed strategic decisions, and fulfill legal requirements, it is crucial to prepare year end accounts accurately.

In this blog, we will examine the importance of year end accounts, their components, and the due dates and penalties associated with their submission.

What Are Year End Accounts?

A company’s financial activities for a given accounting period, usually 12 months, are summarised and presented in year end accounts, also known as annual accounts. These accounts provide a thorough summary of the entity’s performance and financial transactions over the course of the accounting period.

Presenting a transparent and accurate picture of the company’s financial status, including its assets, liabilities, income, expenses, and profits or losses during the financial year, is the main goal of year end reports. Since they provide important information on the company’s financial health and viability, they are crucial for a variety of stakeholders, including creditors, investors, owners, and regulatory bodies.

What’s Included in Year End Accounts?

- Profit and Loss Statement: Summarises your company’s revenue and costs for the year and indicates if you turned a profit or a loss.

- Balance Sheet: A summary of your company’s assets, liabilities, and equity at the end of the year.

- Notes to the Accounts: Details that go into greater depth about important numbers, accounting procedures, and any unusual transactions.

- Director’s or Auditor’s Report: Describes the operations, financial situation, and any audit results of the company. Essential for specific limited companies.

When Are Year End Accounts Due in the UK?

Both Companies House and HMRC (HM Revenue & Customs) require limited firms in the UK to submit their year end (or annual) accounts. Depending on whether you’re filing for the first time or a subsequent filing, the deadlines vary slightly:

- Companies House Deadlines

- First accounts: Due 21 months after the date of incorporation.

- Subsequent accounts: Due 9 months after the end of your company’s financial year.

- HMRC (Corporation Tax Return) Deadlines

- The full statutory accounts and corporation tax return for your business must be filed within a year after the conclusion of your accounting period.

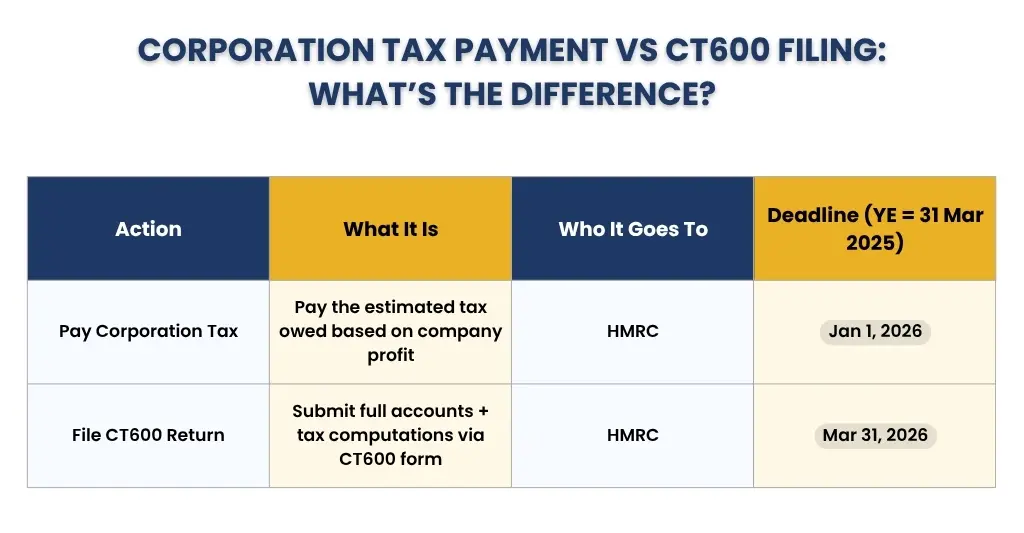

- However, any unpaid corporation tax must be settled within nine months and one day following the conclusion of your accounting period.

Example:

