Learn how to identify and fix HMRC tax bill errors for individuals and SMEs. Correct mistakes and claim refunds quickly.

The only reason your latest HMRC tax bill looks wrong is because it isn’t a dream – it’s real. It happens every year: thousands of individuals in the UK, be they employees, freelancers, or even owners of small businesses, find out that they have been charged the wrong amount of tax.

Sometimes it is an error in the tax code that will imply that you have overpaid. Other times, it’s a PAYE mistake that shows a higher liability than you actually owe. Either way, it’s frustrating – and it can leave you wondering where to start.

The reality is that the mistakes in the HMRC tax bills are not rare, as people believe. They occur due to inaccurate statistics, system errors, or due to mere negligence, and they can occur to anybody. You just need to know how to identify them at an early stage and what actions are to be taken to correct them.

This blog will help you identify the ways in which mistakes in the HMRC tax bills can happen, how to check your own records, and what to do in case of being overcharged (or undercharged). Should it be personal income tax or business PAYE, here are some tips on how to ensure that the figures are right with HMRC, and how to recover those you consider to be rightfully yours.

What Are HMRC Tax Bill Errors?

HMRC tax bill error: This happens when the value of the tax you are owed (or one that is owed) is computed in error. It can affect individuals paying taxes in terms of income tax, National Insurance or Tax Credits and businesses in terms of PAYE, VAT or corporation tax.

Common examples include:

- Overpaying or underpaying income tax.

- Receiving a wrong P800 calculation.

- HMRC is applying an incorrect tax code.

- Businesses are reporting inaccurate PAYE data.

- Errors in allowances or deductions (e.g., personal allowance).

Even a small discrepancy can lead to significant financial implications, so it’s important to check your HMRC communications regularly.

Why Do HMRC Tax Bill Errors Happen?

Mistakes can happen on both sides — either by HMRC or by the taxpayer. Let’s look at the common causes.

HMRC Mistakes (Tax Code & System Errors)

Sometimes, HMRC’s system automatically applies the wrong tax code, especially if:

- You have multiple jobs or pensions.

- Your benefits-in-kind or expenses weren’t updated.

- A previous employer didn’t close your PAYE record correctly.

- Your personal allowance wasn’t adjusted for recent income changes.

These HMRC tax code errors can cause you to overpay or underpay tax during the year. Always review your code on your payslip or the HMRC app to ensure it matches your circumstances.

Common Individual Mistakes

For individuals, misleadingly few reporting errors frequently lead to HMRC disparities, such as:

- Failing to report all sources of income (like savings, interest or freelance work).

- Incorrectly claiming allowances or reliefs.

- Ignoring P800 letters or coding notices.

- Entering wrong information on self-assessment returns.

In case HMRC thinks that you are underpaying taxes, then they will give a tax demand. However, when you have paid too much, you might qualify to get a refund by making an overpayment relief claim.

Common Business Mistakes (PAYE Errors)

Payroll and PAYE are common causes of dispute with HMRC in the case of SMEs. Typical mistakes include:

- Submitting payroll with incorrect employee information.

- Missing timely reporting of benefits/bonuses.

- Operating with obsolete software that miscalculates deductions.

- Misreporting National Insurance or pension contributions.

In some cases, duplicate employee records can cause HMRC to double-count payments or tax liabilities, leading to inflated tax bills.

How Can I Check If My HMRC Tax Bill Is Correct?

Checking your tax bill’s accuracy is the first step. Here’s how:

- For individuals:

Log in to your personal tax account and check your income, PAYE, and tax code. Check your P60, P45, and payslips against those of HMRC.

- For businesses:

Log in to your HMRC business tax account to examine your PAYE returns, VAT returns and corporation tax returns. Check your payroll records on a monthly basis.

If figures don’t match or an unexpected bill appears, act quickly — HMRC expects you to raise the issue within a specific timeframe.

How To Correct HMRC Tax Bill Errors

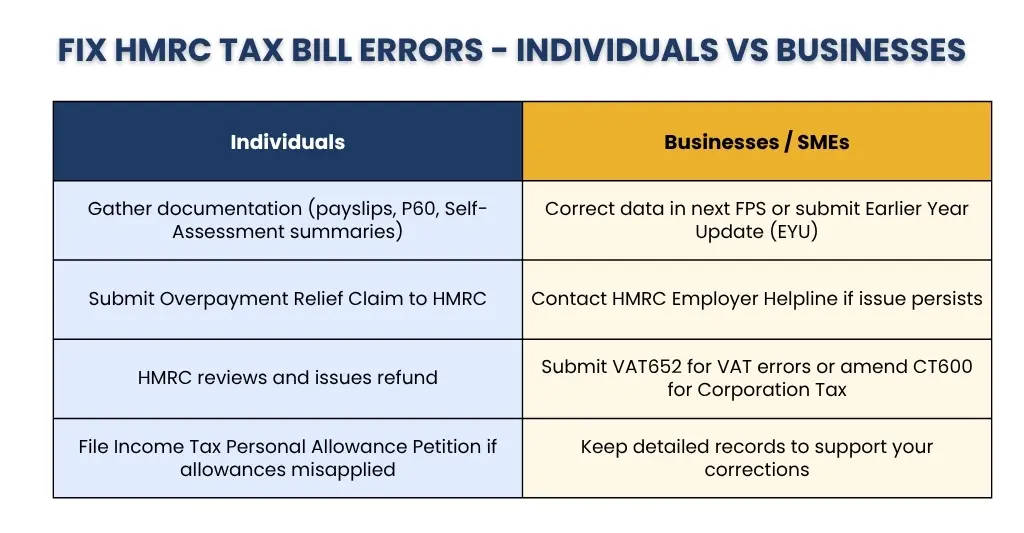

For Individuals — HMRC Overpayment Relief Claim

If you’ve overpaid tax, you can request a correction through an HMRC Overpayment Relief Claim. This process allows you to reclaim overpaid amounts within four years of the end of the tax year in question. The steps incldude:

- Gather documentation – Payslips, P60s, or Self-Assessment Summaries.

- Submit a written claim to HMRC, explaining the overpayment and referencing “Overpayment Relief”.

- HMRC will assess your claim and issue a refund if verified.

If the issue relates to an incorrect personal allowance, you can also file an HMRC Income Tax Personal Allowance Petition. This helps rectify errors where HMRC has misapplied allowances, particularly after job changes or benefit adjustments.

You can read our related post on the P800 tax calculation process for more details on checking refund notices.

Tip: Always keep records for at least six years in case HMRC requests further evidence.

For Businesses / SMEs

Businesses must address tax errors differently depending on the tax type.

- For PAYE or payroll-related mistakes:

- Correct the data in your next Full Payment Submission (FPS) or submit an Earlier Year Update (EYU) if it’s from a previous tax year.

- Contact HMRC’s Employer Helpline if overpayment persists after correction.

- Keep detailed payroll reports to support your case.

- For VAT or Corporation Tax issues:

- Submit an error correction form (VAT652) for VAT overpayments.

- Amend your CT600 return if corporation tax was misreported.

Prompt communication and accurate documentation can speed up HMRC’s response time and minimise penalties.

How To Prevent HMRC Tax Bill Errors

Prevention is always better than correction. Both individuals and SMEs can reduce their risk with a few key practices:

- Keep accurate records: Retain payslips, invoices, and receipts for all income and expenses.

- Update HMRC regularly: Report changes to income, benefits, or business operations as soon as they occur.

- Use reliable accounting software: Automate tax calculations and reduce human error.

- Schedule year end reviews: Compare reported income with actual figures to identify discrepancies early

. - Work with qualified accountants: Professional supervision is capable of making your submissions correct and competent.

When Should I Seek Professional Help?

In case the numbers do not work out – or you have already received a demand or been fined by the HMRC, then you need professional assistance to:

- Liaise directly with HMRC on your behalf.

- File overpayment relief or error correction claims.

- Assistance in PAYE reconciliations or submission of year ends.

- Eliminate future problems through active planning of taxes.

Conclusion & Next Steps

Errors in HMRC tax bills may occur to anybody – but that does not mean that it should develop into a lasting issue. It could be an error related to a personal tax code or a miscalculation in payroll; there is always an opportunity to act promptly, present evidence and get into clear contact with HMRC.

Year End Checklist by E2E:

At E2E Accounting UK, we assist individuals and SMEs to prevent tax surprises by:

- Thorough year-end reviews and reconciliations.

- PAYE and tax code audits.

- Overpayment relief and correction support.

- Immediate accounting data to avert any future discrepancies.

Download Your Year End Checklist for Individuals & SMEs – Get Help With HMRC Tax Bill Errors & Next Steps

Our professionals ensure that your books, returns, and communication with HMRC are always correct and compliant, and you do not waste time, stress, or money. We also look into the latest HMRC warnings on scams, and keep you as well as the system updated, so you don’t fall in any trap.

People Also Ask:

What counts as an HMRC tax bill error?

Any wrong calculation of tax to be paid or refunded, e.g. tax code problems, misreports of PAYE, and allowance errors.

How can I check if my HMRC tax bill is correct?

Compare your payslips, P60s and HMRC account data. The difference in the codes, earnings or allowances can indicate a fault.

Can I correct HMRC mistakes myself?

Yes, most individual cases can be resolved through an overpayment relief claim or by updating your records online.

What should I do if I find a business PAYE error?

In your next FPS, or call the HMRC Employer Helpline to update the figures.

Why choose E2E Accounting UK for HMRC tax bill errors and year-end support?

E2E Accounting UK offers proactive, personalised and compliant accounting services. Our professionals will keep your finances in line with HMRC standards, whether it is error correction or annual reporting. No matter the industry/sector, we help businesses and individuals alike in staying compliant while growing at the same time.