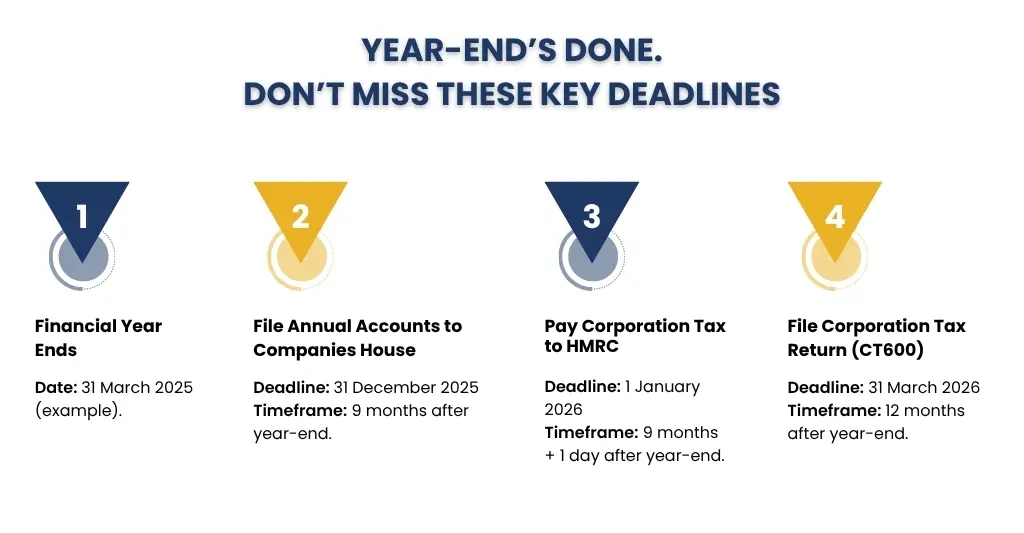

If your accounting period ends on 31 March 2025:

- File with Companies House by 31 December 2025.

- Pay Corporation Tax by 1 January 2026.

- File Corporation Tax Return with HMRC by 31 March 2026.

Who Needs to File Year End Accounts — and How It Works by Business Type

Sole Traders:

HMRC determines how much income tax and national insurance you owe; this process discloses your earnings and expenditures. Therefore, in the UK, sole proprietors must file an annual self-assessment tax return with HMRC.

Deadline for online filing: 31 January following the end of the tax year (e.g., for the 2024/25 tax year ending 5 April 2025, the filing deadline is 31 January 2026).

- Deadline for paper returns: 31 October (of the same year the tax year ends).

- Payment deadline: 31 January (same as filing deadline), with a possible second payment on account due by 31 July.

Partnerships:

You must file both an individual tax return for each partner and a partnership tax return (SA800) for a business partnership.

- SA800 filing deadline: The SA800 must be filed by the end of the tax year on either January 31 (online) or October 31 (paper).

- Partner Self Assessments (SA100): The same dates as for sole proprietors apply to Partner Self Assessments (SA100)- January 31 online and October 31 on paper.

- Payment: By January 31st and possibly July 31st for account payments, each partner pays taxes on their portion of the profits.

Partnerships do not have to pay Corporation Tax to HMRC, but each partner is required to pay Income Tax and National Insurance according to their profit-sharing percentage.

Ltd Companies:

Limited companies must meet both Companies House and HMRC filing requirements.

–> Statutory Accounts (Companies House):

- First year: Due within 21 months of incorporation.

- After that: Due 9 months after the company’s financial year ends.

–> Corporation Tax Return (CT600) (HMRC):

- After the accounting period ends, submit the CT600 and complete accounts within a year.

- One day and nine months after the end of the accounting period, corporation tax payments are due.

Accounts must be precise and compliant to avoid penalties and potential legal action. To accomplish these duties, most businesses employ accountants.

Dormant Companies and LLPs:

Dormant Companies: If a corporation hasn’t had any major transactions in a fiscal year, it’s said to be inactive. Inactive businesses still need to:

- Use the same deadlines to file inactive accounts with Companies House (9 months following year end).

- Submit a Confirmation Statement every year.

- If HMRC requests it, only then should you file a Corporation Tax return. Otherwise, you might not be affected.

LLPs (Limited Liability Partnerships):

LLPs must file:

- Even in the event of a loss, they must submit annual reports to Companies House.

- Like a general partnership, an SA800 partnership goes back to HMRC.

- Individual tax returns for every member (SA100).

You still need to file dormant accounts with Companies House if your LLP is dormant, but you might not have to file a SA800 unless HMRC asks you to.

How to Prepare Year End Accounts?

An essential duty for each company is to prepare year end accounts. Following a defined procedure helps guarantee compliance and prevent last-minute stress, regardless of whether you’re a limited business, partnership, or sole proprietor.

Step 1 – Close Your Books

Finalising your financial records for the accounting year is a prerequisite for creating your year end accounts. This is involved with:

- Reconciling bank statements: Ensuring all transactions match your accounting records.

- Checking for outstanding invoices: Verify the accounts receivable and payable to see what has been paid and what is still due.

- Record all expenses: Include any outstanding bills, travel expenses, subscriptions, and petty cash.

- Posting year end journals: Such as accruals, prepayments, depreciation, and stock adjustments.

The accuracy and compliance of the reports you produce later are guaranteed when your books are closed correctly.

Step 2 – Generate Reports

Once your records are finalised, you need to generate the key reports required for filing:

For limited businesses, this consists of:

- Profit and Loss Statement (P&L).

- Balance sheet- summary of your year end equity, liabilities, and assets.

- Unless exempt, statutory accounts must contain a directors’ report, notes to the accounts, and occasionally an auditor’s report.

For sole traders or partnerships, the focus is on producing:

- Income and expenditure statements

- Capital accounts (for partnerships)

These reports feed into your Corporation Tax return (CT600) or Self Assessment tax return.

Step 3 – File Accounts

The filing requirements for various entities differ:

- Companies House: Within nine months of the end of your fiscal year, submit your statutory accounts.

- HMRC: Within a year after the end of the year, submit your full accounts and Corporation Tax return (CT600). The deadline for paying the tax is nine months and one day.

Partnerships and sole proprietors are required to file Self Assessment tax returns to HMRC by January 31 of the year after the end of the tax year, although they do not file with Companies House.

Tip – Use Accounting Software or Outsource to an Expert

Manually preparing year end accounts can be tedious and error-prone. Here’s how to simplify it:

- To automate bookkeeping, create reports, and monitor due dates, use accounting software such as Xero, QuickBooks, or FreeAgent.

- Hire a professional bookkeeper or accountant to handle your bookkeeping needs; they can identify areas for improvement, guarantee compliance, and save you time.

- The year end procedure can be streamlined by using cloud-based technologies that provide you and your accountant with real-time access to your finances.

By assisting you in avoiding penalties and enhancing your financial planning, this modest investment frequently pays off.

Year End Accounting Checklist for UK Businesses

Utilise this checklist to make sure your company maintains compliance and meets its financial obligations at the end of the financial year.

Finalise Your Financial Records:

- Reconcile all bank accounts and credit cards.

- Review outstanding invoices (unpaid customer invoices)

- Chase overdue payments if necessary.

- Record all business expenses, including receipts and mileage.

- Post any final journal entries (accruals, prepayments, depreciation)

Take Stock (if applicable):

- Conduct a physical inventory count.

- Adjust stock values for write-offs, damages, or obsolescence.

Review Payroll Records:

- Verify the accuracy of all payroll, pensions, and PAYE records.

- Complete year end payroll reports, including P60s and P11Ds if necessary.

Generate Year End Financial Reports:

- Profit and Loss Statement (P&L)

- Balance Sheet

- Cash Flow Statement (optional but useful)

Prepare and Submit Accounts:

- Prepare statutory accounts in the required format

- Submit accounts to Companies House (within 9 months)

- Pay Corporation Tax (within 9 months + 1 day)

- File Corporation Tax Return (CT600) with HMRC (within 12 months)

Review Business Performance:

- Compare current year results with previous years.

- Set goals for the next financial year.

- Meet with your accountant for strategic planning.

Best Accounting Software for Year End Preparation

Year end preparation can be accelerated, simplified, and improved with the use of the appropriate accounting software. Here are a few of the best choices that UK companies use:

Xero:

- Cloud-based and approved by HMRC.

- Automates invoicing, VAT, and bank feeds.

- Generates year end reports and establishes connections with accountants.

- Excellent for small and medium-sized enterprises.

QuickBooks Online:

- Easy to use and perfect for non-accountants.

- Keeps track of earnings, outlays, payroll, and mileage.

- Integrated Self-Assessment and Corporation Tax Tools.

- Dashboards and reporting in real time.

Sage Business Cloud Accounting:

- A reliable supplier in the UK with robust compliance components.

- Good for expanding companies with intricate requirements.

- Manages year end accounting, payroll, VAT, and invoicing.

- Provides collaborative tools for accountants.

Where and How to File Year End Accounts

Correctly filing your year end accounts is crucial to maintaining compliance and avoiding fines. Depending on the type of business you run, here’s where and how to submit them:

Where to File?

- Companies House (for Limited Companies & LLPs): Utilise accounting software or the Companies House website to electronically submit your statutory accounts. These must be filed within nine months of the end of your company’s financial year.

- HMRC (for all businesses):

- Limited Companies: Use HMRC’s online service or software to file your Corporation Tax Return (CT600) and full accounting.

- Sole Traders & Partnerships: Self-Assessment tax returns (and SA800 for partnerships) must be filed by sole traders and partnerships.

How to File?

- Online via Government Portals

- WebFiling at Companies House: For basic account submissions

- HMRC Online Services: For Self-Assessment and Corporation Tax. Requires establishing authentication codes and a company tax account.

Penalties for Late or Incorrect Filing

Companies House and HMRC may automatically impose a penalty for late filings or inaccurate accounts.

- Companies House (Limited Companies)

- Up to 1 month late: £150

- 1–3 months: £375

- 3–6 months: £750

- Over 6 months: £1,500

Penalties double if late for 2 years in a row.

- HMRC (Corporation Tax Return)

- 1 day late: £100

- 3 months: +£100

- 6 months: +10% of unpaid tax

- 12 months: another 10%

Example: Why Timely Filing Matters?

Assume that your limited company owes £5,000 in unpaid taxes after filing its corporation tax return four months late and its accounts with Companies House 2.5 months late.

- Companies House Penalty:

Since the accounts are between 1–3 months late → £375

- HMRC Penalties:

- £100 (1 day late)

- +£100 (after 3 months)

- No 10% yet (applies at 6 months)

- → Total: £200

Total penalties: £375 (Companies House) + £200 (HMRC) = £575

If this happens two years in a row, the Companies House penalty would double to £750, just for being a few weeks late.

UK Tax Year Dates and Why They Matter

Maintaining compliance and preventing missed deadlines requires an understanding of the UK tax year.

UK Tax Year Dates:

- Tax year runs: 6 April to 5 April the following year

- Example: The 2024/25 tax year runs from 6 April 2024 to 5 April 2025

Why It Matters?

- Sole traders & partnerships use these dates to file Self Assessment returns

- PAYE (Pay As You Earn) is calculated based on the tax year

- Deadlines for tax returns and payments are based on the tax year

- Self Assessment deadline: 31 January after the tax year ends

- Paper returns: 31 October

How Much Do Accountants Charge for Year End Accounts?

Fees vary based on business type, complexity, and location:

- Sole traders: £150–£400

- Partnerships: £300–£600

- Limited companies: £600–£1,500+

- VAT-registered or complex companies: £1,000–£2,500+

Prices often include tax returns, basic advice, and Companies House filing.

Can I Do My Year End Accounts Myself?

Yes, you can — especially if you’re a sole trader or have a simple business. HMRC and Companies House both offer online filing tools.

You Can DIY If:

- Your accounts are straightforward

- You’re confident with numbers and tax rules

- You use accounting software (e.g., FreeAgent, QuickBooks)

Benefits of Outsourcing Year End Accounting Services

You can increase accuracy, decrease stress, and save time by outsourcing your year end accounting services. Here’s how,

- Expert Compliance: Ensures filings meet HMRC and Companies House requirements. It reduces the risks of errors and penalties.

- Time-Saving: Frees your time to focus on running your business. No need to understand complex tax rules.

- Tax Efficiency: Accountants are competent to determine permissible costs and benefits. They also assist with tax planning and liability reduction.

- Stress Reduction: Avoid filing errors and last-minute deadlines. Be relaxed in knowing that it’s being handled by professionals.

Why Choose E2E Accounting for Your Year End Support?

Our goal at E2E Accounting is to make year end accounting precise, stress-free, and straightforward. Our 600+ staff are qualified to make sure your accounts meet all HMRC and Companies House regulations, regardless of whether you are a limited company, partnership, or sole proprietor. We provide clear, fixed pricing that doesn’t include any additional costs, so you always know what you’re getting.

We offer completely cloud-based services that integrate easily with programs like Xero, QuickBooks, and FreeAgent, facilitating real-time collaboration and simple document sharing. Our timely submissions lower the possibility of fines or expensive errors, so you can rely on us.

People Also Ask:

Do I need an audit for my year end accounts?

An audit is required if your company exceeds two of the following:

– Annual turnover over £10.2 million

– Total assets over £5.1 million

– More than 50 employees

Otherwise, you may be exempt unless required by your shareholders or articles of association.

What if I make a mistake after submitting?

After submitting your year end accounts, you have the following options if you make a mistake:

– Send Companies House the updated (edited) accounts. Make sure to mark them as amended.

– If the error impacts your tax return, notify HMRC separately*.

– Take immediate action to prevent fines or legal problems.

How long should I keep company records?

Records related to your organisation must be retained for a minimum of six years from the end of the financial year in which they are kept.

You might have to retain them longer in specific circumstances, such as:

– If a transaction spanning many accounting periods is displayed

– Should HMRC be carrying out a compliance audit

Do sole traders need to file year end accounts?

Although sole proprietors are exempt from filing official year end accounts with Companies House, they must:

– Maintain precise financial documentation. Each year, submit a Self Assessment tax return to HMRC.

– Even though it’s not required by law, year end accounting can assist you in managing your taxes and business.

What’s the difference between SA800 and SA100?

The primary Self Assessment tax return for individuals is the SA100, and the tax return for partnerships is the SA800. The partnership’s income is reported on the SA800, and each partner thereafter reports their portion on their individual SA100 form.

What’s the difference between Companies House and HMRC?

Companies House handles company registration and records. HMRC deals with taxes and payments.

Do deadlines differ between Companies House and HMRC?

Yes. Companies House requires an accounts report 9 months after the year end. HMRC needs the tax return 12 months after the year end and tax payment within 9 months and 1 day.